Mitigation Banking

In this article, Anant JAIN (ESSEC Business School, Grande Ecole – Master in Management, 2019-2022) talks about Mitigation Banking which is a mechanism to preserve the ecosystem.

Introduction

Mitigation banking is a system of credits and debits devised by regulatory agencies to ensure that development impacts on wetlands and streams by private companies, as well as rare species and habitats, are offset by the preservation, enhancement, restoration, or creation (PERC) of similar ecological features in nearby areas, ensuring that local ecosystems are not harmed. This system is mainly used in the United States. To ‘mitigate’ anything implies to lessen the severity of it, to compensate for a loss, in this case the environmental harm.

As per the statement by the Ecological Restoration Business Association (ERBA), “mitigation banks are highly regulated enterprises that have historically been proven to deliver the highest quality, most reliable offset to environmental impacts…and a private investment into ‘green infrastructure’ to help offset the impacts associated with economic growth.”

A mitigation bank is a place created specifically for this purpose. A mitigation banker is a person or company that does this type of business. Mitigation credits are assets that may be sold to persons who are striving to comply with particular environmental standards and balance ecological damage they are responsible for. These credits are known as “ecological assets” when they are sold on an active market. They may be likened to other extractable natural resources such as minerals, oil, and natural gas in this regard.

Individuals or businesses conducting commercial or industrial projects that must adhere to state and federal environmental standards are often the buyers of mitigation credits.

There are two types of mitigation banks which are mentioned below:

Wetland And Stream Banks

Wetland and stream banks provide credits to counteract wetlands and streams’ ecological damage. The USACE (Army Corps of Engineers) and the USEPA (United States Environmental Protection Agency) regulate and authorize these banks (Environmental Protection Agency). Wetland banks are still referred to as “mitigation banks” since they were the first sort of offset scheme to be established. However, wetland and stream banks, as well as conservation banks, are now referred to as Mitigation Banks.

Conversation Banks

Conservation banks provide credits to compensate for the loss of rare or unique species and/or their habitats, which are often categorized as threatened or endangered under state and federal regulations. USFWS (Fish and Wildlife Service) and NMFS (National Marine Fisheries Service) regulate and authorize these banks (National Marine Fisheries Service). Unlike wetland and stream banks that focus on a given area, conservation banks deals with species.

The Process Of Mitigation Banking

When a mitigation bank buys a degraded site that it wants to restore, it engages with regulatory bodies like the Mitigation Banking Review Team (MBRT) and the Conservation Banking Review Team (CBRT) to have plans approved for the bank’s construction, maintenance, and monitoring.

These organizations also provide their approval to the quantity of mitigation credits a bank can earn and sell in connection with a certain restoration project. These mitigation credits can be purchased by anybody planning commercial development on or near a wetland or stream in order to mitigate the detrimental impact of their project on the surrounding ecology. The mitigation banker is in charge of not only the mitigation bank’s development, but also its ongoing care and maintenance.

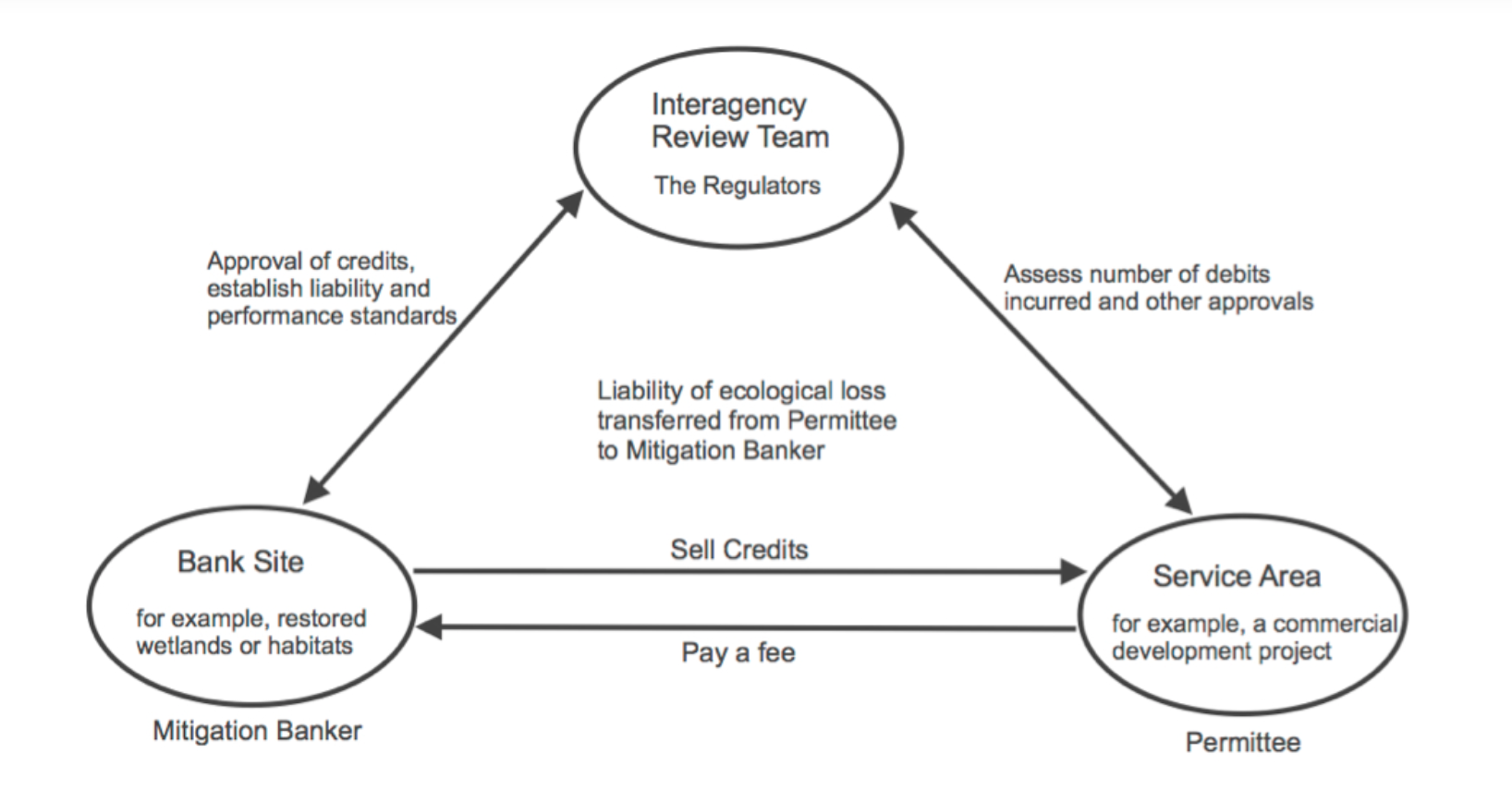

Figure 1. Mitigation Banking Process.

Source: EASI

As depicted above in Figure 1, the US Environmental Protection Agency has established four main components of a mitigation bank:

- The actual area that is repaired, developed, upgraded, or conserved is referred to as the bank site.

- The bank instrument is a written agreement between bank owners and regulators that establishes liabilities, performance criteria, management and monitoring requirements, and loan approval terms.

- The Interagency Assessment Team (IRT) is a multi-agency group that oversees the bank’s regulatory review, approval, and monitoring.

- The service area is the geographical region for which a development project can pay the bank for permissible damages.

Benefits Of Mitigation Banking

The following mentioned below are the benefits of mitigation banking:

Conservation And Protection Of The Environment

Mitigation banks create a permanent conservation easement on the site, with a trust fund committed to the long-term preservation of the bank’s natural resources. Many large landowners, including the government, are able to maintain a property in its current management state (for example, grazing, timber removal, low-impact recreation, or education) while retaining ecological functionality, also known as ecosystem services, by securing mitigation credits from neighboring ecosystems. As a result, mitigation banking contributes to the preservation of nature and its variety. Increased industrialization and urbanization will inevitably have an influence on natural ecosystems, streams, and wetlands. Mitigation banks offer a way to at least somewhat mitigate this effect.

Increased Efficiency

To counteract each specific development, a mitigation bank is more efficient than restoring a distinct biological location. This is because restoring a large, contiguous piece of land is easier than preserving a number of smaller locations. A mitigation bank’s economies of scale and technical competence make it more efficient not just in terms of cost, but also in terms of recovered acreage (an area of land usually used for agricultural purposes) quality.

Regulatory Ease And Reduced Time Lag

Buying credits from an approved mitigation bank is easier for developers than obtaining regulatory permissions, which may take months. Mitigation banks, on the other hand, have already restored impacted acreage units in the process of obtaining credits. As a result, there is little to no time between a service area’s environmental effect and its rehabilitation at a bank site.

Transfer Of Liability

The mitigation banking mechanism effectively transfers ecological loss obligation from the developer (also known as permittee) to the mitigation banker. Once the permittee has purchased the requisite credits, the mitigation banker is responsible for developing, maintaining, and monitoring the site on a long-term basis. If no qualifying mitigation bank exists in a given location, the developer might design their own mitigation project to compensate for environmental loss. Permittee-responsible mitigation is what it’s termed.

Challenges Of Mitigation Banking

The following mentioned below are the challenges of mitigation banking:

Incorrect Valuation Of Ecological Loss

The difficulty of accurately measuring ecological loss in monetary terms is the most significant barrier for successful mitigation banking. Regulators must price and analyze the credits granted to mitigation banks, but despite the adoption of a variety of environmental assessment tools by these agencies, it is difficult to adequately capture the economic cost of natural resource destruction.

Difference In The Quality Of Artificial VS Natural Wetlands

It is debatable if natural ecosystems like wetlands, which have evolved over generations, can be intentionally built in a matter of years. In certain situations, the quality of these intentionally created wetlands has been shown to be inferior to its wild counterparts in terms of floral and faunal richness.

Only Partial Replication Of Impacted Sites

Mitigation banks, as opposed to individual mitigation in which developers establish their own mitigation sites in the neighborhood of acres damaged, are thought to be positioned distant from the impact locations and hence unable to entirely recreate the impacted site.

Summarizing The Current Situation Of Mitigation Banks In The US

- Mitigation banking is a methodology that provides a system of credits and debits to transfer accountability for ecological harm from the permittee to the mitigation banker, all while adhering to regulatory rules. A mitigation banker builds, restores, maintains, and administers the land at a bank site in order to gain mitigation credits, which are then sold for a charge to a permittee or developer.

- Mitigation banking is a lengthy and complicated procedure. The most crucial aspect is site selection: the mitigation banker must conduct extensive study about the site’s watershed and service region, as well as identify ecosystems that require restoration and augmentation. The mitigation banker is in charge of maintaining and monitoring the restored environment once all of the permissions are in place.

- A wetland mitigation bank must be capable of restoring 100 acres of damaged wetlands, while a stream mitigation bank must be capable of restoring 4,000 linear feet of degraded streams. Sites that don’t fit these criteria can be grouped together with others in the same watershed to form an umbrella mitigation bank.

- Because only related ecosystems may mitigate development projects, the cost of mitigation bank credits will vary greatly depending on location and effect activities. An emerging wetland credit in Iowa, US, for example, might cost anywhere from $35,000 to $55,000 per acre, while a forested wetland credit can cost up to $75,000.

- In the United States, a number of mitigation banks have been approved. According to the U.S. Army Corps of Engineers’ (USACE) Regulatory In-Lieu Fee and Bank Information Tracking System (RIBITS), there were over 2,000 licensed banks as of July 2021.

- Despite regulations requiring no net loss of habitat value and function, agencies have struggled to manage mitigation efforts. Wetland mitigation initiatives, for example, have been approved in certain circumstances based on total acreage rather than ecological value or function equivalent. Simply assuming a similar number of acres isn’t enough to achieve real equivalence unless the replacement ecological services provided by those acres are also the same. Even with the application of environmental assessment tools, regulatory agencies confront a problem in determining the right economic or monetary value for ecological damage. Despite the fact that mitigation banks must be placed in the same watershed as the damage to be deemed acceptable compensation, mitigation banks are frequently located far from the actual impact location. As a result, retaining the original value and function is challenging.

- Despite some of its flaws, it nevertheless offers a number of benefits. The future of mitigation banking is bright for both project developers and nature, with increased private investment in the establishment of mitigation banks and ecosystem research, as well as reducing regulatory regulations.

Related Posts On The SimTrade Blog

Useful Resources

Ecological Restoration Business Association (ERBA)

USACE (Army Corps of Engineers)

USEPA (United States Environmental Protection Agency)

USFWS (Fish and Wildlife Service)

NMFS (National Marine Fisheries Service)

About The Author

The article was written in August 2024 by Anant JAIN (ESSEC Business School, Master in Management, 2019-2022).