In this article, Ines ILLES MEJIAS (ESSEC Business School, Global BBA, 2020-2024) analyzes the effect of Elon Musk’s tweets on the cryptocurrency market and its link with the concept of market efficiency.

Who is Elon Musk?

Founder of SpaceX and Tesla, Elon Musk, is known to be one of the richest and most famous people in the world. He is known to be a “technological visionary”, especially working in companies which focus on innovation and technology. Elon Musk has currently over 120 million followers on Twitter, a social media platform which he is regularly active on to speak about his life, his business or give his opinion on a wide variety of topics, one of them being cryptocurrency. No surprises he likes Twitter so much that he chose to purchase this one for US$ 44 billion not so long time ago in 2022.

Why does Elon Musk have an impact on the crypto market?

The effect of Elon Musk on the crypto market seems to be explained by his tweets due to his persona, as he is also known to be a successful investor and one of the wealthiest people in the world in 2022.

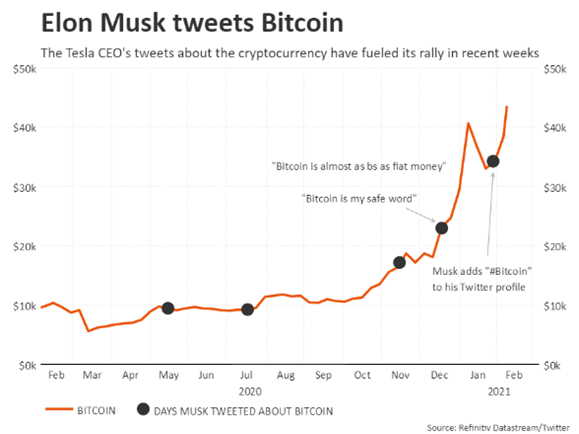

His activity on Twitter seems to affect the prices and volumes of cryptocurrencies on the short-term, by looking at the price changes or volatility following his tweets. This is called the “Elon Musk Effect”. The two most known cryptocurrencies having been influenced by Elon Musk are the Bitcoin and the Dogecoin. Likewise, we know thanks to his tweets and affirmation in conferences that he currently owns three cryptocurrencies: Bitcoin, Ethereum, and Dogecoin.

Examples of the positive impact of Elon Musk’s tweets on the crypto market

Elon Musk’s tweets seem to have an influence in the variation of cryptocurrency prices.

December 2021: “Bitcoin is my safe word”

In December 2021, Elon Musk positively tweeted about the Bitcoin saying that it is his “safe word”. This made the value of Bitcoin increase largely as the graph below shows.

Figure 1. Elon Musk’s tweet effect on Bitcoin

Source: Source: Reuters

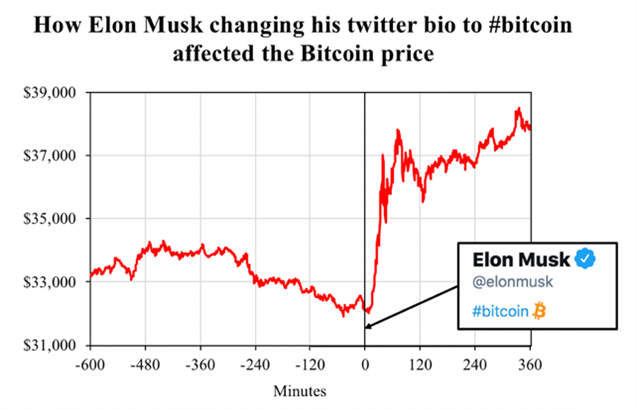

January 2022: Elon Musk shows he’s a Bitcoin supporter.

In January 2022, Elon Musk changed his Twitter bio by adding “#bitcoin” which caused the Bitcoin to increase its value by 20%.

Figure 2. Elon Musk’s tweet effect on Bitcoin

Source: Source: Blockchain Research Lab

Figure 3. Elon Musk’s tweet effect on Bitcoin

Source: Source: Blockchain Research Lab

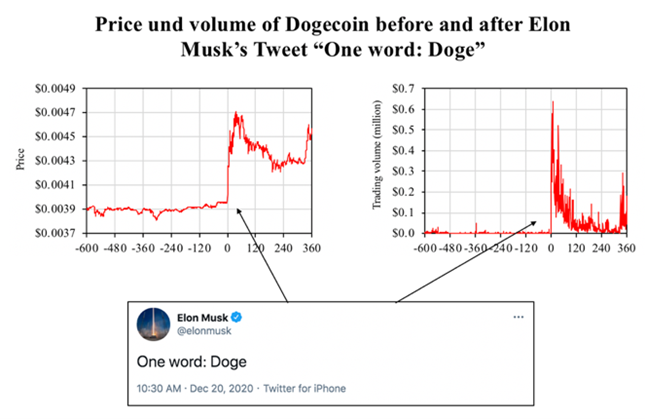

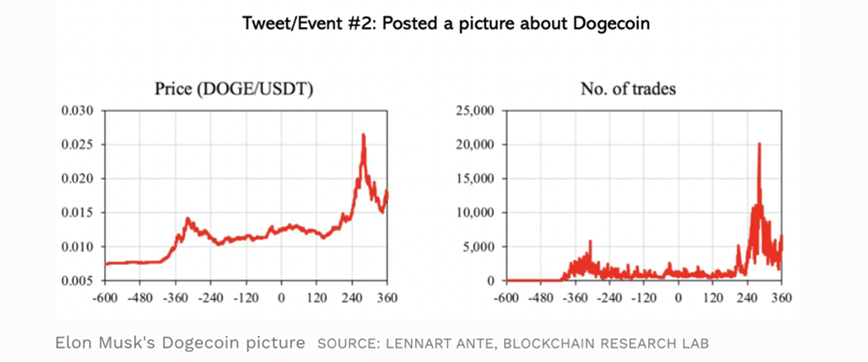

Moreover, the price of Dogecoin raised by more than 500% after he tweeted that it was his favorite cryptocurrency. For this he is also known to be the “Dogefather” or “King of Dogecoin”. He also tweeted that SpaceX will accept Dogecoin payments which again, made the value of one of his cryptocurrencies raise largely.

Figure 4. Elon Musk’s tweet effect on Dogecoin

Source: Source: Blockchain Research Lab

Figure 5. Elon Musk’s tweet effect on Dogecoin

Source: Source: Blockchain Research Lab

Examples of the negative impact of Elon Musk’s tweets on the crypto market

Elon Musk can have a positive but also a negative impact on the crypto market by creating its own up and downs. For instance, after his presence on Saturday Night Live in May 2021, the Dogecoin’s value fell 34%. This was shocking considering that it was predicted by many crypto enthusiasts that it would increase the Dogecoin’s value to US$ 1.

Also, after Musk called Dodgecoin to be a “hustle”, its price went down by more than 30%.

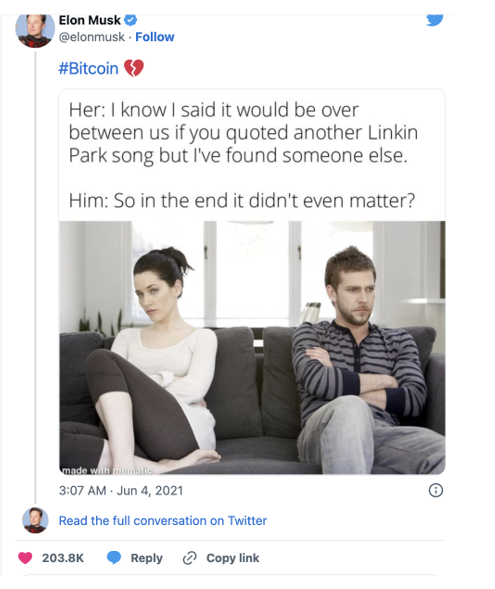

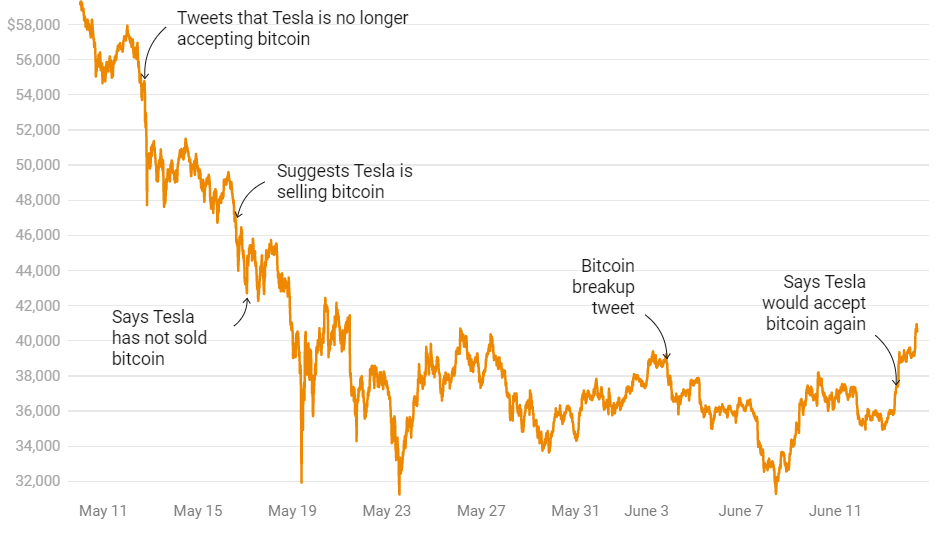

A last example I will add is of when Elon Musk tweeted a meme about breaking up with bitcoin on June 3. This caused the price of Bitcoin to decrease by 5%.

Figure 6. Tweet of Elon Musk on June 4, 2021

Source: Twitter.

Impact of Elon Musk’s tweets on the cryptocurrency market

Figure 7. Impact of Elon Musk’s tweets on the cryptocurrency market

Source: Coinjournal.

Why did it interest me?

This topic really caught my attention as I’ve always been very interested in investing, although never had the courage to do so due to the potential loss of real money. So, when I heard about this virtual currency, I became interested in knowing more about it, and after some research I found out about the news regarding Elon Musk and his effect on these. It was surprising and shocking seeing how an individual can have so much power over something, especially the power of social media.

Link with market efficiency

There are three types of market efficiency: weak efficiency related to market data (prices and transaction volumes), semi-strong efficiency related to all public information (company accounts, analyst reports, etc.) and strong efficiency (all public as well as private information).

Given the market reaction after Elon Musk’s tweets, the market is definitely efficient in the semi-strong sense. By observing the market reaction before Elon Musk’s tweets, we may wonder if the market is also efficient in the strong sense…

Useful resources

Academic articles

Gupta, R.R., Arya, R.K., Kumar, J., Gururani, A., Dugh, R., Dugh, A. (2022). The Impact of Elon Musk Tweets on Bitcoin Price. In: Mandal, J.K., Hsiung, PA., Sankar Dhar, R. (eds) Topical Drifts in Intelligent Computing. ICCTA 2021. Lecture Notes in Networks and Systems, vol 426. Springer, Singapore. https://doi.org/10.1007/978-981-19-0745-6_44

Business resources

Joe Khalique-Brown (15/06/2021) The Elon Musk Bitcoin saga continues: BTC rallies 10% Coin Journal

Noel Randewich (08/02/2021) Musk’s Bitcoin investment follows months of Twitter talk Reuters.

Related posts on the SimTrade blog

▶ Hugo MEYER <ahref=”https://www.simtrade.fr/blog_simtrade/regulation-cryptocurrencies/” target=”_parent”> The regulation of cryptocurrencies: what are we talking about?

▶ Alexandre VERLET Cryptocurrencies

▶ Alexandre VERLET The NFTs, a new gold rush?

About the author

The article was written in December 2022 by Ines ILLES MEJIAS (ESSEC Business School, Global BBA, 2020-2024).