Multiples valuation method for stocks

In this article, Jorge KARAM DIB (ESSEC Business School, Master in Strategy and Management of International Business (SMIB), 2024-2025) introduces the method to evaluate stocks called “multiples valuation”.

How much should a stock be worth?

Valuing stocks is a complex yet essential endeavor for investors seeking to make informed decisions in the financial markets. Knowing if you are paying a fair price or if you are over or under paying for a stock is every investors question. Of course, a decision on whether investing or not in a company comes after a long due diligence of valuating the financials of the company, following their reports, and many more actions to ensure you are buying something of value. Some investors call this method “value investing”, when the investor value a stock above the actual price, it is said that the type of investing is “value”, trying to take advantage of the differential between the actual price and the theoretical price. And when they buy a stock for a competitive advantage that is not expected in the near future to concede, it is usually called “growth investing”. Although some famous investors disagree in these definitions, they are used frequently in the financial language.

While there is no one-size-fits-all approach to valuing stocks, investors often turn to a range of methodologies, one of which is multiples analysis. By examining multiples such as price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S), and many more, investors gain insights into how the market values a company relative to its earnings, assets, or revenue. In this article we will try to shine a light on this valuating method and walk through the benefits and limitations the method has.

Multiples valuation method

Multiples valuation method involves analyzing one or more multiples, such as the price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) ratios, among others. Each multiple provides a unique perspective on how the market values a company relative to its earnings, assets, or revenue.

The price-to-earnings (P/E) ratio, for instance, compares a company’s stock price to its earnings per share (EPS), indicating how much investors are willing to pay for each dollar of earnings generated by the company. A low P/E ratio may suggest that the stock is undervalued, while a high P/E ratio could indicate overvaluation.

One key aspect of this method is that it is usually compared against the ratios of companies within the same industry. It is from the investor’s criteria to decide which filters to apply for deciding against what companies the objective should be compared with, but usually it should be on the same market, region can also be an important factor, and also the size.

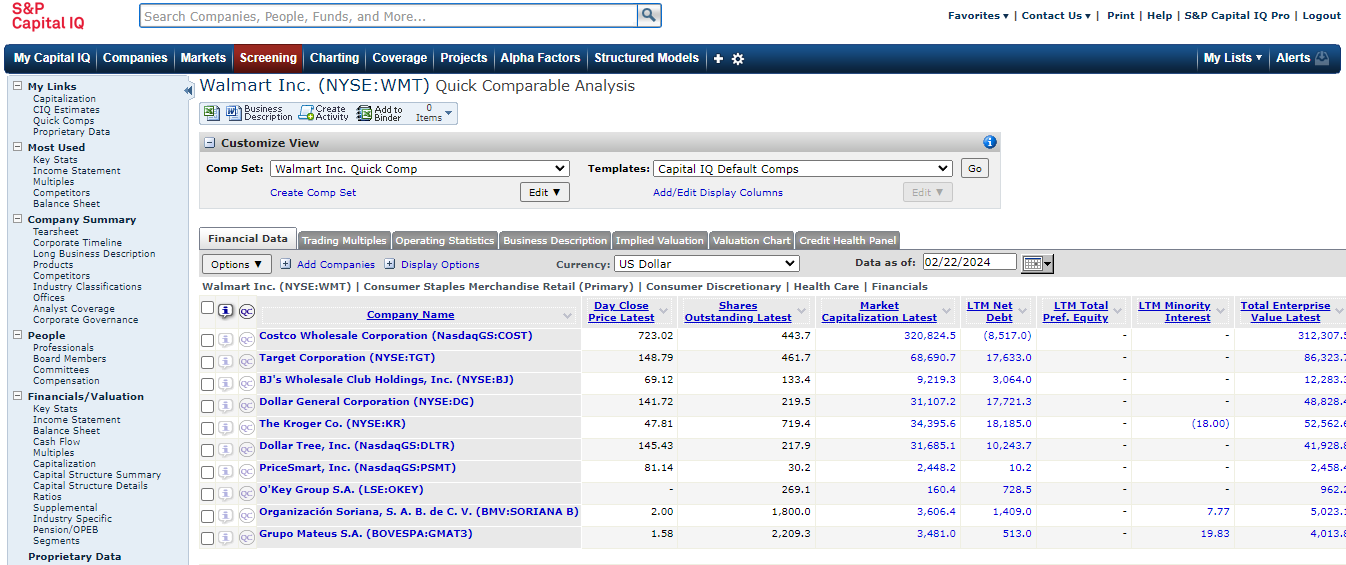

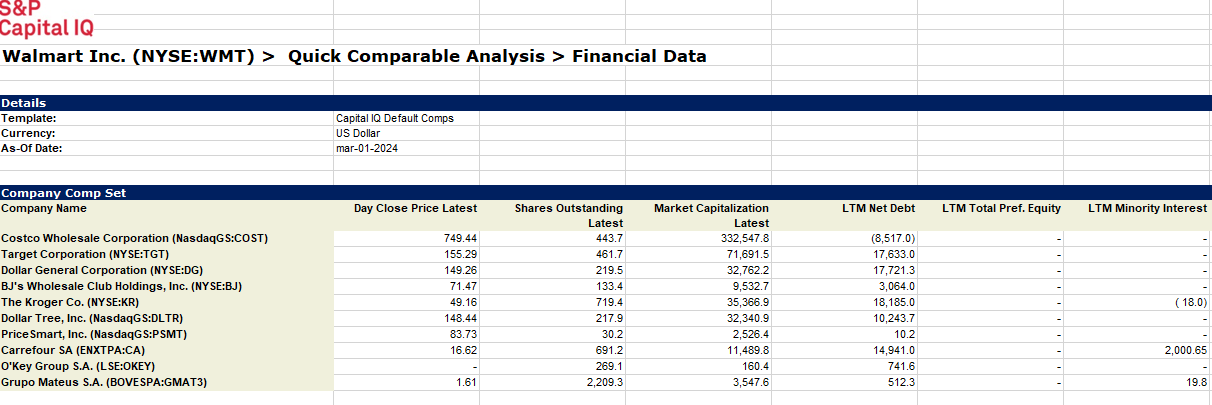

There are many sources of information to consult the information from, many of them free. This platform simplifies the valuation by providing not only the information, but in some cases, the ability to connect through an API and do the consulting automatically through a query. In the next image is shown an example from Capital IQ, one of the most prestigious information sources in the financial world, about Walmart and some recommendations from the platform of similar companies in the market to facilitate the calculation.

Walmart’s comparison.

Source: Capital IQ.

Calculations

Calculating multiples involves straightforward mathematical formulas that utilize key financial metrics derived from a company’s financial statements. If we use the case for P/E, then we would need to divide the “Market price per share” with the “Earnings per share”. After getting the ratio, let’s say of Walmart, the next step is to get the median P/E for the “similar” companies that the investor decided to compare the company with. With these two values the investor can start seeing a trend on where the company is positioned versus their competitors. The next step is to calculate the price per share of Walmart using the P/E of the similar companies, and see the comparison between the price with the original P/E versus the “mean” of similar companies.

Example: Walmart

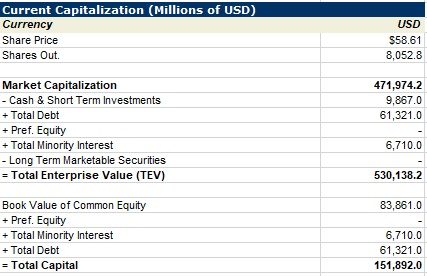

This section will be dedicated to illustrate the method explained earlier using Walmart as an example and Capital IQ as the source of information. The first step is to consult the key financials as shown in the next picture.

Walmart’s key financials.

Source: Capital IQ.

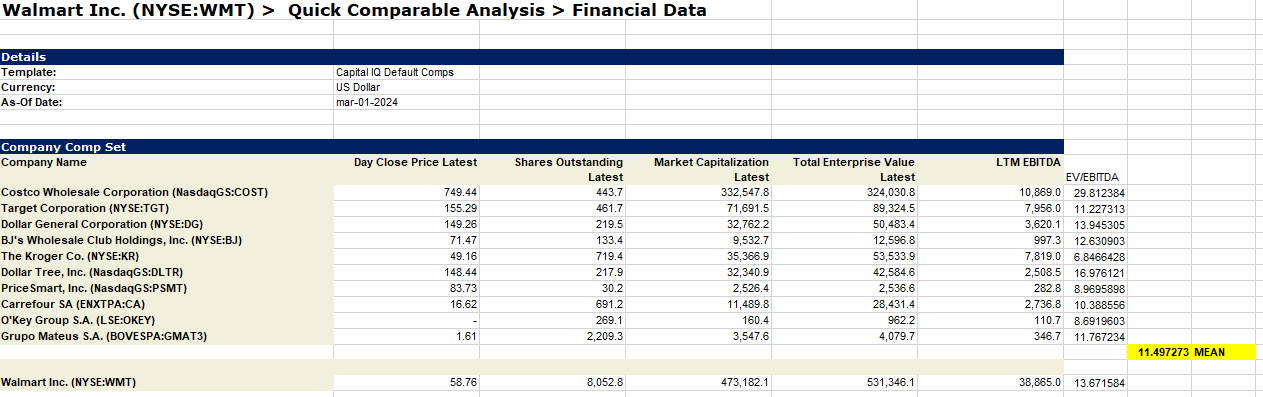

Next, compute the information with the comparable companies suggested by Capital IQ. Important to note that the companies can be added or withdrawn according to everyone’s own criteria.

Comparable analysis.

Source: Capital IQ.

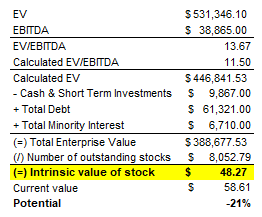

After retrieving all the information, the next step is to do the calculations explained earlier in the document. The mean EV/EBITDA ratio for the comparable companies and then recalculate the price of Walmart’s stock using the mean EV/EBITDA ratio.

Mean EV/EBITDA ratio.

Source: Capital IQ.

Valuation of Walmart’s stock.

Source: Capital IQ.

In this case, we see an underappreciation of Walmart’s stock, this doesn’t mean that anyone shouldn’t buy stocks of the company, is just the perspective of the valuation method, and also it is not an investing advice.

Conclusions

The multiples valuation method provides investors with a valuable framework for assessing the worth of a stock by comparing it to similar companies within the same industry. By using this method, investors gain insights into how the market values a company relative to its earnings, assets, or revenue.

However, it’s important to recognize the limitations of this approach. Multiples analysis relies heavily on historical financial data and may not fully capture future growth prospects or qualitative factors such as industry dynamics and competitive positioning. Additionally, multiples are subject to fluctuations in market sentiment and may not always reflect the intrinsic value of a company accurately.

Despite these limitations, multiples analysis remains a widely used and valuable tool in the arsenal of investors. When applied judiciously and supplemented with thorough research and analysis, multiples can provide valuable insights into a company’s valuation and help investors identify potential investment opportunities.

Why should I be interested in this post?

This post is with the only intention for educational purposes. Targeting people who are interested in knowing more about valuation methods for stocks. In any way this article pretends to be an investment advice and/or suggestion. Any decision should be taken under personal responsibility and with their respective due diligence previous to the decision.

Related posts on the SimTrade blog

▶ Ghali EL KOUHENE Asset valuation in the Real Estate sector

▶ Isaac ALLIALI Understanding the Gordon-Shapiro Dividend Discount Model: A Key Tool in Valuation

Useful resources

McKinsey & Company The right role for multiples in valuation

Chastenet E. and A. Marion (2015) Valuation Using Industry Multiples: How to Choose the Most Relevant Multiples, Business Valuation Review, 34(4): 173-183.

Schueler A. (2020) Valuation with Multiples: A Conceptual Analysis, Journal of Business Valuation and Economic Loss Analysis, 15(1) pp. 20190020.

About the author

The article was written in March 2024 by Jorge KARAM DIB (ESSEC Business School, Master in Strategy and Management of International Business (SMIB), 2024-2025).