In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole – Master in Management (MiM), 2021-2024) explains the business models of exchanges.

Introduction

Firstly, what is a business model? A business model refers to the framework that outlines how an exchange creates, delivers, and captures value from its various activities and operations. It essentially describes the way in which the exchange generates revenue, interacts with market participants, and sustains its competitive advantage within the financial ecosystem. The business model of exchanges revolves around creating a platform that facilitates the trading of financial instruments for buyers and sellers. Exchanges act as intermediaries, bringing together buyers and sellers in a regulated and transparent environment. The primary components of the business model for exchanges include marketplace facilitation, market data and technology services leading to revenues.

Delving a bit more into revenue generations and understanding the blend of volume and non-volume revenues is crucial for exchanges to ensure a diversified income stream and sustainable business growth. The primary difference between volume and non-volume revenues in the context of exchanges lies in their dependence on trading activity. Volume revenues (transaction fees for example) are directly linked to the volume of trading activity on the exchange whereas non-volume revenues are not (directly) tied to the volume of trading activity but derived from other sources (listing fees for companies). Successful exchanges strategically balance these revenue sources to adapt to changing market dynamics and evolving industry trends.

Volume revenues

Charging transaction fees

One of the primary sources of volume-based revenue for exchanges is charging transaction fees for each trade executed on their platform. Exchanges typically charge fees to both buyers and sellers for facilitating the trading of financial instruments such as stocks, bonds, or derivatives. For example, the New York Stock Exchange (NYSE) charges transaction fees based on the number of shares traded.

Selling market data

Exchanges generate revenue by selling real-time market data feeds to financial institutions, traders, and data vendors. These fees are often based on the volume of data consumed. Nasdaq, for instance, charges fees for access to its proprietary market data, including bid-ask quotes and trade information.

Clearing and Settlement Fees

Exchanges may derive revenue from clearing and settlement services, especially in derivatives markets. Clearinghouses associated with exchanges ensure the fulfilment of trades by acting as intermediaries between buyers and sellers. They charge fees based on the volume of contracts cleared. The Chicago Mercantile Exchange (CME) is an example where clearing fees contribute to its revenue.

Non-volume revenues

Listing Fees

Exchanges often charge companies fees for listing their shares on the exchange. These fees are not directly tied to trading volumes but are based on factors like market capitalization or the number of listed securities. The London Stock Exchange (LSE), for instance, generates revenue through listing fees paid by companies listed on its markets.

Subscription and Software Services

Some exchanges offer subscription-based services and software solutions, catering to market participants’ needs for advanced analytics, trading tools, and connectivity. These services, which may include premium data feeds, trading platforms, or risk management tools, contribute non-volume-based revenue.

Technology and Licensing

Exchanges often license their technology to other financial institutions or exchanges globally. Licensing agreements for trading platforms, surveillance systems, or other proprietary technologies contribute to non-volume revenues. Euronext, for example, has a technology solutions business that provides services to other exchanges and financial institutions.

Educational Programs and Events

Some exchanges generate revenue by organizing educational programs, conferences, and events. These events may attract participants willing to pay fees for networking opportunities, industry insights, and educational sessions. Singapore Exchange (SGX) hosts events and training programs as part of its non-volume revenue initiatives.

Example: Euronext

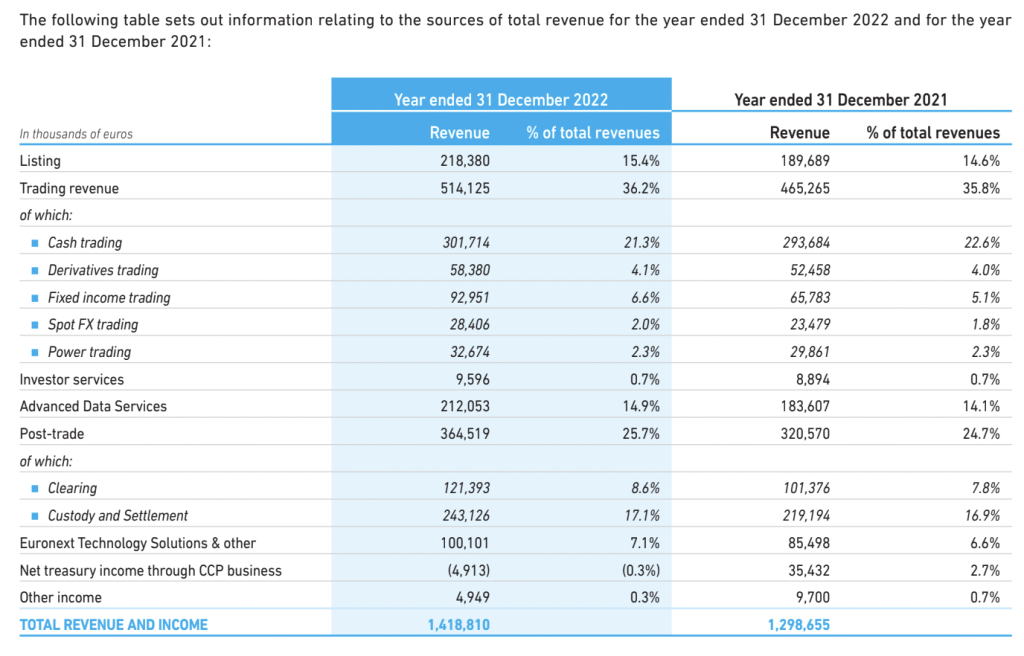

You will find below a screenshot of Euronext revenue which was generated in years 2021 and 2022 with the different components (listing, trading revenue, investor services, data services, post-trade, and technology solutions).

For Euronext, the main revenues come from trading revenue (36.2%), post-trade (25.7%), listing (15.4%) and data services (14.9%).

Revenue generation of Euronext in the years 2021 and 2022.

Source: Euronext

Now that we spoke about revenues we generate through the business model of exchanges, the next natural question that comes to us is what kind of costs occur in managing it, right?

Various types of costs involved in the model of exchanges:

The costs involved in the business model of exchanges encompass various expenses necessary for their operations, technology infrastructure, regulatory compliance, and strategic development. A few elements of the costs involved are:

Technology Infrastructure

Exchanges invest heavily in developing and maintaining robust technology infrastructure. This includes trading platforms, data centers, and systems for order matching and execution.

Personnel Costs

Employee salaries and benefits constitute a significant portion of the costs. This includes staff involved in technology development, regulatory compliance, customer support, and other operational functions.

Regulatory Compliance

Compliance costs are essential for implementing systems that ensure adherence to regulatory requirements, supporting surveillance, risk management, and reporting.

Operational Expenses

General operational expenses cover day-to-day costs such as rent, utilities, maintenance, and administrative infrastructure.

Security and Risk Management

Investments are made in security measures and risk management systems to protect against cyber threats, fraud, and operational risks, ensuring the stability and security of the exchange.

Example: Euronext

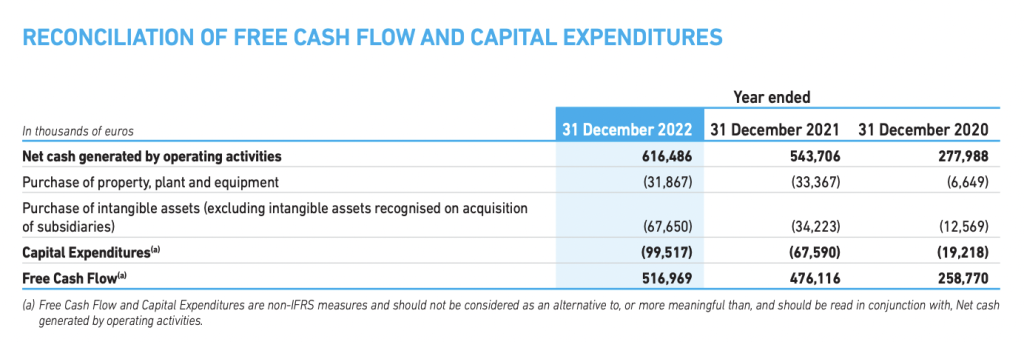

You will find below a screenshot of Euronext expenditure in years 2021 and 2022 with the different costs involved in purchasing property, plant, equipment, and intangible assets.

Capital Expenditure of Euronext in years 2020,2021 and 2022.

Source: Eeuronext

Why should I be interested in this post?

Learning about exchange business models equips management students with insights into strategic decision-making. They can analyze how exchanges diversify revenue streams, expand globally, and adapt to market trends. The diversification of offerings by exchanges and their role in risk management showcase practical applications of management principles. Understanding how exchanges manage risks associated with different financial instruments is relevant for students interested in risk management and strategic planning.

Related posts on the SimTrade blog

▶ Micha FISCHER Exchange-traded funds and Tracking Error

▶ Nithisha CHALLA Securities and Exchange Board of India (SEBI)

Useful resources

Euronext Euronext business (revenue charts)

New York Stock Exchange (NYSE) The NYSE market model

London Stock Exchange (LSE) An overview of the London Stock Exchange

About the author

The article was written in February 2024 by Nithisha CHALLA (ESSEC Business School, Grande Ecole – Master in Management (MiM), 2021-2024).