In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) gives an overview of US Treasuries, their types, characteristics, and advanced applications.

Introduction

US Treasuries are a cornerstone of global financial markets, serving as a benchmark for risk-free investments and a safe-haven asset during times of economic uncertainty. As a finance professional, understanding the basics and intricacies of US Treasuries is essential for making informed investment decisions and navigating the complexities of global finance. In this article, we will provide a comprehensive overview of US Treasuries, covering the basics, types, characteristics, market structure, and advanced applications.

What are US Treasuries?

US Treasuries are debt securities issued by the US Department of the Treasury to finance government spending and pay off maturing debt. They are considered one of the safest investments globally, backed by the full faith and credit of the US government.

Types of US Treasuries

There are four main types of US Treasuries:

Treasury Bills (T-bills)

- Short-term securities with maturities ranging from a few weeks to 52 weeks

- Sold at a discount to face value, with the difference representing the interest earned.

- Low risk, low return investment (low duration fixed-income securities)

Treasury Notes (T-Notes)

- Medium-term securities with maturities ranging from 2 to 10 years

- Sold at face value, with interest paid semi-annually

- Moderate risk, moderate return investment (medium duration fixed-income securities)

Treasury Bonds (T-Bonds)

- Long-term securities with maturities ranging from 10 to 30 years

- Sold at face value, with interest paid semi-annually

- Higher risk, higher return investment (high duration fixed-income securities)

Treasury Inflation-Protected Securities (TIPS)

- Securities with principal and interest rates adjusted to reflect inflation

- Designed to provide a hedge against inflation

- Low risk, low return investment

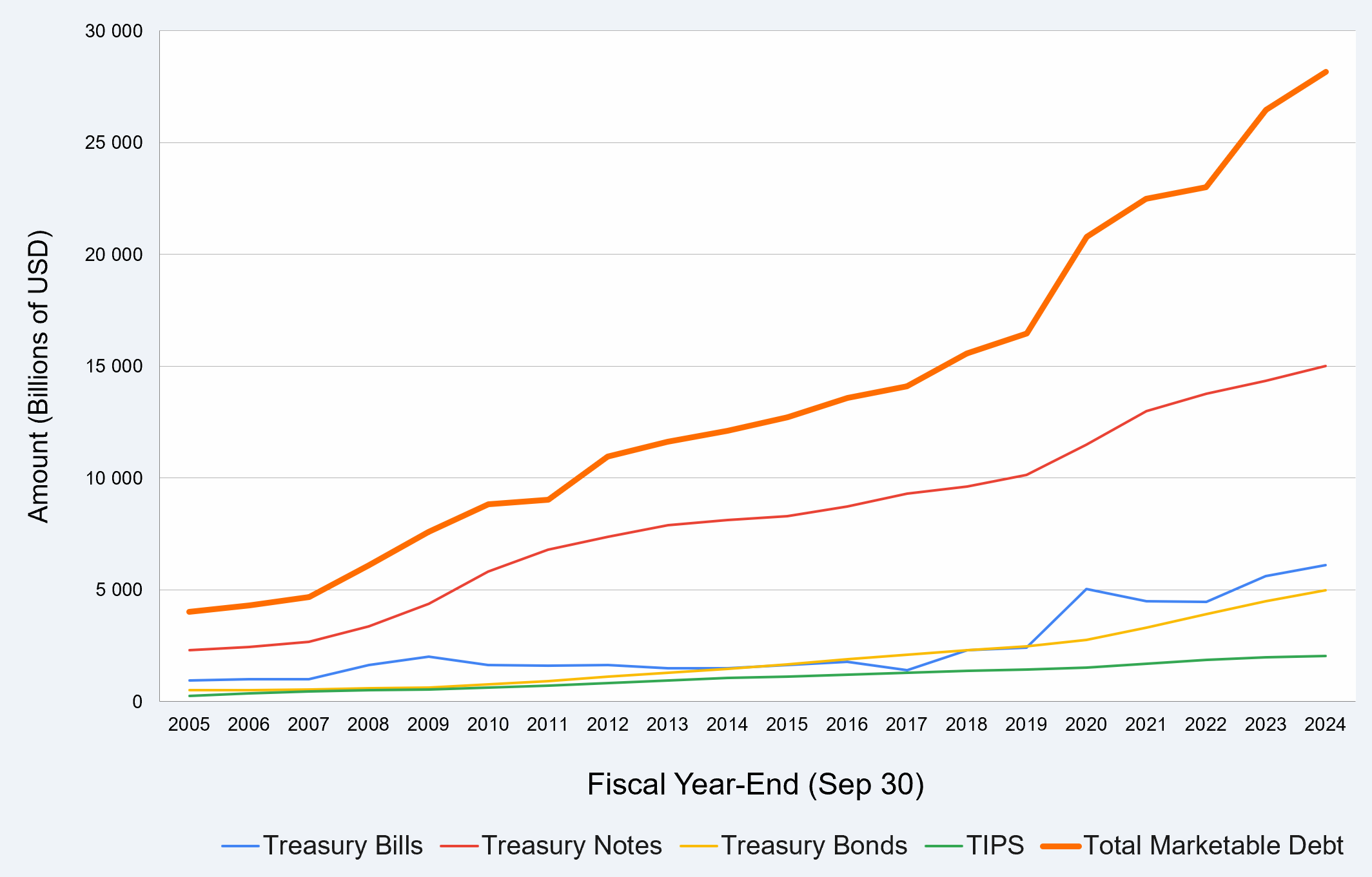

Figure 1 below gives the Evolution of the Structure of U.S. Federal Debt by Security Type from 2005 to 2024.

Evolution of the Structure of U.S. Federal Debt by Security Type from 2005 to 2024

Source: U.S. Department of Treasury

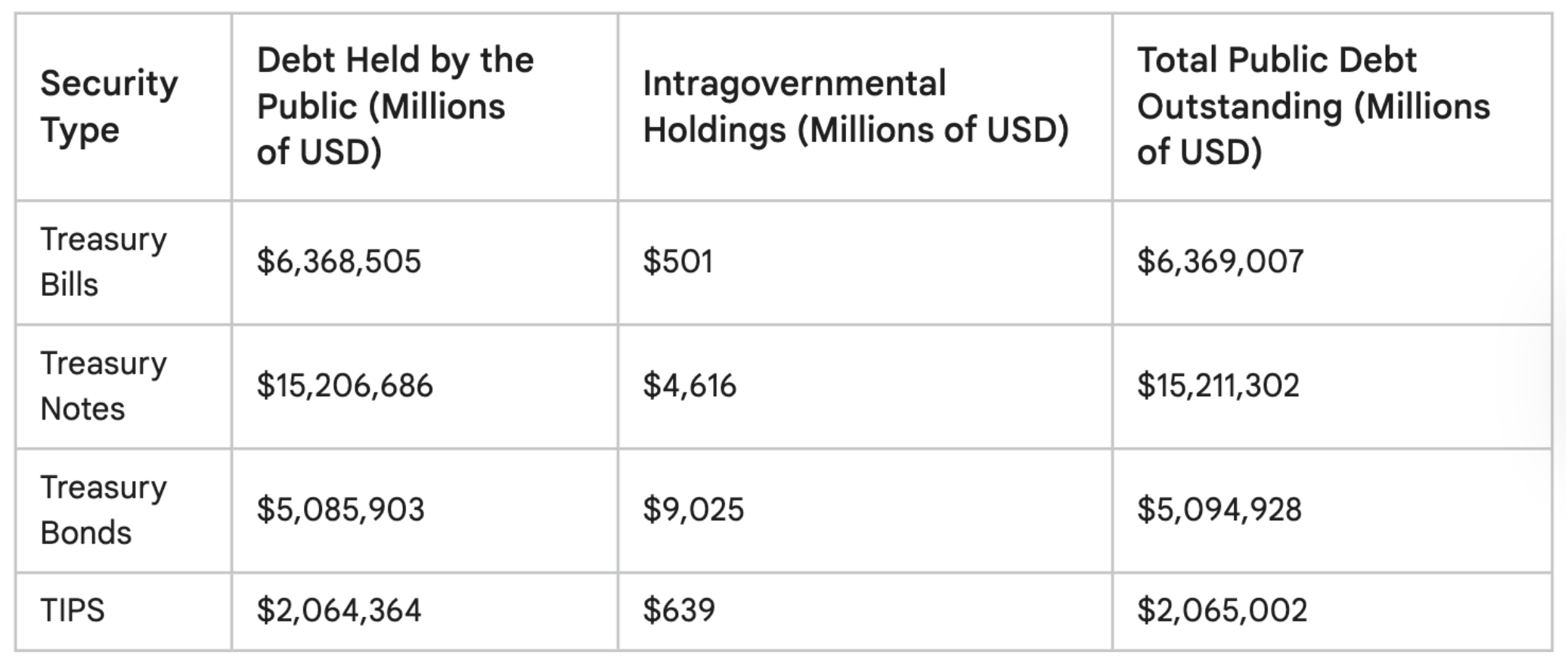

Figure 2 below gives the U.S. Federal Debt by Security Type on August 31, 2025.

U.S. Federal Debt by Security Type on August 31, 2025

Source: U.S. Department of Treasury

Characteristics of US Treasuries

US Treasuries have several key characteristics such as Risk-free status, Liquidity, Taxation, and Return characteristics

Risk-free status: US Treasuries are considered one of the safest investments globally, backed by the full faith and credit of the US government.

Liquidity: US Treasuries are highly liquid, with a large and active market.

Taxation: Interest earned on US Treasuries is exempt from state and local taxes.

Return characteristics: US Treasuries offer a relatively low return compared to other investments, but provide a high degree of safety and liquidity.

Market Structure

The US Treasury market is one of the largest and most liquid markets globally, with a wide range of participants, including:

- Primary dealers: Authorized dealers that participate in US Treasury auctions.

- Investment banks: Firms that provide underwriting, trading, and advisory services.

- Asset managers: Firms that manage investment portfolios on behalf of clients.

- Central banks: Institutions that manage a country’s monetary policy and foreign exchange reserves.

Advanced Applications of US Treasuries

US Treasuries have several advanced applications, including:

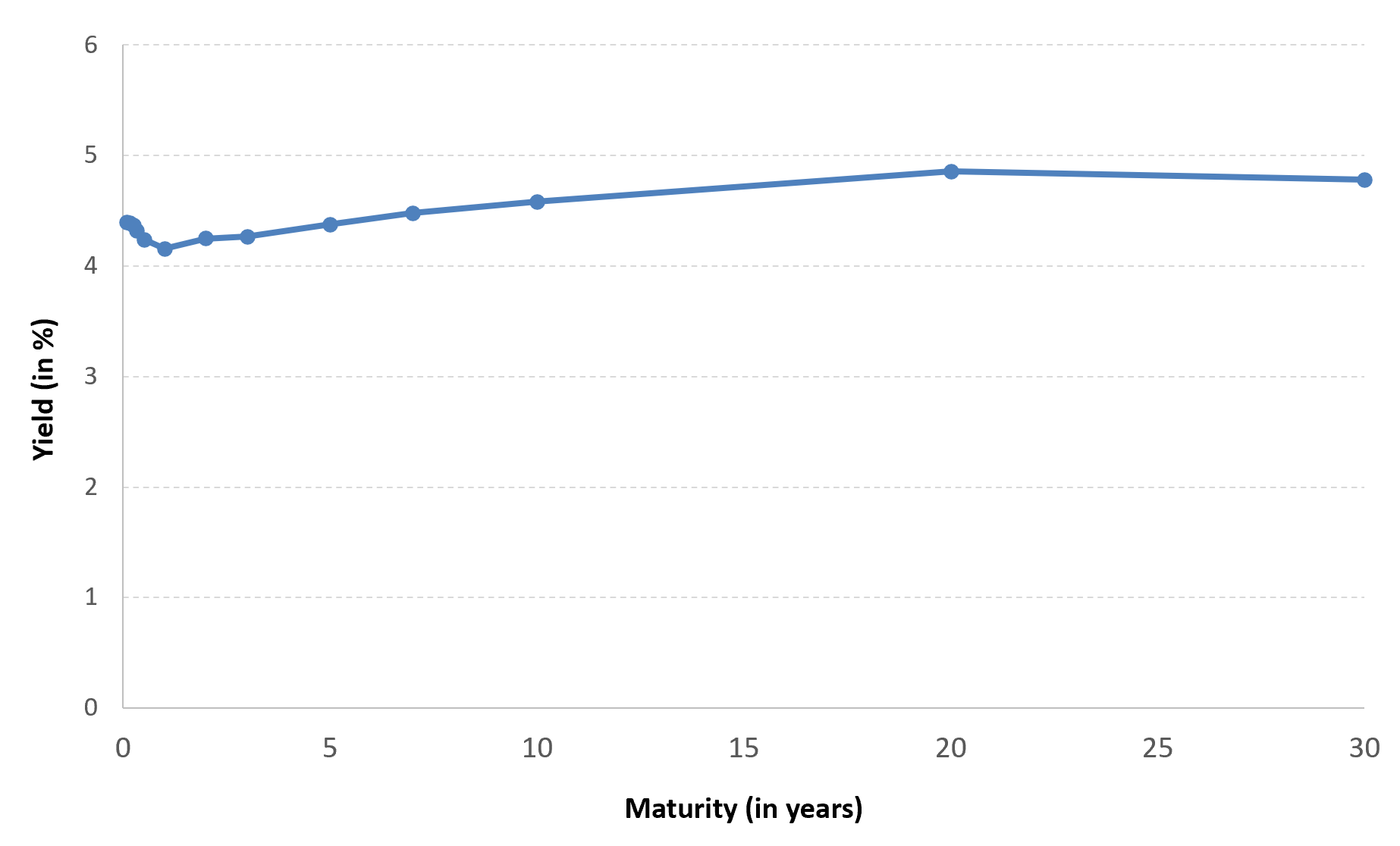

- Yield curve analysis: US Treasuries are used to construct the yield curve, which is a graphical representation of interest rates across different maturities.

- Hedging strategies: US Treasuries are used to hedge against interest rate risk, inflation risk, and credit risk.

Figure 3 below gives the yield curve for the Treasuries in the United States on June 28, 2024.

Yield curve for US Treasuries (31/12/2024)

Source: U.S. Department of Treasury

You can download below the Excel file for the data used to build the figure for the yield curve for US Treasuries.

Conclusion

US Treasuries are a fundamental component of global financial markets, offering a safe-haven asset and a benchmark for risk-free investments. By understanding the basics and intricacies of US Treasuries, finance professionals can make informed investment decisions and navigate the complexities of global finance.

Why should I be interested in this post?

Understanding US Treasuries is crucial for anyone pursuing a career in finance. These instruments provide insights into Monetary Policy, Fixed-Income Analysis, Portfolio Management, and Macroeconomic Indicators.

Related posts on the SimTrade blog

▶ Nithisha CHALLA Datastream

▶ Ziqian ZONG The Yield Curve

▶ Youssef LOURAOUI Interest rate term structure and yield curve calibration

▶ William ARRATA My experiences as Fixed Income portfolio manager then Asset Liability Manager at Banque de France

Useful resources

Treasury Direct Treasury Bonds

US Treasury Yield curve data

About the author

The article was written in October 2025 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024).