Financial markets are not accounting enough for the Ukraine-Russia conflict

In this article, Henri VANDECASTEELE (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021-2022) reflects on the Ukrain-Russia conflict.

Geopolitical events and financial markets

Normally investors do not have to lie awake over political turmoil. On the contrary, if you go through the list of past geopolitical events and their impact on the market, you will see that they were almost always a reason to buy stocks. So, there is no reason to scare investors unnecessarily with geopolitical analysis. You must look at the broader macroeconomic context. It is always more relevant than the event itself.

Some historical perspective: the 1973 Yom Kippur War

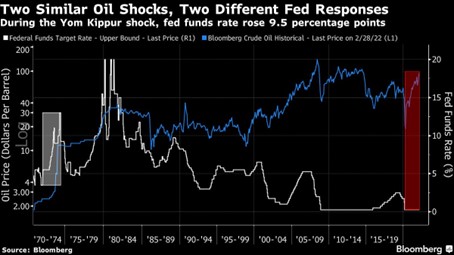

In that respect, there is a problem with the Russian-Ukrainian conflict, because it is different from the norm. A rare exception to the rule that geopolitical turmoil is a buying opportunity was the 1973 Yom Kippur War between Israel and some Arab countries. That war took place in the middle of an inflationary context. In the US, the government was driving inflation with 1960s social programs and spending on the Vietnam War. The US central bank was raising interest rates. And then came the Yom Kippur war and the subsequent oil embargo by the Arab countries, which drove up the price of oil, putting a cherry on top of the cake of existing inflation. It was a matter of bad timing.

Evolution of oil prices and Fed funds rate (1970-2022).

Source: Bloomberg.

What about today (update November 2022)

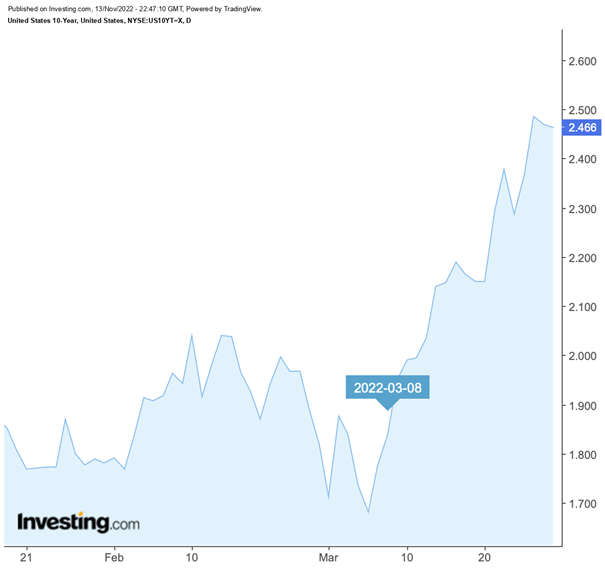

Today we have a similar situation due to the global inflationary environment. If Russia effectively invades hard, the market impact would be serious, with a solid correction for stock markets and higher oil prices. Financial markets are not taking this into account enough. 10-year U.S. government paper is considered the ultimate haven, but the yield on that paper does not show that investors are very concerned. If a Russian invasion does occur, gold and wheat are an interesting hedge. Both did well in the 2014 Russian invasion of Crimea.

Evolution of the US 10-year interest rate.

Source: investing.com.

Link with market efficiency

This situation links to market efficiency in a semi-strong form (public news). Even with the information publicly available, the markets are not pricing in or correcting in the risk or consequences of a hard invasion of Russia into the Crimea. A hard invasion could potentially induce a lot of uncertainty and volatility into the market, with Russia’s strong foothold in the international energy market. Potential embargos and supply shortages could have a major impact on the prices and induce a hefty inflation increase. This is currently not priced in the markets and thus shows that the market was not efficient in the semi-strong form.

Useful resources

Related posts on the SimTrade blog

▶ Bijal GANDHI Interest Rates

About the author

The article was written in November 2022 by Henri VANDECASTEELE (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021-2022).