In this article, Camille KELLER (ESSEC Business School, Bachelor in Business Administration (BBA), 2020-2024) explains the role, structure, and significance of French government bonds known as Obligations Assimilables du Trésor (OATs).

Introduction

Obligations Assimilables du Trésor (OATs) are the backbone of France’s government debt strategy, providing a reliable means to finance public expenditures. These long-term debt securities are issued by the French Treasury and are central to the stability of France’s financial system.

OATs not only ensure the funding of state operations but also serve as a benchmark for the European financial markets. Their appeal lies in their fixed and predictable returns (if hold until maturity), making them a popular choice for institutional investors seeking stability in a historically low-risk asset.

This article dives into the structure and purpose of OATs, their relevance in monetary policy, and their role in the broader European and global financial system.

What Are OATs and How Do They Work?

OATs are long-term debt securities issued by the French Treasury to meet the government’s borrowing needs. The maturities of OATs ranges from 2 to 50 years. Investors receive fixed annual interest payments and the principal amount at maturity.

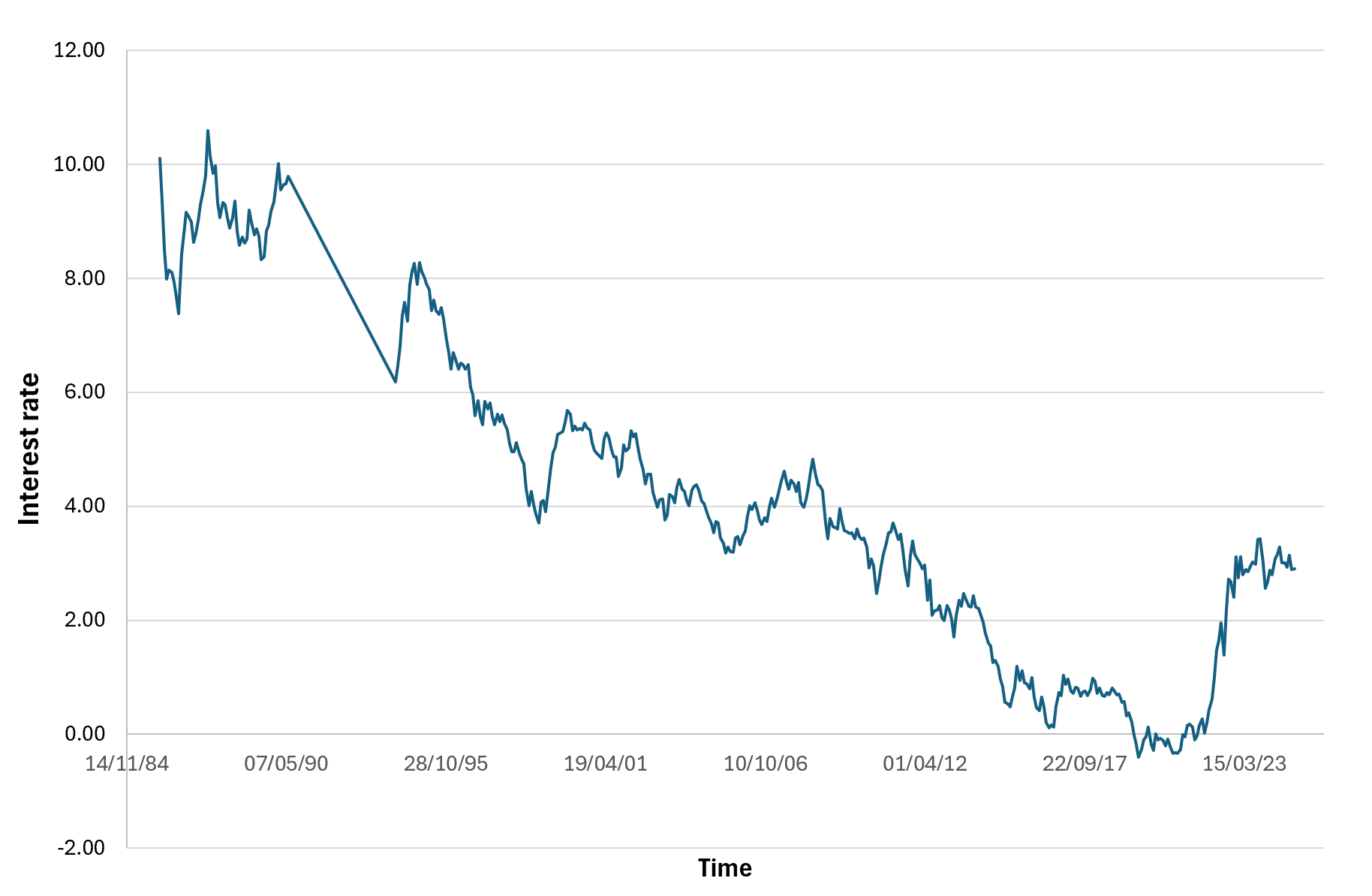

Figure 1 below gives the evolution of the OAT interest rate (10 year of maturity) over the period January 1986 – December 2024 (date from investing / Banque de France). You can download the Excel file for the historical data used to build the figure.

Evolution of the OAT interest rate.

Source: investing / Banque de France.

OATs are issued through public auctions managed by Agence France Trésor (AFT), the French government agency responsible for debt issuance and management. These auctions allow competitive and non-competitive bidding, ensuring a transparent and efficient process.

The reliability of OATs is grounded in the French government’s creditworthiness, supported by a robust and diversified economy. This low-risk profile attracts a wide range of investors, including pension funds, insurance companies, and foreign governments, making OATs a staple of institutional portfolios.

In financial markets, OATs play a vital role as benchmarks for euro-denominated securities. They influence pricing for corporate bonds, mortgages, and other fixed-income instruments within the Eurozone. Their stability and liquidity make them a key asset class in European financial systems.

The Role of OATs in Monetary Policy

OATs are an integral part of monetary policy in the Eurozone, serving as tools for the European Central Bank (ECB) and other institutions to influence financial conditions. As sovereign bonds, they are used in the ECB’s open market operations, including quantitative easing programs aimed at stabilizing the economy.

Through these programs, the ECB purchases OATs and other Eurozone bonds to inject liquidity into the financial system. This lowers interest rates, supports borrowing, and stimulates economic growth during periods of economic stagnation or crisis.

The yield on OATs is also a key indicator of France’s economic health and investor sentiment. Rising yields suggest increased borrowing costs for the government and heightened risk perceptions, while lower yields signal strong investor confidence and stability.

Additionally, OATs contribute to the overall functioning of the Eurozone’s financial architecture by providing a risk-free benchmark for pricing other securities. Their role in monetary policy extends beyond France, influencing financial markets across the European Union.

OATs as a Global Benchmark

OATs hold significance beyond France, serving as a critical component of global financial systems. Their euro-denominated nature positions them as an attractive option for central banks and institutional investors seeking diversification in foreign reserves.

Global investors often compare OATs with other sovereign bonds, such as U.S. Treasury bonds and German Bunds, to evaluate risk and return profiles. This competition reinforces OATs’ status as a key player in international capital markets.

In times of financial uncertainty, OATs provide a safe haven for investors looking to preserve capital. Their high liquidity and the French government’s strong credit ratings ensure consistent demand, particularly during economic turbulence.

However, OATs’ global importance also comes with challenges. Economic or political instability in France can impact investor confidence, affecting the broader European financial system. Despite these risks, their resilience and reliability continue to cement their role in global markets.

Why Should I Be Interested in This Post?

This post is a valuable resource for students and professionals interested in understanding OATs as a key financial instrument. It highlights their significance in government financing, monetary policy, and global markets, making them essential knowledge for those exploring careers in finance or economics.

Related Posts on the SimTrade Blog

▶ Georges WAUBERT Introduction to bonds

▶ Georges WAUBERT Bond Markets

▶ Georges WAUBERT Bond valuation

▶ Georges WAUBERT Bond risks

▶ Bijal GANDHI Credit Rating

▶ Jayati WALIA Credit risk

Useful Resources

Organisation for Economic Co-operation and Development (OECD)

About the Author

The article was written in December 2024 by Camille KELLER (ESSEC Business School, Bachelor in Business Administration (BBA), 2020-2024).