Financial markets move every second, reacting to every new piece of information, every financial statement, every geopolitical event. Prices rise, fall, move too far, come back again, and for anyone observing from the outside, this constant motion can easily appear chaotic.

Yet, behind this apparent disorder lies a deeper structure, a logic shaped by the continuous exchange between buyers and sellers who negotiate and adjust their positions in real time.

In this article, Hadrien PUCHE (ESSEC Business School, Grande École Program, Master in Management, 2023-2027) explains why Peter Steidlmayer’s quote is so meaningful.

Peter Steidlmayer and the origin of market profile

Peter Steidlmayer

Source : Profile trading

Peter Steidlmayer is known above all as the creator of the Market Profile methodology, introduced at the Chicago Board of Trade in the early 1980s. His goal was both simple and ambitious: to provide market participants with a clearer understanding of where the market was “accepting” value, rather than simply where prices happened to appear on a linear chart.

The quote that defines his philosophy first gained prominence in his seminal work:

“The market is a continuously unfolding process of discovery. Price is not value in itself, but the market’s best guess at a given moment. Only through the passage of time, with sufficient volume at a given range, can value be established.”

— Peter Steidlmayer, Markets and Market Logic: Trading and Investing with a Sound Understanding and Approach (1986).

Until this publication, most analysis focused on time-based charts that displayed the sequence of prices but said little about the intensity of trading at each level. Steidlmayer added a decisive dimension by incorporating Volume at Price, revealing how the market behaves like a continuous auction. Buyers and sellers negotiate, the market explores different levels, and value emerges where transactions cluster and where time confirms acceptance.

The quote takes its meaning directly from this framework. For Steidlmayer, markets discover value in the same way an auction settles a fair price: not through a single print, but through repeated interaction. A sudden spike tells us very little; it is merely a “probe.” But when the market spends time around a certain level with significant volume, it offers a reliable indication of Accepted Value.

To learn more about market profiles, check out this article by Michel Verhasselt on Market Profiles.

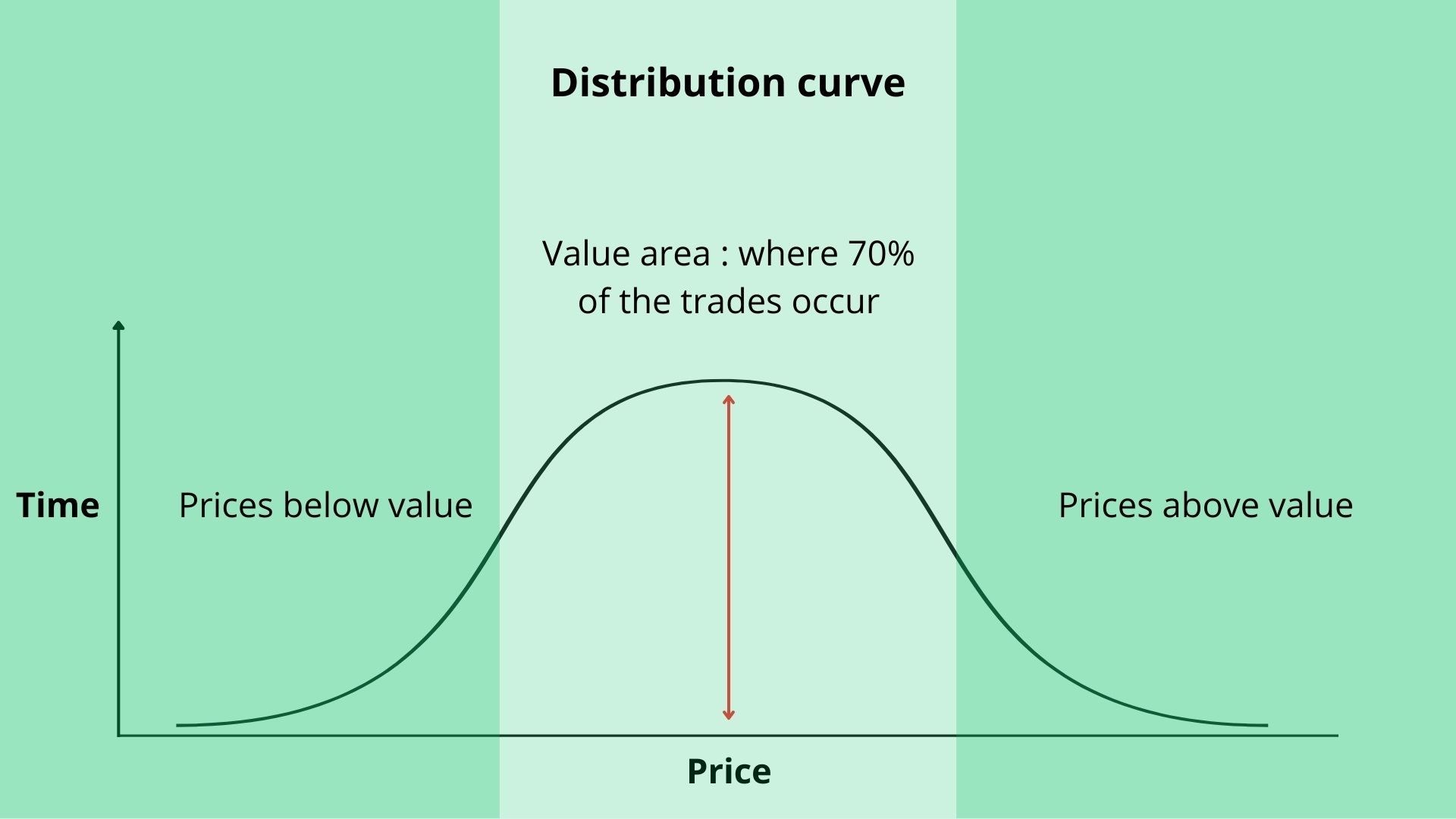

The graph below presents Steidlmayer’s market price distribution. The curve is constructed by dividing the trading session into equal time intervals (typically 30 minutes) and recording each price level traded during every interval. Each instance of a price occurring within a given bracket is labeled a Time Price Opportunity (TPO). The distribution is then formed by aggregating the total number of TPOs at each price level across the session, thereby producing a time-weighted empirical distribution of prices. Under conditions of relative balance between supply and demand, this process often yields a bell-shaped profile. In this framework, price discovery exhibits an ordered structure: the central region of the curve (characterized by a high concentration of TPOs) reflects sustained trading activity and temporary equilibrium, commonly interpreted as the market’s most accepted estimate of fair value. Conversely, the tails correspond to price levels traversed quickly, signaling rejection, imbalance, and potential disequilibrium (often associated with emotional trading).

Analysis of the Quote

“The market is a continuously unfolding process of discovery” captures the very essence of Steidlmayer’s thinking. By framing the market this way, he reminds us that it is not a static mechanism but a living process in perpetual motion. Prices are not definitive statements of value; they are temporary judgments, mere snapshots of the market’s collective opinion at one precise moment.

Price reflects the most recent consensus, influenced by news, emotion, and short-term liquidity. It is the market’s best guess, but never its final conclusion. True value, on the other hand, does not reveal itself instantly. It appears gradually through the accumulation of transactions that demonstrate where participants genuinely agree. This requires sufficient volume and visible acceptance to prove that a broad set of participants (and not just a few aggressive traders) concurs on a price level.

This distinction explains why short-term volatility often expresses emotion more than fundamentals. In contemporary terms, price discovery is fast and exploratory, while value discovery is slow, deliberate, and shaped by consensus. This is what Warren Buffet meant when he said “Price is what you pay, value is what you get”.

Understanding that the market is a “continuously unfolding” conversation helps investors remain focused on the durable signal of value rather than reacting to the transient noise of price.

Three Financial Concepts Linked to the Quote

Market microstructure and auction theory

Financial markets operate in many ways like auctions. Buyers raise their bids, sellers adjust their offers, and the market constantly seeks the level at which both sides find balance. This is the essence of Market microstructure, the study of how a market’s participants and their behavior determine the price of an asset. Just like in an auction, participants negotiate in real-time, until the highest price someone is willing to pay and the lowest price someone is willing to sell meet.

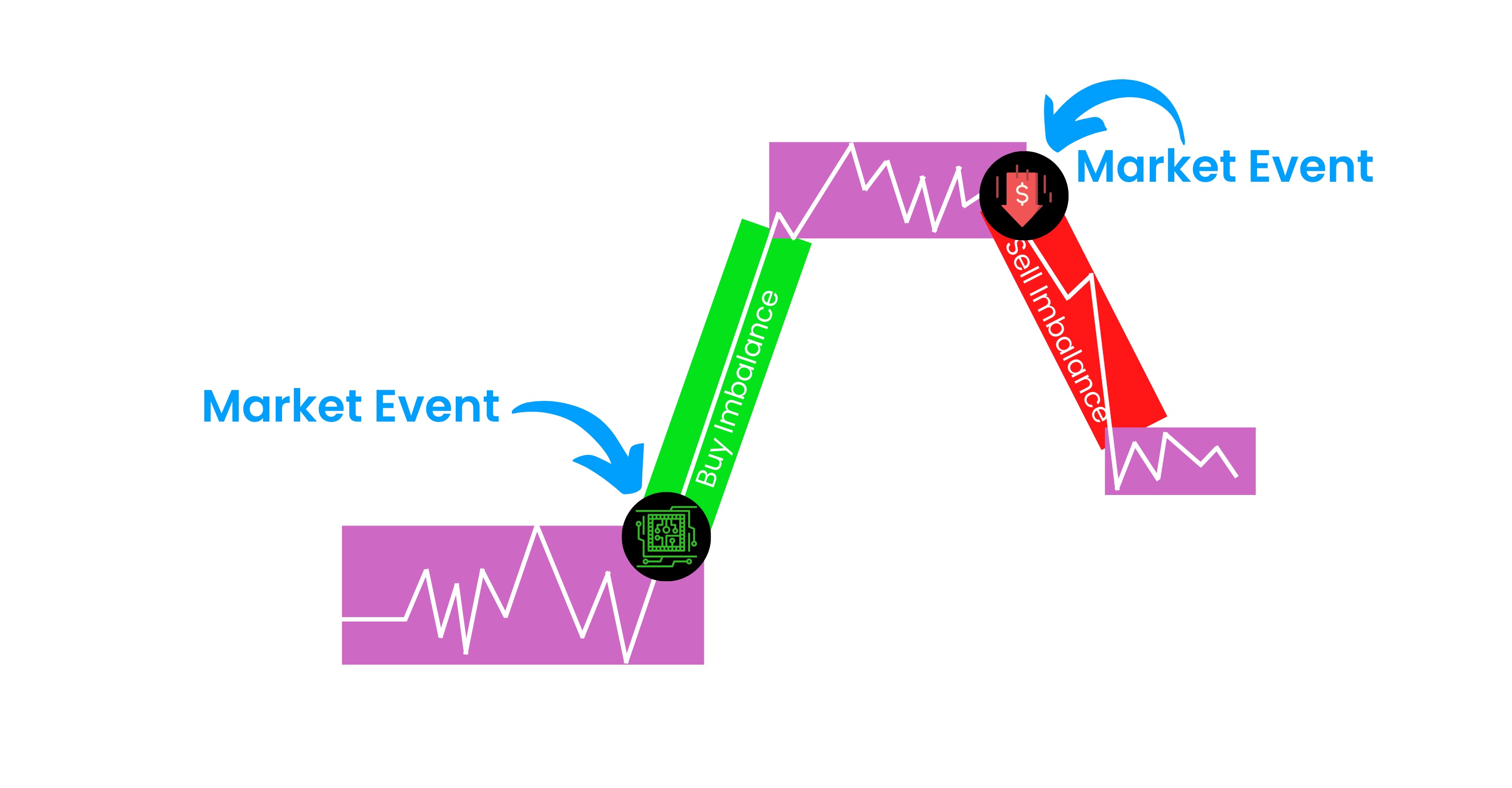

Steidlmayer’s vision aligns perfectly with the principles of market microstructure: during periods of uncertainty, the market enters a “discovery” phase, where prices move rapidly and vertically to find new participants. This is the market effectively “probing” for the limits of supply and demand, in a continuously unfolding process of discovery.

When a price is found, the market stops moving vertically and starts moving horizontally, spending more time at a specific level to facilitate the maximum amount of trade. These consolidation areas are visual representation of agreement. It shows that the market has stopped searching and has found a temporary equilibrium where both buyers and sellers are satisfied with the price.

As you can see here, the price moves in a range until a market event causes an auction. When an appropriate price is found, the market resumes moving in a new range again. Source : Jump trading.

Liquidity

Liquidity plays a decisive role in determining whether a price reflects genuine value or merely a temporary distortion. In finance, liquidity is defined as the ability to buy or sell an asset quickly without significantly affecting its price. It is a multi-dimensional concept, analyzed through several key components:

- Tightness: Refers to the cost of a transaction, typically measured by the width of the bid-ask spread.

- Depth: The volume of orders available at various price levels above and below the current market price.

- Breadth: The number and diversity of market participants, indicating a wide range of interests.

- Resiliency: The speed at which prices recover to “fair value” after a large, potentially disruptive trade.

In Steidlmayer’s framework, a price level reached on minimal volume is considered “unfair” or an outlier; it tells us very little because it lacks the support of the broader market. On the other hand, a price level traded repeatedly with strong participation speaks with far more authority. It indicates that a large number of participants have agreed on this price, and that is therefore “fair”.

This is why professional investors rely on measures such as the Volume Weighted Average Price (VWAP), the volume profile, and value area boundaries. These tools help separate the meaningful “signal” of institutional conviction from the surrounding “noise” of retail emotion. In essence, price is the discovery mechanism, but volume is the validation.

Without volume, a price movement is a mere suggestion; with volume, it becomes a confirmed consensus of value.

Market efficiency

The quote also relates to the Efficient Market Hypothesis (EMH), which suggests that asset prices reflect all available information. There are three distinct forms of market efficiency:

- Weak form: Assumes that current prices reflect all information contained in past prices and trading volumes, meaning technical analysis cannot consistently produce excess returns.

- Semi-strong form: Assumes that prices adjust instantly to all publicly available information, such as earnings announcements or economic data.

- Strong form: Assumes that prices reflect all information, including private or insider information, according to which price should always equal value.

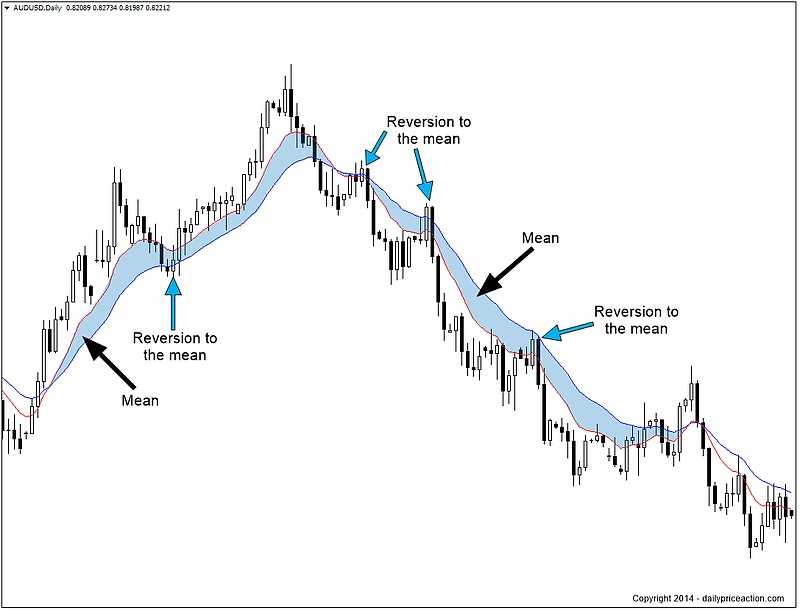

Steidlmayer proposes a more nuanced and realistic vision: markets are constantly searching for value, and they do not find it immediately. Because the “process of discovery” is driven by human participants with varying expectations, the market often overshoots or undershoot its true value before settling into a new equilibrium.

We can clearly see the market’s propensity for emotional excess, where price extends far beyond fair value before reverting to the mean. These oscillations prove that price discovery is a non-linear process driven by temporary imbalances in supply and demand.

Source: dailypriceaction.com

This concept is essential for students. It explains why markets may be broadly efficient over long horizons, but still display irrational behavior in the short term. These “inefficiencies” are not market failures, but proof that the discovery process is in action.

By understanding that the current price is a search (and not a final answer), an investor can remain calm when the market overreacts, knowing that prices will eventually pull back towards the established value area.

My opinion on this Quote

I believe this quote offers a very accurate description of market behavior. It captures, with remarkable clarity, the difference between instantaneous price and durable value. What I find particularly compelling is the way it reframes volatility as part of the market’s natural process of exploration (rather than a source of confusion).

This perspective encourages patience, and reinforces the idea that investors should focus on context and ranges rather than individual specific prices.

However, it is important to nuance this perspective in the context of today’s modern markets. Steidlmayer’s logic was developed in the 1980s, long before the dominance of High-Frequency Trading (HFT) and algorithmic execution. Today, the “process of discovery” often happens in milliseconds, particularly on large cap stocks. While the fundamental principles of auction theory still apply, the transition from price to value is now much faster.

Despite this technological shift, the core lesson remains: the market is a conversation, and even if that conversation is now partly led by machines, the ultimate consensus still requires time and volume to establish true value.

Why should this quote matter to you ?

This quote is a good way of adding an additional level of complexity to your understanding of how markets truly function. Understanding the market’s process of discovery helps better understand markets movements, distinguish noise from genuine information, and avoid reacting impulsively to volatility. It teaches you to appreciate the essential roles of time, liquidity, and volume in revealing value, in order to make better decisions.

Ultimately, this quote conveys a profound lesson. The market is more of a conversation than a verdict, a continuous exchange of perspectives that gradually converges toward value. For any student who hopes to approach markets with discipline and understanding, mastering this idea is both a practical and an intellectual advantage.

Related posts

Famous quotes about valuation

▶ Hadrien PUCHE “Price is what you pay, value is what you get” – Warren Buffett

▶ Hadrien PUCHE “The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

Other famous quotes

▶ Hadrien PUCHE “The big money is not in the buying and selling, but in the waiting.” – Charlie Munger

▶ Hadrien PUCHE “Don’t look for the needle in the haystack. Just buy the haystack.” – John C. Bogle

About market profile

▶ Michel VERHASSELT Market profiles

▶ Michel VERHASSELT Difference between market profiles and volume profiles

▶ Michel VERHASSELT Trading strategies based on market profiles and volume profiles

▶ Raphael TRAEN Volume-Weighted Average Price (VWAP)

Useful resources

Steidlmayer P.J. and K. Koy (1986) Markets and Market Logic: Trading and Investing with a Sound Understanding and Approach, Porcupine Press.

Steidlmayer P.J. and S.B. Hawkins (2003) Steidlmayer on Markets: Trading with Market Profile, John Wiley & Sons, Second Edition;

Trader Dale Volume Profile vs. Market Profile – What Is The Difference? YouTube video

About the Author

This article was written in February 2026 by Hadrien PUCHE (ESSEC Business School, Grande École Program, Master in Management, 2023-2027).

▶ Discover all articles by Hadrien PUCHE