In this article, Youssef LOURAOUI (Bayes Business School, MSc. Energy, Trade & Finance, 2021-2022) elaborates on the concept of quantitative equity investing, a type of investment approach in the equity trading space.

This article follows the following structure: we introduce the quantitative equity investing. We present a review of the major types of quantitative equity strategies and we finish with a conclusion.

Introduction

Quantitative equity investing refers to funds that uses model-driven decision making when trading in the equity space. Quantitative analysts program their trading rules into computer systems and use algorithmic trading, which is overseen by humans.

Quantitative investing has several advantages and disadvantages over discretionary trading. The disadvantages are that the trading rule cannot be as personalized to each unique case and cannot be dependent on “soft” information such human judgment. These disadvantages may be lessened as processing power and complexity improve. For example, quantitative models may use textual analysis to examine transcripts of a firm’s conference calls with equity analysts, determining whether certain phrases are commonly used or performing more advanced analysis.

The advantages of quantitative investing include the fact that it may be applied to a diverse group of stocks, resulting in great diversification. When a quantitative analyst builds an advanced investment model, it can be applied to thousands of stocks all around the world at the same time. Second, the quantitative modeling rigor may be able to overcome many of the behavioral biases that commonly impact human judgment, including those that produce trading opportunities in the first place. Third, using past data, the quant’s trading principles can be backtested (Pedersen, 2015).

Types of quantitative equity strategies

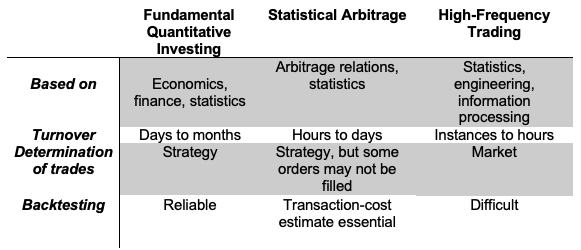

There are three types of quantitative equity strategies: fundamental quantitative investing, statistical arbitrage, and high-frequency trading (HFT). These three types of quantitative investing differ in various ways, including their conceptual base, turnover, capacity, how trades are determined, and their ability to be backtested.

Fundamental quantitative investing

Fundamental quantitative investing, like discretionary trading, tries to use fundamental analysis in a systematic manner. Fundamental quantitative investing is thus founded on economic and financial theory, as well as statistical data analysis. Given that prices and fundamentals only fluctuate gradually, fundamental quantitative investing typically has a turnover of days to months and a high capacity (meaning that a large amount of money can be invested in the strategy), owing to extensive diversification.

Statistical arbitrage

Statistical arbitrage aims to capitalize on price differences between closely linked stocks. As a result, it is founded on a grasp of arbitrage relations and statistics, and its turnover is often faster than that of fundamental quants. Statistical arbitrage has a lower capacity due to faster trading (and possibly fewer stocks having arbitrage spreads).

High Frequency Trading (HFT)

HFT is based on statistics, information processing, and engineering, as the success of an HFT is determined in part by the speed with which they can trade. HFTs focus on having superfast computers and computer programs, as well as co-locating their computers at exchanges, actually trying to get their computer as close to the exchange server as possible, using fast cables, and so on. HFTs have the fastest trading turnover and, as a result, the lowest capacity.

The three types of quants also differ in how they make trades: Fundamental quants typically make their deals ex ante, statistical arbitrage traders make their trades gradually, and high-frequency traders let the market make their transactions. A fundamental quantitative model, for example, identifies high-expected-return stocks and then buys them, almost always having their orders filled; a statistical arbitrage model seeks to buy a mispriced stock but may terminate the trading scheme before completion if prices have moved adversely; and, finally, an HFT model may submit limit orders to both buy and sell to several exchanges, allowing the market to determine which ones are hit. Because of this trading structure, fundamental quant investing can be simulated with some reliability via a backtest; statistical arbitrage backtests rely heavily on assumptions on execution times, transaction costs, and fill rates; and HFT strategies are frequently difficult to simulate reliably, so HFTs must rely on experiments.

Table 1. Quantitative equity investing main categories and characteristics.

Source: Source: Pedersen, 2015.

Conclusion

Quants run their models on hundreds, if not thousands, of stocks. Because diversification eliminates most idiosyncratic risk, firm-specific shocks tend to wash out at the portfolio level, and any single position is too tiny to make a major impact in performance.

An equity market neutral portfolio eliminates total stock market risk by being equally long and short. Some quants attempt to establish market neutrality by ensuring that the long side’s dollar exposure equals the dollar worth of all short bets. This technique, however, is only effective if the longs and shorts are both equally risky. As a result, quants attempt to balance market beta on both the long and short sides. Some quants attempt to be both dollar and beta neutral.

Why should I be interested in this post?

It may provide an opportunity for investors to diversify their global portfolios. Including hedge funds in a portfolio can help investors obtain absolute returns that are uncorrelated with typical bond/equity returns.

For practitioners, learning how to incorporate hedge funds into a standard portfolio and understanding the risks associated with hedge fund investing can be beneficial.

Understanding if hedge funds are truly providing “excess returns” and deconstructing the sources of return can be beneficial to academics. Another challenge is determining whether there is any “performance persistence” in hedge fund returns.

Getting a job at a hedge fund might be a profitable career path for students. Understanding the market, the players, the strategies, and the industry’s current trends can help you gain a job as a hedge fund analyst or simply enhance your knowledge of another asset class.

Related posts on the SimTrade blog

▶ Youssef LOURAOUI Introduction to Hedge Funds

▶ Youssef LOURAOUI Portfolio

▶ Youssef LOURAOUI Long-short strategy

Useful resources

Academic research

Pedersen, L. H., 2015. Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined. Chapter 9 : 133 – 164. Princeton University Press.

About the author

The article was written in December 2022 by Youssef LOURAOUI (Bayes Business School, MSc. Energy, Trade & Finance, 2021-2022).