In this article, Bryan BOISLEVE (CentraleSupélec – ESSEC Business School, Data Science, 2025-2027) shares his professional experience as a Counterparty Risk Analyst intern within Société Générale’s investment banking division.

About the company

Société Générale is one of the largest European banking groups, offering retail banking, corporate and investment banking, and specialised financial services in over 60 countries. As of 31 December 2024, the Group had around 119,000 employees, served more than 26 million clients in 62 countries, and reported total assets of EUR 1,573.5bn, with total equity of EUR 79.6bn. In 2024, revenues (net banking income) amounted to EUR 26.8bn and group net income (Group share) reached EUR 4.2bn.

Logo of Société Générale

Source: the company.

Its Corporate & Investment Banking (CIB) branches serve corporates and institutional investors with financing, capital markets, and risk-management solutions on a diverse range of asset classes (equities, fixed income, derivatives…).

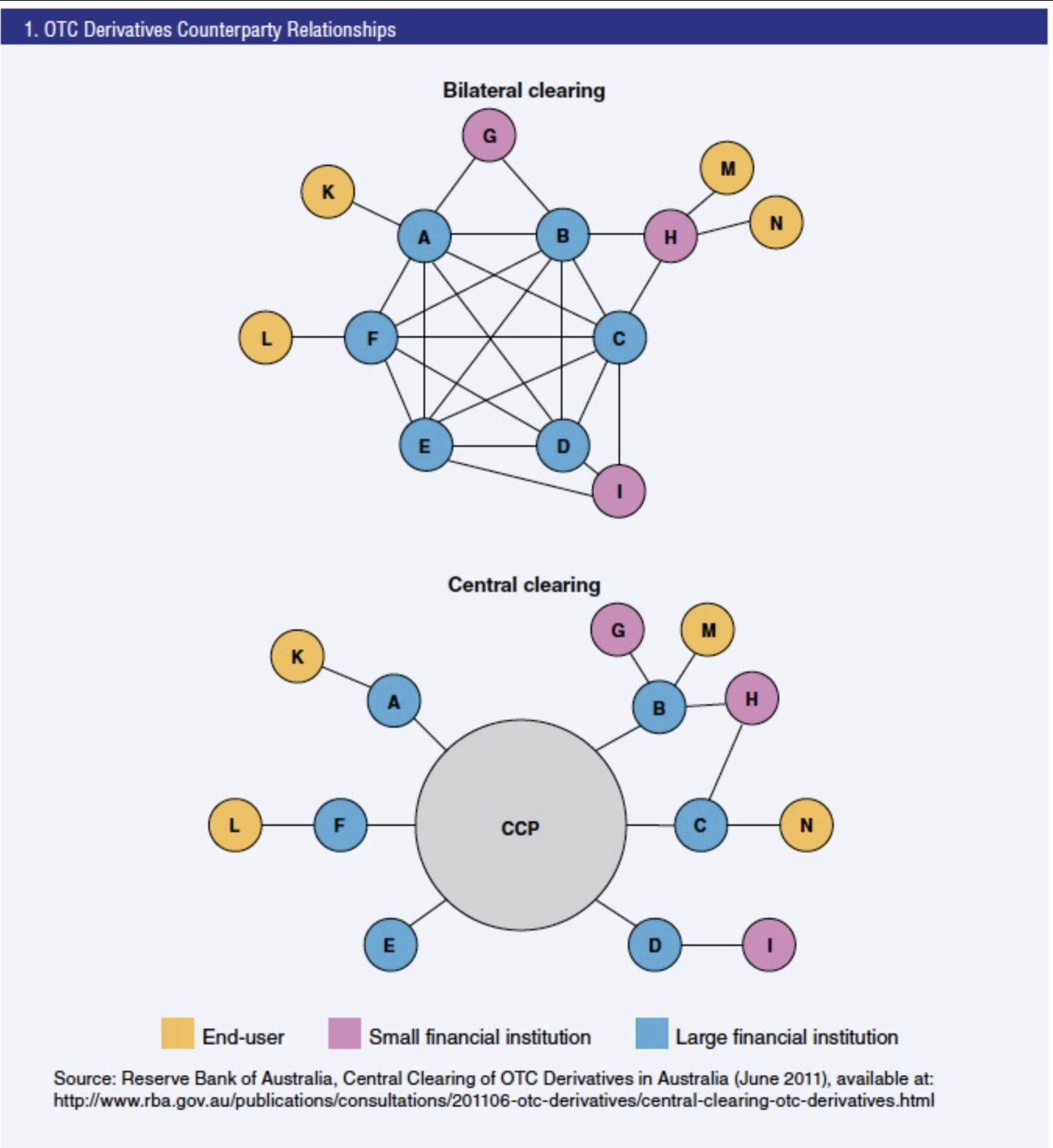

The bank is a major clearing member at leading central counterparties (CCPs), acting as an intermediary between clients and clearing houses for listed and cleared OTC derivatives. This activity is supported by a structured process of daily margining, exposure monitoring, and default fund contributions, embedded within risk management and control functions. The chart below helps illustrate the distribution and scale of OTC derivatives activity, and how a CCP simplifies OTC operations.

Chart of derivatives market structure with CCP

Source: Bank Of Australia

During my internship, I worked in the front office counterparty risk team (counterparty risk has also a team in middle office) in Paris, which monitors exposures to central counterparties and major clearing brokers, analyses margin models, and challenges the robustness of CCP risk frameworks used for derivatives clearing.

My internship

Over three months, I focused on cleared derivatives exposures, supporting the team in monitoring house and client portfolios across several CCPs and in assessing whether margin and default fund resources were sufficient under stressed market conditions.

My missions

My main tasks were to analyze house and client risk exposures using Initial Margin (IM), Default Fund (DF), Variation Margin (VM), Value at Risk (VaR) and Conditional VaR (CVaR), to automate DF estimations for two CCPs in Python, to draft annual credit reviews for major central counterparty, and to investigate daily IM and DF breaches together with traders and the wider risk department.

I also implemented an Almgren–Chriss optimal execution model on a client book to better estimate liquidation costs in the Default Management Process, improving the bank’s view on how quickly and at what cost a defaulted portfolio could be unwound.

Required skills and knowledge

This internship required strong quantitative skills (statistics, VaR/CVaR, optimisation), solid understanding of derivatives and CCP mechanics, and programming abilities in Python to automate risk calculations, as well as proficiency with Excel and internal risk systems.

On the soft-skill side, I had to communicate complex risk topics clearly to traders and senior risk managers, work accurately under time pressure when margin breaches occurred, and be proactive in proposing model improvements or new monitoring dashboards.

A good example of how I applied these skills is when my manager asked me to create a dashboard available for key managers that could show the historical exposition and an estimate of this exposition on a specific CCP. After my internship ended, the team decided to implement the model used for the estimation as well as the dashboard for all the CCP where Société Générale was a clearing member.

What I learned

I learned a lot during my internship: how CCPs use margin models, default funds and stress tests to ensure they can withstand the default of major clearing members, and how a bank as a clearing member independently challenges those frameworks to protect its balance sheet.

This experience also taught me to question model assumptions, to combine quantitative analysis with qualitative judgement on CCP governance and transparency, and it confirmed my interest in pursuing a career in quantitative risk management. I also learned how to work with colleage from different countries and different backgrounds which is a soft skills that can really be helpful in a professional environment.

Economic, financial, and business concepts related to my internship

I believe these are three financial concepts related to my internship which are very important: central counterparty default waterfalls, initial margin models, and the Almgren–Chriss optimal execution framework.

Central counterparty default waterfall

The CCP default waterfall is the sequence of financial resources used to absorb losses when a clearing member defaults: the member’s IM, then its DF contribution, then the CCP’s own capital (“skin‑in‑the‑game”), and finally the mutualised default fund and any additional loss-allocation tools.

Understanding this waterfall was crucial in my role, because my analyses assessed whether Société Générale’s exposures and contributions at each CCP were consistent with its risk appetite and with regulatory “Cover‑2” stress-test standards.

Initial margin models (VaR / SPAN)

CCPs typically compute IM with either VaR-based models or SPAN-style scenario approaches, which aim to cover potential losses over a margin period of risk at high confidence levels (often 99% or more).

In my reviews of multiple CCPs, I compared how their IM methodologies capture product risk, concentration risk and wrong-way risk, and how model choices translate into the level and procyclicality of margin calls for the bank and its clients.

Almgren–Chriss optimal execution

The Almgren–Chriss model provides an optimal schedule to liquidate large positions by balancing market impact costs against price risk, typically leading to front‑loaded execution for risk‑averse traders.

By calibrating this model on client portfolios, I helped the team estimate realistic liquidation costs that would arise in a CCP default management auction, improving the calibration of IM add‑ons and internal stress scenarios.

Why should I be interested in this post?

For a student in finance, counterparty risk at a global investment bank like Société Générale, offers a great opportunity on how derivatives markets, CCPs and regulation interact between each other, and shows how quantitative models directly influence daily risk decisions and capital usage.

This type of internship is particularly valuable if you are interested in careers in market risk, XVA, clearing risk or quantitative research, because it combines modelling, coding and discussions with trading desks on real portfolios and real constraints. Overall it is a great internship to have a first step in the trading floor.

Related posts on the SimTrade blog

Profesional experiences

▶ All posts about Professional experiences

▶ Roberto RESTELLI My internship at Valori Asset Management

▶ Julien MAUROY My internship experience as a Finance & Risk Analyst

Financial techniques

▶ All posts about Financial techniques

▶ Akshit GUPTA Initial and maintenance margins in stocks

▶ Akshit GUPTA Initial and maintenance margins in futures contracts

Useful resources

Financial regulation

European Securities and Market Authority (ESMA) Clearing obligation and risk mitigation techniques under EMIR.

Bank of International Settlements (BIS) (April 2012) Principles for financial market infrastructure.

Bank of England (November 2025) Central Counterparty (CCP) policy and rules.

Boudiaf, I., Scheicher, M., Vacirca, F., (April 2023) CCP initial margin models in Europe, Occasional Paper Series, European Central Bank (ECB).

International Swaps and Derivatives Association (ISDA) (August 2013) CCP Loss Allocation at the End of the Waterfall.

Academic research

Almgren, R., Chriss, N., 2000. Optimal execution of portfolio transactions, Working Paper.

Duffie, D., Scheicher, M., Vuillemey, G., 2014. Central Clearing and Collateral Demand, Working Paper.

Pirrong, C., 2013. A Bill of Goods: CCPs and Systemic Risk, Working paper, Bauer College of Business University of Houston.

Berndsen, R., 2021. Fundamental questions on central counterparties: A review of the literature, The Journal of Futures Markets, 41(12) 2009-2022.

About the author

The article was written in December 2025 by Bryan BOISLEVE (CentraleSupélec – ESSEC Business School, Data Science, 2025-2027).

▶ Read all articles by Bryan BOISLEVE .