Waiting is never easy. In life, at work, and certainly in finance, we are naturally drawn to quick outcomes and instant gratification. This preference for immediacy is built into our psychology, a leftover from a time when obtaining resources in the present meant survival.

This is why the quote resonates so strongly. It expresses a universal tension between the comfort of the present and the rewards that arrive only through the passage of time. The analogy with food captures the idea beautifully: most of us choose what tastes good now, such as a sugary treat or a risky trade, instead of what will benefit us later, like a healthy meal or a disciplined investment. Markets consistently reward discipline, yet human nature urges us toward the immediate emotional release provided by action.

In this article, Hadrien PUCHE (ESSEC, Grande École Program, Master in Management, 2023-2027) comments on Aristotle’s famous quote about the discipline required for long-term success.

Aristotle

Source: Wikimedia Commons

Aristotle was one of the most influential thinkers in ancient Greece and a foundational figure of Western philosophy. Born in the fourth century BCE in Stagira, he studied under Plato and later tutored Alexander the Great. He founded the Lyceum, emphasizing careful observation and reason across logic, ethics, and metaphysics.

In ethics, Aristotle focused on character development through deliberate practice. He believed virtues like patience are not natural gifts, but habits formed through repeated disciplined actions. This connects directly with long-term investing, which rewards consistent behaviors and emotional mastery. While the quote is often misattributed, its message stands at the center of successful investing: the true test is not intelligence, but emotional endurance.

Analysis of the Quote

This quote encompasses the central tension in investing: the difficulty of the present versus the reward of the future. In markets, patience is an active discipline. It requires staying invested through volatility and resisting popular trends. These moments of discomfort represent the “bitter” side of patience.

The “sweet fruit” is compounding—a force that transforms small, consistent gains into extraordinary outcomes. It only rewards those who give it time. Legendary investors like Buffett, Lynch, and Munger insist that patience, not genius, accounts for their success. The investor who endures temporary discomfort for long-term clarity exercises patience exactly as Aristotle would have understood it.

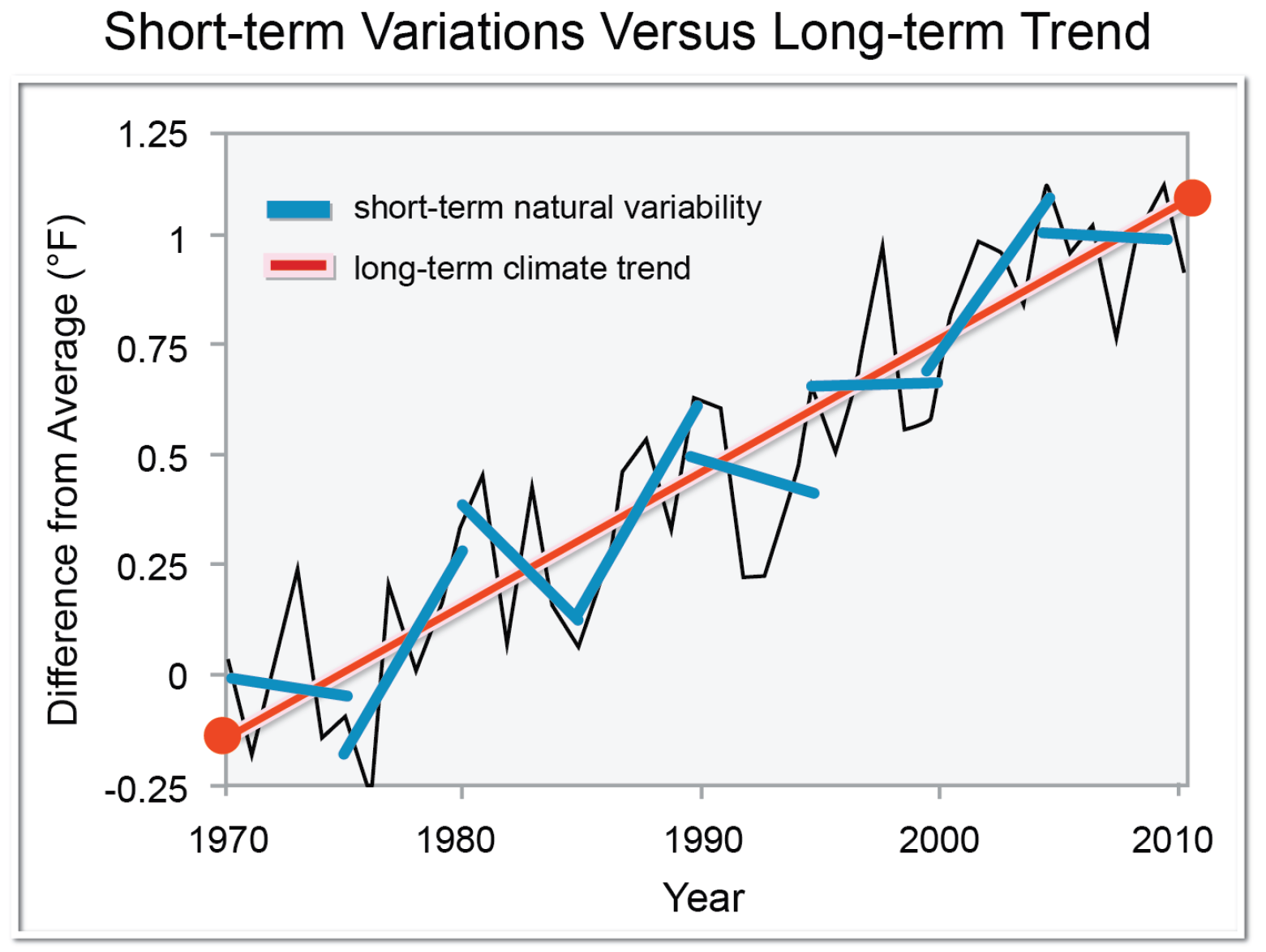

Short-term variations matter less than the long-term average trend. Source: Wikimedia Commons.

Historical Failures of Patience

History shows that impatience fueled many financial catastrophes. During the 17th-century **Tulip Mania**, prices soared as traders flipped bulbs for quick profits, only to see the market collapse in days. The same pattern repeated in the **South Sea Bubble** and the **Dot-Com Bubble**, where speculation displaced fundamentals. Across these episodes, short-term excitement overshadowed long-term thinking, turning promising opportunities into costly lessons.

Financial Concepts Tied to the Quote

Time Horizon: The Power of μ over σ

Having a long time horizon allows investors to rely on fundamentals rather than hype. Quantitatively, this is the battle between the expected return ($\mu$) and volatility ($\sigma$). While market prices are dominated by $\sigma$ (random swings) in the short term, the long-term outcome is driven by $\mu$ (intrinsic growth).

Viewing decisions through a 10 or 20-year perspective reframes downturns as opportunities. This is due to time diversification: as the holding period ($t$) expands, the annualized volatility decreases at a rate of $1/\sqrt{t}$. Time reduces the “noise,” making the fundamental $\mu$ eventually overwhelm the temporary $\sigma$.

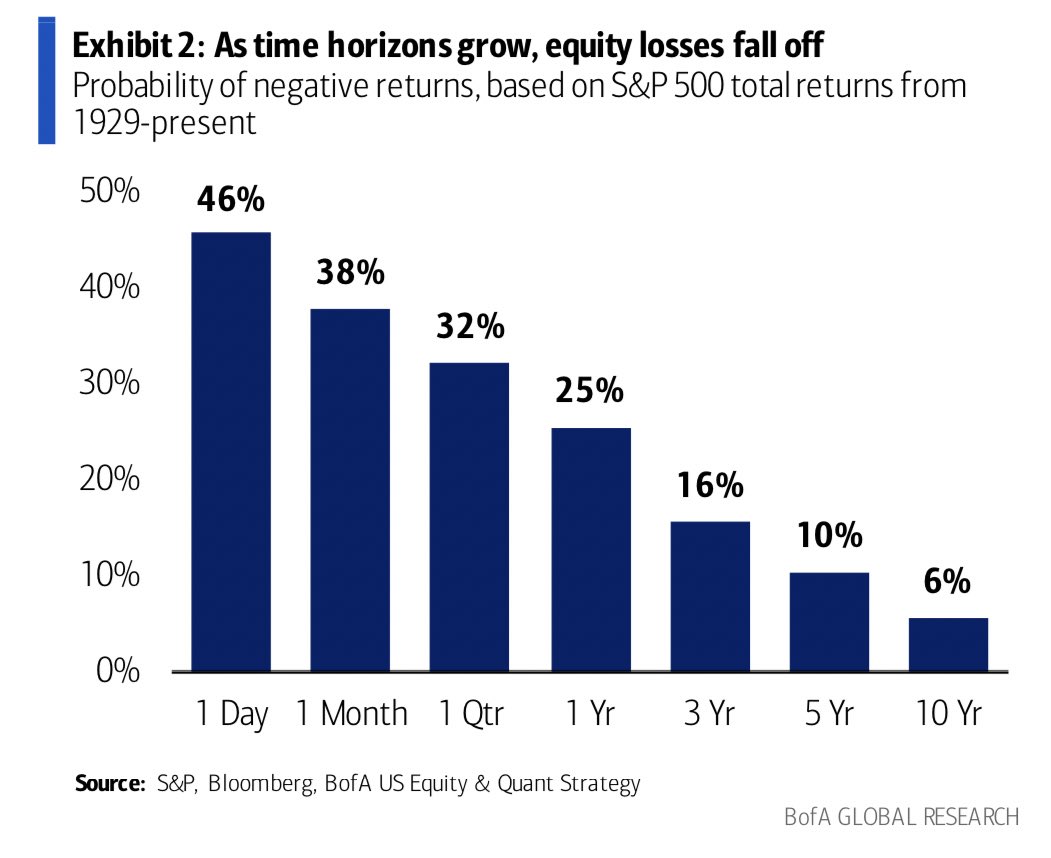

Risk and Reward Balance

Patience does not remove risk, but it improves emotional endurance. Impatient investors often understand risk in theory but panic when it appears on a statement, leading to selling at the worst time. Patient investors focus on long-term goals, allowing time to work as a risk management tool.

Opportunity Cost and the Value of Inactivity

In behavioral finance, opportunity cost is what one sacrifices by choosing one action over another. Many investors mistakenly equate activity with progress, yet frequent transactions lead to higher costs and taxes. Buffett and Munger emphasize that strategic inactivity is often the most effective decision.

This tendency to favor motion is driven by action bias, or the “Goalkeeper Syndrome.” A study by Bar-Eli et al. (2007) found that goalkeepers have the highest probability of stopping a penalty by staying in the center of the goal, yet they do so only 6.3% of the time. They dive because the regret of “doing nothing” feels worse than the regret of a failed action. This carries over to investment management, where investors churn portfolios during volatility just to feel in control.

My Opinion in a Modern Context

This quote is especially relevant today. Trading apps encourage activity, and social media amplifies FOMO (Fear of Missing Out). In this environment, patience is a competitive advantage. Successful investors are often not the smartest, but the most consistent. In a world that rewards speed, the courage to wait becomes rare and extremely valuable.

Why This Quote Should Matter to You

Patience isn’t just a pleasant virtue; it’s a tool that shapes results. Whether building a career or managing finances, patience allows you to:

- Make thoughtful choices grounded in clarity rather than impulse.

- Avoid stress-driven errors.

- Stay aligned with long-term goals despite short-term distractions.

Related Posts on the SimTrade Blog

▶ Hadrien PUCHE “Most people overestimate what they can do in a year…” – Bill Gates

▶ Hadrien PUCHE “Price is what you pay, value is what you get” – Warren Buffett

Useful resources

Aristotle. Nicomachean Ethics. Translated by Terence Irwin. Hackett Publishing, 1999.

Bar-Eli, M., Azar, O. H., Ritov, I., Keidar-Levin, Y., & Schein, G. (2007). Action bias among elite soccer goalkeepers: The case of penalty kicks. Journal of Economic Psychology, 28(5), 606-621.

Kindleberger, Charles P., and Robert Aliber. Manias, Panics, and Crashes. Palgrave Macmillan, 2011.

Mackay, Charles. Extraordinary Popular Delusions and the Madness of Crowds. Wordsworth Editions, 1995.

About the Author

This article was written in January 2026 by Hadrien PUCHE (ESSEC Business School, Grande École Program, Master in Management, 2023-2027).

▶ Discover all articles by Hadrien PUCHE