In this article, Jules HERNANDEZ (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2025) shares his professional experience as Financial Analyst in a Multi-Family Office.

About the company

I worked two years in a Multi-Family Office (MFO) as a Financial Analyst. The purpose of this wealth management firm is to support families and executives across multiple dimensions of their wealth. Their comprehensive wealth management approach offers highly personalized, long-term service focused on objective advice, with a broad scope of expertise spanning legal, tax, financial, and real estate matters.

What is a MFO ?

According to the AFFO (The French Family Association), a Family Office is a advisory structure designed to support one or several families in the management, organization, and long-term preservation of their wealth. Its mission extends across all dimensions of patrimonial oversight and is carried out in close alignment with the family’s objectives, values, and governance framework. Acting solely in the interest of the families it serves, a Family Office adheres strictly to the principles of independence, confidentiality, and full alignment of interests. It typically operates as a multidisciplinary coordinator, bringing together and overseeing the work of various external advisors and partners, including lawyers, notaries, chartered accountants, financial and real estate asset managers, and insurance specialists. The role of a Family Office (FO) or a Multi-Family Office (MFO), who supports several families instead of one, delivering services to each on a strictly individualized and confidential basis, is to cover a broad spectrum of responsibilities, ranging from financial advisory and asset management to wealth strategy and structuring. Where relevant, it also integrates the personal values and convictions of its clients into wealth management decisions. For instance, when a family seeks to invest with an environmentally responsible or impact-driven approach, the Family Office will orient investment choices toward solutions that meet these specific criteria. The financial advisors leading a FO or a MFO must manage their clients’ wealth with a 360-degree vision, as emphasized by Charles-Henri Bujard, President of the AFFO, in his perspective on the Family Office model.

My internship

In January 2024, I joined the team as a financial analyst as part of a two-year work-study program. This experience consisted of two six-month full-time periods at the office, a university exchange, and a period of academic coursework. I worked closely with the Head of Investments on various assignments. Although I was attached to the investment division, I had to fully immerse myself in the firm and understand the role played by each department. The back office, the tax division, and the financial division are highly interconnected and must work hand in hand to ensure efficient and effective wealth management for clients.

My missions

Working in a small structure meant that the tasks were highly varied, and I had the opportunity to take on a wide range of responsibilities. To present this more clearly, let’s divide these tasks into three main categories: Front Office, Middle Office, and Reporting & Sales/Marketing.

Front-Office missions

My front-office responsibilities were multifaceted. The first focused on designing the allocation of our clients’ listed portfolios. This involved identifying the best investment opportunities in public markets, deciding where to invest and selecting the most suitable investment funds in order to capture the highest possible performance. These funds were UCITS available through life insurance contracts. According to the European Fund and Asset Management Association (EFAMA), UCITS (Undertakings for Collective Investment in Transferable Securities) are EU-regulated investment funds designed to protect investors through strict rules on diversification, liquidity and transparency. In simple words, Insurance companies provides a list of EU-regulated investment funds in which a contracted client can invest in. These allocations were reviewed and adjusted regularly, which required carrying out portfolio rebalancing operations (the process of modifying a portfolio’s allocation by divesting from certain holdings and investing in new ones). As part of my role, I was therefore also responsible for executing these rebalancing transactions across clients’ accounts. In addition, in the pursuit of increasingly efficient diversification, I was tasked with conducting due diligence on several ranges of fixed-maturity bond funds with the objective of building a “buy-and-hold” bond strategy for our clients. This due diligence process gave me the opportunity to analyze multiple funds from different asset managers, both from a quantitative and qualitative perspective.

Middle-Office missions

Middle-office responsibilities mainly involved investment continuity management and portfolio monitoring tasks. As some clients were invested in private equity or private debt funds, it was necessary to respond to capital calls issued by fund managers, ensuring that clients’ accounts held sufficient cash to meet these capital requirements. I was also responsible for verifying portfolio data on tools such as Quantalys in order to accurately calculate and present performance results to clients. Quantalys is a tool used mainly by wealth managers (but also asset managers) to back test and build hypothetical portfolios, in order to analyze what would have been the performance over time. We used it to build portfolios and to track their associated performance. Each time we made allocation decisions, we had to update the portfolio data in the tool. This tool is also a huge database gathering all the funds available in the world.

Reporting & Marketing

I was responsible for producing client reporting. This involved preparing portfolio reports using various portfolio management and analytics tools such as FactSet, a leading financial data and analytics platform widely used by investment professionals to access market data, company financials, fund analytics, and performance metrics (basically a concurrent of Bloomberg, which is more known), and Quantalys, which I already mentioned previously. I then led a reporting automation project, streamlining and significantly accelerating the production process. Initially, reports were produced manually using Excel; we transitioned the reporting framework to Power BI, Microsoft’s business intelligence and data visualization tool, which enables the automation of data processing and the creation of interactive dashboards and dynamic reports. Within this framework, I fully developed both the quantitative data models and the visual reporting architecture, improving both accuracy and usability of client reports. In addition, when we conducted webinars or presentations for clients and prospective investors, I was responsible for producing ad hoc analyses on a range of topics, including macroeconomic developments, in-depth analysis of investment funds within our portfolios, and performance presentations supported by detailed charts. Finally, with the aim of demonstrating to potential prospects what their returns could have been if they had invested with us from a given starting point, I built an Excel-based model tracking the performance of the proposed model portfolio.

Required skills and knowledge

In this profession, and particularly within this firm, the required knowledge primarily relates to financial markets. We must have a solid understanding of a wide range of financial investments (equities, bonds and different bond structures, private markets such as private equity, private debt including secondary markets, infrastructure, specialized investment funds such as semi-liquid evergreen funds, structured products, etc.). It is also essential to be comfortable with economic and geopolitical news, as well as macroeconomic analysis, in order to build the most suitable portfolios for clients. In terms of skills, strong data analysis capabilities and a high level of rigor are required when interpreting financial information. Finally, strong communication skills are essential: being comfortable speaking with clients, demonstrating active listening, and providing tailored analysis to meet each client’s specific needs.

What I learned

First, I strengthened my knowledge of financial markets. Being attached to the investment management team, I discovered numerous asset classes that I had not previously been familiar with. I then gained an understanding of how investments work in practice and which vehicles are available in France to invest. Taxation plays a central role in wealth management, and I learned to understand its constraints in order to grasp how it impacts an individual’s overall wealth. Finally, I learned how to work cross-functionally with multiple teams, an essential aspect of the financial advisor’s role. This experience also allowed me to develop key professional qualities: rigor, analytical thinking, autonomy, as well as collaboration and a strong sense of collegiality.

Financial concepts related to my internship

I present below three financial concepts related to my internship: investment horizon, diversification, and the importance of a qualitative relationship with clients.

Investment Horizon

As a financial advisor, wealth manager or even a regular investor, before building a portfolio or making any investment, it is essential to define a key parameter, a parameter that even takes precedence over the client’s risk aversion: the investment horizon. According to the French Regulator (Autorité des Marchés Financiers or AMF), the investment horizon corresponds to the period during which an investor plans to hold a financial product. In other words, the investor identifies their liquidity needs beforehand and ensures they will not need to unwind their positions before the end of that period. This concept matters because there is a significant difference between the ease of selling an asset and the speed at which cash can be withdrawn without loss. Consider an equity portfolio, for example. While stocks are known for being liquid, meaning investors can buy or sell them with relative ease, it is risky to invest in equities with a short investment horizon. John Maynard Keynes often reminded us that no one, ever, was and will be able to time the market consistently. Because of this structural uncertainty, an investor may suddenly face substantial losses, as it happened during the subprime crisis. It took roughly five years for the S&P 500 to recover its pre-crisis levels and erase the losses caused by the collapse of the U.S. housing market. If an investor had needed liquidity only two years after the crisis, they would have locked in heavy losses. But had they waited longer, exiting after the recommended 7 to 8-year horizon for an equity portfolio, they would not only have recovered from the 2008 downturn, but also benefited from strong capital gains. Therefore, it is crucial for any client to understand their investment horizon and anticipate potential liquidity needs. With this mindset, they can better protect themselves against the inherent uncertainty of financial markets.

Diversification

Diversification is one of the fundamental principles of portfolio management. Throughout this experience, I realized that it goes far beyond simply spreading investments across several assets: it involves building an allocation capable of withstanding various market scenarios. To diversify is to accept that we can never predict with certainty which asset will outperform, but that we can significantly reduce risk by avoiding dependence on a single source of performance. Diversification can be applied at multiple levels. Within an equity portfolio, for example, it can be beneficial to gain exposure to different geographical regions (US, Europe, Asia, Emerging Markets, etc.), to different currencies (EUR, USD, GBP, etc.), and to various economic sectors (healthcare, financials, industrials, etc.). But diversification must also be executed on a broader scale, across the entire wealth base. It is essential to split the overall assets into several relatively small investments across different vehicles. To ensure efficient diversification, it is crucial to explore and invest in multiple asset classes. Part of the portfolio should be dedicated to growth, invested in riskier assets with higher return potential (equities, structured products, private equity, venture capital, cryptocurrencies, commodities…). Another portion should be allocated to defensive assets to preserve wealth (income-producing real estate, bonds, private debt, or precautionary cash reserves). This approach to diversification achieves several objectives: first, it breaks down wealth into multiple sources of income that do not depend on one another. Second, it helps dilute risk by investing in assets that are uncorrelated. Finally, it allows for a strategic allocation of resources across different investment goals: income generation, growth, and capital preservation.

Importance of a qualitative relationship with clients

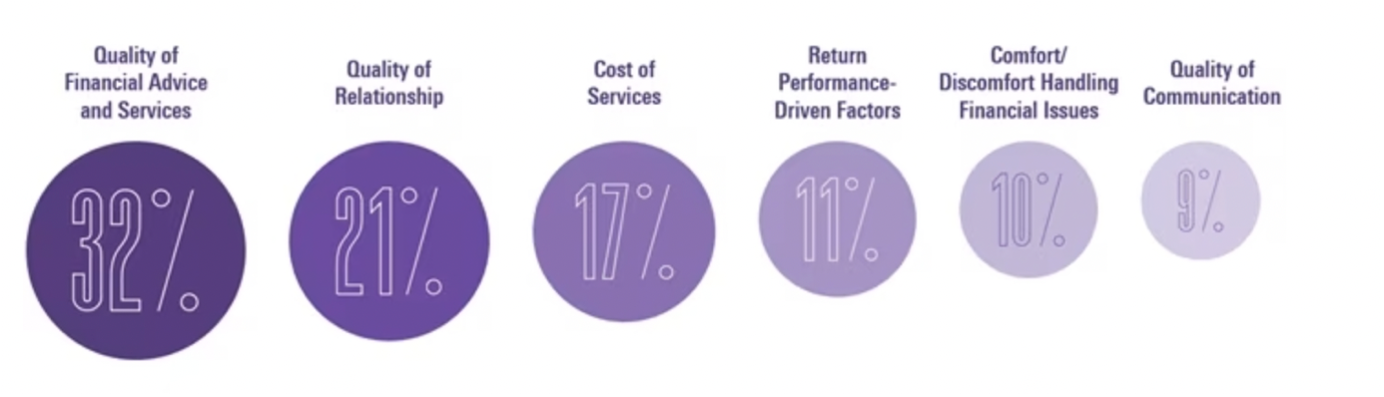

To conclude this article, I would like to highlight the importance of the relationship between the advisor and the client. Beyond the technical aspects of investing, this relationship forms the true foundation of successful wealth management. An allocation can be perfectly constructed, a portfolio ideally diversified, and an investment horizon carefully respected… but without a relationship built on trust, no strategy can truly succeed. I understood that this relationship relies above all on attentive listening and a deep understanding of the client’s objectives: their projects, constraints, personal situation and family situation. An advisor is not only a financial technician, he or she is a reliable source of support in whom the client can place their trust. The advisor must also demonstrate strong pedagogical skills to help clients navigate a complex and time-consuming financial environment. In 2023, Danielle Labotka, a behavioral scientist, conducted a study for Morningstar involving a large sample of clients working with financial advisors. The study revealed that 21% of respondents (3,003 respondents) consider the quality of the relationship with their advisor to be the most important factor, surpassing all other aspects shown below :

Importance of concepts among financial advisors’ customers

Source: Morningstar, April 2023, Danielle Labotka, “Why Do Investors Fire Their Financial Adviser?”

Why should I be interested in this post?

The world of wealth management and financial advisory is experiencing strong growth, particularly in France, a country where financial literacy is steadily increasing and where individuals are increasingly aware that putting their savings to work is essential to building long-term wealth. According to the CNCGP (the national chamber of financial advisors, “Chambre Nationale des Conseils en Gestion de Patrimoine”), and their last report in 2025, called Baromètre 2025, France was counting in 2023, 23,16 structures providing financial advisory services to French customers. In 2024, this number rose to 2,439, which represents a +5,3% increase. This number is expected to grow, since according to studies made by Statista in October 2025, the number of assets under management by wealth managers in France should rise at a rate of +1,6% per year until between 2025 and 2029. This means that they will have that wealth managers will have to deal with more and more clients and therefore, investments. Certain structural issues in France, such as the pension system, are beginning to reveal their limitations, making it important for individuals to no longer rely solely on the State to finance their post-career years. As a result, the wealth management industry presents significant opportunities for the future. This profession also represents a balance between market finance, corporate finance, and client relationship management, fields that are deeply interconnected in the day-to-day practice of the role.

Related posts on the SimTrade blog

Professional experiences

▶ All posts about Professional experiences

▶ Julien MAUROY My internship experience at BearingPoint – Finance & Risk Analyst

▶ Wenxuan HU My experience as an intern of the Wealth Management Department in Hwabao Securities

▶ Emmanuel CYROT Deep Dive into evergreen funds

▶ Louis DETALLE A quick review of Wealth Management’s job…

Financial techniques

▶ Akshit GUPTA AMF

▶ Lilian BALLOIS Discovering Private Equity: Behind the Scenes of Fund Strategies

▶ Akshit GUPTA Asset Allocation

▶ Rayan AKKAWI Warren Buffet and his basket of eggs

▶ Nithisha CHALLA Index fund manager: Unveiling the Dynamics of Passive Investing

▶ Youssef LOURAOUI Passive Investing

Useful resources

Labotka, D. (2023) Why do investors ‘break up’ with their financial adviser? Morningstar.

Autorité des Marchés Financiers Horizon de placement

European Fund and Asset Management Association (EFAMA) UCITS

Macrotrends S&P 500 Historical chart

French Family Office Association (AFFO) Family Office : Definition and Mission

Leclerc C. (26/09/2025) Les family offices au service des patrimoines sophistiqués ClubPatrimoine.

Chambre Nationale des Conseils en Gestion de Patrimoine (CNCGP) Baromètre 2025, état des lieux de la profession.

Statista (October 2025) Wealth Management – Data for France

About the author

The article was written in December 2025 by Jules HERNANDEZ (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2025).

▶ Read all articles by Jules HERNANDEZ.