In this article, Mahé FERRET (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2022-2026) explains the appeal and challenges of selling structured products in France.

Introduction

Structured products are investment products combining traditional assets (stocks, bonds, indexes…) with derivatives (options, futures…) to offer customized returns tailored to an investor’s risk profile.

In recent years, structured products have gained popularity due to persistent low interest rates and increased market volatility. For instance, buffered ETFs reached $43.4 billion in assets in 2024 according to N.S Huang (Kiplinger, 2024). In France, the market has grown significantly, reaching €42 billion in 2023, an 82% increase over two years, showing investors’ interest in higher returns with safety. Sales teams in investment banks actively seek to answer this demand by offering structured solutions to wealth managers, private banks and institutional investors, using payoff strategies and risk scenarios to support which product to choose.

Why Structured Products Appeal to French Investors

These products are particularly interesting for France’s investment culture, known for capital protection and an income preference due to low interest rates and relatively more risk-averse type of investors. The structured products appeal to French investors as they aim to protect the initial investments and offer higher returns than traditional bonds.

Capital protection means that an investor will not lose their initial investment, even if the market is dropping, and will earn a profit if the market performs well. As an example, BNP Paribas offers Capital Protection Notes (CPNs) tied to the S&P500 that guarantees the initial investment amount at maturity and 130% of the average performance of the index if it rises. If the index’s performance is zero or negative, the investor will only receive its capital back, with no additional return. In client meetings, sales professionals use scenario simulations and historical data to demonstrate the potential returns under different market conditions. Another type of structured product that could interest sustainable caring French investors could be an ESG (Environmental, Social, Governance) note tied to a renewable energy index. As an example, an ESG-linked structured product is tied to indices like the Euronext Eurozone ESG Large 80 Index, with a fixed or conditional coupon of 3 to 5% annually and a maturity of usually 5 to 8 years. With the increasing demand for these products, ESG investments are more and more promoted by Sales through a sustainable aspect, especially to family offices and pension funds committed to responsible investing. ESG products include ESG factors while still using traditional assets like stocks, allowing investors to search for both financial returns and positive societal impact. They often include stock from companies with already strong ESG processes, green bonds supporting environmental projects or derivatives linked to sustainability indicators.

Regulatory Environment in France

In France, the Autorité des marchés financiers (AMF) regulates the sales of structured products to ensure fairness and transparency. These products are complex, and regulations like PRIIPs (Packaged retail and insurance-based investment products) require a Key Information Document (KID) to explain them in simple terms. MiFID II (Markets in Financial Instruments Directive II) also mandates clear disclosure of risks and costs. ESG products, in particular, are under scrutiny to prevent greenwashing. It is an important aspect for the Sales team to consider, as they must respect regulatory requirements at every step with the clients, from pre-trade client conversations to post-sale documentation, and integrate it into their sales pitch.

Client Segments and Tailored Offerings

As complex as these products can be, one of their benefits is that they can be tailored to each investor’s profile risk (more or less tolerance to risk). The structured products can be ideal for retail investors needing safe products. A retail investor could be a retiree seeking a complementary source of revenue and would seek a PPN guaranteeing €10,000 principal with a 3% coupon if the CAC 40 stays flat or rises. The product can be chosen according to the risk level and could be a principal-protected note (PPN), for safer investments. However, less risk-averse investors could seek customized high-return options like a Rainbow note (a derivative-based product designed to offer potential returns based on the performance of a basket of assets, often with a focus on the best or worst performers within that basket) and institutions would need complex products for portfolio strategies like a buffered note. A rainbow note is a product linked to at least two assets and answers a diversification benefit, with a growth and stability balance. Sales teams must match the product structure to the investor’s objectives by collaborating with structuring desks (Department of the trading room that creates the structure that best fits the demands of the client) and traders to design personalized solutions. For a pension fund, a buffered note, designed to allow you to earn a return based on the performance of a stock but with a “buffer” to protect from some losses, offers risk management characteristics, with protection against the first 10% of losses on a global equity index.

Benefits

Structured financial products offer several advantages that make them attractive to a wide range of investors. From a sales perspective, they are attractive tools to meet a client’s needs with a lot of advantages. First, they often include capital protection, meaning that even if the underlying asset’s performance declines, the investor’s capital will be preserved at a predetermined protection level. Additionally, these products can provide regular income, but only to the extent that specific market conditions are met during the investment period. Structured products also allow investors to bet on market volatility, meaning that the products’ prices tend to fall when volatility rises. This creates an opportunity to buy low during periods of high volatility and sell when the volatility declines. Furthermore, these instruments both answer the client’s investment preferences and the diversification potential by offering many investment options across different asset classes. Sales professionals often highlight how these products provide a unique combination of stability and performance that standard products cannot offer.

Challenges

Structured products, despite their benefits, also present common obstacles for investors and for the sales team. Sales must be able to clearly explain these risks using simplified language to make it understandable to even non-expert clients. First, there is the issuer’s risk. Since these tools are issued by banks or other intermediaries, there is a risk that the issuer becomes insolvent or unable to meet its obligations, and the investor may not receive their returns at maturity. There is also an underlying risk, as the value of a structured product depends directly on the performance of the underlying asset, which is subject to high volatility. In extreme cases, the product’s value could go to zero if the asset performs poorly. A second aspect is sometimes the lack of liquidity that can be common for such unique products. Although some products are listed and supported by market makers there is no guarantee of continuous availability in the market. Investors may have difficulties buying or selling the product before maturity, which could lead to unexpected losses due to the absence of market participants at the time of the transaction. Finally, the product can be seen as complex because they are multi-layered, combining different asset types (indices, funds) with different payoff conditions and risk levels.

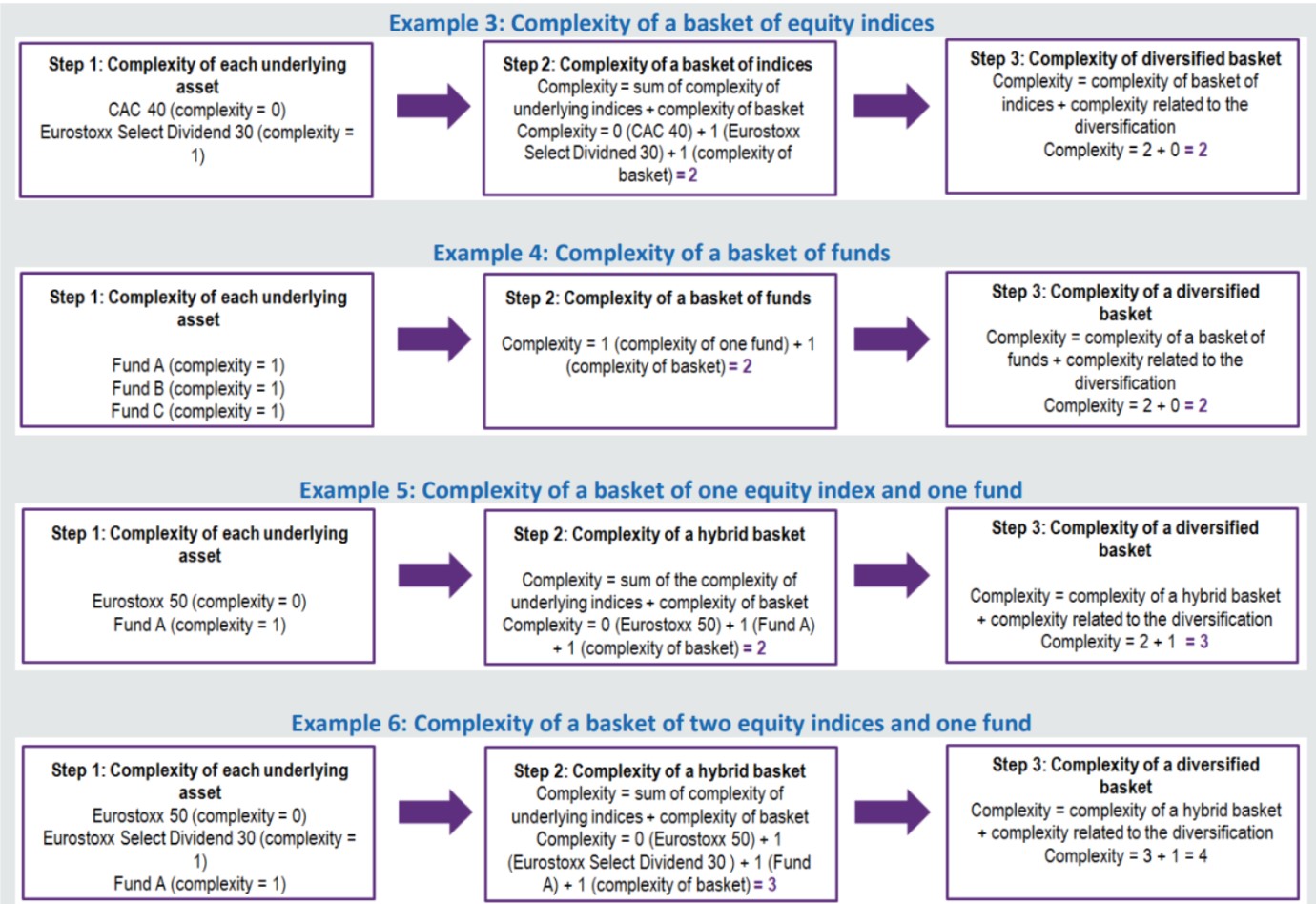

Complexity of a basket of equity indices.

Source: AMF.

On this graph, each added asset increases the product’s complexity, making it harder to assess risk, performance and transparency. An investor needs then to evaluate each asset but also their own impact within a basket.

Why should I be interested in this post?

As an ESSEC student interested in business and finance, I found that learning about structured products really helped me understand how financial institutions create investment solutions based on different risk profiles. They’re a great example of how finance can combine both protection and performance. For anyone considering a career in sales, asset management, or investment banking, getting familiar with these products is a great way to build practical knowledge and better understand how finance works in the real world.

Related posts on the SimTrade blog

▶ Akshit GUPTA Equity structured products

▶ Dante MARRAMIERO Structured debt, private equity, rated feeder funds, collateral fund obligations

▶ Shengyu ZHENG Capital guaranteed products

▶ Jayati WALIA Fixed income products

Useful resources

AMF & ACPR Analysis of the French structured product market

Kiplinger Buffered ETFs: What are they and should you invest in one?

Itransact BNP PARIBAS S&P 500 100% CAPITAL PROTECTED NOTE 5

Yassien Yousfi ESG structured products: challenges and opportunities

Klara Gjorga Equity Derivatives and Structured Products Sales

Line Grinden Quinn – Structured Products: Sound strategy or sales pitch?

About the author

The article was written in June 2025 by Mahe FERRET (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2022-2026).