In a world that often focuses on immediate results and instant gratification, it can be easy to overlook how regular effort accumulates into long-term impact.

This quote by Bill Gates reminds us that human ambition and effort are most effectively realized over extended periods of time. Planning ahead, embracing patience, and committing to consistent action are the keys to achieving extraordinary outcomes.

In this article, Hadrien PUCHE (ESSEC, Grande École, Master in Management, 2023-2027) reflects on this quote, exploring how it applies not only to personal growth but also to finance, and especially investing.

About Bill Gates

Bill Gates

Source: Wikimedia Commons

Bill Gates is a co-founder of Microsoft and one of the most influential entrepreneurs of the late twentieth and early twenty-first century. Beyond his contributions to technology, he is widely recognized for his philanthropy through the Bill and Melinda Gates Foundation, which focuses on global health, education, and poverty reduction. Gates has often spoken about vision, long-term planning, and the accumulation of effort over time.

“Most people overestimate what they can do in a year and underestimate what they can do in ten.”

Bill Gates

The quote is widely attributed to Bill Gates, although its true authorship is uncertain. What matters, however, is that Gates has consistently demonstrated through his work in technology and philanthropy how sustained effort and strategic planning can produce results that far exceed initial expectations.

Analysis of the quote

The central insight of this quote is that time magnifies effort. People often approach challenges with a short-term mindset, setting goals that are ambitious for a short period but fail to consider the compounding effect of consistent action. This makes them unable to reach these goals, leading to potential failure, whereas small steps over ten years can accumulate to produce extraordinary results.

This bias toward short-term thinking is prevalent in many areas of life, from career planning to investing. Individuals overestimate what they can accomplish quickly, which can lead to frustration when immediate goals are not met. Simultaneously, they underestimate what can be achieved over a decade, missing opportunities for growth, learning, and accumulation of value.

In finance, this mindset manifests in impatience with investments or ventures that require time to mature. In personal development, it is reflected in the failure to adopt habits that pay dividends over the long term. Gates’ quote is a reminder that extraordinary achievements are rarely the product of sudden effort. They are the result of consistent, incremental progress compounded over years.

This idea of long-term, incremental effort resonates closely with Malcolm Gladwell’s The Tipping Point: How Little Things Can Make a Big Difference. Gladwell explains how small, consistent actions or seemingly minor events can accumulate over time until they trigger a dramatic, outsized effect: the “tipping point.”

Economic and financial concepts related to the quote

I present below three financial concepts: compound interest, investment horizons, Strategic planning and time diversification.

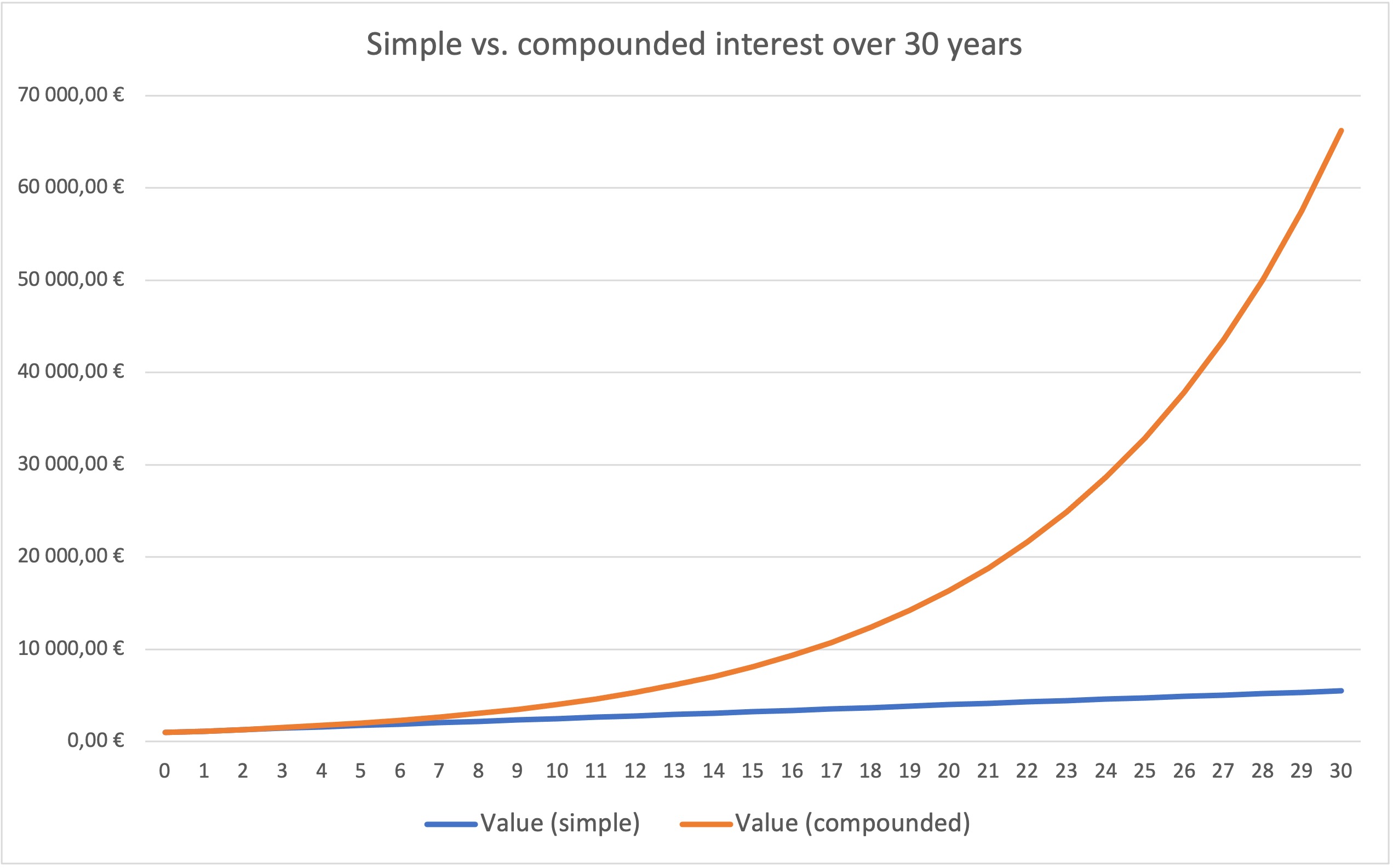

Compound interest

The concept of compound interest is perhaps the most direct financial parallel to Gates’ insight. In investing, the growth of wealth is not linear: returns earned on investments generate additional returns over time, producing an exponential effect. Individuals who understand and leverage compound interest can turn modest contributions into significant wealth over decades, whereas those who focus on immediate gains often miss the cumulative benefits. Gates’ quote captures this principle in human effort and strategic planning, emphasizing that patience and consistency are more powerful than short bursts of activity.

This is why Einstein famously called compound interest the “eighth wonder of the world”.

Source: the author.

To better understand compounding, download this excel file and try to play around with the interest rate.

You can download the Excel file provided below, which contains the calculations of EBITDA for Carrefour.

Investment horizons

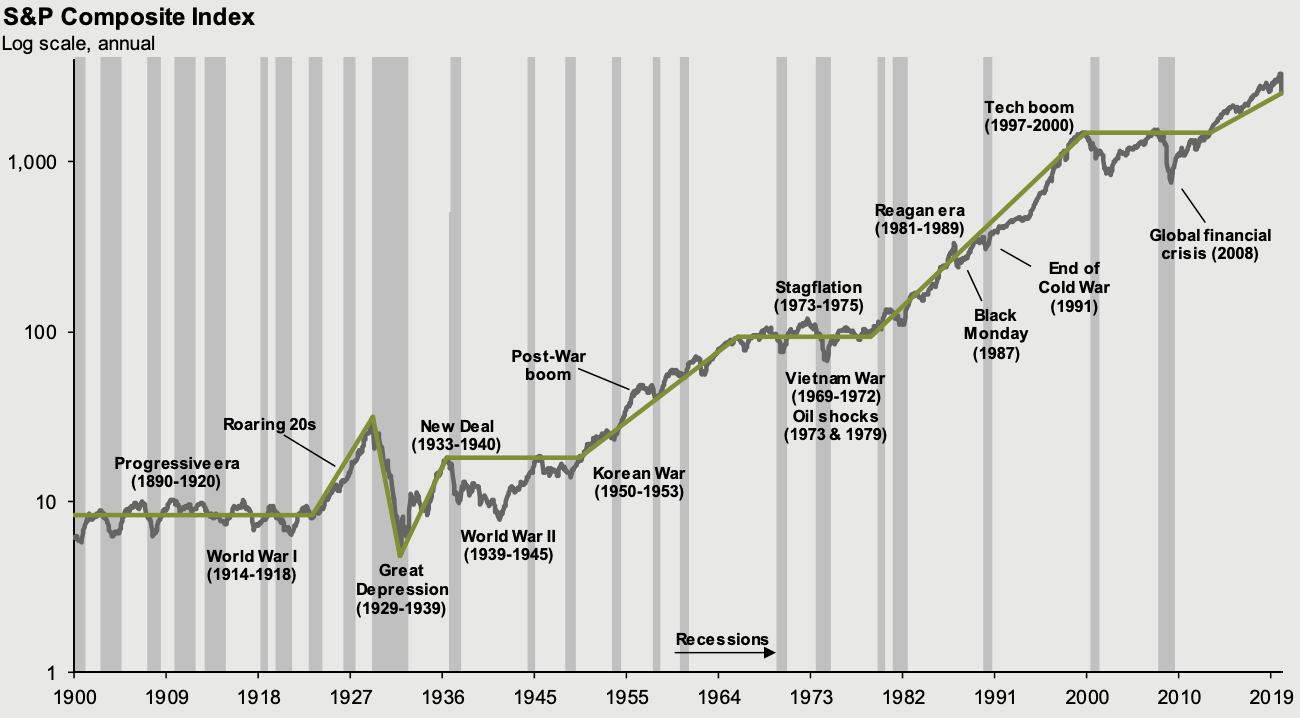

Successful investing often relies on a long-term perspective. Markets can be volatile in the short term, but sustained investment in fundamentally sound assets typically produces growth over extended periods. Investors who overreact to short-term fluctuations may underperform by frequently buying and selling, while those who commit to a long-term strategy benefit from the power of time. Gates’ insight mirrors this approach.

From a financial standpoint, this is also a question of μ vs σ: in the short run, market movements are dominated by σ (sigma; volatility), which makes returns unpredictable and often discouraging. But over longer horizons, μ (mu; the average expected return) becomes more visible, and the noise of volatility fades relative to the trend. In other words, the longer you stay invested, the more likely the underlying growth of the market (and not short-term fluctuations) will determine your outcome.

Source: internet.

As you can see on this graph, the S&P 500 index tends to perform well on the long run and always recover from times of crisis.

Just as how small investments compound over many years, consistent effort in personal or professional life produces results far greater than what is visible in a single year.

Strategic planning and time diversification

In economics and business, strategic planning means looking beyond immediate gains and considering how decisions will play out over multiple years or even decades. Investments in areas such as research and development, employee training, or infrastructure rarely pay off right away. Yet, as these efforts accumulate, they can create lasting competitive advantages, foster innovation, and drive long-term profitability.

A similar logic applies in finance through time diversification. Short-term market fluctuations can be unpredictable, but the longer an investor stays committed to a well-constructed portfolio, the greater the chance that temporary volatility smooths out and long-term growth prevails.

Gates’ quote captures the essence of both ideas: meaningful results (in business, investing, or personal development) come not from quick wins but from sustained effort and the willingness to think further ahead than the next quarter or the next year.

My opinion about this quote

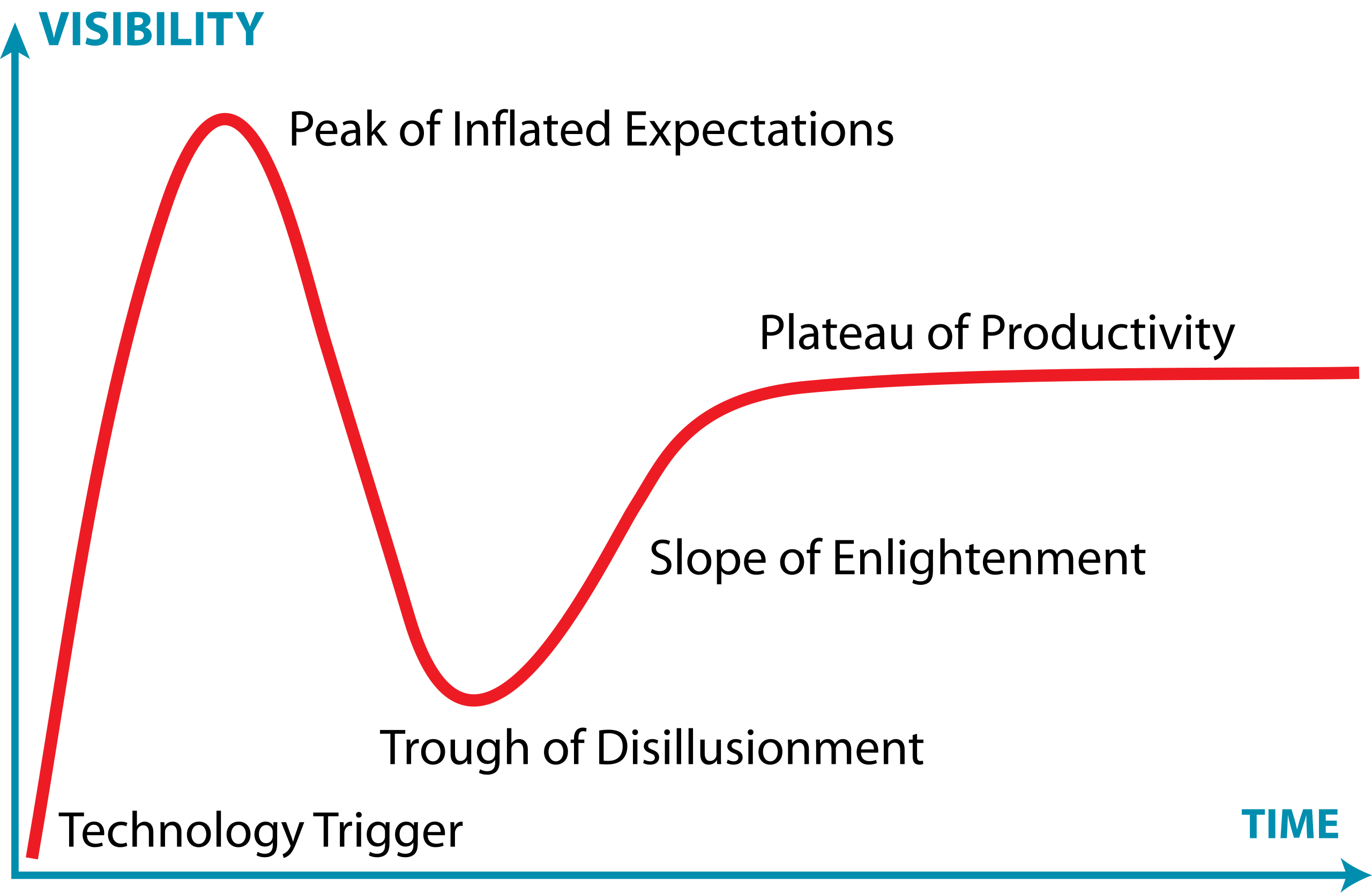

This quote feels especially relevant today, as the pace of technological change accelerates with the rise of artificial intelligence and other innovations. Society is not accustomed to this level of speed, which can distort our perception of what is achievable. While there is a temptation to believe that technological advances will produce massive change within just a few years, Gates’ quote reminds us to temper optimism with realistic expectations. In reality, it often takes considerable time for firms to integrate new technologies and realize meaningful productivity gains, as seen with the adoption of the internet and, more recently, with AI.

This dynamic is clearly illustrated in the graph below, known as the Gartner Hype Cycle. This framework describes the typical pattern of expectations surrounding new technologies. When a breakthrough such as generative AI emerges, public enthusiasm and media attention often inflate expectations far beyond what is achievable in the short term. As a result, we tend to overestimate the immediate impact of the innovation.

However, as the technology progresses through the different phases of the cycle (from initial excitement to disillusionment, and eventually to maturity), its long-term transformative potential becomes clearer. The Gartner Hype Cycle helps explain why we so often underestimate what a technology can achieve over a decade, even while exaggerating what it can achieve in its first year.

Source: Gartner.

The Gartner Hype Cycle, illustrates the typical progression of expectations around new technologies.

At the same time, the quote encourages reflection on long-term potential. Even if technologies develop more slowly than expected, incremental improvements over a decade can still lead to transformative outcomes. The lesson is to maintain both patience and vigilance, avoiding the extremes of overconfidence or neglect.

This principle also applies to personal finance and life planning. Many people set short-term goals and become frustrated when progress seems slow. Yet, the cumulative effect of consistent action, thoughtful saving, learning, or skill development often surpasses what we anticipate in the first year. By recognizing the value of long-term effort, individuals can better allocate resources, set meaningful goals, and make decisions that pay off over time.

In professional contexts, such as career progression or entrepreneurship, the quote is equally valuable. Building a company, developing expertise, or pursuing innovation rarely produces instant results. Sustained effort, compounded knowledge, and consistent decision-making are what lead to exceptional achievements over the long term.

Why should you be interested in this post?

Bill Gates’ quote is a reminder to plan thoughtfully, embrace patience, and recognize the exponential power of effort. While no one can predict the future with certainty, adopting a long-term perspective allows individuals to maximize the impact of their actions and investments.

This insight is particularly relevant for students and young professionals. You do not need a detailed plan for the next ten years, but considering the direction of your efforts and making incremental progress can dramatically improve outcomes over time. Recognizing the gap between short-term overestimation and long-term underestimation fosters discipline, focus, and resilience in both personal and financial decisions.

Whether applied to investing, professional development, or personal goals, this quote encourages a mindset that values consistency, foresight, and the compounding power of effort. Understanding this principle allows individuals to avoid the pitfalls of impatience while harnessing the opportunities presented by sustained dedication.

Related posts on the SimTrade blog

Useful resources

Gates, B. (2021) How to Avoid a Climate Disaster: The Solutions We Have and the Breakthroughs We Need, Penguin Random House.

Graham, B. (1949) The Intelligent Investor: A Book of Practical Counsel, New York: Harper & Brothers.

Malkiel, B. G. (2019) A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing, 12th Edition, New York : W. W. Norton & Company.

Gladwell M. (2000) The Tipping Point: How Little Things Can Make a Big Difference, Boston, MA: Little, Brown and Company.

About the author

The article was written in November 2025 by Hadrien PUCHE (ESSEC, Grande École, Master in Management – 2023-2027).