Markets

This article written by Juan Francisco Rodriguez Rodriguez (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021) presents the basics of markets and details two types of market microstructure: the fixing procedure and the limit order book.

What is a market?

The market is a process that operates when there are people who act as buyers and sellers of goods and services, generating an exchange. There is a market if there are people with the intentions to buy and sell, and when participants agree to exchange goods and services at an agreed price. For the market to work, you need buyers and sellers, and these two parts are what make up the market.

Buyers

On the one hand, the buyer is the person who acts in a market with the intention of acquiring a good or service by paying an amount of money (or in exchange for another good or service). Therefore, when someone buys, this person considers that the good or service he is receiving is worth more than the money he is paying for.

Sellers

On the other hand, the seller is the person who is willing to deliver a good or service by accepting a quantity of money (or in exchange for another good or service). The seller considers that the money that she is receiving has more value than the good or service that she offers.

Supply and demand

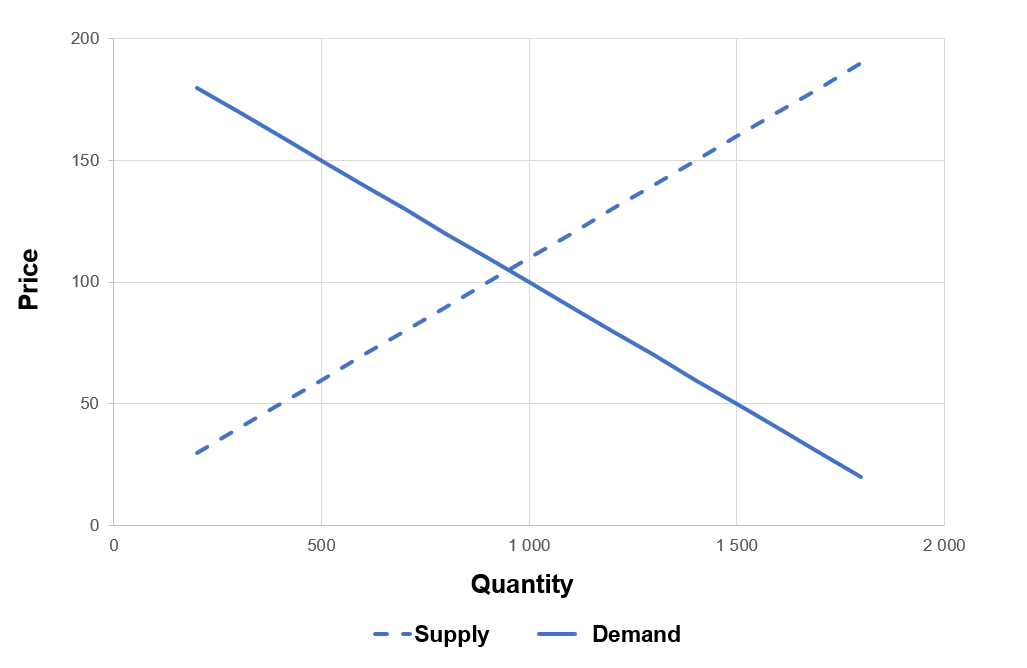

In a market, the price of the product is determined by the law of supply and demand. If the price is high, few people will be willing to pay for it but many will want to produce it; if the price is low, many will be willing to buy it but few willing to produce it. The price will be eventually at an acceptable level for both parties.

Financial markets

Market used to be a physical place where the processes of exchange of goods and services took place, but due to technology markets no longer need a physical space.

Add two images: one for a physical market, one for a digital market (guys in front of computers) for Wall Street

Market with a fixing procedure

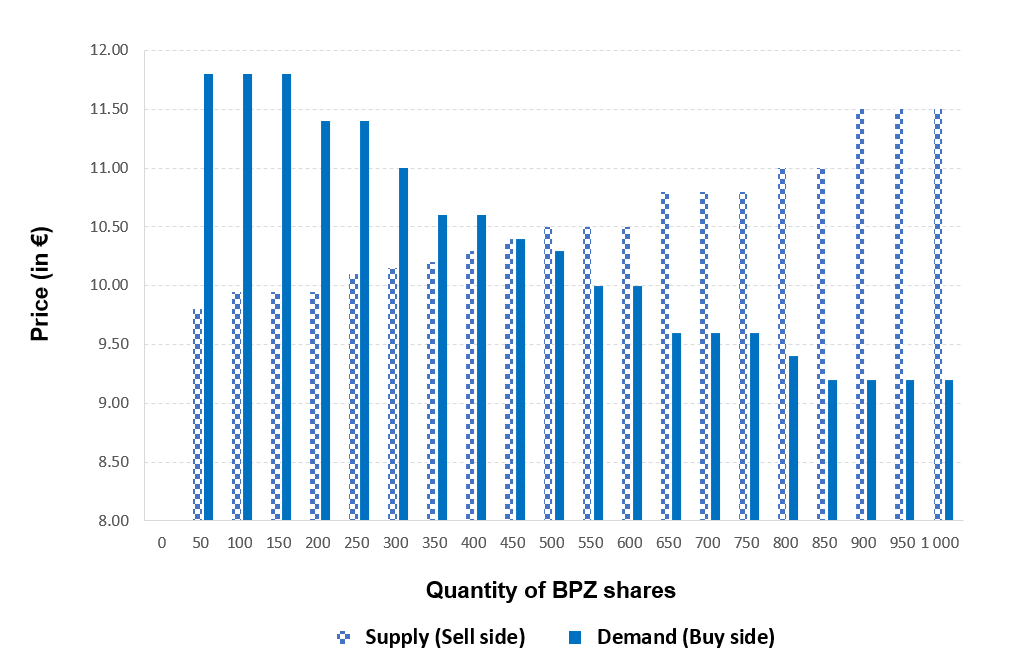

The fixing procedure is a form of trading securities in financial markets by fixing single prices or “fixing”. This procedure is commonly based on auctions. At the close of each auction the orders are crossed to maximize the quantity exchanged between buyers and sellers, and the new price is set.

Auctions are periods in which orders are entered, modified, and canceled. No negotiations are executed until the end of the auction. During this period, an equilibrium price is set based upon supply and demand, and negotiations take place at the end of the auction at the last equilibrium price calculated to maximize the quantity exchanged between buyers and sellers.

The fixing procedure is used for securities presenting a low level of liquidity. It is also used to set the opening and closing prices for continuous markets.

Market with a limit order book

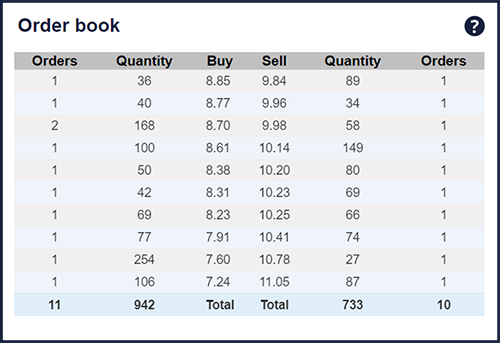

A limit order book is a record of pending limit orders waiting to be executed against market orders.

When the price limit of a buy limit order arriving to the market is lower than the best proposition on the “Sell” side of the order book, it is simply recorded in the order book, and is carried out as long as it has reached the market price. When the price limit of a sell limit order arriving to the market is higher than the best proposition on the “Buy” side of the order book, it is simply recorded in the order book, and is carried out as long as it has reached the market price.

Relevance to the SimTrade Certificate

These terms are very relevant to the SimTrade Certificate because they lay the foundations for us to know how financial markets work and the different ways in which a transaction can be carried out, whether to buy or sell an asset. I definitely think this will add value to my career in finance and help me make better investment decisions in the future.

The SimTrade platform uses a market with a limit order book, which corresponds to the current standard for real financial markets organized around the world.

The concept of markets relates to the SimTrade Certificate in the following ways:

About theory

- By taking the Discover SimTrade course, you will discover the SimTrade platform that simulates a market with a limit order book.

- By taking the Trade orders course, you will know more about the different type of orders that you can use to buy and sell assets in financial markets.

About practice

-

- By launching the Sending an Order simulation, you will practice how financial markets really work and how to act in the market by sending orders.

- By launching the Market order simulation and the Limit order simulation, you will practice market orders and limit orders that are the two main orders used by investors to build and liquidate positions in financial markets.

More about SimTrade

Article written by Juan Francisco Rodriguez Rodriguez (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021).