In this article, Daniel LEE (ESSEC Business School, Global Bachelor in Business Administration (GBBA) – 2023-2027) explains the Weighted Average Cost of Capital (WACC).

Introduction

The Weighted Average Cost of Capital (WACC) is one of the most important concepts in corporate finance and valuation. I know that for some students, it feels abstract or overly technical. In reality, WACC is simpler than we think.

Whether it is a DCF, investment decision or assessing long-term value creation, understanding WACC is essential to interpret the financial world. In a DCF, WACC is used as the discount rate applied for FCF. Moreover, a higher WACC lowers the PV of future cashflows whereas a lower WACC increases the firm value. That is why WACC is a benchmark for value creation.

What is the cost of capital?

Every company needs funding to operate, which comes from two main sources: debt and equity. Debt is provided by banks or bondholders and equity is provided by shareholders. Both expect to be compensated for the risk they take. Shareholders typically require a higher return because they bear greater risk, as they are paid only after all other obligations have been met. In contrast, debt investors mainly expect regular interest payments and face lower risk because they are paid before shareholders in case of financial difficulty. The cost of capital represents the return required by each group of investors, and the Weighted Average Cost of Capital (WACC) combines these required returns into a single percentage.

The cost of capital is the return required by each investor group and WACC combines these two expectations with a simple %.

Breaking down the WACC formula

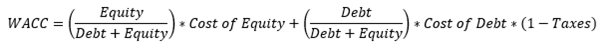

WACC is calculated with this formula:

Cost of Equity: CAPM model

Cost of equity = Risk-free rate + β (Expected market return – Risk-free rate)

Beta measures how sensitive a company’s returns are to movements in the overall market. It captures systematic risk, meaning the risk that cannot be eliminated through diversification. A beta above 1 indicates that the firm is more volatile than the market, while a beta below 1 means it is less sensitive to market changes.

It is important to distinguish between unlevered beta and levered beta. The unlevered beta reflects only the risk of the firm’s underlying business activities, assuming the company has no debt. It represents the pure business risk of the firm and is especially useful when comparing companies within the same industry, as it removes the effect of different financing choices. This is why analysts often unlever betas from comparable firms and then relever them to match a target capital structure.

The levered beta, on the other hand, includes both business risk and financial risk created by the use of debt. When a company takes on more debt, shareholders face greater risk because interest payments must be made regardless of the firm’s performance. This increases the volatility of equity returns, leading to a higher levered beta and a higher cost of equity.

The risk-free rate represents the return investors can earn without taking any risk and is usually approximated by long-term government bond yields. It acts as the baseline return in the CAPM, since investors will only accept risky investments if they offer a return above this rate. Choosing the correct risk-free rate is important: it should match the currency and the time horizon of the cash flows. Changes in the risk-free rate have a direct impact on the cost of equity and, therefore, on firm valuation.

Cost of Debt

The interest payments are tax-deductible. That’s why we include 1-T in the formula. For example: if a company pays 5% interest annually and the corporate tax rate is 30% then the net cost of debt is 5%*(1-0.3) = 3.5%.

Capital Structure Weights

The weights Equity/(Equity+Debt) and Debt/(Equity+Debt) represents the proportion of equity and debt in the company’s balance sheet. We can then assume that a firm with more debt will have a lower WACC because debt is cheaper, but too much debt is risky. That is why the balance is very important for valuation and that usually you use a “target capitalization”. Target capitalization is an assumption of the level of debt and equity that a company is expected to have in the long term, rather than the current one.

Understanding risk through the WACC

WACC is a measure of risk. A higher WACC means the company is riskier and a lower WACC means it’s safer.

WACC is also closely linked to a firm’s capability to create value. If ROIC > WACC then the company creates value, but if ROIC < WACC, the company destroys value. This rule is widely used by CFO and investors to take decisions.

How is WACC used in practice?

- WACC is the discount rate applied to FCF in the DCF > Lower WACC = Higher valuation; Higher WACC = Lower Valuation

- As said before, it helps to assess value creation and find NPV

- Assessing capital structure > helps to find the optimal balance between debt and equity

- Comparing companies > good preliminary step to look at similar companies in the same company, the WACC will tell you a lot about their risk

Example

To illustrate how the WACC formula is used in practice, let us take the DCF valuation for Alstom that I made recently. In this valuation, WACC is used as the discount rate to convert future free cash flows into present value.

Alstom’s capital structure is defined using a target capitalization, that was chosen on the industry and the comps. Equity represents 75% of total capital and debt 25%. The cost of equity is estimated using the CAPM. Based on the base-case assumptions, Alstom has a levered beta that reflects both its industrial business risk and its use of debt. Combined with a risk-free rate and an equity risk premium, this leads to a cost of equity of 8.3%.

The cost of debt is estimated using Alstom’s borrowing conditions. Alstom pays an average interest rate of 4.12% on its debt. Since interest expenses are tax-deductible, we adjust for taxes. With a corporate tax rate of 25.8%, the after-tax cost of debt is:

4.12%×(1-0.258)=3.05%

We can now compute the WACC:

WACC=75%×8.3%+25%×3.05%=6.98%

This WACC represents the minimum return Alstom must generate on its invested capital to satisfy both shareholders and lenders. In the DCF, this rate is applied to discount future free cash flows. A higher WACC would reduce Alstom’s valuation, while a lower WACC would increase it, highlighting how sensitive valuations are to financing assumptions.

Conclusion

To conclude, WACC may look a bit complicated, but it represents a simple idea: the company must generate enough to reward its investors for the risk they take. Understanding WACC allows people to interpret valuations, understand how capital structure influences risk and compare businesses across industries. Once you master the WACC, it is one of the best tools to dig your intuition about risk and valuation.

Related posts on the SimTrade blog

▶ Snehasish CHINARA Academic perspectives on optimal debt structure and bankruptcy costs

▶ Snehasish CHINARA Optimal capital structure with corporate and personal taxes: Miller 1977

▶ Snehasish CHINARA Optimal capital structure with no taxes: Modigliani and Miller 1958

Useful resources

Damodaran, A. (2001) Corporate Finance: Theory and Practice. 2nd edn. New York: John Wiley & Sons.

Modigliani, F., M.H. Miller (1958) The Cost of Capital, Corporation Finance and the Theory of Investment, American Economic Review, 48(3), 261-297.

Modigliani, F., M.H. Miller (1963) Corporate Income Taxes and the Cost of Capital: A Correction, American Economic Review, 53(3), 433-443.

Vernimmen, P., Quiry, P. and Le Fur, Y. (2022) Corporate Finance: Theory and Practice, 6th Edition. Hoboken, NJ: Wiley.

About the author

The article was written in January 2026 by Daniel LEE (ESSEC Business School, Global Bachelor in Business Administration (GBBA) – 2023-2027).

▶ Read all articles by Daniel LEE.