The financial rivalry between Abu Dhabi and Dubai

In this article Mayriem MEDDAH (ESSEC Business School, Master in Strategy and Management of International Business, 2021-2022) analyzed the financial rivalry between Abu Dhabi and Dubai through their respective sovereign wealth fund.

This post is organized as followed: in a first part, the geographical and political context of Abu Dhabi and Dubai among the United Arab Emirates (UAE) will be described. This will enable the reader to understand the economic development of the two emirates. Then, we will go through the economic strategy of Abu Dhabi and Dubai. For that matter, the topic of sovereign wealth fund will be analyzed, discussed, and compared between Abu Dhabi and Dubai.

Geographical and political overview of the United Arab Emirates

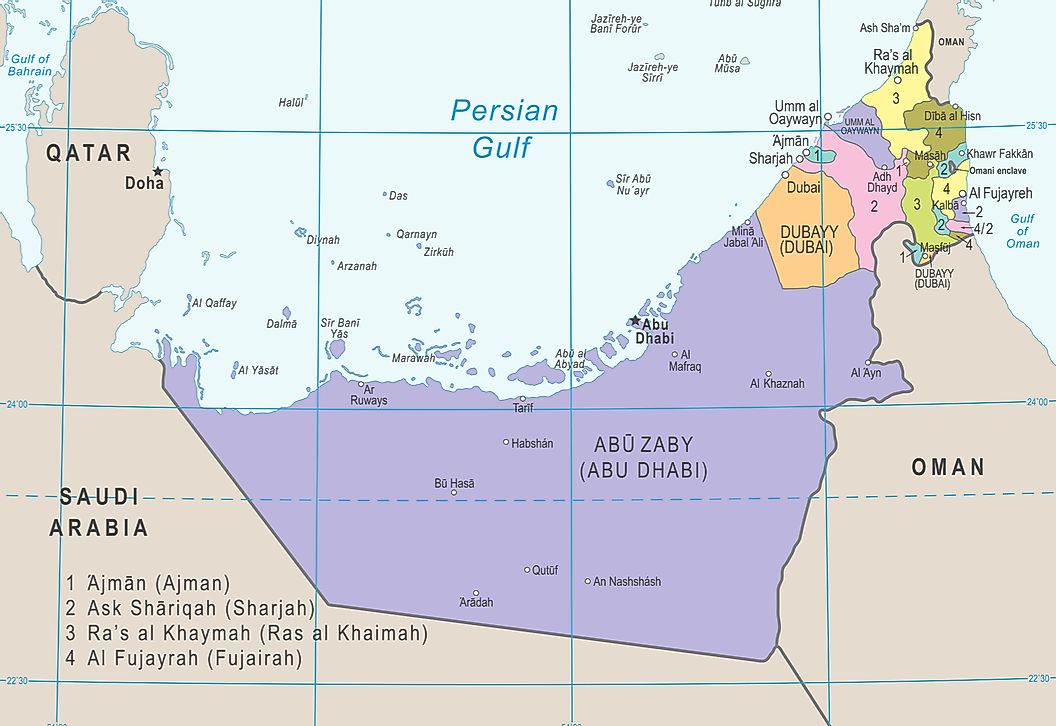

Abu Dhabi and Dubai are the most famous and biggest emirates among the United Arab Emirates (UAE). The UAE gathers seven emirates: Abu Dhabi, Ajman, Dubai, Fujaïrah, Ras al-Khaïmah, Sharjah et Oumm al-Qaïwaïn. Each of these emirates is managed by an emir who possesses his own administration. Sultan bin Zayed Al Nahyan, Emir of Abu Dhabi, has been elected as President of the UAE whereas, Mohammed ben Rachid Al Maktoum, Emir of Dubai has been named as Vice President and Prime Minister. Abu Dhabi is the biggest oil producer among all emirates, that enables the UAE to be ranked as the world’s seventh biggest oil producer.

Figure 1. Map of the United Arab Emirates.

Source: World Atlas.

Economic development

The economic rivalry between the two brothers is and has always been an ongoing process. After the independence has been proclaimed in December 1971, Cheikh Zayed bin Sultan Al Nahyan, leader and founder of Abu Dhabi had the ambition of building a financial and political platform between the western world and the eastern world. From the very beginning, he knew how crucial the movement of material and immaterial goods was, in the sake of the prosperity of Abu Dhabi. Thanks to their black gold reserves, the two emirates had the financial resources to diversify their economy.

Economic strategy: the sovereign wealth fund

Sovereign wealth fund: definition and objectives

Since their formal entrance on the investment scene in the 2000s, sovereign wealth funds (SWF) have appeared to be major investors in corporate and real resources across the globe. SWFs aim at deploying dedicated stated owned pools of capital across global markets and assets classed in furtherance of a country’s strategic, economic, or social priorities. It is the opportunity for nations with high variance in public revenues to ensure a steady level of cash flows and provide resources for long-term investment. SWFs invest both in real and financial assets, ranging from stocks, bonds, real estate, precious metals, and hard infrastructure to alternative investments such as private equity, hedge funds, and venture funds.

Santiago Principles

The Santiago Principles consists of twenty-four generally accepted principles and practices voluntarily endorsed by IFSWF members. The objectives of the Santiago Principles are to help maintain a stable global financial system and free flow of capital and investment. Another goal of Santiago Principles is to comply with all applicable regulatory and disclosure requirements in the countries in which SWFs invest. It ensures that SWFs investment are based on economic considerations (expected returns and risks) and ensures that SWFs have in place a transparent and sound governance structure that provides adequate operational controls, risk management, and accountability.

The SWF in the world

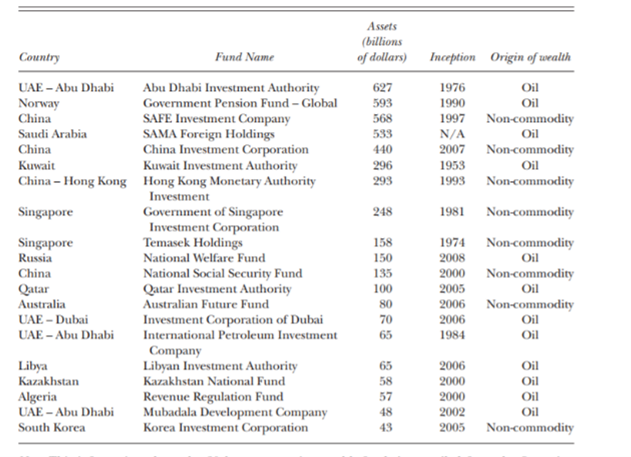

There are between 40 and 70 different sovereign wealth funds run by political entities. Table 1 below gives the list of the 20 largest SWFs and estimates of their holdings. We can notice how heterogeneous the source of wealth is between countries. In many of the middle eastern countries, such as Abu Dhabi, Qatar or Kuwait, petroleum has been the main source of wealth.

Table 1. Leading Sovereign Wealth Funds in the world.

Source: MIT.

The SWF in Abu Dhabi

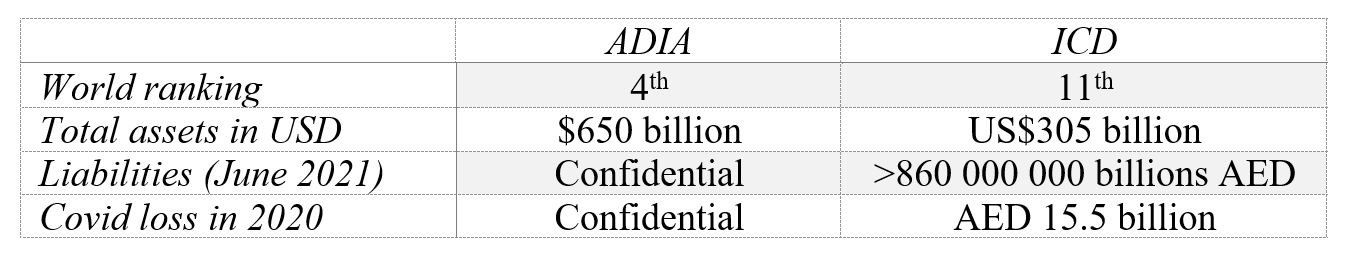

Established in 1976, the Abu Dhabi Investment Authority (ADIA) is a globally diversified investment institution that prudently invests funds on behalf of the Government of Abu Dhabi through a strategy focused on long‑term value creation. The ADIA was ranked as the fourth-largest sovereign wealth fund in the world in 2021, with $650 billion in assets.

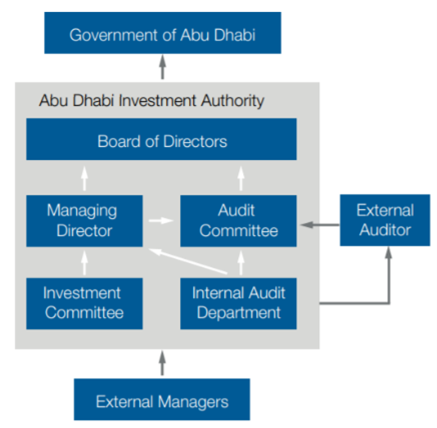

Governance

The governance of the allocation and transfer of funds remains quite obscure, which also explains why the ADIA fund is the least transparent SWF in the world. The governance has not disclosed rules or procedures for such distributions and decision among the allocation of assets. The ADIA fund is wholly owned by the Abu Dhabi Government. There is a separation of roles and responsibilities among the owner, the governing entity, and the management. According to the ADIA policy, the investments activities are conducted without reference to the Government of Abu Dhabi and has no visibility on the spending requirement. The only requirement made from the government is to generate sustainable long-term returns and to return funds to the government as needed. With lack of transparency, no official information regarding the external mangers is available.

Figure 2. The internal institutional reporting structure for ADIA.

Source: ADIA.

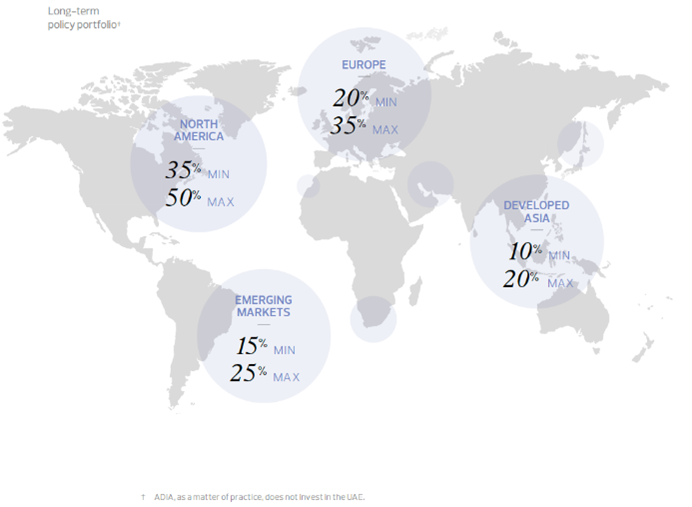

Long-term policy portfolio by region

Abu Dhabi with far more oil reserves, following the ambition of the Cheikh Zayed Bin Sultan Al Nahyan, decided to invest in long lasting projects that include, education, science, art, finance with a sustainability dimension. Abu Dhabi financial resources have been placed and organized within different wealth funds owned by the Emirate. The most famous and powerful one is by far, the Abu Dhabi Investment and Authority (ADIA). This fund has been created by the founder of Abu Dhabi with the goal to invest its reserves in anything other than gold or short-term credit. With a highly diversified and long-term strategy portfolio, Abu Dhabi has been able to have a footprint in the world’s major markets.

Figure 3. ADIA long-term policy portfolio by region.

Source: IFSWF.

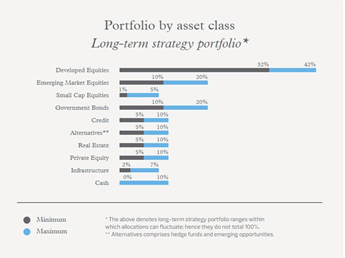

Long-term policy portfolio by asset class

With a flexible investment approach, the ADIA fund, made investments in various assets, from equities, real estate, to infrastructure.

Figure 4. ADIA long-term policy portfolio by asset class.

Source: Gulf News.

The SWF in Dubai

Established in 2006, the Investment Corporation of Dubai (ICD) is the Sovereign Wealth Fund (SWF) of the Government of Dubai. It has been established to manage the Dubai’s portfolio of commercial companies and investments. This fund is aiming to further Dubai’s presence globally and enhance Dubai’s economic power. ICD reported assets worth US$305 billion.

Governance

The governance of the ICD is made through the delegation of certain authorities including carious active committees that report and operate under the oversight of the Board of directors. There are five main committees. The investment committee comprises three Board members and is responsible, the audit committee, the remuneration committee, the management committee, and the risk management committee, which comprised of all department heads is responsible for recommending and overseeing the implementation of a sound risk management framework. The ICD parent is self-funding and does not typically receive funding or seek support from the Government of Dubai. ICD parent occasionally receives non-monetary contributions from the Government of Dubai such as ownership interests in companies.

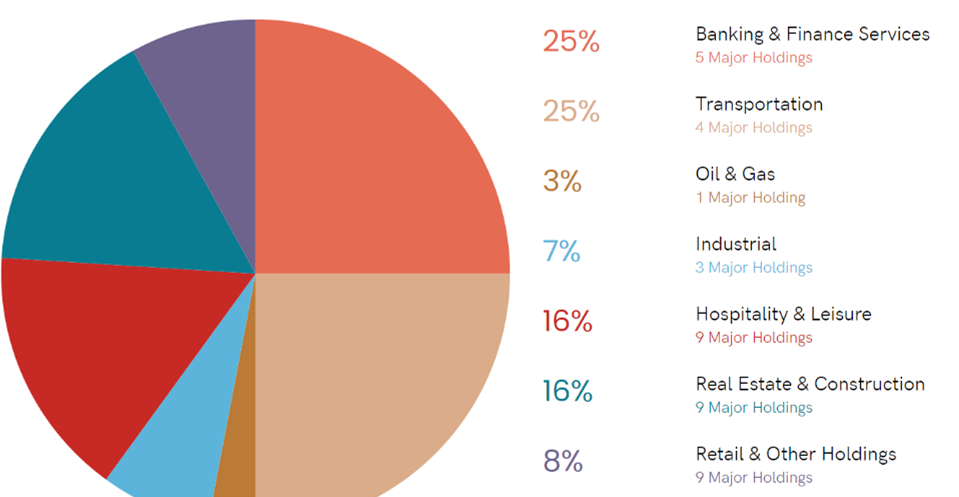

Long-term policy portfolio by assets

ICD’s portfolio companies are selected from a variety of sectors to afford diversification and risk minimization. In its entirety, the portfolio is reflective of Dubai’s growth plan and strategic focus areas.

Figure 5. ICD long-term policy portfolio by asset class.

Source: ICD.

The financial competition

Table 2. ADIA and ICD comparison.

The financial competition between the two emirates, is largely won by Abu Dhabi. Indeed, the ADIA sovereign wealth fund is ranked number four among the SWFs in the world. Also, the Mubadala Investment company, another SWF owed by Abu Dhabi, manages around 230 billion USD of assets, and is ranked just behind Dubai. Those astronomic numbers, place Abu Dhabi as a key player on the financial scene not only in the Middle East but also across the world. Dubai’s struggle is still going even after the 2008 economic crisis. Indeed, with those outrageous real estate and infrastructure projects, Dubai had enrolled itself into a debt whole and could hardly get out of it. For that reason, Dubai asked the big brother, Abu Dhabi, for help. That is why, Abu Dhabi levered 5 billion USD to save Dubai. Why not letting the Dubai drown? Abu Dhabi always knew it is a small emirate with very few people, with yet a very strategic spot but surrounded by much bigger and reckless players like Kuwait, which is the third biggest SWF in the world with total assets worth of $737 billion or Qatar with total asset worth of $367 billion. What better ally than a brother? That is why, even though Abu Dhabi won the financial battle among the United Arab Emirates, unification, loyalty, and mutual support is a matter of survival for Abu Dhabi.

Why should I be interested in this post?

In a context of financial crisis due to the pandemic, nation’s role is undeniably crucial in maintaining world’s economic stability. For that matter, the sovereign wealth fund is an interesting tool that can enable countries into overcoming today’s challenges.

Useful resources

Abu Dhabi Investment Authority (ADIA)

Investment Corporation of Dubai (ICD)

Sovereign Wealth Fund Institute (SWFI)

International Forum of Sovereign Wealth Funds (IFSWF)

Gulf News (September 8, 2021) Abu Dhabi wealth fund’s returns surged in 2020 despite COVID

Related posts on the SimTrade blog

▶ Youssef LOURAOUI Portfolio

▶ Akshit GUPTA Asset Allocation

About the author

The article was written in February 2022 by , Mayriem MEDDAH (ESSEC Business School, Master in Strategy and Management of International Business, 2021-2022).