Political Risk: An Example in France in 2024

In this article, Marine SELLI (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2020-2024) explores the intricate relationship between political risk and financial markets, focusing on France’s landscape in 2024.

The context

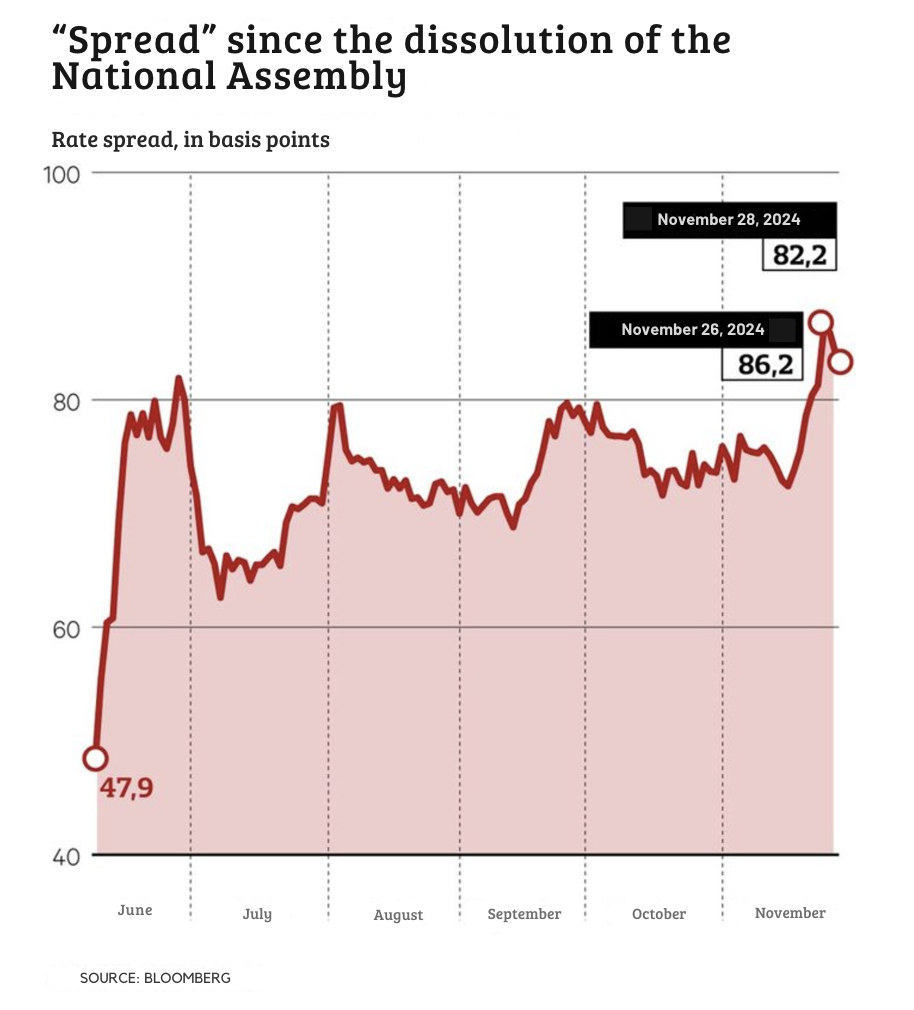

Financial market stability is critically dependent on political risk, which determines how investors behave, borrowing costs and how strong a nation’s currency is. Consequently, market fears of political instability under Michel Barnier’s government have been heightened in France. Indeed, the instability has manifested itself in rising bond spreads, pressure on the euro and rising costs of debt issuance. Therefore, France’s financial landscape is being impacted by political uncertainty.

Spread Since the Dissolution of the National Assembly.

Source: Bloomberg, Les Echos

The Cost of French Debt Rises

One of the most widely followed indicators of France’s economic health is its government bonds (obligations assimilables du Trésor or OATs): the yield reflects market confidence in France’s creditworthiness and economic conditions, with rising yields often signaling increased risk perceived by investors. Additionally, the spread between OAT yields and German Bunds serves as a benchmark for comparing investor sentiment toward France versus Europe’s strongest economy. In the past few months, the French bond market has spiked to political uncertainty. As a result, the spread between French and German 10-year bond (which represents a key risk gauge) spiked to 89 basis points in late November 2024. It is the highest since eurozone crisis days in 2012, and up from the 55 basis points in May 2024 before parliamentary dissolution.

Spread Between French and Greek Bonds.

Source: Bloomberg, Les Echos.

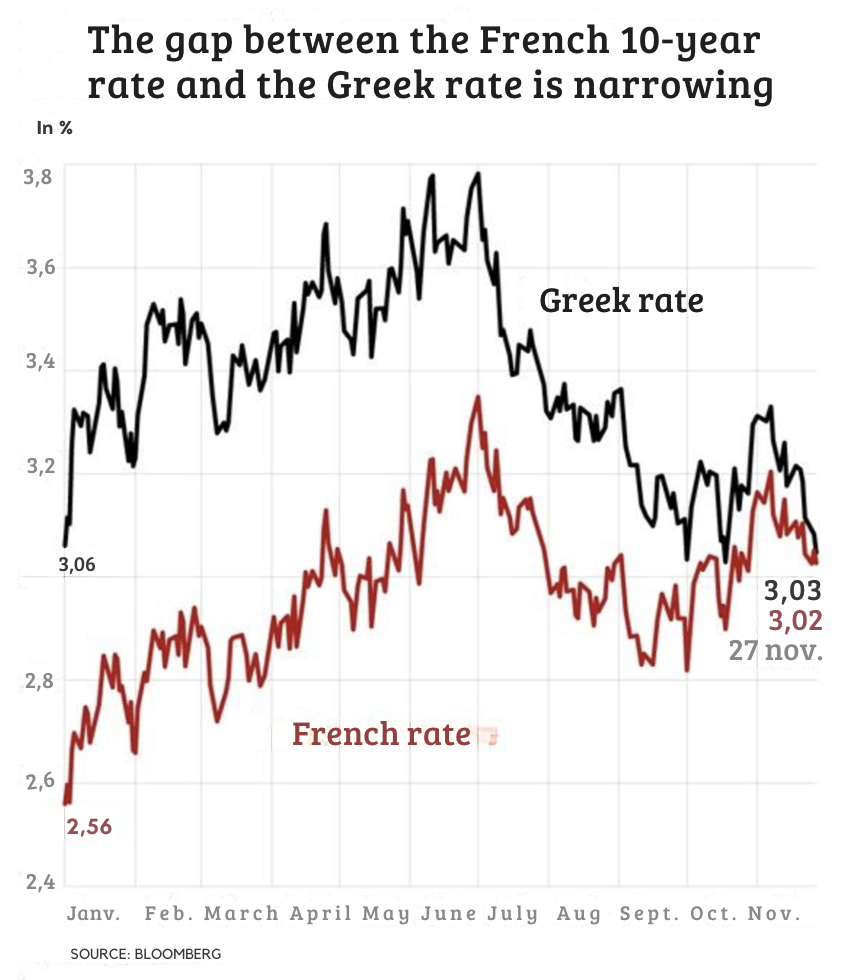

The spread reflects the additional yield investors demand to hold French debt over German bonds, which are the eurozone’s safest. Therefore, it represents a quantifiable expression of the risk that markets see associated with France’s political and fiscal situation. This comes as France’s 10-year bond yield has risen sharply from 2.9% at the start of 2024 to 3.2% in November 2024. However, German yields have remained steady at 2.1%, reflecting a difference in confidence among investors in the two economies.

Therefore, the implications for France’s borrowing costs are profound. In 2025, the government will issue €300 billion in bonds, a record amount, as debt refinancing needs and budgetary deficits are pushing up borrowing. A 30 basis point rise in yields could add £900m a year to the interest bill, further stretching a budget that is already under severe strain. Hence, the urgent need to restore market confidence is underlined by the cumulative cost of higher borrowing rates.

The Cost of French Debt Rises

France’s political challenges have also put pressure on the euro, often considered a barometer of European unity. The euro is currently trading at $1.05 and risks further depreciation to parity with the US dollar if the Barnier government collapses. Historically, currency markets have been sensitive to French political developments, and we can point to recent examples.

For instance, speculation of a severe euro devaluation swirled around a ‘Frexit’ in 2017 after fears of such an outcome during the presidential campaign of Marine Le Pen. Analysts had forecast up to 5% fall in the euro, but Emmanuel Macron’s eventual victory eased those fears, pushing the euro 10% higher in four months. However, in 2024, the situation is less clear. The euro’s path remains fragile as investor sentiment is weighed down by political uncertainty and fiscal deficits near 6% of GDP. Further decline would aggravate inflationary pressures by increasing the cost of imports, especially energy, and would provide only modest export benefits in a weak global economy.

Meanwhile, the widening of the French-German spread in recent weeks has been a clear signal that skepticism about France’s political and fiscal outlook has been growing.

France, a semi core of the eurozone, now has borrowing costs approaching those of southern European countries such as Spain and Portugal, which have been viewed as riskier. For example, Spanish 10-year bond yields have fallen below those of France due to the improved fiscal discipline in and economic performance by Spain. In the meantime, France’s credit default swaps are trading at 0.4%, implying a default probability of 2.6%. This is still below Greece’s 5%, but it reflects a loss of confidence in French fiscal management.

Additionally, liquidity concerns are also at play. France’s ability to get enough private investors to put money into its debt is becoming more reliant on these private investors as the European Central Bank reduces its purchases of bonds. The shift in market dynamics only underscores the need for political stability.

France Fiscal Outlook

France’s fiscal outlook is a daunting challenge for financial markets. This comes as the government embarks on its record €300 billion debt issuance program for 2025, at a time when interest costs are rising and the budget remains in deficit. As a result, the sheer volume of outstanding debt, coupled with higher yields, will push debt servicing expenses to €55 billion in 2025, from €50 billion in 2024.

Moreover, France’s debt-to-GDP ratio is already 111% in 2024, one of the highest in the eurozone. That ratio has been a source of concern about the sustainability of France’s fiscal policies, given that it comes amid a slow economic growth. That’s why analysts warn that without meaningful reforms to deal with structural deficits, the debt trajectory could become unsustainable, which will then trigger further downgrades from credit rating agencies and higher borrowing costs.

Outstanding French Debt Overview.

Source: Agence du Trésor.

In conclusion, France is at a crossroads, and its financial markets are reflecting deep seated worries about political instability and fiscal sustainability. Widening bond spreads, growing debt servicing costs and pressure on the euro underscore the need for action. Furthermore, this case serves as a textbook example of how political risk can deeply impact financial markets. The interplay between France’s domestic political turmoil, bond spreads, currency volatility, and investor sentiment demonstrates how closely markets monitor political developments.

Why should I be interested in this post?

This post provides an analysis of how political risk impacts financial markets, focusing on the French bond market, currency fluctuations, and fiscal sustainability. It gives you an outlook on the real-world consequences of political instability, offering a detailed understanding of how investor sentiment shifts in response to political uncertainties.

Related posts on the SimTrade blog

▶ Georges WAUBERT Bond Risks

▶ Henri VANDECASTEELE Financial markets are not accounting enough for the Ukraine-Russia conflict

▶ Georges WAUBERT Bond Markets

Useful resources

Les Echos (Financial Market Section)

Standard & Poor’s (S&P) Global Ratings

About the author

The article was written in December 2024 by Marine SELLI (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2020-2024).