Special Acquisition Purpose Companies (SPAC)

In this article, Martin VAN DER BORGHT (ESSEC Business School, Master in Finance, 2022-2024) develops on the SPACs.

What are SPACs

Special purpose acquisition companies (SPACs) are an increasingly popular form of corporate finance for businesses seeking to go public. SPACs are publicly listed entities created with the objective of raising capital through their initial public offering (IPO) and then using that capital to acquire a private operating business. As the popularity of this financing method has grown, so have questions about how SPACs work, their potential risks and rewards, and their implications for investors. This essay will provide an overview of SPAC structures and describe key considerations for investors in evaluating these vehicles.

How are SPACs created

A special purpose acquisition company (SPAC) is created by sponsors who typically have a specific sector or industry focus; they use proceeds from their IPO to acquire target companies within that focus area without conducting the usual due diligence associated with traditional IPOs. The target company is usually identified prior to the IPO taking place; after it does take place, shareholders vote on whether or not they would like to invest in the acquisition target’s stock along with other aspects such as management compensation packages.

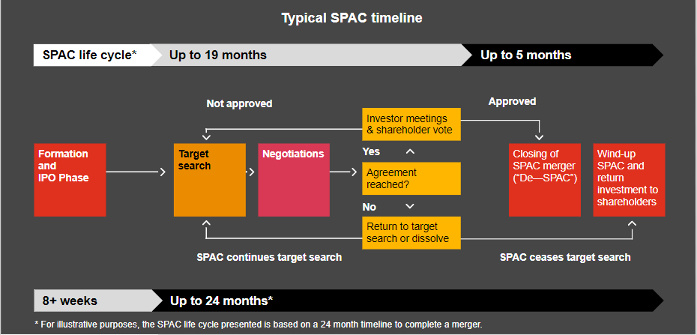

The SPAC process

The process begins when sponsors form a shell corporation that issues share via investment banks’ underwriting services; these shares are then offered in an IPO which typically raises between $250 million-$500 million dollars depending on market conditions at time of launch. Sponsors can also raise additional funds through private placements before going public if needed and may even receive additional cash from selling existing assets owned by company founders prior to launching its IPO. This allows them more flexibility in terms of what targets they choose during search process as well as ability transfer ownership over acquired business faster than traditional M&A processes since no need wait secure regulatory approval beforehand. Once enough capital has been raised through IPO/private placement offerings, sponsor team begins searching for suitable candidate(s) purchase using criteria determined ahead time based off desired sector/industry focus outlined earlier mentioned: things like size revenue generated per quarter/yearly periods competitive edge offered current products compared competitors etcetera all come play here when narrowing down list candidates whose acquisitions could potentially help increase value long-term investments made original shareholders..

Advantages of SPACs

Unlike traditional IPOs where companies must fully disclose financial information related past performance future prospects order comply regulations set forth Securities & Exchange Commission (SEC), there far less regulation involved investing SPACs because purchase decisions already being made prior going public stage: meaning only disclose details about target once agreement reached between both parties – though some do provide general information during pre-IPO phase give prospective buyers better idea what expect once deal goes through.. This type of structure helps lower cost associated taking business public since much due diligence already done before opening up share offer investors thus allowing them access higher quality opportunities at fraction price versus those available traditional stock exchange markets. Additionally, because shareholder votes taken into consideration each step way, risk potential fraud reduced since any major irregularities discovered regarding selected targets become transparent common knowledge everyone voting upon proposed change (i.e., keeping board members accountable).

Disadvantages of SPACs

As attractive option investing might seem, there are still certain drawbacks that we should be aware such the high cost involved structuring and launching successful campaigns and the fact that most liquidation events occur within two years after listing date – meaning there is a lot of money spent upfront without guarantee returns back end. Another concern regards transparency: while disclosure requirements are much stricter than those found regular stocks, there is still lack of full disclosure regarding the proposed acquisitions until the deal is finalized making difficult to determine whether a particular venture is worth the risk taken on behalf investor. Lastly, many believe merging different types of businesses together could lead to the disruption of existing industries instead just creating new ones – something worth considering if investing large sums money into particular enterprise.

Examples of SPACs

VPC Impact Acquisition (VPC)

This SPAC was formed in 2020 and is backed by Pershing Square Capital Management, a leading hedge fund. It had an initial funding of $250 million and made three acquisitions. The first acquisition was a majority stake in the outdoor apparel company, Moosejaw, for $280 million. This acquisition was considered a success as Moosejaw saw significant growth in its business after the acquisition, with its e-commerce sales growing over 50% year-over-year (Source: Business Insider). The second acquisition was a majority stake in the lifestyle brand, Hill City, for $170 million, which has also been successful as it has grown its e-commerce and omnichannel businesses (Source: Retail Dive). The third acquisition was a minority stake in Brandless, an e-commerce marketplace for everyday essentials, for $25 million, which was not successful and eventually shut down in 2020 after failing to gain traction in the market (Source: TechCrunch). In conclusion, VPC Impact Acquisition has been successful in two out of three of its acquisitions so far, demonstrating its ability to identify successful investments in the consumer and retail sector.

Social Capital Hedosophia Holdings Corp (IPOE)

This SPAC was formed in 2019 and is backed by Social Capital Hedosophia, a venture capital firm co-founded by famed investor Chamath Palihapitiya. It had an initial funding of $600 million and has made two acquisitions so far. The first acquisition was a majority stake in Virgin Galactic Holdings, Inc. for $800 million, which has been extremely successful as it has become a publicly traded space tourism company and continues to make progress towards its mission of accessible space travel (Source: Virgin Galactic). The second acquisition was a majority stake in Opendoor Technologies, Inc., an online real estate marketplace, for $4.8 billion, which has been successful as the company has seen strong growth in its business since the acquisition (Source: Bloomberg). In conclusion, Social Capital Hedosophia Holdings Corp has been incredibly successful in both of its acquisitions so far, demonstrating its ability to identify promising investments in the technology sector.

Landcadia Holdings II (LCA)

This SPAC was formed in 2020 and is backed by Landcadia Holdings II Inc., a blank check company formed by Jeffery Hildebrand and Tilman Fertitta. It had an initial funding of $300 million and made one acquisition, a majority stake in Waitr Holdings Inc., for $308 million. Unfortunately, this acquisition was not successful and it filed for bankruptcy in 2020 due to overleveraged balance sheet and lack of operational improvements (Source: Reuters). Waitr had previously been a thriving food delivery company but failed to keep up with the rapid growth of competitors such as GrubHub and DoorDash (Source: CNBC). In conclusion, Landcadia Holdings II’s attempt at acquiring Waitr Holdings Inc. was unsuccessful due to market conditions outside of its control, demonstrating that even when a SPAC is backed by experienced investors and has adequate funding, there are still no guarantees of success.

Conclusion

Despite all these drawbacks, Special Purpose Acquisition Companies remain a viable option for entrepreneurs seeking to take advantage of the rising trend toward the digitalization of global markets who otherwise wouldn’t have access to the resources necessary to fund projects themselves. By providing unique opportunity to access higher caliber opportunities, this type of vehicle serves fill gap left behind many start-up ventures unable to compete against larger organizations given the limited financial capacity to operate self-sufficiently. For reasons stated above, it is clear why SPACs continue to gain traction both among investors entrepreneurs alike looking to capitalize quickly on changing economic environment we live today…

Related posts on the SimTrade blog

▶ Daksh GARG Rise of SPAC investments as a medium of raising capital

Useful resources

U.S. Securities and Exchange Commission (SEC) Special Purpose Acquisition Companies

U.S. Securities and Exchange Commission (SEC) What are the differences in an IPO, a SPAC, and a direct listing?

U.S. Securities and Exchange Commission (SEC) What You Need to Know About SPACs – Updated Investor Bulletin

PwC Special purpose acquisition companies (SPACs)

Harvard Business Review SPACs: What You Need to Know

Harvard Business Review SPACs: What You Need to Know

About the author

The article was written in January 2023 by Martin VAN DER BORGHT (ESSEC Business School, Master in Finance, 2022-2024).