In this article, Camille Keller (ESSEC Business School, Bachelor in Business Administration (BBA), 2020-2024) explores the economic and environmental factors influencing rising coffee prices, shedding light on global futures markets and sustainability efforts.

Environmental Factors: Climate Change and Coffee Production

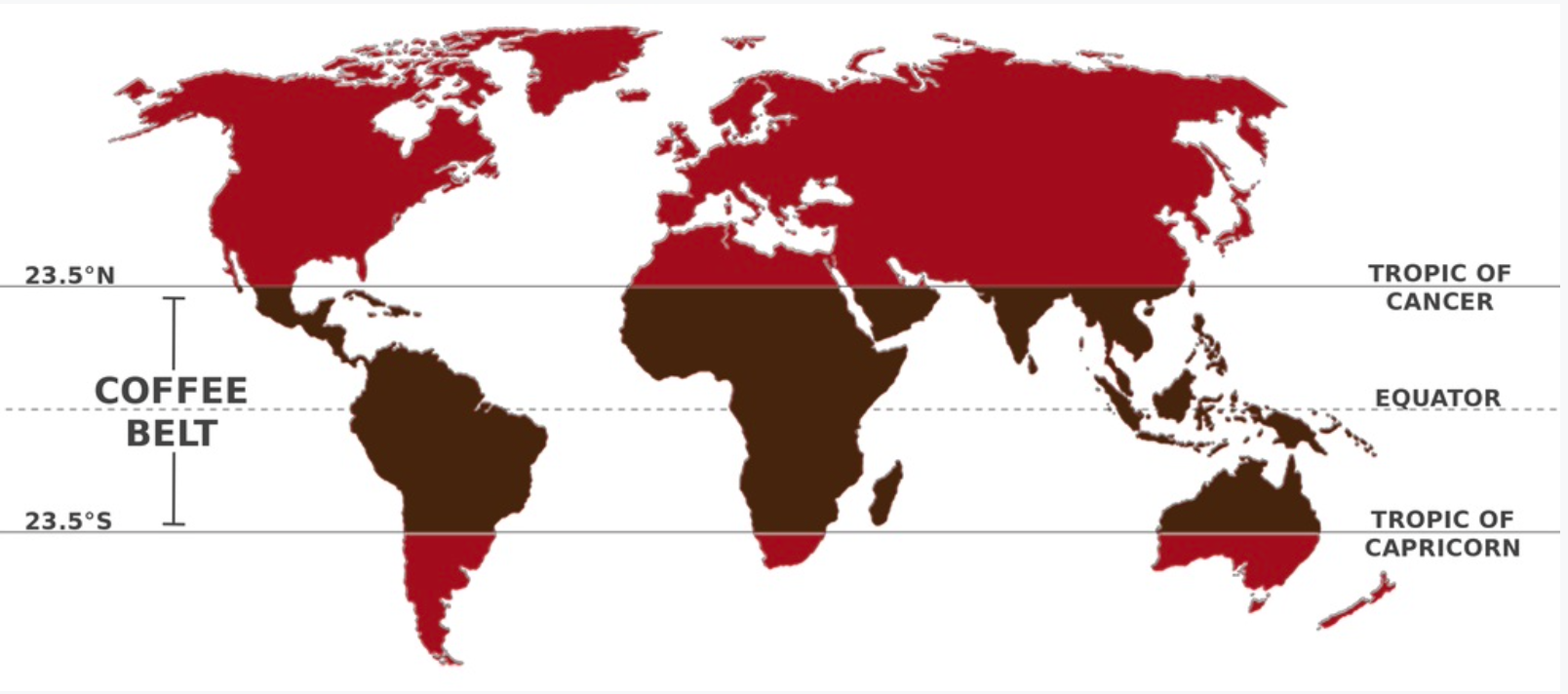

It’s no secret that coffee is deeply tied to the environment. Arabica coffee, cherished for its smooth flavor, accounts for about 60% of global coffee production—but it’s also notoriously sensitive to climate change. Reardon-Smith et al. (2019) highlight how rising temperatures and unpredictable weather patterns are shrinking suitable growing areas and reducing yields. The regions best known for coffee cultivation, including Brazil and Vietnam, are among the hardest hit.

A study by Tavares et al. (2018) paints a stark picture for Southeast Brazil, a vital hub for Arabica production. Projections indicate that suitable cultivation areas could drop by as much as 60% by the end of the century, with yields potentially falling by 25% under high greenhouse gas scenarios. These environmental hurdles are compounded by deforestation and soil degradation, leaving farmers with limited options to sustain production.

Adding to the pressure, Trading Economics (2025) reports that persistent below-normal rainfall in key Brazilian regions has exacerbated supply constraints. Brazil’s 2024 coffee harvest was estimated at 54.2 million 60-kg bags, down 1.6% from the previous year. Such trends not only strain global supply but also drive prices higher as demand outpaces production.

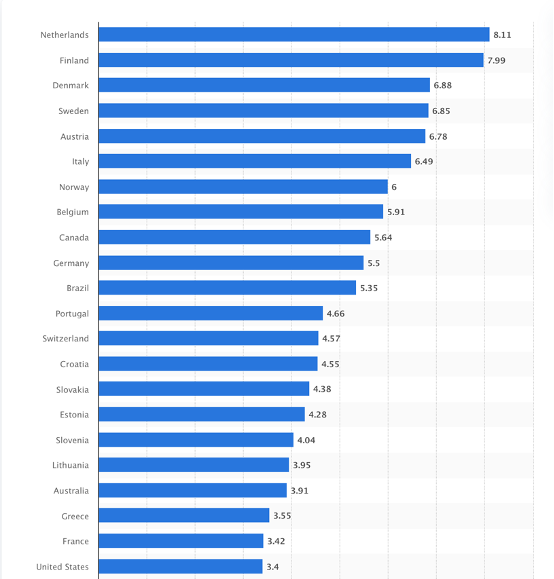

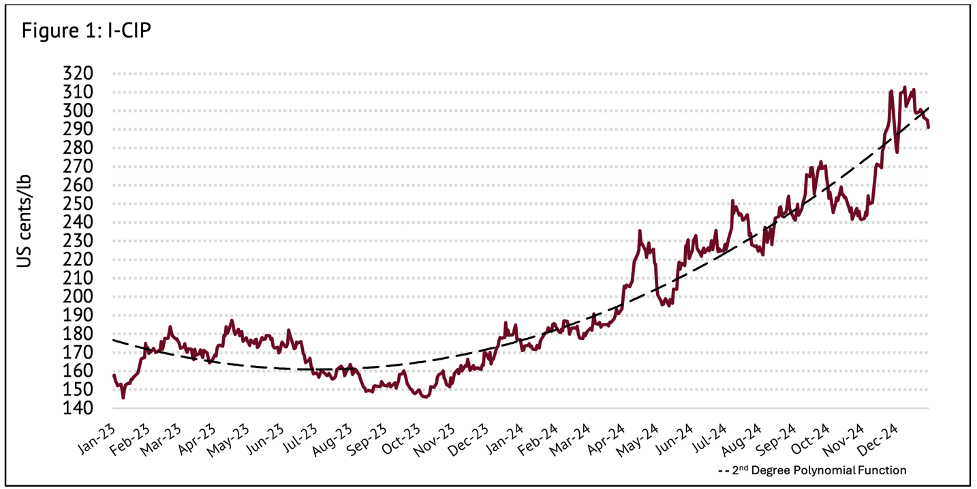

The ICO Composite Indicator Price (I-CIP)

Source: ICO Report 2024.

Economic Factors: Supply Chain Disruptions and Consumer Trends

Beyond environmental woes, economic forces play a crucial role in the coffee market. In recent years, global supply chain disruptions have caused delays and driven up transportation costs, creating additional upward pressure on coffee prices. The COVID-19 pandemic underscored the fragility of global logistics, making it harder to get coffee beans from farms to consumers.

Consumer behavior also holds significant sway. According to Capps et al. (2023), coffee demand in the United States is highly price-sensitive, with a price elasticity of -1.93. This means that as prices rise, many consumers cut back on their purchases. Yet, wealthier households tend to continue buying coffee regardless of price increases, reflecting the complex dynamics of socioeconomic factors in shaping demand.

Meanwhile, the International Coffee Organization (ICO, 2024) notes that global coffee prices rose by 40% in 2024, with the ICO Composite Indicator Price averaging 299.61 US cents/lb in December. This surge has been driven by a combination of tight supply and robust demand, particularly for Arabica coffee. Additionally, logistical challenges, such as container shortages and prolonged shipping times to European markets, have amplified cost pressures throughout the supply chain.

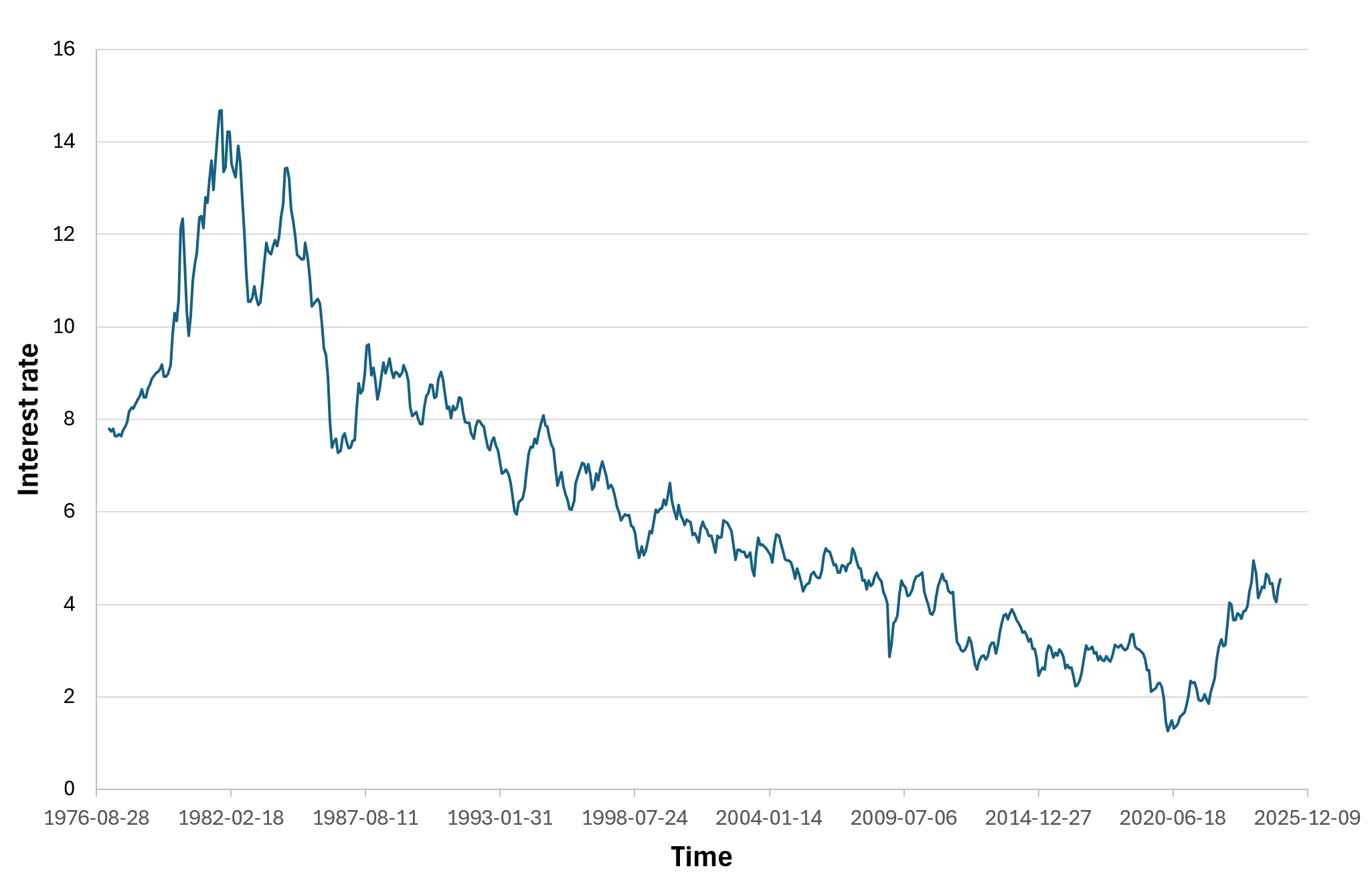

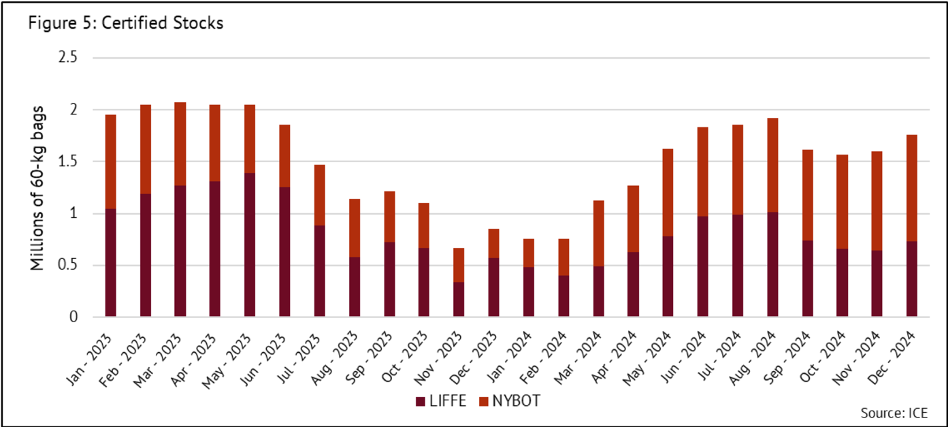

Certified Stocks of Arabica and Robusta Coffee

Source: ICO Report 2024.

EU Regulations and Market Dynamics

Adding to these challenges are new European Union regulations aimed at combating deforestation. Savage (2024) reports that coffee futures hit a 47-year high in November 2024, partly due to fears surrounding these laws. The regulations require companies to ensure their supply chains are free of deforestation, significantly increasing compliance costs for producers. While these measures promote sustainability, they have also added uncertainty and volatility to the market, pushing prices further upward.

Moreover, the ICO (2024) highlights the volatility of coffee prices, with Arabica and Robusta exhibiting sharp fluctuations. Certified stocks of Robusta coffee increased by 13.3% from November to December 2024, while Arabica stocks grew by 7.8%. Despite these increases, the imbalance between supply and demand continues to fuel price volatility, as traders and roasters navigate a challenging market landscape.

Conclusion: Future Outlook of a Volatile Market

The interplay of environmental and economic factors makes it clear: coffee prices are unlikely to stabilize anytime soon. Climate change will continue to constrain supply, while evolving consumer preferences and regulatory changes shape demand. This complex web of factors requires innovative solutions from policymakers, industry leaders, and consumers alike.

For consumers, this may mean accepting higher prices as the new norm. However, increased awareness of the environmental and social costs of coffee production could drive more sustainable consumption patterns. Initiatives such as fair trade certification and carbon-neutral labeling are gaining momentum, offering a pathway to a more equitable and resilient coffee industry.

Why Should I Be Interested in This Post?

This post provides ESSEC students and global business enthusiasts with valuable insights into how environmental changes, economic challenges, and regulatory dynamics are shaping one of the world’s most consumed commodities.

Related Posts on the SimTrade Blog

▶ Camille KELLER Global Coffee Habits: Understanding Consumption Trends Across the World

▶ Camille KELLER From bean to brew: understanding coffee as a global commodity

▶ Anant JAIN Understanding Price Elasticity Of Demand

▶ Akshit GUPTA Futures Contract

Useful Resources

International Coffee Organization (ICO) Coffee Market Report 2024

Trading Economics Arabica Coffee Futures

Financial Times Coffee Futures Hit 47-Year High

Yen Pham, Kathryn Reardon-Smith, Shahbaz Mushtaq & Geoff Cockfield (2019) The impact of climate change and variability on coffee production: a systematic review Climatic Change Journal, 156, 609-630

About the Author

The article was written in January 2025 by Camille Keller (ESSEC Business School, Bachelor in Business Administration (BBA), 2020-2024).