In this article, Roberto RESTELLI (ESSEC Business School, Master in Finance (MiF), 2025–2026) explains how he founded BCapital Fund at Bocconi University—a student‑run, global‑equity investment student association—and what it taught him about markets, leadership, and teamwork.

Founding BCapital Fund (2022)

During my final semester at Bocconi University in Milan in 2022, driven by passion for financial markets and curiosity, I founded a student society called BCapital Fund. The aim was to bring together friends with the same enthusiasm and replicate— as closely as possible— the functions of an investment fund focused exclusively on global equities, rather than a typical university club centered on articles. It became the first student‑run investment fund in Italy and among the first in Europe.

BCapital Fund – Student Investment Society at Bocconi University.

Source: BCapital Fund.

Concept & investment approach

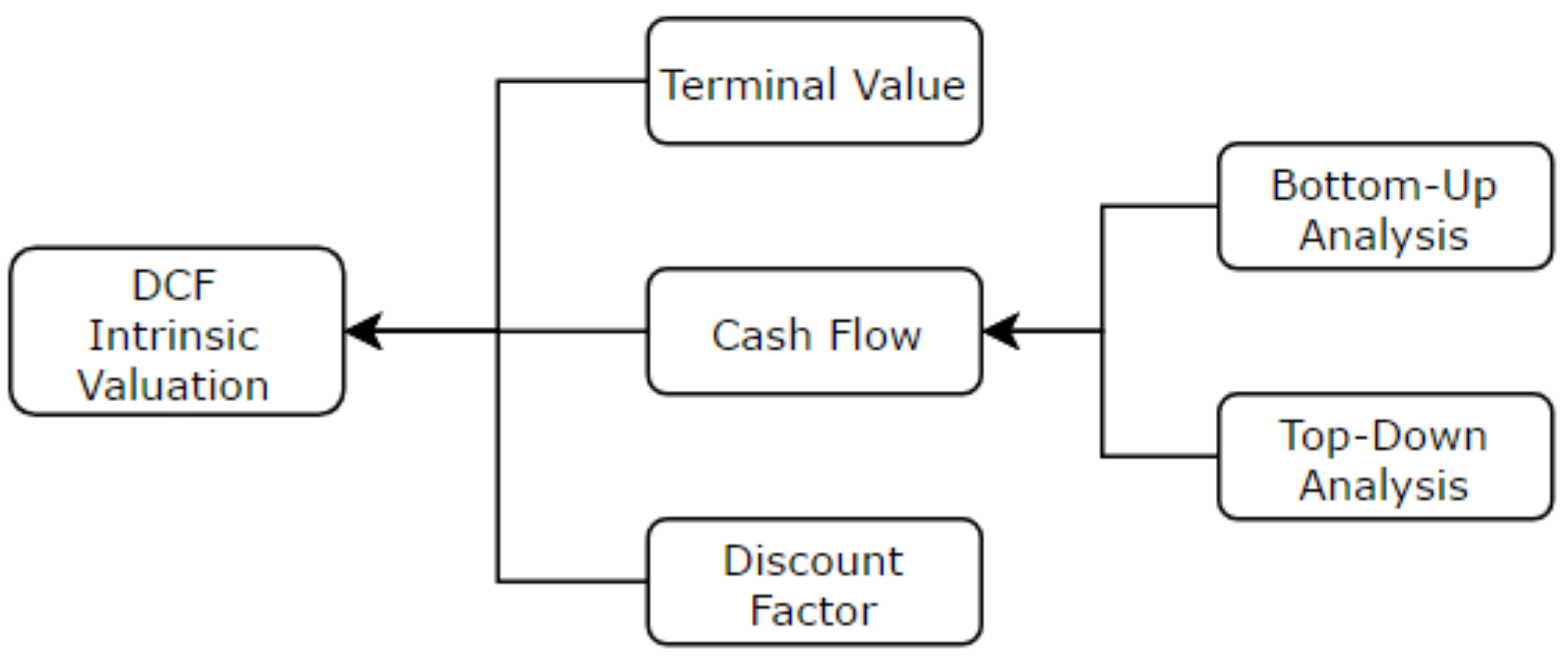

Using various online brokers, we simulated investments with US$1,000,000 in demo capital. Each month, we published a detailed report explaining our investment theses—supported by deep company research and macro analysis—modeled on the style of hedge‑fund letters. Report after report, we improved visuals, explanations, and content to make our publications as professional as possible.

We began with eight members (first‑year BSc students in Management, Finance, and Law). At the university society fair in September, the idea resonated immediately: we received 120+ applications and grew to 25 members by October, representing countries such as Russia, India, China, Italy, and the UK.

How we structured the fund

- Portfolio Department: junior analysts, senior analysts, and portfolio managers responsible for investment decisions.

- Macroeconomic Department: focused on inflation, central‑bank policy (e.g., Fed rate moves), and broader trends.

- Data & Reporting: charts, report layout, and document production using Word and Excel.

- Legal & Communications: documentation plus LinkedIn and Instagram pages.

For six months, a crypto sleeve—run by several passionate members—delivered a +33% return, contributing positively to the main equity portfolio’s performance over the period. Over time, our approach narrowed into a global‑equity and macro strategy. We also hosted campus events to share insights and engaged the broader student body, while steadily building a simulated‑portfolio track record.

Personal reflection

Now that I’m no longer a Bocconi student, I’m not involved operationally. I handed the society over to younger bachelor students who continue to add value and deliver performance, carrying the project forward as most of the original eight members have moved on.

This was the highlight of my bachelor’s degree: pursuing a passion with friends, learning continuously, and being recognized as one of the most innovative student initiatives in Italy. Most gratifying is seeing the project thrive beyond my tenure.

What I learned

I learned a great deal from a diverse team with complementary skills. Exposure to different departments let me explore portfolio construction and valuation, macro analysis and central‑bank actions, and the technical side of modeling and reporting.

Personally, I learned the importance of organisation and clarity. To execute and lead effectively, you need rigorous structure and precision—from sequencing investment ideas and valuation frameworks to standardising report templates and social‑media posts.

Teamwork was another key skill. Working in larger groups helped me collaborate, deliver projects in teams of five or more, recognise when others’ ideas are better, adapt the final outcome, and stay open to different viewpoints—well‑suited to my extroverted personality. Finally, mutual help matters: with the right people, everything becomes easier than going solo.

Concepts related to my society

- Follow your passion: the project began organically with friends who shared a genuine interest—learning more and preparing beyond what university offers.

- Just do it: step outside your comfort zone, take initiative, and build—without overthinking everything that could go wrong.

- Keep learning: learning never stops; hands‑on practice is often more engaging than lectures, because you work directly with the topics.

Why should I be interested in this post?

If you are an ESSEC student curious about launching student initiatives or pursuing public‑markets roles, this post offers a practical blueprint: how to design a student investment fund, structure departments, recruit and scale, and publish professional‑grade research—skills that translate directly to internships and entry‑level roles.

Conclusion

BCapital Fund was more than a student initiative—it was a proving ground for disciplined investing, collaborative leadership, and continuous learning. Building a multi‑department team, publishing research, and iterating our process taught me how to set a clear vision, structure execution, and raise the bar. Handing the project to the next cohort—and seeing it grow—confirmed the value of creating something that endures. I carry forward stronger analytical judgment, sharper communication, and a practical sense of how strategy, macro context, and rigorous reporting come together in public markets.

Related posts on the SimTrade blog

▶ Alexandre VERLET Classic brain teasers from real-life interviews

Useful resources

Bocconi Student Finance Society LinkedIn page

European Securities and Markets Authority (ESMA)

About the author

The article was written in November 2025 by Roberto RESTELLI (ESSEC Business School, Master in Finance (MiF), 2025–2026).