Quote stuffing

This article written by Akshit Gupta (ESSEC Business School, Master in Management, 2022) presents the concept of quote stuffing which is a type of market manipulation practice seen across financial markets.

Introduction

Quote Stuffing is the practice of entering huge number of buy or sell orders for a security within a short time frame (i.e. milliseconds or nanoseconds) and immediately cancelling them. For example, a company practicing quote stuffing can make more than 2000 transaction in a second to manipulate the market. It is one of the recent practices seen to be used by traders to manipulate the financial market. As the technology is improving and traders have quick access to the order books of the exchanges with the help of technology driven brokerage firms, the possibility for the use of quote stuffing is increasing as it is very easy to enter and cancel orders at a high frequency.

The mechanism

Under quote stuffing, the manipulator stuffs the order book of a security and distorts the bid-ask spread for that security by placing massive orders and increasing the quantities at the sell and buy sides of the order book for that security. The practice is used to deceive other traders by creating an artificial view about the market depth and liquidity for a security. The practice may be done by the manipulator to slow down the processing of data, cause high latency problems (a delay in the processing of orders at the exchange) and disrupt the exchange trading system.

Honest investors can make trades under the false impression of increased liquidity for a particular security. But as soon as the trades are executed, the false orders are cancelled using the algorithms and the liquidity disappears from the market for that security, harming the investor’s position by decreasing the liquidity in the market.

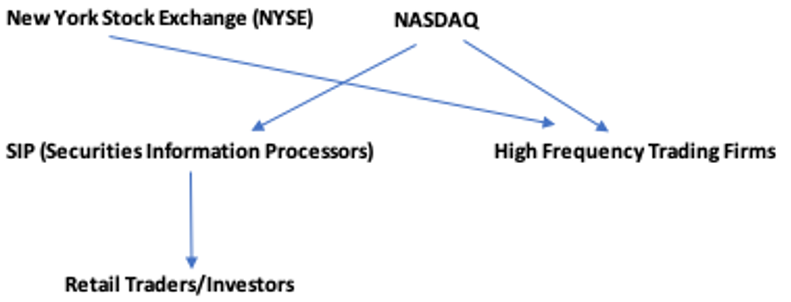

Structure in US financial markets

High frequency trading firms in USA have a direct access to the stock exchanges operating in a financial market and receive data flows from them directly. Whereas in the case of retail traders/investors, SIP (Securities Information Processors) receive data from stock exchanges and creates the NBBO (National Best Bid and Offer) which is then shown to these retail traders/investors.

(Securities information processors are organizations that help in collecting, processing, consolidating and disseminating all the bid/ask prices from traders and issuing real time quote or trade information to the market participants.)

(National Best Bid and Offer is the highest price on the bid side and lowest price on the ask side available for the traders of any security in the financial markets.)

The quote stuffing strategy can also work by creating a latency arbitrage trading opportunity for the High Frequency Trading firms which send false quotes to the exchanges and profits from the time delay that results when the SIP updates the order book for the retail traders by adding and deleting the orders created by the HFT firms.

Latency refers to the time delay between which an order is requested and responded to in a marketplace. Latency Arbitrage Trading refers to the use of low latency trading by HFT trading firms to shorten the request and response time in the financial market and earn profits by having the time advantage over high latency traders.

For example, a HFT firm practices quote stuffing on the stocks of Company A. Seeing an increased liquidity in the stocks of Company A, a trader enters a sell limit order for the stock of company A at $10 on NYSE. The exchange will send the data to the SIP feed (which will then create the NBBO and send it to the other traders in the market) and HFT firms simultaneously. The HFT firms will look for the best buy price across all exchanges. They find the stock of Company A available at an ask price of $9.95 on Nasdaq. The firm will immediately buy the share and sell it to the retail investor at $10, earning a $0.05 on the trade caused due to quote stuffing. The amount may seem insignificant but if the volume of such trades is taken into consideration, the HFT earns huge profits using quote stuffing.

Rules and Regulations

Considered a market manipulation practice, quote stuffing has been made illegal across many stock exchanges throughout the world. Many instances of potential quote stuffing have been observed in the financial markets but since complex algorithms are involved in such practices, it is very difficult to find evidence to prove the intent of the firms/individuals practicing it.

The Commodity Future Trading Commission (CFTC) has banned quote stuffing under Rule 575 implemented in May 2013. Although no official laws have been enacted by market regulators, quote stuffing is still a major issue in the financial markets. Also, many proposals to put a minimum time period between entering an order and cancelling it are in consideration, which will prevent HFT firms to cancel the orders immediately after the initial request.

Real life example

The Flash Crash of 2010 has been an infamous example of the repercussions of HFT and quote stuffing techniques used by the HFT firms. The practice of quote stuffing hampers the natural price discovery mechanism in the market. It also distorts the bid-ask spread and provides a false signal about the movement of the prices of a security. The regulatory bodies around the world are working hard towards protecting the interest of all the investors in the market and providing free, fair and equal access to them by keeping a check on such market manipulation.

Relevance to the SimTrade Certificate

The concept of quote stuffing relates to the SimTrade Certificate in the following ways:

About theory

- By taking the Trade orders course, you will know more about the different type of orders that you can use to buy and sell assets in financial markets.

- By taking the Market information course, you will understand how information is incorporated into market prices and the associated concept of market efficiency.

About practice

- By launching the Sending an Order simulation, you will practice how financial markets really work and how to act in the market by sending orders.

- By launching the Efficient market simulation, you will practice how information is incorporated into market prices through the trading of market participants, and grasp the concept of market efficiency.

Related posts on the SimTrade blog

▶ Akshit GUPTA Market manipulation

▶ Akshit GUPTA Analysis of The Hummingbird Project movie

▶ Akshit GUPTA High frequency trading

About the author

Article written in January 2021 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).