In this article, Aastha DAS (ESSEC Business School, Bachelor’s in Business Administration, Exchange Student from Northeastern University) presents the “Women in Finance” association at Northeastern University.

Background on women in finance

In almost all industries around the world, women are underrepresented at the top, excluding few sectors like nursing and education. One industry where women are highly underrepresented is the financial services. The Deloitte Center for Financial Services revealed the statistic that of the largest financial institutions in the US, only six out of 107 are run by female CEOs in 2019. This can be attributed to how women and men start on par during the start of their careers in finance, but men are more motivated to grow in the ranks to the C-level executive (C like Chief Executive Officer, Chief Financial Officer, Chief Investment Officer, Chief Economist, etc.). There are significantly fewer precedents for women in high levels of finance making it difficult for aspiring women in finance to find role models and mentors to rely on as a guide, especially in venture and private equity.

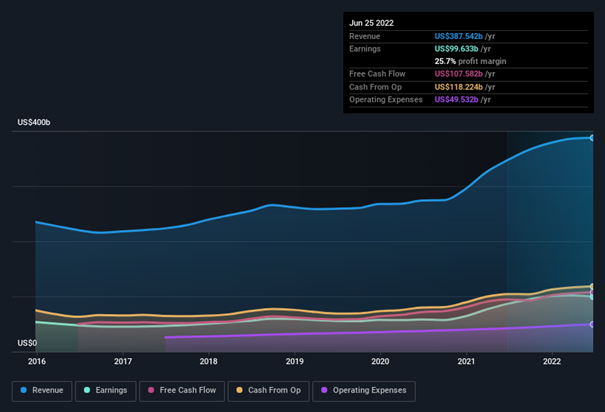

Figure 1. Women in Finance 2022 semester recap.

Source: Northeastern University.

There is a growing rate of initiatives trying to bolster women into the industry with the gender gap reducing exponentially in MBA programs, yet women still only account for a small ratio of finance staff at top global business schools. Nonprofit organizations like “Girls Who Invest” help diversity initiatives support women to bring young women into the world of finance through internships and mentoring programs, providing them with the best possible foundation.

Women need these programs and mentors to show them that they are capable of getting through any hardship in the path of achieving C-level executive positions and success, starting from as young as high school. These programs help to spark interest in the field and show them that there is so much more to the industry than seen regularly by someone not as exposed to the different sectors.

One industry where women are highly underrepresented is the upper levels of financial services management and investment services with the Deloitte Center for Financial Services revealing the statistic that of the largest financial institutions in the US, only six out of 107 are run by female CEOs in the USA, based on a 2019 rate.

The unfortunate statistic of the “broken rung” describes how women in lower entry level positions are promoted into managerial and C-level positions at a significantly lower rate than men. The broken rung can be defined as women having misfortune in promotion and this creates a ripple effect with progressive organizational grades creating disproportionate levels of women in the organizational hierarchy, especially involving diversity in senior leadership.

Misconceptions also root from stereotypes discouraging women from entering the finance space under the belief that they do not necessarily have the work-life balance as men as they should have to take care of families while working fulltime, but this belief is changing as women in finance are supported and men are also bolstered to take more responsibility within the home.

Women in Finance at Northeastern University

Women in Finance at Northeastern University

At Northeastern University, I have been involved in Women in Finance (WiF) since my first year starting with being involved in the Peer Mentorship program and then also acting as a Peer Mentor in my sophomore year and being a mentee in the Alumni Mentorship program. I also enjoyed being a part of the E-Board at Women in Finance as a Research Associate in Spring 2022 as part of the Street Talk. I thoroughly enjoyed being on the Street Talk as I felt as I was able to give back to the Women in Finance community through the works of the team, creating new ideas for the initiative, while also having the pleasure of being on the E-Board and getting to know all the other members and creating connections with one another. I also enjoyed being a part of the Professional program as I got to gain much insight from my alumni mentor, where I learned more firsthand information about the field, I am interested in. This upcoming Spring 2023, I will be taking on the role of President for the organization to best represent the Women in Finance initiative at Northeastern.

Missions of the organization

There are several organizations at many universities encouraging women in the business world and even entrepreneurship, but few have separate organizations for finance which is what draws me to this. The Women in Finance Initiative at Northeastern University strives to continue to uphold WiF’s goal to “educate, empower, support, and mentor” students by offering interesting and engaging programming and events that help students navigate finance. As members of the board, representing the organization with many endorsers and supports, WiF hopes to help provide the resources and instill confidence in female students, so they are empowered to pursue strong co-ops, internships, and leadership opportunities. Specifically, helping equip students with the skills to be successful in finance roles is valuable. The Wall Street Prep Series is an excellent program for students the organization has created to allow enrollment into a financial basics course with access to the certificate to learn incredibly valuable skills that can set them apart in interviews and on the job. Likewise, the mentorship programs provide invaluable guidance for students, and even use it in interviews and resumes. Continuing these programs and working to develop new ones allows WiF to fulfill its goal to educate students, and in doing so, helps with students’ confidence. Providing support like this allows women to realize their potential, which is another overarching goal.

The organization also has its the Executive Speaker Series (ESS) is an opportunity for undergraduate women, open to an interdisciplinary audience, to learn the stories and wisdom from female executives. In the past this has included positions across the C-level: CEO, CFO, CIO, and Chief Economist. These executives have traditionally worked in either the finance industry or come from some studying or other background in finance to further inspire women pursuing a business degree, particularly in finance and/or accounting.

Figure 2. Women in Finance Executive Speaker Series (ESS).

Source: Northeastern University.

Acquiring financial skills

As many women explore the world of finance, it is important to build technical skills, and this is where the workshops from WiF come to use. The goal of workshops and skill series this semester is to help build members’ technical skills for the purpose of interviewing for co-ops or full-time work. We want our members to be competitive as technical interviewing becomes more popular with higher level positions. Technical skills include but are not limited to financial modeling, investing, personal finance, excel, PowerPoint, and learning how to use Bloomberg. This Fall we are already committed to hosting a Bloomberg Education Series through Northeastern’s virtual terminals.

The opportunities like the NYC and Fidelity Treks are something that not many other organizations offer. Each spring Women in Finance offers educational and networking Treks to companies in both Boston and New York City. The Freshman NYC Trek is where students go on a 3-day trip to New York and can visit various firms to learn about various career paths with a focus on Investment Banking and Consulting. Virtual Treks and networking opportunities in the form of a career education series are also regularly offered. Career Education panels are programmed to include but are not limited to, a Private Equity Panel, a Corporate Finance Panel, a Navigating Investment Banking Panel, and a Restructuring Panel.

Looking forward

Continuing to develop more unique programming like those that draw more students to the organization helps keep our organization up to date with the everchanging markets and world of finance. In the long term, because of the value of those opportunities, WiF could even become a draw to the university of prospective students. Continuing to have corporate sponsors can help fund more events like the treks while also helping to potentially build out more co-op/internship experiences for students with our sponsors. Given how male-dominated finance is, Women in Finance at Northeastern is a safe space for women to explore the field and know their worth and to encourage them to pursue roles they otherwise many not and provide a supportive community for females in finance.

Moving forward, ensuring that Women in Finance can help many more generations of young woman aspiring to be in this sector and the business world, I hope to create more long-lasting connections for the organization to allow more diverse parts of the finance field. I also hope to ensure that each semester remains consistent with the past while maintaining a level of improvement if necessary.

Why should I be interested in this article?

It is worth reading this article because of the underrepresentation of women in the finance industry and how that is pivoting to change over time and the impact that women can make at a high level. It can be daunting to enter a field like this, especially with so many controversial opinions and stereotypes. I would not be where I am in my career with an Investment Banking internship, financial services co-op, and upcoming M&A solutions consulting internship in NYC without this organization and I owe it to Northeastern University’s Women in Finance Initiative for providing me with the resources, support, mentorship, and confidence to put myself where I may not have felt I belonged before. I am not a finance concentration or major at my university, yet I learned that anyone can go into a role of finance, and that one is not just constricted as it is an open playing field, as long as you apply yourself and find the path of finance you want to go through, by exposing yourself to the different opportunities in finance like investment banking, equity research, sales & trading, asset management, wealth management, venture capital, angel investing, private equity, hedge funds, global capital markets, and so many more untapped industries for women to climb the ranks in.

Useful resources

Women in Finance (Northeastern University)

Related posts on the SimTrade blog

▶ Alexandre VERLET Women in Finance

About the author

The article was written in December 2022 by Aastha DAS (ESSEC Business School, Bachelor’s in Business Administration, Exchange Student from Northeastern University).