In this article, Julien MAUROY (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2025) shares his professional experience as a Finance Export Analyst at Bpifrance.

Overview of Bpifrance and Bpifrance Assurance Export

Bpifrance is France’s public investment bank. Created in 2012 to support businesses at every stage of their development, from start-up to international expansion, through financing, investment, innovation and guarantees.

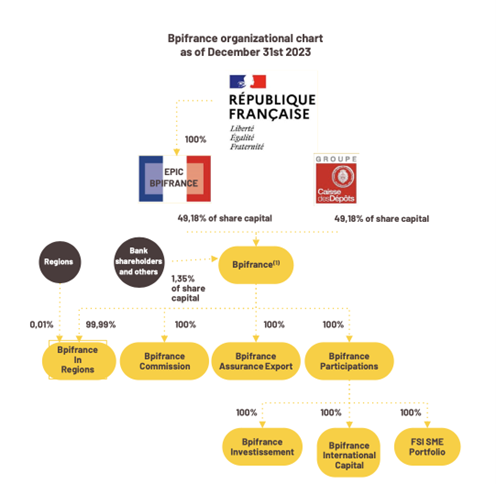

Here is a chart showing the organization of Bpifrance and its entities in 2023.

Bpifrance organizational chart as of December 31st 2023.

Source: the company.

Today, Bpifrance plays a major role in the French economy. In 2023, the institution supported more than 84,000 companies, mobilizing over €69 billion in financing, guarantees, investment and export support.

Bpifrance currently employs approximately 3 700 people across France, making it one of the largest public financial institutions in Europe.

Since 2017, Bpifrance Assurance Export has been managing public export guarantees on behalf of and under the control of the State (more specifically, the Treasury Department). These guarantees secure and facilitate the international operations of French companies by covering the economic and political risks associated with their export contracts.

Before 2017, the management of public export guarantees was carried out by Coface. The transfer of this activity to Bpifrance aimed at strengthening the alignment between France’s industrial policy, export strategy, and financing tools.

My experience and service

I joined this department as an Export Finance Analyst intern, working at the intersection of three departments: ASR (Administration and Risk Monitoring), ESC (Social Environment and Governance) and NTI (Internal Rating and Pricing). I had the opportunity to work with teams responsible for portfolio monitoring (€69 billion in outstanding loans and nearly 1,500 companies) and teams responsible for analysing and reviewing export insurance applications. This internship had a strong economic, strategic and geopolitical aspect, and working in collaboration with the treasury was very enriching.

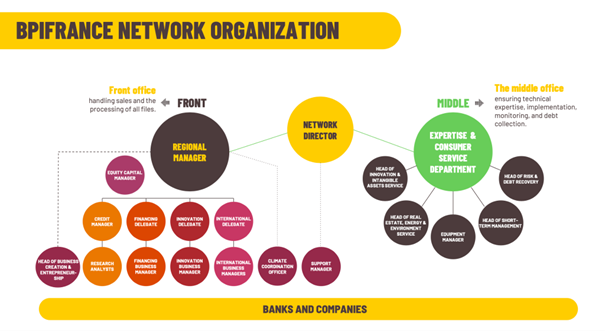

Here is a chart showing the distribution of services and the managerial structure of Bpifrance.

Organization of Bpifrance.

Source: the company.

During this internship, my tasks were varied and demanding:

- Participating in the analysis of the financial and non-financial situation of exporting companies and their foreign counterparts,

- Carrying out an assignment on the credit insurance portfolio in order to better manage reporting on behalf of the Treasury Department,

- Producing benchmarks and memos for the Treasury, participating in various committees (rating, pricing, guarantees commission).

These tasks enabled me to understand the importance of export financing and guarantees in the French economy and in supporting exporters who wish to carry out projects abroad.

Macroeconomic vision, economic diplomacy and geopolitics

Working in this context allowed me to broaden my macroeconomic vision and better understand the interactions between finance, politics and geopolitics. Analysing transactions that sometimes involved governments directly and institutional players made me aware of the challenges of sovereign risk management. I was able to observe how financial decisions are part of a foreign economic policy approach: supporting a strategic project in an emerging country or strengthening a French industrial sector.

I understood that risk analysis is not limited to reading a company’s financial statements, but requires a detailed understanding of the economic, social and political environment of the buyer or the purchasing country.

What I learnt from this experience

This internship was a rich and decisive experience in my career. It taught me to think on a macroeconomic scale and analyze risks from a strategic perspective.

I worked on sometimes complex economic issues between exporting companies and foreign buyers. I developed rigorous analytical skills and a more comprehensive understanding of the challenges of export financing and insurance in the French economy.

Finally, this immersion at the crossroads of finance, strategy and macroeconomics was fascinating. I gained a lot from it and am certain that I want to continue my career in multidimensional roles like this one.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Frédéric ADAM Senior banker (coverage)

▶ Dawn DENG Assessing a Company’s Creditworthiness: Understanding the 5C Framework and Its Practical Applications

▶ AnnieY EUNG Understanding the Economics of Tariffs

Useful resources

Business

Academic articles

Hayez S. and F. Savel (2018) Bpifrance : entreprises et territoires, Revue d’économie financière, 132(4):179-189.

Gervais F., Guillermain E., Parker D., Venin E., Wagenhausen F., Mayrhofer U., Soathan G.A., Aymard T., Meurier M. B., Varet S., Arzumanyan L. and Ph. Blesbois (2020) Module 22. La gestion du risque de crédit, Exporter – Pratique du commerce international Foucher (27th edition), 22: 332-347.

Alferdo P. (2019) Fiche 15. L’assurance-crédit export, Fiches de droit du commerce international, 215-223.

About the author

The article was written in November 2025 by Julien MAUROY (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2025).

▶ Read all articles by Julien MAUROY.