In this article, Yann-Ray KAMANOU TAWAMBA (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2024-2025)

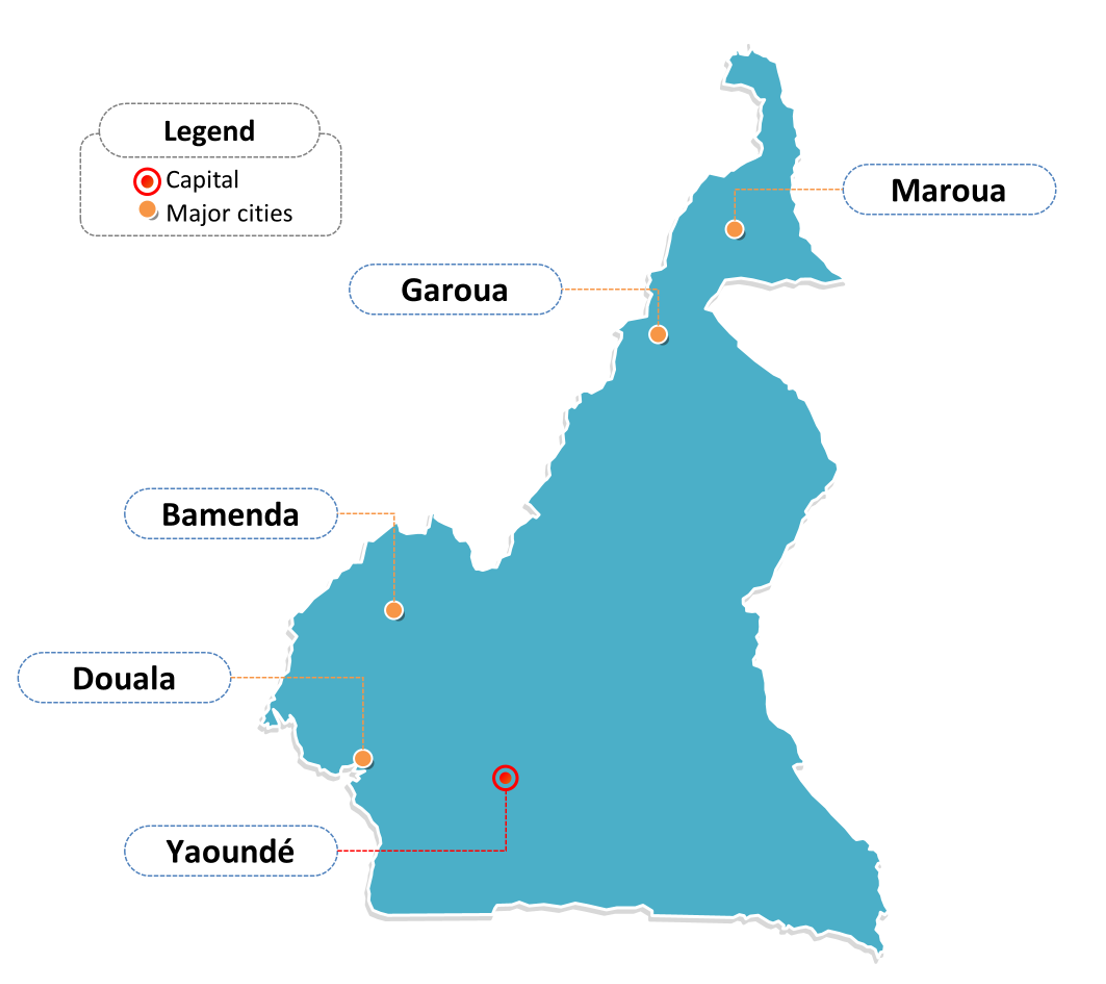

Cameroon’s real estate sector is experiencing notable growth, driven by rapid urbanization and a burgeoning population. The residential real estate market is projected to expand by 4.99% annually from 2025 to 2029, reaching a market volume of approximately US$354 billion by 2029. Major cities like Douala and Yaoundé are at the forefront of this expansion, with real estate transactions increasing by 8% year-over-year in 2024.

Map of Cameroon.

Source: The author.

Trends in the Market

Urbanization is a significant trend shaping Cameroon’s real estate landscape. With an urbanization rate of 56.5% in 2023, the demand for housing in metropolitan areas is surging. The housing deficit in Cameroon is estimated at more than 2.5 million units, indicating a strong need for investment in both affordable and high-end residential properties. Rising land prices in prime areas such as Bonanjo (Douala) and Bastos (Yaoundé) have further driven the expansion of real estate development projects.

It is quite hard to find a liable chart online about real estate prices in Cameroon as many information, data are not documented at all. However, what I can say it’s that as of February 2025, the average monthly rent for a one-bedroom apartment in the city center (of Yaounde or Douala) is approximately 456,188 CFA francs, while outside the city center, it’s around 287,722 CFA francs.

Local Special Circumstances

Despite its positive growth trajectory, the market faces challenges such as a shortage of affordable housing, with over 60% of urban dwellers living in informal settlement. This scarcity presents opportunities for developers to invest in housing projects tailored to the middle-income segment. Additionally, Cameroon’s relative political stability compared to neighboring countries has bolstered investor confidence, making it an attractive destination for real estate investments. Notably, foreign direct investment (FDI) in real estate has grown by 12% annually since 2020, reflecting increasing trust in the sector.

Why should I be interested in this post?

This post provides a data-driven analysis of the growing Cameroonian real estate market, highlighting key investment opportunities and economic trends. The post explores essential financial concepts such as real estate financing, foreign direct investment (FDI), and mortgage-backed securities, all of which are relevant to careers in banking, asset management, and investment advisory. Understanding these dynamics can help students identify potential career opportunities in emerging markets, real estate funds, and financial institutions looking to expand in Africa.

Related posts on the SimTrade blog

▶ Daniel MEAGHER The Irish Real Estate Market: Trends, Challenges, and Opportunities

▶ Clément KEFALAS My experience of Account Manager in the office real estate market in Paris

▶ Arthur EVERARD My experience as a Real Estate Analyst at Eaglestone

▶ Ghali EL KOUHENE Asset valuation in the Real Estate sector

Useful resources

Satista Real Estate – Cameroon

The African Investor 14 statistics for the Cameroon real estate market in 2025 https://www.numbeo.com/property-investment/country_result.jsp?country=Cameroon&utm_source

About the author

The article was written in February 2025 by Yann-Ray KAMANOU TAWAMBA (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2024-2025).