Top 5 companies by market capitalization in the Europe

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023) presents the top 5 companies by market capitalization in Europe.

Introduction to market capitalization

Market capitalization, often referred to as “market cap,” is a key metric used in the financial world to assess the size and value of a publicly traded company. Market capitalization provides insights into a company’s position in the market and its relative size compared to other companies. It is a measure of a company’s total market value, calculated by multiplying its current stock price by the total number of outstanding shares. It is an important indicator for investors, analysts, and market participants as it reflects the perceived worth of a company by the investing public. Note that market capitalization assesses the size of the company in the equity market, but the total value of the company measured by its assets or the sum of its liabilities and shareholders’ equity may be larger if the company uses debt (financial leverage).

Top 5 companies by market capitalization in Europe

The top 5 companies in the European market according to market capitalization by 2023 are as follows:

1) Nestlé S.A.

2) ASML Holding N.V.

3) Roche Holding AG

4) Novartis AG

5) SAP SE

By looking at these top 5 companies, we observe that these companies mainly belong to different sectors to the economy: Consumer Goods, Technology, and Healthcare.

We detail below the characteristics of each company: statistics, analysis of revenues, and stock market data.

#1 Nestlé S.A.

Logo of Nestle

Source: the company.

Statistics

Market capitalization: $315.44 Billion

Listed on exchanges: SIX Swiss Exchange

Listed on Stock Indexes: Swiss Market Index (SMI) and the Euro Stoxx 50 Index.

Industry: Consumer Goods (Food and Beverage)

Location of headquarters: Vevey, Switzerland

Year founded: 1866

Number of employees: 342,982

Revenues

Nestlé is a multinational food and beverage company known for its wide range of products, including baby food, dairy products, confectionery, coffee, and pet care. The company owns popular brands such as Nescafé, KitKat, Maggi, Purina, and Nespresso. With a global presence, Nestlé serves consumers in various markets and has a strong focus on nutrition, health, and wellness. The company’s diverse portfolio and commitment to sustainability have contributed to its success in the European market.

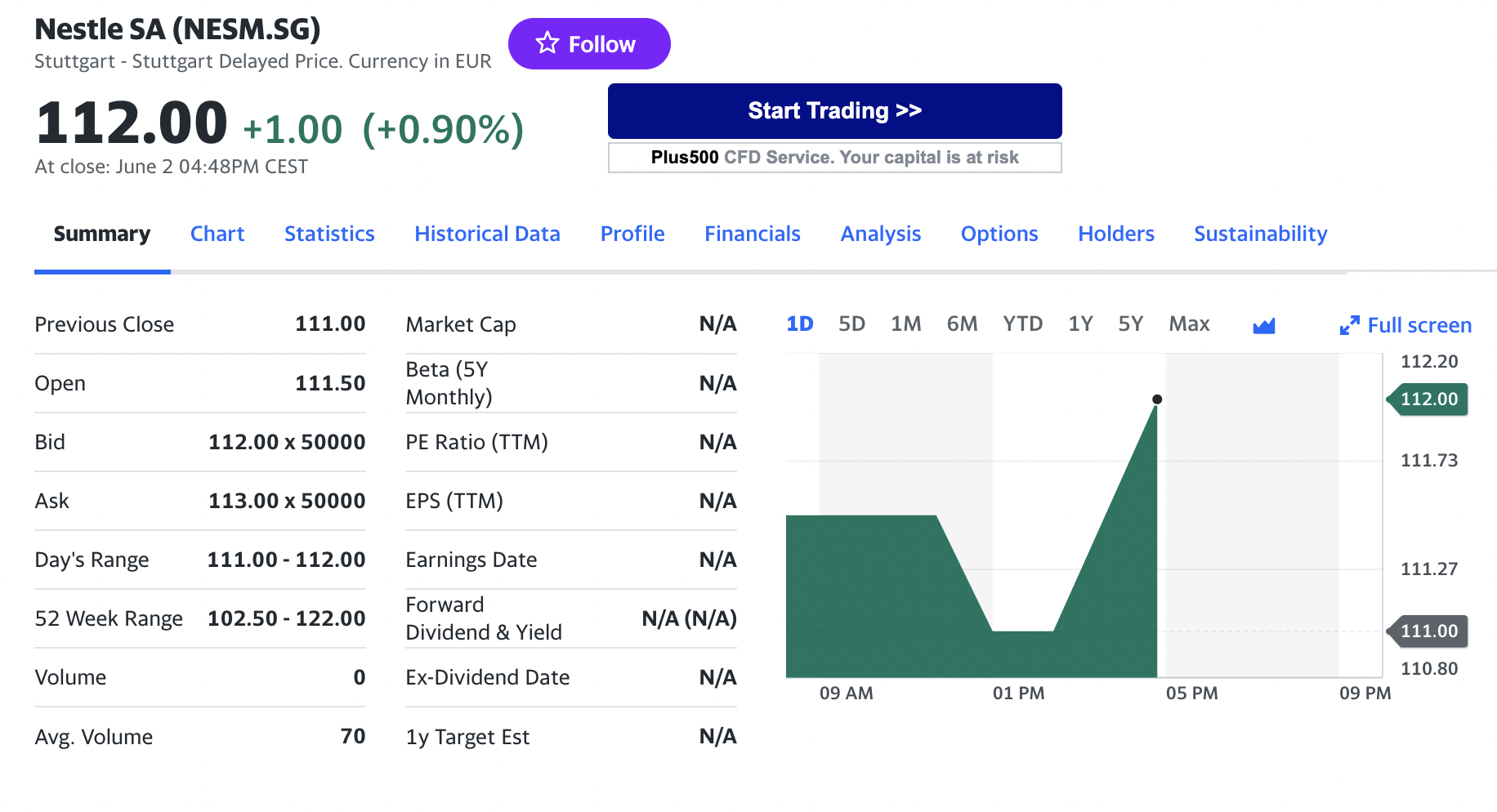

Stock chart

Stock chart for Nestle

Source: Yahoo! Finance.

The historical data for Nestle stock prices can be downloaded from Yahoo! Finance website: Download the data for Nestle

#2 ASML Holding N.V.

Logo of ASML Holding N.V.

Source: the company.

Statistics

Market capitalization: $280.24 Billion

Listed on exchanges: Euronext Amsterdam, NASDAQ

Listed on Stock Indexes: AEX Index.

Industry: Technology (Semiconductor Equipment)

Location of headquarters: Veldhoven, Netherlands

Year founded: 1984

Number of employees: 166,890

Revenues

ASML Holding is a Dutch company that specializes in the development and manufacturing of advanced semiconductor equipment used in the production of integrated circuits. The company’s lithography systems play a critical role in enabling the production of smaller, faster, and more efficient chips. ASML’s innovative technology and high-performance equipment have made it a trusted partner for semiconductor manufacturers worldwide. The company’s success has been driven by its focus on research and development, as well as its ability to meet the evolving demands of the semiconductor industry.

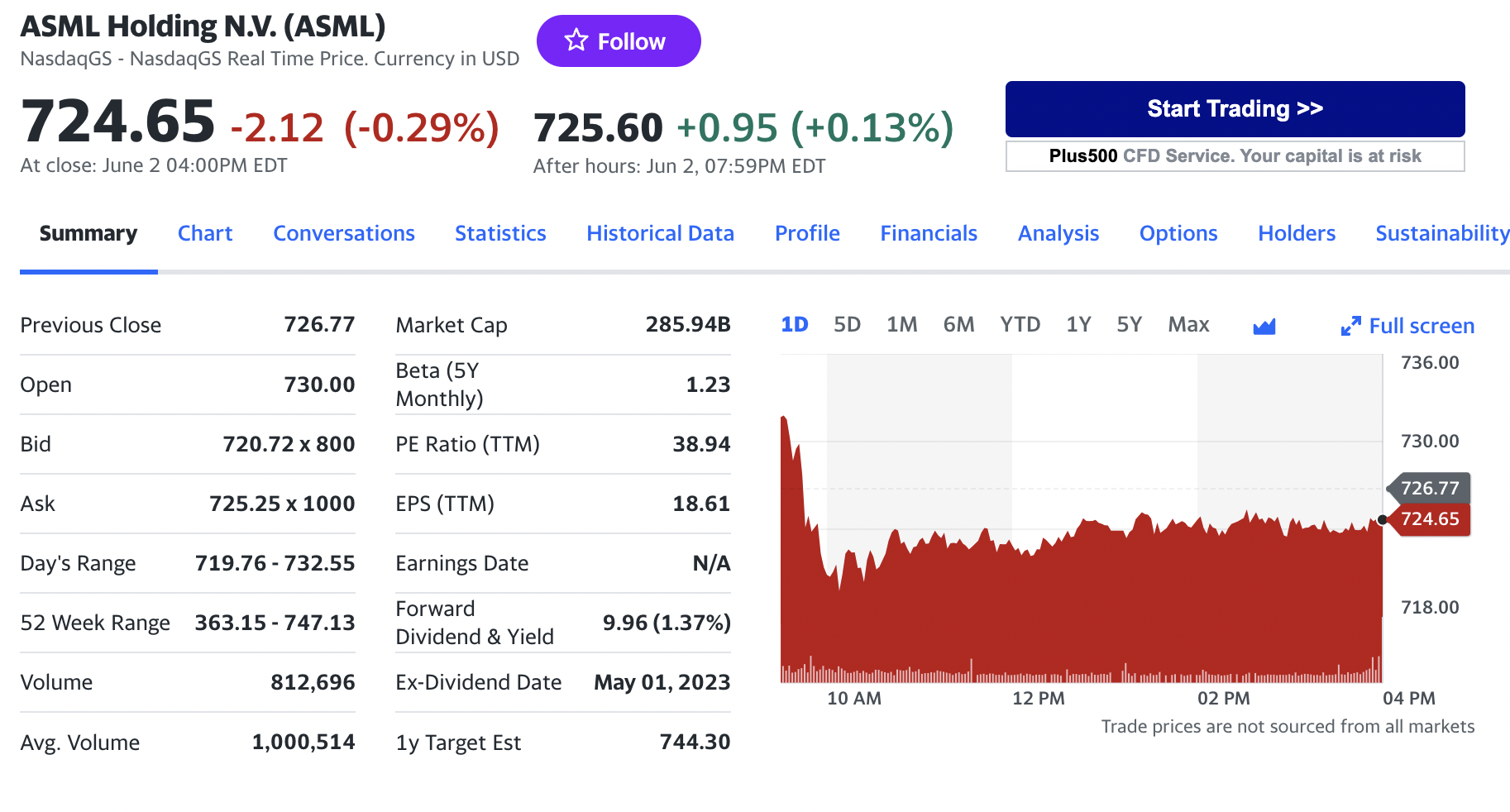

Stock chart

Stock chart for ASML

Source: Yahoo! Finance.

The historical data for ASML stock prices can be downloaded from Yahoo! Finance website: Download the data for ASML

#3 Roche Holding AG

Logo of Roche

Source: the company.

Statistics

Market capitalization: $253.04 Billion

Listed on exchanges: Swiss Exchange, OTCQX International Premier

Listed on Stock Indexes: Swiss Market Index

Industry: Healthcare (Pharmaceuticals)

Location of headquarters: Basel, Switzerland

Year founded: 1896

Number of employees: 149,000

Revenues

Roche Holding is a global healthcare company that operates in the fields of pharmaceuticals and diagnostics. The company focuses on developing and delivering innovative medical solutions to address various diseases, including cancer, infectious diseases, neuroscience disorders, and rare diseases. Roche’s pharmaceutical portfolio includes drugs for oncology, immunology, and other therapeutic areas. The company is also a leader in the diagnostics industry, offering a wide range of diagnostic tests and systems. Roche’s commitment to advancing healthcare and improving patient outcomes has solidified its position as a prominent player in the European market.

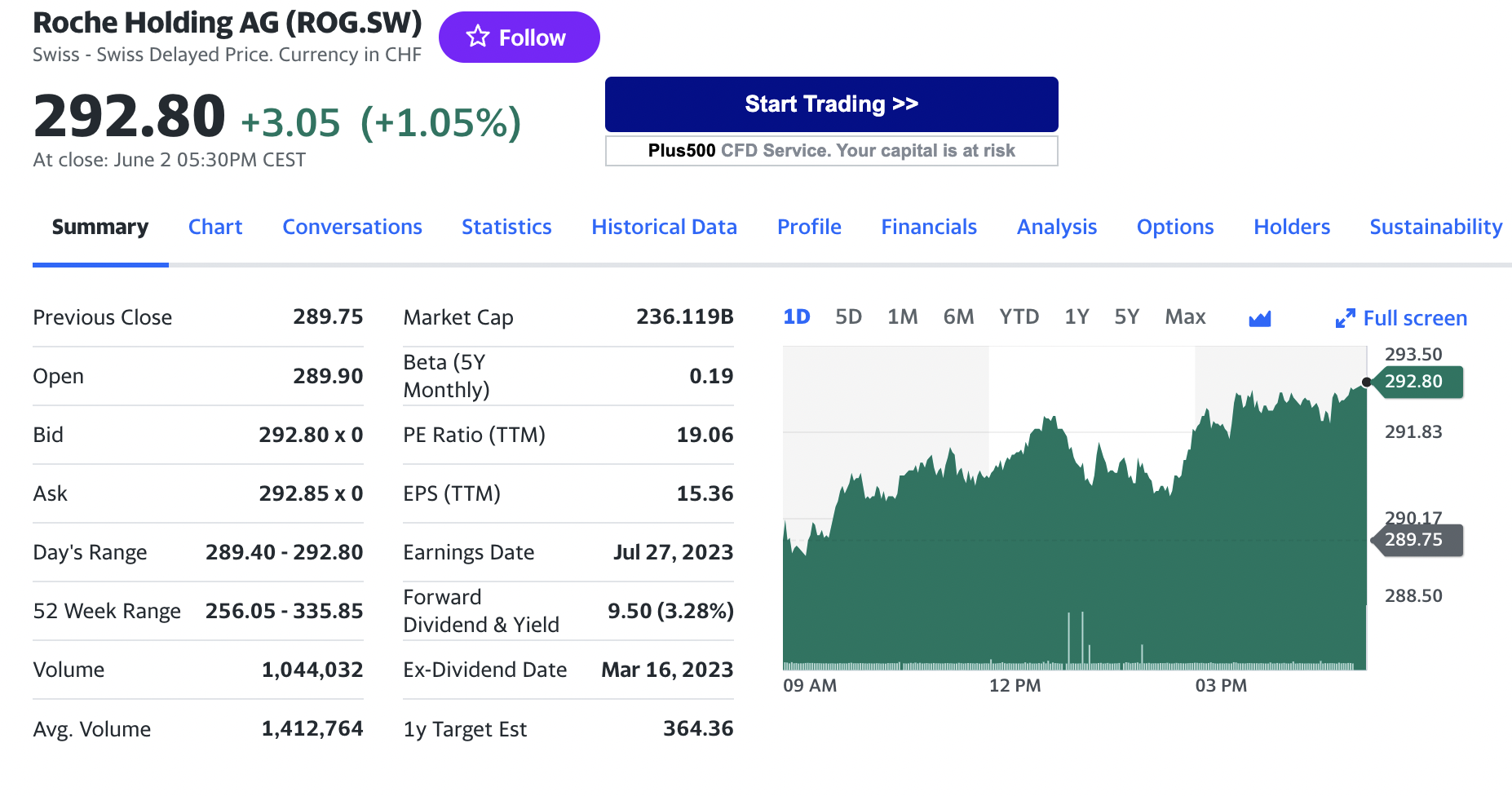

Stock chart

Stock chart for Roche Holding

Source: Yahoo! Finance.

The historical data for Roche Holding stock prices can be downloaded from Yahoo! Finance website: Download the data for Roche Holding

#4 Novartis AG

Logo of Novartis

Source: the company.

Statistics

Market capitalization: $208.78 Billion

Listed on exchanges: SIX Swiss Exchange, NYSE

Listed on Stock Indexes: Swiss Market Index

Industry: Healthcare (Pharmaceuticals)

Location of headquarters: Basel, Switzerland

Year founded: 1996

Number of employees: 335,186

Revenues

Novartis is a multinational pharmaceutical company focused on the research, development, and commercialization of innovative healthcare solutions. The company’s portfolio includes prescription medicines, generic drugs, vaccines, and consumer health products. Novartis operates in various therapeutic areas, including oncology, immunology, cardiovascular, and ophthalmology. With its commitment to advancing medical science and improving patient outcomes, Novartis has established itself as a leader in the European pharmaceutical industry.

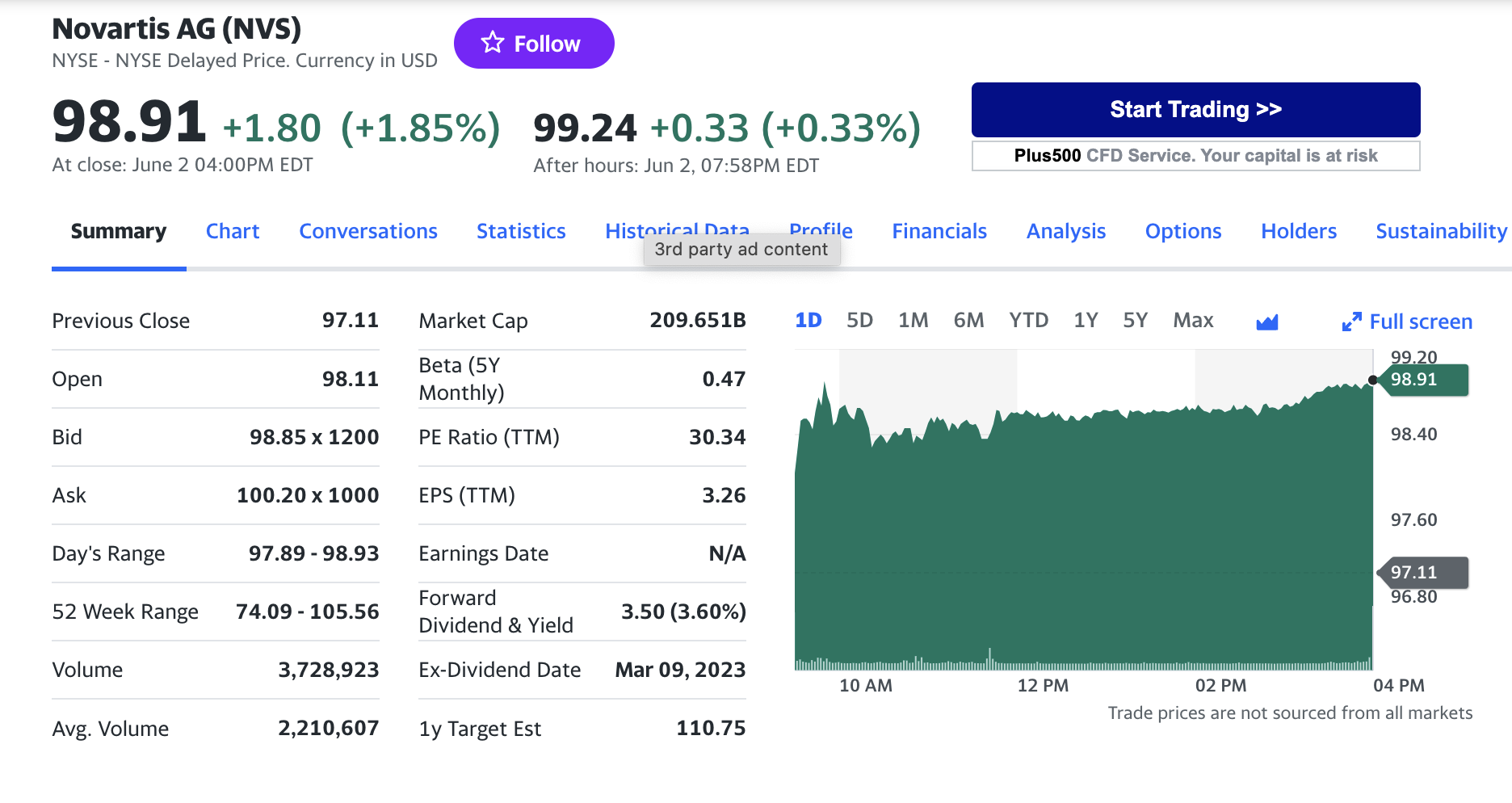

Stock chart

Stock chart for Novartis

Source: Yahoo! Finance.

The historical data for Novartis stock prices can be downloaded from Yahoo! Finance website: Download the data for Novartis

#5 SAP SE

Logo of SAP

Source: the company.

Statistics

Market capitalization: $154.66 Billion

Listed on exchanges: Frankfurt Stock Exchange

Listed on Stock Indexes: DAX Index

Industry: Technology (Enterprise Software)

Location of headquarters: Walldorf, Germany

Year founded: 1972

Number of employees: 528,748

Revenues

SAP is a leading enterprise software company that provides solutions for business operations, analytics, cloud computing, and customer experience. Its software applications help companies manage various aspects of their operations, including finance, human resources, supply chain, and customer relationship management. SAP serves clients across industries and has a strong presence in Europe and globally. The company’s innovative solutions and commitment to digital transformation have made it a key player in the European technology sector.

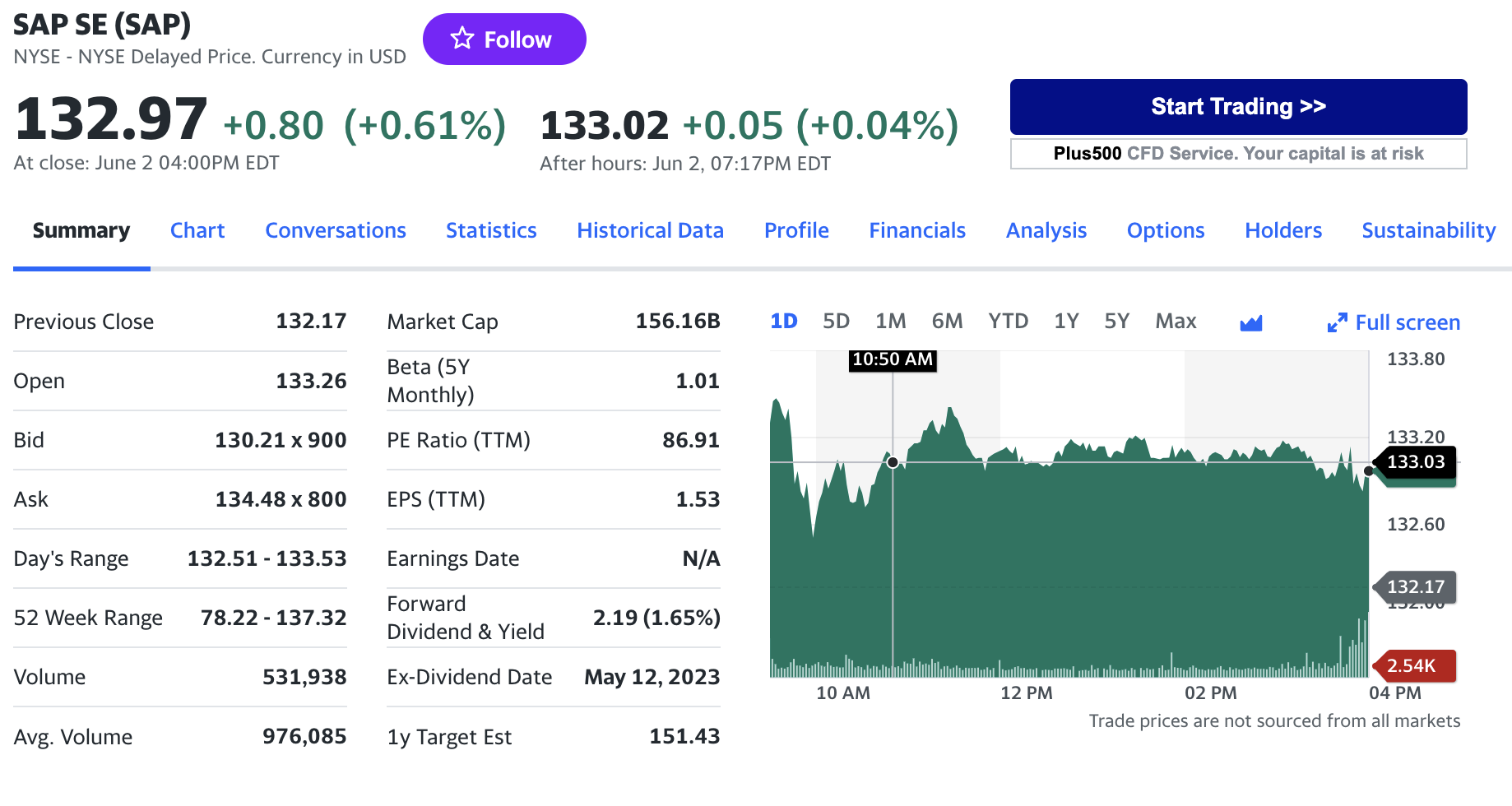

Stock chart

Stock chart for SAP

Source: Yahoo! Finance.

The historical data for SAP stock prices can be downloaded from Yahoo! Finance website: Download the data for SAP

Why should I be interested in this post?

As a management student, understanding the top companies in different markets and their market capitalization holds significant value. It provides you with industry insights, allowing you to comprehend the competitive landscape and trends within specific sectors.

Analyzing market capitalization aids in investment analysis, enabling you to assess the size, growth potential, and financial health of companies. Moreover, studying successful companies (success being measured by their market capitalization) provides valuable lessons in competitive strategy, organizational management, and leadership practices.

Related posts on the SimTrade blog

▶ All posts about financial techniques

▶ Nithisha CHALLA Market capitalization

▶ Nithisha CHALLA Top 5 companies by market capitalization in China

▶ Nithisha CHALLA Top 5 companies by market capitalization in the United States

▶ Nithisha CHALLA Top 5 companies by market capitalization in India

Useful resources

Companies Market Cap Largest European companies by market capitalization

Statista Market capitalization of leading companies on Euronext stock exchange as of February 2023

Yahoo! 10 Best European Companies To Invest In

About the author

The article was written in June 2023 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023).