The Consumer Confidence Index

In this article, Jianen HUANG (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021-2023) explains about the consumer confidence index.

What is CCI

The Consumer Confidence Index, or CCI, is a widely used economic indicator that measures the level of optimism or pessimism that consumers feel about the economy. It is a metric that is usually used by governments, businesses, and investors to gauge consumer sentiment and predict future economic activity. The CCI is an important tool for economists and policymakers because consumer spending accounts for a significant portion of economic activity in most countries. When consumers feel more confident about the economy, they are more likely to spend money, which results in boosting economic growth. Conversely, when consumers are feeling uncertain or pessimistic about the future, they are more likely to save their money, which can lead to a slowdown in economic activity.

The index is based on a survey of consumers, which includes questions about their current financial situation, their expectations for the future, and their spending intentions. And the Index is calculated by averaging the responses of a survey of consumers. Based on these responses, a composite index is created that reflects the level of consumer confidence. A high index reading suggests that consumers are optimistic about the economy, while a low index reading suggests that consumers are pessimistic.

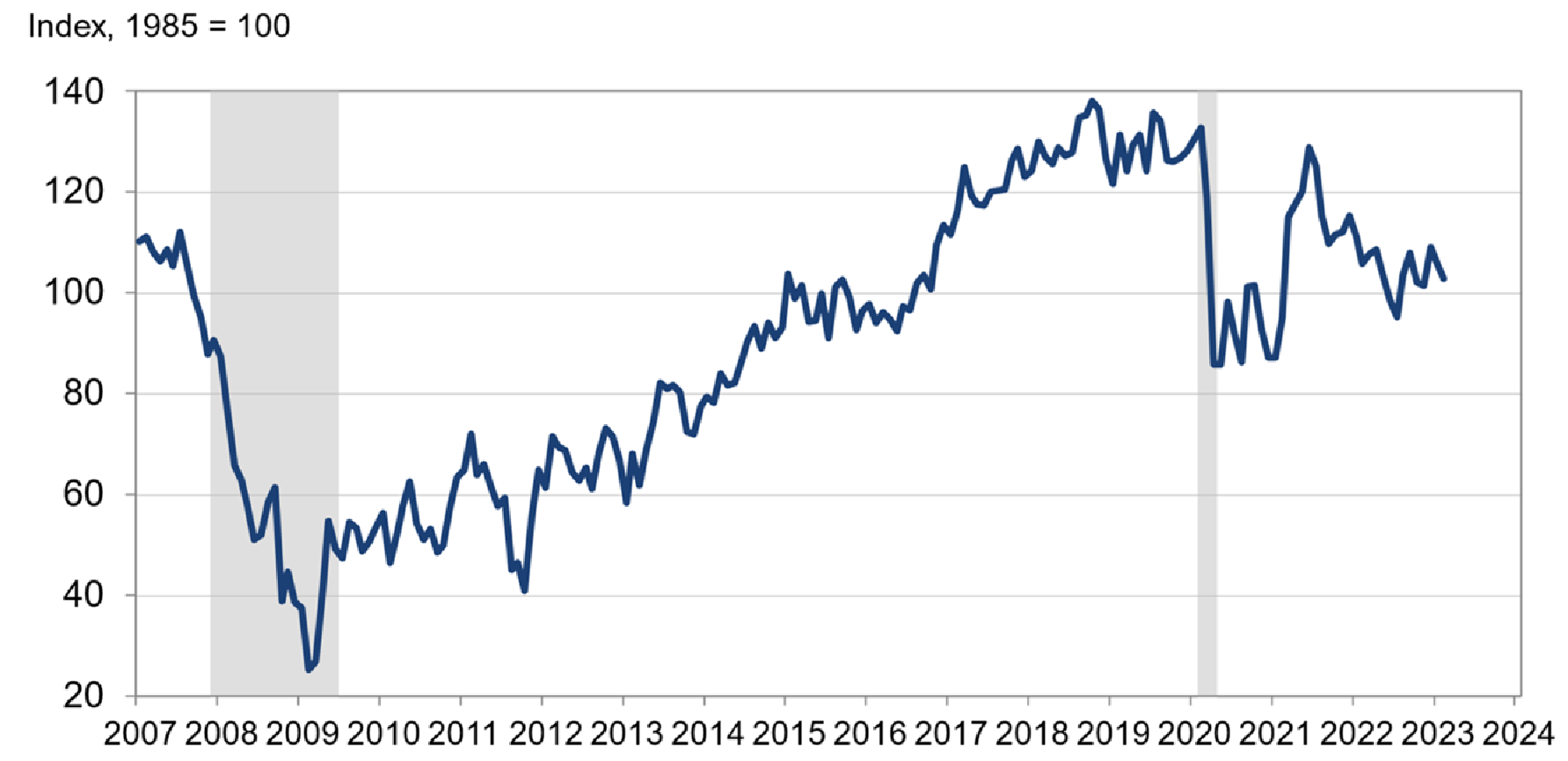

The figure below shows the US Consumer Confidence Index on a yearly basis. In the figure, there is a significant decrease in CCI in 2020, and that is strongly due to the impact of the COVID-19 pandemic, and at the beginning of 2022, there is another decrease that is because of the Ukraine-Russian war. The Consumer Confidence Index is based on the confidence level of consumers in the economy, and disruptions like these can significantly influence the confidence of consumers, which will lead to a fall in the financial market.

Consumer Confidence Index in the US.

Source: The Conference Board.

Regional Differences

There are several different versions of the Consumer Confidence Index used around the world, and each of them has its own methodology and survey questions.

In the United States, the index is produced by the Conference Board, a nonprofit research organization. The survey used to calculate the index asks consumers about their feelings on business conditions, employment, and income. The index is then calculated based on the percentage of consumers who feel positive about these factors.

In China, the CCI is released monthly by the National Bureau of Statistics. It is based on a survey of urban households, and the index is calculated based on four components: consumers’ assessments of current economic conditions, their expectations for future economic conditions, their confidence in the job market, and their willingness to spend money.

In the European Union, the Consumer Confidence Index is calculated by the European Commission. The survey used to calculate the index asks consumers about their expectations for the economy, their personal finances, and their intentions to make major purchases. The index is then calculated based on the percentage of consumers who feel positive about these factors.

Limitations of CCI

Despite its importance, the Consumer Confidence Index has some limitations that we need to take into account. First, the index is based on a survey of consumers, which means that it may not accurately reflect the true state of the economy. Consumers may be overly optimistic or pessimistic based on factors that are not related to the economy, such as current events or personal experiences. Additionally, the index only measures consumer sentiment, which may not always translate into actual economic activity. Consumers may feel optimistic about the economy, and still choose to save their money instead of spending it.

Another limitation of the Consumer Confidence Index is that it may not be a good indicator of the economic outlook for all segments of the population. The index is based on a survey of consumers as a whole, which means that it may not accurately reflect the experiences of specific demographic groups. For example, consumers who are experiencing financial difficulties may have a more pessimistic outlook on the economy than consumers who are financially secure.

Conclusion

In conclusion, the Consumer Confidence Index is an important economic indicator that measures the level of optimism or pessimism that consumers feel about the economy. While the index has some limitations, it remains a useful tool for predicting future economic activity and understanding the sentiments of consumers. By keeping an eye on the Consumer Confidence Index, stakeholders can gain a better understanding of the economic climate and make informed decisions about the future.

Related posts on the SimTrade blog

▶ Bijal GANDHI Economic Indicators

▶ Bijal GANDHI Consumer Confidence Index

Useful resources

National Bureau of Statistics China Consumer Confidence Index

The Conference Board US Consumer Confidence Index

European Union EU Consumer Confidence Index

About the author

The article was written in April 2023 by Jianen HUANG (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021-2023).