Netflix’s announcement impacts Disney’s stock price

In this article, Ines ILLES MEJIAS (ESSEC Business School, Global BBA, 2020-2024) analyzes how Netflix announcement regarding its decrease in earnings and subscribers also affected Disney’s stock price.

Description of firm

Netflix (1997) and Disney + are both world leading entertainment streaming services. They both offer a wide variety of content ranging from TV shows, Movies, Documentaries and even original series and movies. Both streaming services are available as an app for mobile phones, tablets, etc, as well as streaming to watch online on our computers. This allows users to enjoy from their services anytime and anywhere, and, through the app even download content to watch offline. They both work as subscriptions with different plans which customers can choose to subscribe to depending on their income and needs. However, Netflix, having been launched before, was the market leader in the streaming entertainment industry for a very long time.

Description of event

Netflix reports its first customer decline of 26% in over 10 years, and Disney stocks fell 5.3% also consequently. Netflix reported a loss of 200,000 members in the first quarter and forecasted a loss of 2 million subscribers in the current quarter (April 2022). Investors and analysts are rethinking on new ways of boosting their forecasts for the entire industry, and fear that a reopening economy will cripple entertainment companies.

Figure 1. Impact of Netflix announcement.

Source: Bloomberg.

This article talks about the current decline in Netflix subscribers and how it has affected not only their stocks, but also created a fear among analysts and investors in the entertainment streaming industry, as well as impacted other companies’ stocks such as Disney, Warner Bros, etc.

Reaction of market to event

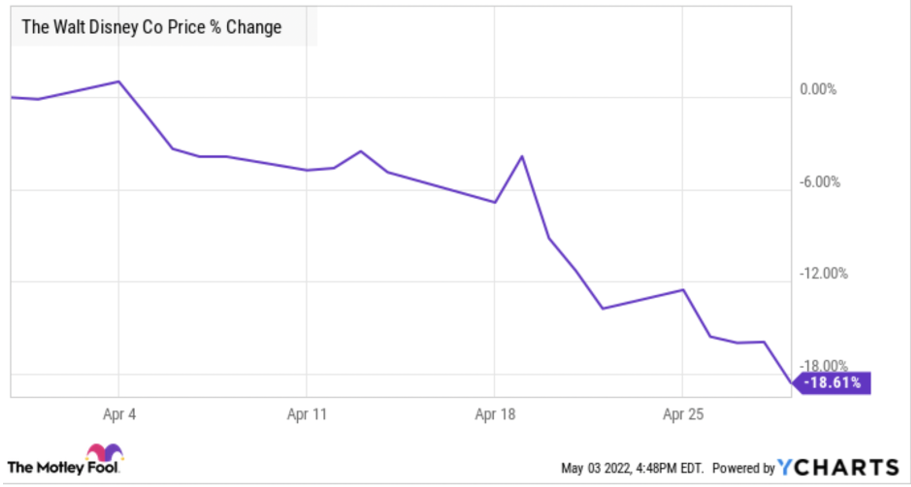

Disney shares fell by 6% after the news. Disney is a competitor, which means that normally it could have benefitted from a cut in Netflix (its competitor) stocks. But this did not seem to happen. Instead, investors feared that Disney might also suffer from a slower growth in earnings like Netflix, which resultantly affected Disney’s stocks negatively. By the end of April, Disney stocks fell by 19%, and, according to S&P Global Market Intelligence, down roughly 40% from its peak last fall.

It is said that one of the main reasons for Netflix big decline in returns and subscribers was content, especially since other entertainment such as HBO are gaining the exclusivity over shows such as Game of Thrones or Sex in the City. Therefore, Netflix plays on offering new Netflix Original content to more attract customers. However, Disney should do good after this as it has a deep content library of franchises that it can leverage to produce hit shows, so in the long-term its growth and revenues should not seem to be very affected by Netflix.

Figure 2. Impact of Netflix announcement on Walt Disney stock price.

Source: Bloomberg.

Link with market efficiency

The efficient market hypothesis states that the market cannot be beaten because it incorporates all information into current share prices, so stocks trade at the fairest value. There are three types of market efficiency that we must know of. First, weak efficiency, where all information contained in past stock market data (prices and transaction volumes) is already reflected in today’s price. Then, we have semi-strong efficiency which in addition to the information contained in historical stock market data, all public information (company accounts, analyst reports, etc.) is already reflected in today’s price. Finally, strong efficiency where all information, public as well as private, is already reflected in today’s price.

I believe this is an example of a semi-strong efficiency as company accounts and reports as well as historical data are included in the price. Disney’s price was subject and result of Netflix public accounts.

Justification of your choice of the event and the firm

I, myself, am a subscriber for both of these entertainment streaming services, so when I heard the news, I was actually surprised about the power and influence that these have on one another. Especially since I believe that both have completely different content which interest me. From a very young age, I’ve been a fan of Disney and their content, which is what made me subscribe to Disney +, while I became a subscriber for Netflix because it was “a trend” back in time and everyone was speaking about all the content available. After reading this news, I also agreed that Netflix has decreased in terms of content and quality, which is why I use more Disney plus, another reason why I was surprised by the news.

Why should you be interested in this post?

Netflix and Disney are two of the most know streaming companies in the world. It’s important to be aware of the impacts that companies from the same industry have on one another, especially to be able to avoid, fight or tackle if news like these were to happen again.

Useful resources

Why Disney Stock fell 19& in April

Stocks fall after shocking drop in Netflix subscribers

About the author

The article was written in December 2022 by Ines ILLES MEJIAS (ESSEC Business School, Global BBA, 2020-2024).