Simple interest rate and compound interest rate

In this article, Sébastien PIAT (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2024) explains the difference between simple interest rate and compound interest rate.

Introduction

When dealing with interest rates, it can be useful to be able to switch from a yearly rate to a period rate that is used to compute interests on a period for an investment or a loan. But you should be aware that the computation is different when working with simple interests and compounded interests.

Below is the method to switch back and forth between a period rate and a yearly rate.

With simple interests

If you think of an investment that generates yearly incomes at a rate of 6%, you might want to know what your monthly return is.

As we deal with simple interests, the monthly rate of this investment will be 0.5% (=6/12).

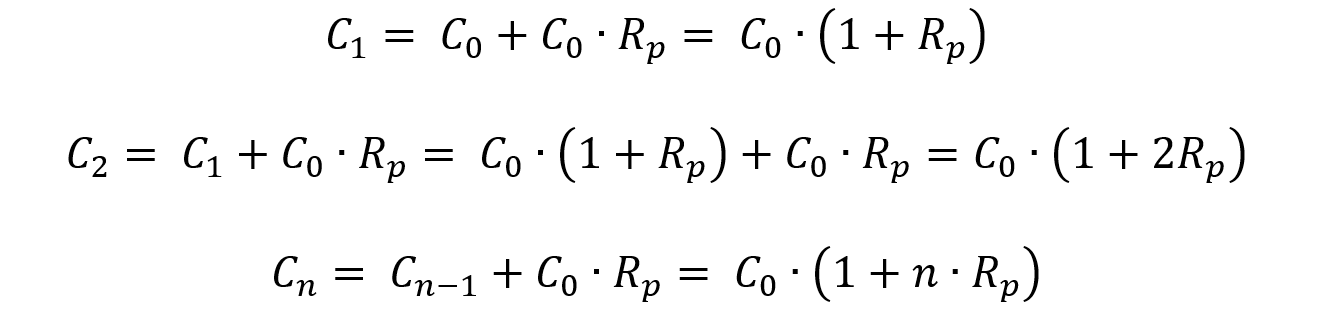

With simple interests, the interests on a given period are computed with the initial capital:

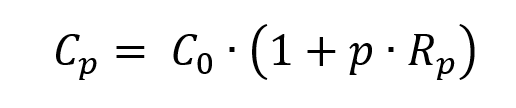

Assuming that the interests are computed over p periods during the year, the capital of the investment at the end of the year is equal to

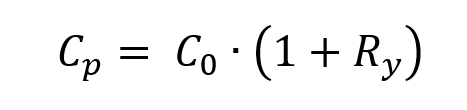

The equivalent yearly rate of return Ry gives the same capital value at the end of the year

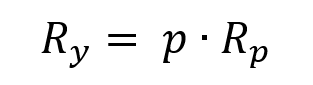

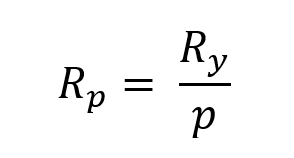

By equating the two formulas for the capital at the end of the year, we obtain a relation between the period rate Rp and the equivalent yearly rate Ry:

With compound interests

Things get a little trickier when dealing with compound interests as interests get reinvested period after period.

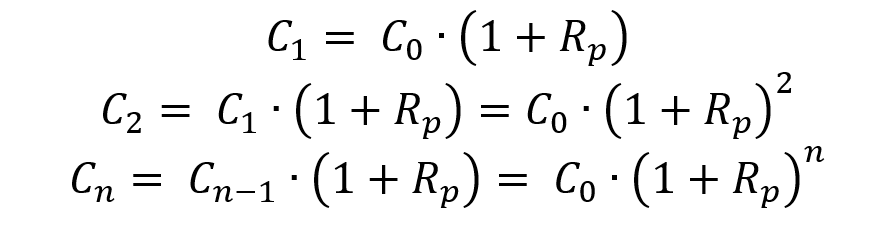

Compounded interests can be considered by the following equation:

Where Rp is the period rate of the investment and Cn is your capital at the end of the nth period.

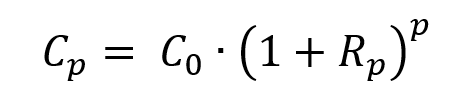

Assuming that the interests are computed over p periods during the year, the capital of the investment at the end of the year is equal to

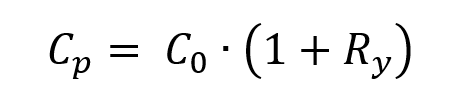

The equivalent yearly rate of return Ry gives the same capital value at the end of the year

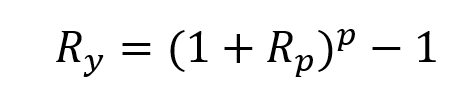

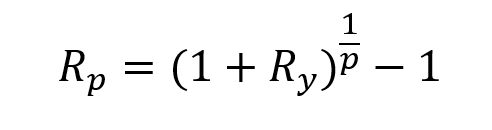

By equating the two formulas for the capital at the end of the year, we obtain a relation between the period rate Rp and the equivalent yearly rate Ry:

Excel file to compute interests of an investment

You can download below the Excel file for the computation of interests with simple and compound interests and the equivalent yearly interest rate.

You can download below the Excel file to switch from a period interest rate to a yearly interest rate and vice versa.

Why should I be interested in this post?

This post should help you switch between a period rate and the equivalent yearly rate of an investment.

This is particularly useful when we deal with cash flows that do not appear with a yearly frequency but with a monthly or quarterly frequency. With non-yearly cash flows, it is necessary to consider a period rate to compute the present value (PV), net present value (NPV) and internal rate of return (IRR).

Useful resources

longin.fr website Cours Gestion financière (in French).

Related posts on the SimTrade blog

▶ Raphaël ROERO DE CORTANZE The Internal Rate of Return

▶ Léopoldine FOUQUES The IRR, XIRR and MIRR functions in Excel

▶ Jérémy PAULEN The IRR function in Excel

▶ William LONGIN How to compute the present value of an asset?

▶ Maite CARNICERO MARTINEZ How to compute the net present value of an investment in Excel

About the author

The article was written in October 2022 by Sébastien PIAT (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2024) .