In this article, Julien MAUROY (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2025) shares technical knowledge on risk management in the business world based on his experiences. The concepts of financial risk in business, risk management, and risk analysis will be presented. All of this information is drawn from my experiences and supported by literature on the subject.

Risk as a strategic lever

This topic aims to explore how companies manage risk and transform it into a lever for decision-making and value creation. It ties in with my academic background at ESSEC Business School and my professional experience in two complementary environments: finance and risk consulting at BearingPoint and export financing at Bpifrance. Today, risk-related issues are omnipresent in business. Whether it is competitiveness, investment decisions or international expansion, every strategy involves a degree of uncertainty.

Risk is no longer just a threat, it is anticipated, studied, calculated and has a market price: the cost of seeking advice, the cost of insurance, etc. It therefore becomes a key management factor for companies that can identify, measure and integrate it into their strategic thinking. This is why understanding risk management means understanding how organisations balance growth, stability and performance. It is this dual approach : consulting (risk reduction) and insurance and export financing (risk assessment and pricing), that I would like to share with you.

Reducing and structuring risk with consulting

During my internship at BearingPoint, I discovered how consulting could help companies reduce and structure their strategic, financial and operational risks. Consultants bring an external perspective to a company’s activities. They use an analytical, neutral approach to identify organisational weaknesses and make more informed decisions.

Within the Finance & Risk department, my assignments consisted of improving the financial performance and financial management of the company’s activities. The main topics were data reliability, reporting automation, and optimisation of budgeting and forecasting processes.

By improving the quality of financial information and its analysis, we helped companies become more agile and better able to manage their business. Companies gained visibility and the ability to anticipate future developments. Consulting is therefore the ideal way to transform uncertainty into a structured and effective methodology for addressing the challenges facing these sectors.

It helps companies adopt rigorous governance, allocate resources and budgets more effectively to each activity, and avoid costly strategic errors.

Finally, consulting helps reduce companies’ exposure to risk by providing support at all levels. It makes decision-making more rational, measurable and aligned with long-term strategy in light of competition and industry challenges.

Measuring and pricing risk with export insurance and financing

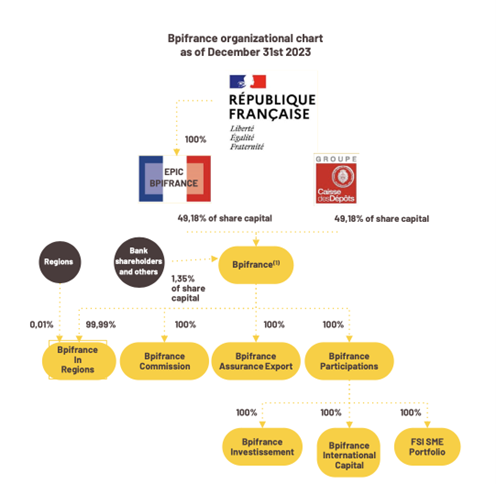

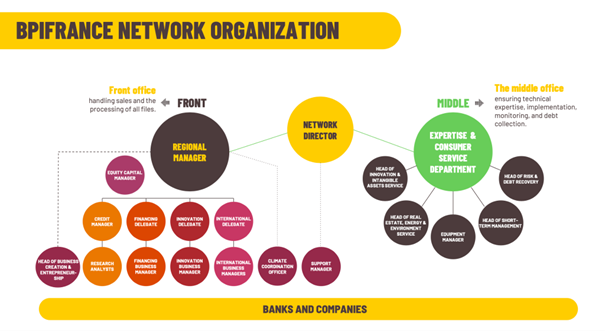

My experience in Bpifrance’s Export Insurance department gave me a different perspective on risk, this time more quantitative and institutional.

In this organisation, risk is not borne solely by the customer seeking insurance, but also by Bpifrance, which insures French exporters against risk arising from foreign buyers. The risk is therefore shared between the lending bank, the insurer and the French exporter.

In export insurance, risk is not abstract: it is analysed, measured and valued. The accuracy of the analysis is paramount, involving financial, extra-financial and geopolitical analysis. An in-depth study of exporting companies and their international counterparties makes it possible to assess their solidity and their ability to honour their financial commitments.

Each project is subject to a detailed risk assessment: counterparty risk, country risk, sectoral or political risk. These factors have an immediate impact on the premium rate applied to the export guarantee. In other words, the higher the risk of loss, the higher the cost of coverage. This approach, based on collaboration with the French Treasury and the OECD, has enabled me to understand how institutions can price risk on a global scale.

In comparison, consulting helps to anticipate, explore solutions and reduce risk, while insurance seeks to assess and price risk. At that point, risk is not avoidable, but is an integral part of the economic model.

Understanding risk in order to leverage it

These two experiences taught me that risk management is not just about protecting yourself from risk, but understanding it so you can use it as a lever for growth.

In consulting, risk is controlled through better organisation, reliable information and a clear strategy. In finance, risk becomes a measurable parameter, integrated into decision-making models and valued according to its potential impact.

These two approaches are therefore complementary: one aims to make the company more resilient, the other enables it to grow despite uncertainty.

These two perspectives show that risk, far from being a constraint, can become a strategic management tool, a driver of adaptation and a source of sustainable competitiveness.

Conclusion: the strategic value of risk management

Through these experiences, I have understood that risk management is at the heart of finance and strategy.

At BearingPoint, I acquired analytical rigour and the ability to structure my thinking, at Bpifrance I gained a macroeconomic vision and a concrete understanding of the link between risk and financial performance.

This dual perspective on qualitative and quantitative risk convinced me that knowing how to assess, integrate and explain risk is a key skill for the future of business.

In an uncertain world, managing risk means managing the relevance of decisions: this is what distinguishes companies that are able to anticipate the future from those that simply react to it.

Opening the topic with the vision of Frank Knight and Nassim Taleb

The study of risk in business has been the subject of earlier studies and research, notably initiated by Frank Knight in 1921 in Risk, Uncertainty and Profit. Knight distinguishes between two essential realities: risk, which can be quantified and insured against, and uncertainty, which cannot be quantified.

This distinction is further developed by Nassim Taleb in The Black Swan (2007), where he shows that certain extreme disruptions, known as ‘black swans’, cannot be predicted or incorporated into traditional models. Examples include pandemics, political shocks and sectoral collapses. For Taleb, the issue is not only one of prediction, but of building resilient organisations capable of absorbing unexpected shocks.

These two perspectives are directly reflected in corporate risk management. I have observed how consulting helps organisations reduce their exposure to ‘measurable’ risk, and conversely, my experience at Bpifrance immersed me in an approach where risk is quantified and priced. But neither consulting nor finance can eliminate uncertainty in Knight’s sense or Taleb’s ‘black swans’. Their role is to help the company better prepare for them by strengthening strategic robustness and adaptability.

That is why risk is no longer just a threat: it becomes a management tool and a lever for structuring action, in order to build organisations that are resilient in the face of the unexpected.

Related posts on the SimTrade blog

▶ Rishika YADAV Understanding Risk-Adjusted Return: Sharpe Ratio & Beyond

▶ Mathias DUMONT Pricing Weather Risk: How to Value Agricultural Derivatives with Climate-Based Volatility Inputs

▶ Vardaan CHAWLA Real-Time Risk Management in the Trading Arena

▶ Snehasish CHINARA My Apprenticeship Experience as Customer Finance & Credit Risk Analyst at Airbus

▶ Marine SELLI Political Risk: An Example in France in 2024

▶ Julien MAUROY My internship experience at BearingPoint – Finance & Risk Analyst

▶ Julien MAUROY My internship experience at Bpifrance – Finance Export Analyst

Useful resources

Didier Louro (25/09/2024) Le risk management au service de la croissance Bearing Point x Sellia (podcast).

Academic articles and books

Cohen E. (1991) Gestion financière de l’entreprise et développement financier, AUF / EDICEF.

Hassid O. (2011) Le management des risques et des crises Dunod.

Knight, F. H. (1921) Risk, Uncertainty and Profit Houghton Mifflin Company.

Mefteh S. (2005) Les déterminants de la gestion des risques financiers des entreprises non financières : une synthèse de la littérature, CEREG Université Paris Dauphine, Cahier de recherche n°2005-03.

Taleb N.N. (2008) The Black Swan Penguin Group.

About the author

The article was written in November 2025 by Julien MAUROY (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2025).

▶ Read all articles by Julien MAUROY.