In this article, Majd MAHRSI (ESSEC Business School, Global BBA Program, 2021-2025) delves into the critical role of governance in fostering sustainable business practices, particularly in emerging economies. Drawing from professional experiences such as an internship at DiliTrust, this article explains how strong governance frameworks can transform businesses and create new career opportunities.

ESG and Its Components

ESG (Environmental, Social, and Governance) is a framework used to evaluate a company’s sustainability practices and ethical commitments. It assesses corporate behavior across three dimensions:

- Environmental (E): Focuses on a company’s impact on the environment, including energy use, waste management, and carbon emissions.

- Social (S): Examines how a company interacts with its stakeholders, such as employees, customers, and communities, covering diversity, labor rights, and community relations.

- Governance (G): Relates to a company’s internal systems for ethical decision-making, leadership accountability, and shareholder rights.

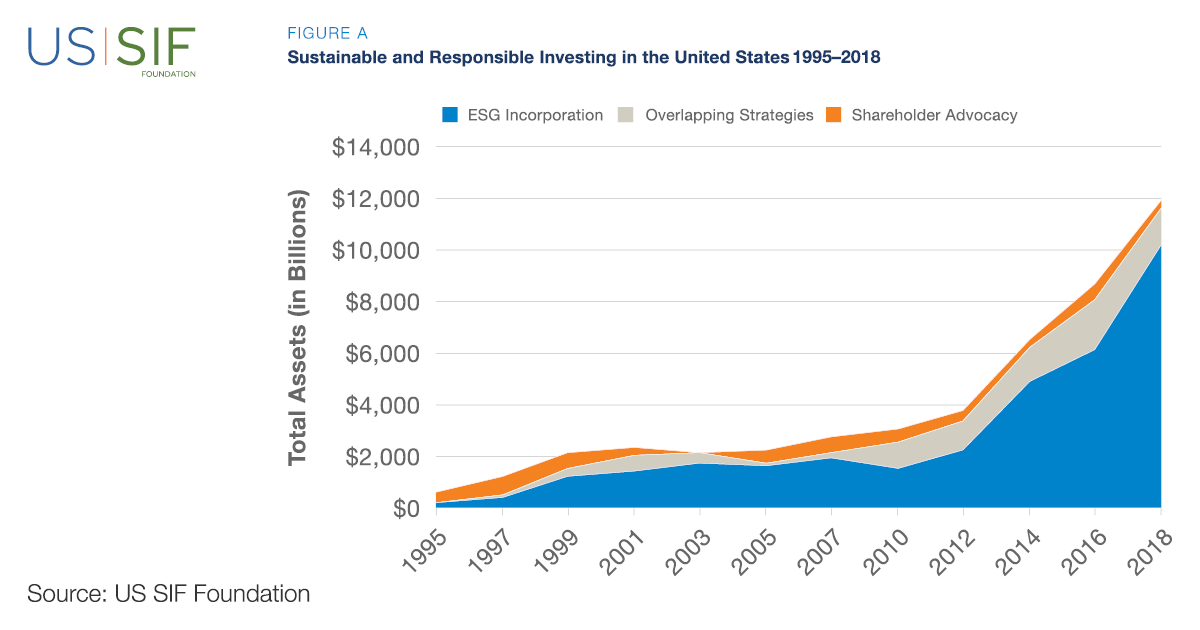

ESG has gained significant traction in recent years, with investors prioritizing companies that integrate sustainability into their core operations. This trend has driven the rise of Socially Responsible Investing (SRI), a strategy where investments are made based on a company’s ESG performance alongside financial returns. According to the Global Sustainable Investment Alliance (GSIA), global SRI assets surpassed $35 trillion in 2022, accounting for nearly 36% of all professionally managed assets. This rapid growth reflects the increasing demand for ethical and sustainable investment options, demonstrating how ESG principles are reshaping financial markets.

Further emphasizing the importance of ESG performance, Friede, Busch, and Bassen (2015) conducted a comprehensive meta-analysis of over 2,000 empirical studies, concluding that approximately 90% of the research found a non-negative relationship between ESG performance and financial performance, with the majority indicating a positive correlation. This underscores the financial benefits of robust governance practices as part of an ESG strategy.

Chart: Below is a graphical representation of the growth of Sustainable and Responsible Investing (SRI) assets in the United States from 1995 to 2018.

Growth of Sustainable and Responsible Investing (SRI) assets

Source: Green America / US SIF Foundation.

Focus on Governance

Governance, the “G” in ESG, refers to the structures, principles, and processes that dictate how a company is controlled and directed. It encompasses:

- Board Diversity and Independence: A diverse and independent board ensures balanced decision-making, reducing conflicts of interest.

- Shareholder Rights: Empowering shareholders with voting rights and transparent reporting fosters accountability.

- Executive Accountability: Ensuring executive compensation aligns with long-term company performance promotes ethical leadership.

- Risk Management: Establishing frameworks for identifying and mitigating financial, operational, and ESG-related risks.

- Transparency and Reporting: Clear and consistent disclosure of governance practices builds stakeholder trust.

According to Eccles, Ioannou, and Serafeim (2014), companies adopting sustainability policies, including strong governance practices, tend to outperform their peers in both stock market returns and accounting metrics, further emphasizing the financial value of ethical leadership.

Without robust governance, even the strongest environmental and social efforts can falter due to poor oversight and unethical practices.

Why Governance Matters in ESG

Good governance forms the foundation for a company’s long-term sustainability and financial stability. It ensures that leadership decisions align with stakeholder interests and corporate ethics.

Trust and Reputation

Strong governance builds stakeholder trust by promoting ethical decision-making and transparency. Companies with robust governance frameworks are better positioned to manage crises and maintain reputational integrity. In contrast, scandals like Enron and Wirecard have shown how governance failures can lead to significant financial and reputational damage.

Attraction of Investors

Investors increasingly view governance as a critical factor when evaluating a company’s sustainability and risk profile. Firms with strong governance, such as Unilever and Microsoft, consistently outperform peers in financial performance and stakeholder trust. According to a study published on Academia.edu, both companies have demonstrated strong financial performance due to their governance practices.

Key Elements of Strong Governance

The importance of effective governance is further highlighted by the OECD Principles of Corporate Governance, which provide a globally recognized framework for transparent and accountable corporate practices.

- Board Diversity and Independence: Diverse and independent boards contribute to better strategic decision-making and accountability. SpringerLink confirms that diversity enhances decision-making quality.

- Transparency and Reporting: Transparent reporting builds trust among investors and regulators. AB Academies highlights its importance for investor confidence.

- Executive Accountability: Linking executive pay to long-term performance ensures leadership integrity. Research from AB Academies supports the link between performance and pay.

- Risk Management: Effective risk management protects against both financial and reputational risks.

- Ethical Practices: Implementing anti-corruption measures and maintaining compliance with laws.

Governance in Emerging Economies

In emerging economies, strong governance frameworks play a transformative role in fostering investor confidence and driving sustainable economic growth. Countries like Saudi Arabia, with Vision 2030, and South Africa, with its King IV Code of Governance, have implemented significant reforms emphasizing transparency, accountability, and ethical leadership to attract foreign investment and modernize corporate practices.

Family-owned businesses, prevalent in regions like the Middle East and Africa, often face unique governance challenges. Implementing independent boards and family charters can help professionalize these businesses, ensuring long-term stability.

Leveraging Technology for Governance

Technological tools, such as those provided by DiliTrust, are transforming governance practices. Platforms for secure document management, compliance tracking, and board meeting organization improve transparency and decision-making efficiency. During my internship at DiliTrust, I witnessed firsthand how these tools streamline governance processes, ensuring accountability across various operational levels.

Career Opportunities in Governance

Governance expertise can lead to several impactful career paths:

- Independent Board Member: Certifications like those from the ITA in Tunisia equip professionals to serve on corporate boards, ensuring strategic oversight.

- Governance Consulting: ESG consulting firms assist businesses in enhancing governance practices, ESG compliance, and sustainability reporting.

- ESG Rating Specialist: Working in agencies that assess corporate governance and sustainability standards.

- Risk and Compliance Management: Roles focusing on enforcing governance frameworks within financial institutions and multinational corporations.

Related Posts on the SimTrade Blog

▶ Majd MAHRSI My Internship Experience at DiliTrust

▶ Anant JAIN Environmental, Social & Governance (ESG) Criteria

▶ Nithisha CHALLA Activists in financial markets and the corporate world

▶ Anant JAIN MSCI ESG Ratings

Useful Resources

South Africa’s King IV Code of Governance

OECD Principles of Corporate Governance

Institut Tunisien des Administrateurs (ITA)

SpringerLink on Board Diversity

Academia.edu on Unilever and Microsoft

About the Author

The article was written in January 2025 by Majd MAHRSI (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2025).