Gautam Adani and Hedge fund Hindenburg

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) presents Gautam Adani’s journey of entrepreneurial success and controversies.

Introduction

Gautam Adani, a name that has become synonymous with entrepreneurial success and controversy, is one of India’s most prominent and influential business magnates. From his humble beginnings to his meteoric rise in various industries, Adani’s story is a testament to the power of determination, innovation, and risk-taking. Born on June 24, 1962, in a small town in Gujarat, India, Gautam Adani came from modest beginnings. His journey began with his family’s trading business of agricultural commodities. In the late 1970s, he moved to Mumbai to explore opportunities beyond his hometown. Adani’s first significant achievement came when he recognized the potential in the power and energy sector. He established Adani Exports Limited in 1988, which focused on the export of agricultural commodities. This marked the initial step in his entrepreneurial journey.

Early Ventures and Foundation of Adani Group

Adani Exports Limited initially focused on trading agricultural commodities, but Adani’s ambitions were much higher. He sensed the burgeoning demand for infrastructure development as India aimed to modernize and grow its economy. In 1998, Adani’s visionary move led to the creation of the Adani Ports and Special Economic Zone (APSEZ) in Mundra, Gujarat. This port became the cornerstone of his conglomerate, offering a gateway for imports and exports. The strategic location and world-class facilities propelled Adani Group to prominence in logistics and infrastructure.

Logo of Adani Group of Industries.

Source: the company.

Recognizing the importance of energy, Adani Group expanded into power generation. The acquisition of power plants, coal mines, and renewable energy projects further diversified the company’s portfolio. This diversification was crucial as Adani anticipated the global shift toward renewable energy sources and committed to substantial solar and wind energy investments.

By looking at the Adani group of industries, we observe that these companies mainly belong to the energy sector.

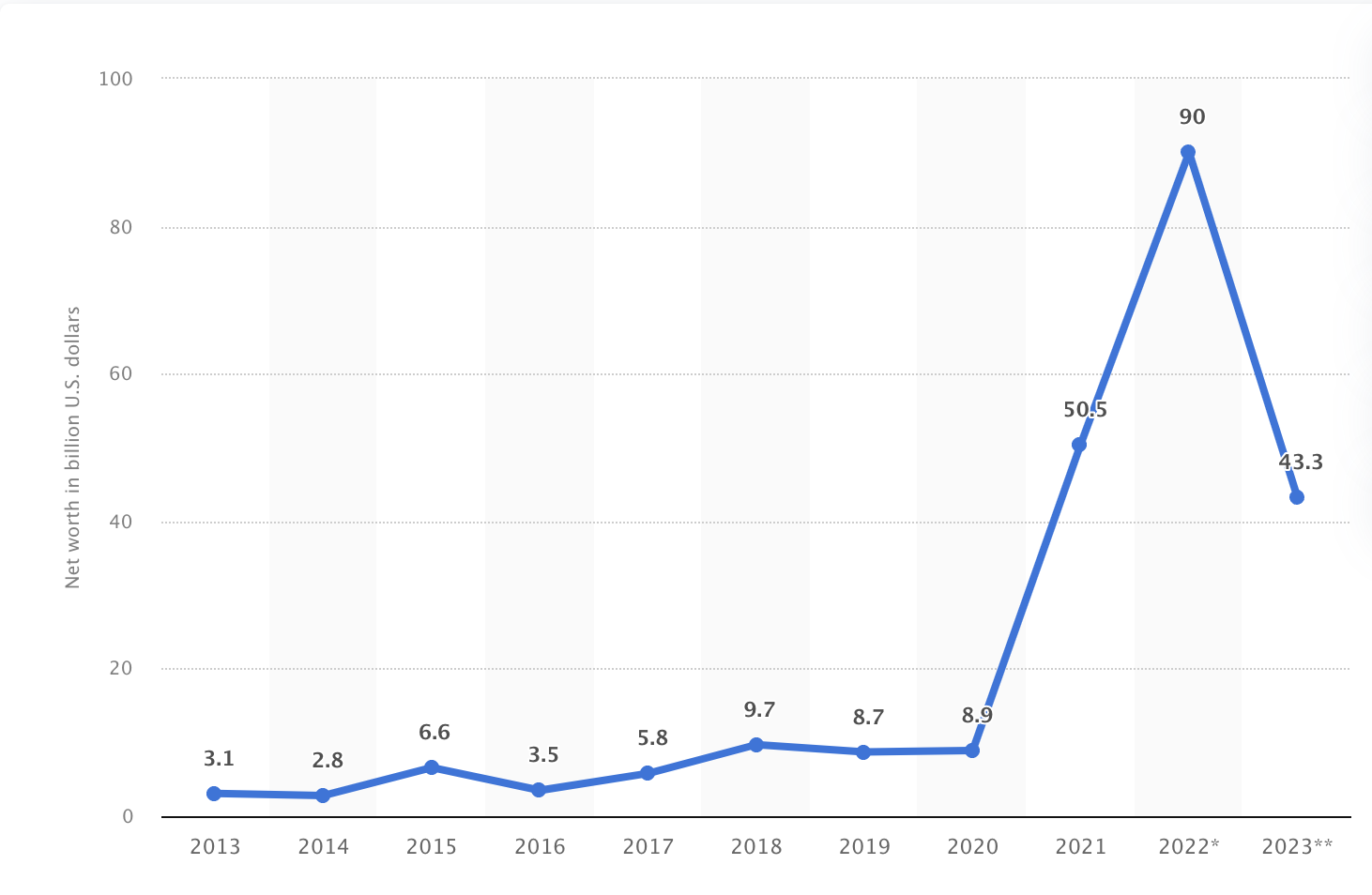

Evolution of Adani Group by its net worth from 2013 to 2023

The figure below shows the evolution of net worth of Adani Group of Industries for the period 2013-2023.

Networth evolution of Adani Group of Industries

Source: Statista.

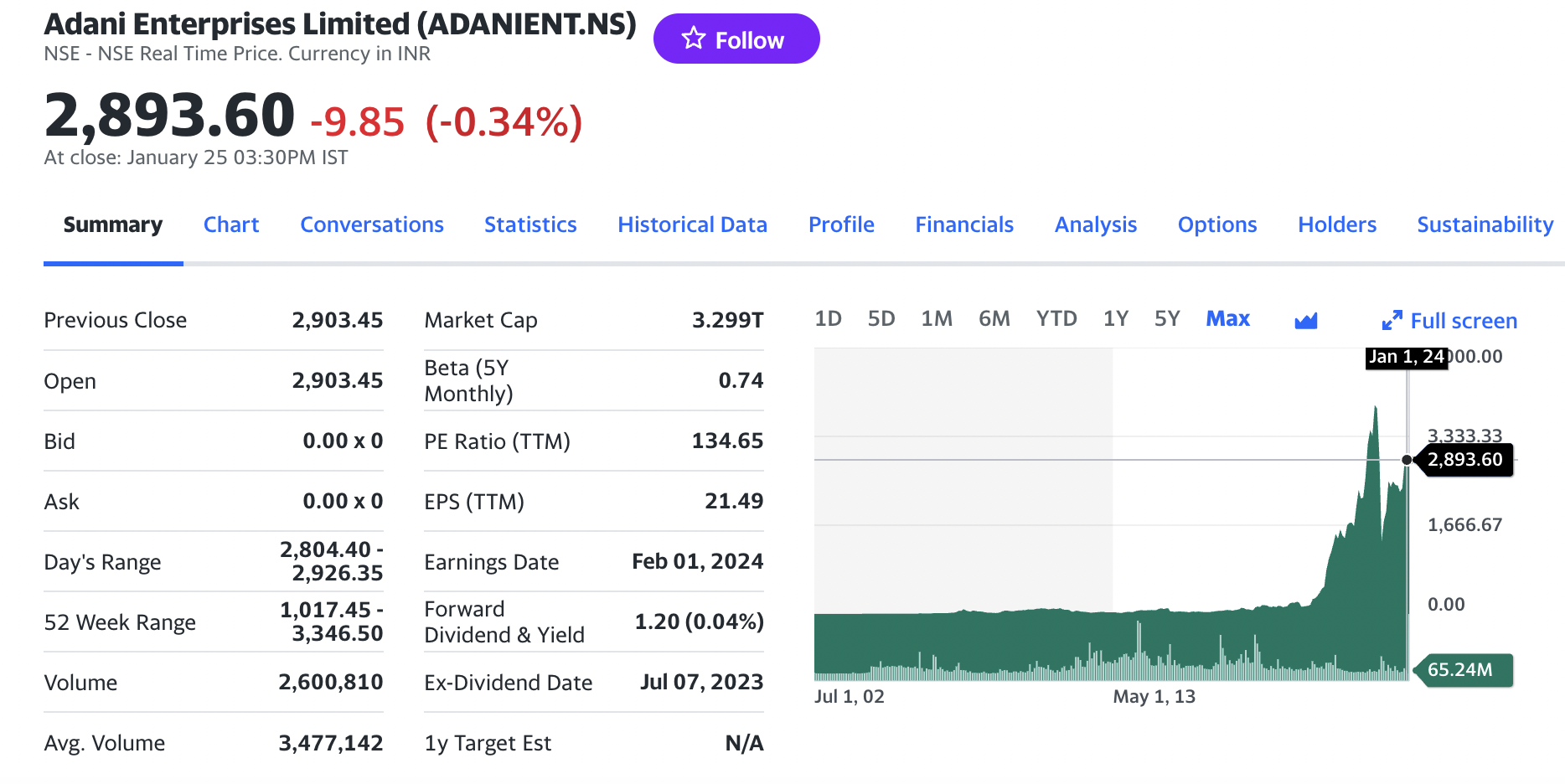

Stock chart

The figure below represents the evolution of the stock price of Adani Enterprises Limited from 2022 to 2023.

Evolution of the stock price of Adani Enterprises Limited

Source: Yahoo! Finance

Global Recognition and Investments

Gautam Adani’s leadership and Adani Group’s success have gained global recognition. The Group’s investments in Australia’s Carmichael coal mine project and its expansion into international markets have positioned Adani as a significant player on the global stage. These international ventures, however, have also exposed him to heightened scrutiny and controversy. In recent years, Adani’s wealth has surged, making him one of the richest individuals in the world. His conglomerate’s stock prices have seen significant growth, fueled by India’s infrastructure push and economic ambitions. This growth has not only enhanced his personal wealth but also contributed to job creation and economic development in various regions. Adani Green Energy Limited, a subsidiary of Adani Group, is one of India’s largest renewable energy companies. This move aligns with global sustainability trends and showcases Adani’s adaptability to changing market dynamics.

What is Hindenburg Research and its Controversies?

Hindenburg Research, a well-known financial analysis firm, has made a name for itself by conducting in-depth investigations into various companies and industries, often revealing hidden or controversial information. The firm is named after the famous Hindenburg disaster, which symbolizes its mission to uncover potential corporate misconduct and issues that could lead to significant losses for investors. Hindenburg Research was founded by Nathan Anderson in 2017. The firm operates as a short-selling research entity, meaning it identifies companies it believes are overvalued or engaging in questionable practices and then takes a short position in their stock, betting that the stock price will decrease. Hindenburg’s reports are comprehensive and detailed, often highlighting issues such as fraud, governance concerns, and misleading business practices.

In recent years, Hindenburg Research gained significant attention for its investigations into various aspects of the Adani Group. The firm’s reports raised concerns about transparency, corporate governance, and environmental impacts associated with Adani’s businesses. Hindenburg’s reports have also had a notable impact on stock prices, causing steep declines in some cases as investors react to the information presented. By conducting thorough investigations and publishing detailed reports, Hindenburg has brought attention to potential risks and problems that could affect both investors and the broader public.

Conclusion

Gautam Adani’s journey epitomizes the entrepreneurial spirit that propels individuals from humble origins to extraordinary heights. His ventures across diverse sectors have reshaped India’s economic landscape, but they’ve also sparked debates about responsible business practices. Amid controversies and investigations by entities like Hindenburg Research, Adani’s legacy will stand as a complex tapestry of triumphs, challenges, and the ever-evolving dynamics of modern business.

Why should I be interested in this post?

Adani’s trajectory from humble beginnings to becoming a business magnate showcases the essence of entrepreneurship, offering inspiration for those aspiring to innovate and lead. His strategic diversification across industries exemplifies the power of adapting to changing market dynamics, a concept central to management education. Furthermore, Adani’s experience underscores the importance of sustainable business practices, corporate governance, and transparency – all critical topics for future business leaders. His global ventures illuminate the complexities of international business relationships. By studying his journey, master’s in management students can bridge theory with real-world application, preparing themselves to navigate the dynamic landscape of modern business with adaptability and resilience.

Related posts on the SimTrade blog

▶ Nithisha CHALLA Top 5 companies market capitalization in India

▶ Nithisha CHALLA Nifty 50 Index

▶ Nithisha CHALLA Securities Exchange Board of India(SEBI)

Useful resources

Adani Group of Industries Businesses of Adani group of industries

Yahoo financials Income statement of Adani group of industries

Statista Evolution of net worth of Adani group of industries

About the author

The article was written in February 2024 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024).