In this article, Tianyi WANG (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2022-2026) explains the structure, payoff, and risks of Snowball products — one of the most popular and complex structured products in Asian financial markets.

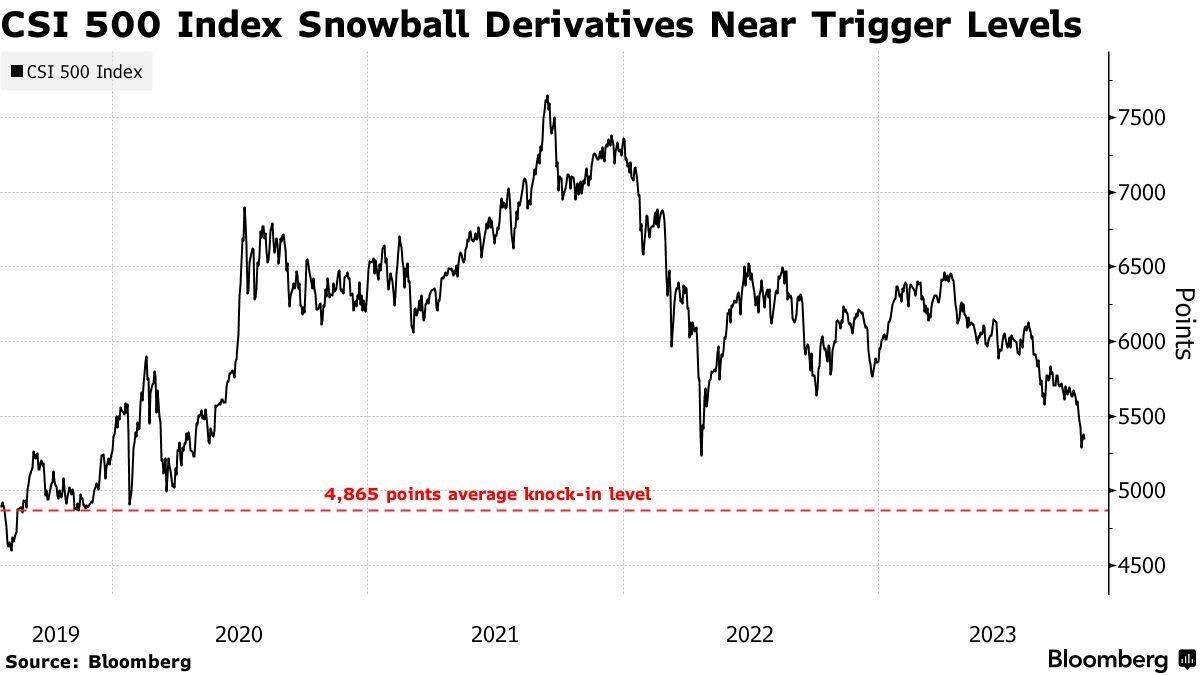

Introduction

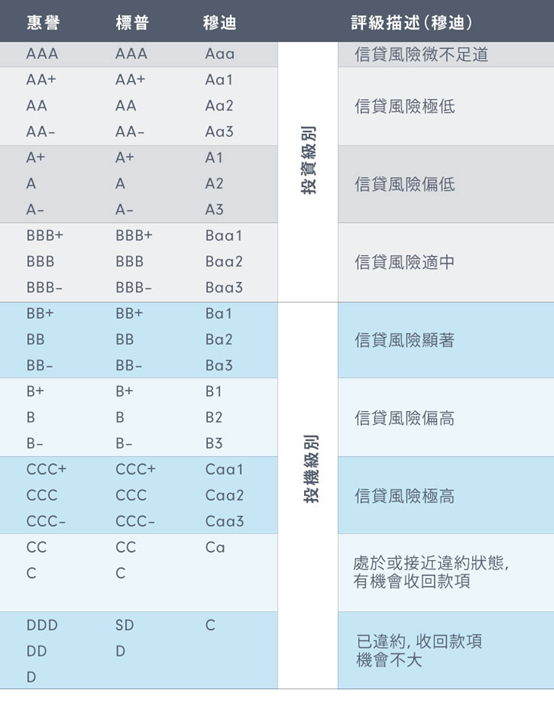

Structured products can be positioned along a broad risk–return spectrum.

Snowball Structure Product .

Source: public market data.

As shown in the figure below, Snowball Notes belong to the category of yield-enhancement products, typically offering annualized returns of around 8% to 15%. These products sit between capital-protected structures—which provide lower but more stable returns—and high-risk leveraged instruments such as warrants. This placement highlights a key feature of Snowballs: while they provide attractive coupons under normal market conditions, they come with conditional downside risk once the knock-in barrier is breached. Understanding this relative positioning helps explain why Snowballs are widely marketed during stable or range-bound markets but may expose investors to significant losses when volatility spikes.

Snowball options have become widely traded structured products in Asian equity markets, especially in China, Korea, and Hong Kong. They appeal to investors seeking stable returns in range-bound markets. However, their path-dependent nature and embedded option risks make them highly sensitive to market volatility. During periods of rapid market decline, many Snowball products experience “knock-in” events or even large losses.

To be more specific, a knock-in event occurs when the underlying asset’s price falls below (or rises above, depending on the product design) a predetermined barrier level during the life of the product. Once this barrier is breached, the Snowball option “activates” the embedded option exposure—typically converting what was originally a principal-protected or coupon-paying structure into one that behaves like a short option position. As a result, the investor becomes directly exposed to downside risks of the underlying asset, often leading to significant mark-to-market losses.

This article explains how Snowball products work, their payoff structure, the embedded risks, and how market behavior affects investor outcomes.

Who buys Snowball products?

Snowball products are purchased mainly by:

- Retail investors — especially in mainland China and Korea, attracted by high coupons and the perception of stability.

- High-net-worth individuals (HNWI) — through private banking channels.

- Institutional investors — such as securities firms and structured product funds, often using Snowballs for yield enhancement.

Because Snowballs involve complex embedded options, they are considered unsuitable for inexperienced retail investors. Nevertheless, retail participation has grown significantly in Asian markets.

What is a Snowball product?

A Snowball is a structured product linked to an equity index (e.g., CSI 500, HSCEI) or a single stock. It provides a fixed coupon if the underlying asset stays within certain price barriers. The product contains three key components:

- Autocall (Knock-out) — product terminates early at a profit if the underlying rises above a set level.

- Knock-in — if the underlying falls below a certain barrier, the investor becomes exposed to downside risk.

- Coupon payment — paid periodically as long as knock-in does not occur and knock-out does not trigger.

Snowballs earn steady income in stable markets, but losses can become severe when markets experience sharp declines.

The name “Snowball” comes from the idea of a snowball rolling downhill: it grows larger over time. In structured products, the coupon accumulates (or “rolls”) as long as the product does not knock-in or knock-out. As the months go by, the investor receives a growing stream of accrued coupons — similar to a snowball becoming bigger. However, like a snowball that can suddenly break apart if it hits an obstacle, the product can suffer significant losses once the knock-in barrier is breached.

Market behavior: what does it mean?

In the context of Snowball pricing and risk, “market behavior” refers to two dimensions:

- Financial market behavior (price dynamics) — movements of the underlying index or stock, volatility levels, liquidity conditions, and short-term shocks. This includes trends such as rallies, range-bound phases, or sharp sell-offs that affect knock-in and knock-out probabilities.

- Investor behavior — how different market participants react: hedging flows from issuers, panic selling during downturns, retail speculation, institutional risk reduction, and shifts in investor sentiment. These behaviors can reinforce price moves and alter Snowball risk.

Together, these elements form “market behavior”: the interaction between market movements and investor actions. For Snowballs, this directly affects whether the product pays coupons, knocks out early, or falls into knock-in and creates losses.

Key barriers in Snowball products

Knock-out (Autocall) barrier

If at any observation date the price exceeds the knock-out barrier (e.g., 103%), the product terminates early and investors receive principal plus accumulated coupons.

Knock-in barrier

If the price falls below the knock-in barrier (e.g., 80%), the product enters a risk state. If at maturity the price remains below the strike, the investor bears the underlying’s loss.

How Snowball payoffs work

The payoff of a Snowball is path-dependent, meaning it depends on the entire trajectory of the underlying index, not just the final price at maturity.

There are three typical outcomes:

Knock-out outcome (early exit)

If the underlying exceeds the knock-out level early, the investor receives:

Principal + accumulated coupons

No knock-in, no knock-out (maturity coupon)

If the underlying never crosses either barrier:

Principal + full coupons

Knock-in triggered (risky outcome)

If knock-in occurs and the final price ends below strike:

The investor bears the underlying loss

Thus, Snowballs deliver strong returns in stable or mildly rising markets but carry significant losses in bear markets.

Why Snowball products are risky

Although marketed as “income products,” Snowballs are essentially short-volatility strategies. The issuer sells downside protection to the investor in exchange for coupons.

Key risks include:

- High volatility increases knock-in probability

- Sharp declines lead to principal losses

- Liquidity risk

- Complex payoff makes risks hard to evaluate for retail investors

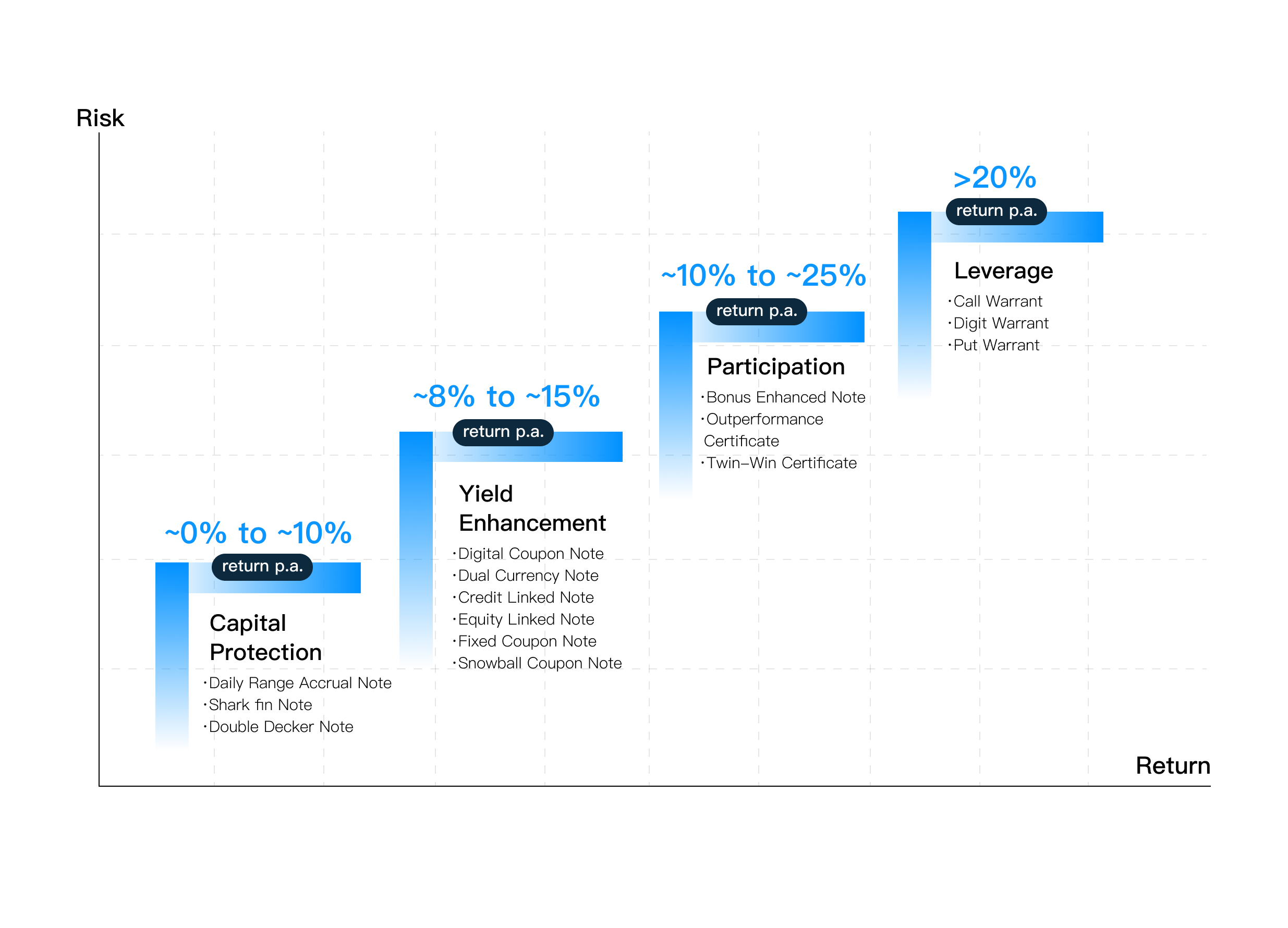

Case study: Why many Snowballs were hit in 2022–2023

During 2022–2023, Chinese equity markets — especially the CSI 500 and CSI 1000 — experienced large drawdowns due to geopolitical tensions, policy uncertainty, and weak economic recovery. Volatility spiked, and mid-cap indices saw rapid declines.

As a result:

- Many Snowballs hit knock-in levels

- Investors faced large mark-to-market losses

- Issuers reduced new Snowball supply due to elevated volatility

This period highlights how market sentiment and volatility regimes directly impact structured product outcomes.

According to Bloomberg (January 2024), more than $13 billion worth of Chinese Snowball products were approaching knock-in triggers. A rapid decline in the CSI 1000 index pushed many products close to their 80% knock-in barrier.

Some investors experienced immediate 15–25% losses as the embedded short-put exposure was activated.

This real-world case demonstrates how quickly Snowball risk materializes when market volatility rises.

Snowball Take Out.

Source: public market data.

How market behavior affects Snowball performance

Volatility

High volatility increases the likelihood of crossing both barriers.

Trend direction

- Upward trends → more knock-outs

- Range-bound markets → steady coupon income

- Downward trends → knock-in risk and principal loss

Liquidity and investor flows

During sell-offs, Snowball hedging can amplify downward pressure, creating feedback loops.

Snowball knock-in chart.

Source: public market data.

Explanation: The chart illustrates a steep market decline where the underlying index falls below its knock-in barrier. When such drawdowns occur rapidly, Snowball products transition into risk mode, immediately exposing investors to the underlying’s downside. This visualizes how market volatility and negative sentiment can activate the hidden risks in Snowball structures.

Conclusion

Snowball products are appealing due to their attractive coupons, but they involve significant downside risks during volatile markets. Understanding the path-dependent nature of their payoff, barrier mechanics, and market behavior is crucial for investors and product designers.

By analyzing Snowball structures, investors gain deeper insight into how derivative products are created, priced, and risk-managed in real financial markets.

Related posts on the SimTrade blog

▶ Shengyu ZHENG Barrier Options

▶ Slah BOUGHATTAS Book by Slah Boughattas: State of the Art in Structured Products

▶ Akshit GUPTA Equity Structured Products

About the author

The article was written in November 2025 by Tianyi WANG (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2022-2026).