In this article, Quentin CHUZET (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2019-2023) explains about Private banks Treasuries Departments and the challenges of proprietary asset allocation.

Introduction

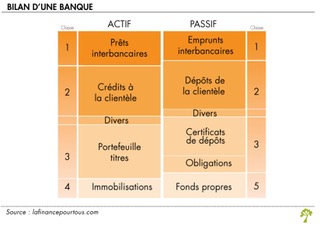

Within the Treasury Department of a Private Bank, the role of its employees is to record incoming and outgoing cash flows, as well as to direct the allocation of assets that comprise its Treasury. Thus, on one hand, we find the amount of cash on the asset side, and on the other hand, on the liability side, the amount of client deposits. In other words, it can be said that the Treasury is primarily constituted by the various deposits made by clients.

These are grouped into 2 categories: sight deposits (money visible in the client’s bank account, available and usable at any time) and term deposits (money placed generally in interest-bearing accounts but only available once the placement has matured).

Private Bank balance sheet

Source: La Finance Pour Tous

To address performance and revenue challenges, the Treasury department manages cash by investing it in interest-bearing products, aiming to generate significant margins. This activity, performed by the Middle and Front Office teams, is referred to as proprietary trading or prop asset allocation.

Before the 2008 financial crisis, the regulatory environment was less stringent, granting banks greater freedom in risk management. However, the crisis highlighted the dangers of this approach, leading to a significant strengthening of regulations.

In 2013, Basel III introduced one of the most important regulatory agreements in banking. It aims to enhance the resilience of banks by increasing their capital and liquidity requirements. Basel III notably introduced a short-term liquidity ratio (LCR) and a long-term liquidity ratio (NSFR).

Regarding liquidity, private banks must now hold sufficient liquid assets to withstand mass deposit withdrawals. They must also comply with a liquidity coverage ratio (LCR), requiring them to have enough high-quality liquid assets to cover their net cash outflows over a 30-day period.

In terms of solvency, private banks must now comply with a capital adequacy ratio (Cooke ratio), requiring them to have sufficient capital to absorb potential losses. Basel III also introduced a leverage ratio, limiting banks’ leverage.

To ensure compliance with these new regulatory frameworks while continuing to maximize revenue, banks have implemented treasury policies and control ratios to define limits and mitigate risks. These treasury policies, spanning multiple pages, guide Front Office teams in asset allocation to maintain the most efficient risk/return ratio possible. It is important to note that each bank has its own risk level, hence treasury policies and their respective limits may vary from one bank to another.

In general, a bank tends to favor a very low-risk level by prioritizing assets that can be quickly liquidated while limiting exposure to interest rate fluctuations or certain sectors. In the risk management process, liquidity and solvency ratios are monitored, as well as ratios related to interest rate risk and non-systematic risk.

Treasury Policy

These Treasury policies, spanning multiple pages, guide Front Office teams in asset allocation to maintain the most efficient risk/return ratio possible. It is important to note that each Bank possesses a risk level unique to itself, which is why Treasury Policies and their constituent limits may vary from one to another.

Thus, this document is divided into several limits and control ratios aimed at protecting against incurred risks. Among the main ratios present in the Treasury Policies, we find:

Liquidity and solvability ratios

Among liquidity and solvability ratios, controls are placed on the recovery time of securities held by the Treasury, with constraints notably regarding recoverable assets within 2 days and those recoverable within 30 days. Through these ratios, the average lifespan of the portfolio is controlled as well as the maximum duration of the securities, as well as the portion of assets placed with the Central Bank, ensuring a high rate of return in periods of high rates and near-immediate liquidity, as it is possible to recover from one day to the next.

These ratios aim to protect against the greatest risk a bank may face: that of illiquidity. This risk is heightened during crises and when clients wish to make massive withdrawals. The bank must thus ensure that all liquidity can be returned.

Security portfolio allocation’s ratios

Through these ratios, the Bank adheres to exposure limits by sector, industry, or company outlined in the Treasury policy: the leverage ratio is a significant indicator. This allows for diversification of allocations and investments and thus frees from specific risk. There are also control ratios based on Moody’s, S&P, and Fitch ratings or ESG ratings.

Finally, there are also ratios aimed at calculating the share represented by each asset class. It should be noted that each asset class represents what is called a “position” in the Treasury Sheet. In other words, each different class represents a different line. Among these lines are placements in the Money Market (Bond Portfolio, NEUCP Portfolio, placements in OPC funds), term interbank loans, currency and rate SWAPs, etc.

Sensitivity ratios

Through these ratios, the Treasury department controls the sensitivity to rates faced by Treasury assets. The Treasury Policy indicates threshold limits that should not be exceeded to ensure optimal rate adjustments, in the event of both increases and decreases.

Risk Management and Asset Allocation

Managing liquidity and solvability risk

To manage liquidity risk as effectively as possible, Private Banks can consider various strategies:

- Purchase securities eligible for ECB refinancing

- Maintain a high proportion of assets placed at the Central Bank on a daily basis (as they are highly liquid and yield interest at times of high interest rates).

- Maintain a short maturity of the security portfolio and short-term deposits.

Interest-rate risk management

Interest-rate risk is a major issue for Private Banks, since a change in interest rates would have a major impact on the yield and price of bond holdings. The sensitivity of an asset represents the length of time during which it cannot be subjected to a variation in its interest rate. Thus, depending on the prevailing trend surrounding interest rate movements, Treasury Traders must invest to maintain a balanced sensitivity ratio. For example, in a scenario where the market strongly expects a future rate decrease, a strategy aimed at maximizing the adjustment period to the rate and thus the sensitivity ratio may be the best option. Conversely, in a scenario where the market anticipates a significant rate hike in the upcoming period, reducing the adjustment period to the rate for the portfolio would allow a quick re-indexing to a higher rate and reduce the time during which those assets would be “under-earning”.

Specific risk and diversification

A specific risk is linked to a particular event, affecting a single company, a sector of activity or a specific financial instrument. It differs from systemic risk, which affects the entire financial system. To reduce this risk, diversification is a key element, which is why a Private Bank can specify limits by sector or asset class in its Treasury Policy.

Therefore, the Treasury department of the Bank and its Front Office teams can allocate their assets to government bonds, as well as to corporate bonds in sectors such as retail, energy, or Real Estate.

Conclusion

In conclusion, the challenges of asset allocation within the Treasury of private banks are manifold. Guided by Treasury Policies, limits, and control ratios, it must adapt to the emergence of a new regulatory environment to define low-risk, high-liquidity investment strategies while addressing performance and revenue maximization objectives. Furthermore, proprietary asset allocation drives private banks to enhance their internal resources and develop tailored management tools.

Why should I be interested in this post?

If you’re interested in proprietary asset management, or in the workings of a treasury department within a private bank, you’ll find a first overview of these topics in this article.

If you have any questions about the position or the sector, please don’t hesitate to contact me on my personal Linkedin page, I’ll be delighted to answer them.

Related posts on the SimTrade blog

▶ Youssef LOURAOUI Asset Allocation Techniques

▶ Akshit GUPTA Asset Allocation

▶ Youssef LOURAOUI Equity Market Neutral Strategy

Useful resources

La Trésorerie active d’une entreprise

Liquidité, solvabilité et crise bancaire : quelles relations ?

Diversification et gestion des risques

Les placements d’une Trésorerie d’entreprise

About the author

The article was written in March 2024 by Quentin CHUZET (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2019-2023).