In this article, Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) talks about Bank Of Japan’s policy shift in 2024.

Introduction

In a significant alteration in its policy in 2024, the Bank of Japan (BoJ) has announced the abandonment of its long- held negative interest rate policy alongside the discontinuation of its Quantitative and Qualitative Monetary Easing (QQE) program with Yield Curve Control (YCC). Having made this announcement in September 2024, it is indeed a historic occasion in the economic history of Japan because it mirrors the growth potential of the economy while demonstrating the central banks trust in Japan’s economic recovery and the ability to revert back to a traditional, arms’ length monetary policy stance.

Understanding QQE With Yield Curve Control

Quantitative and Qualitative Monetary Easing (QQE)

Quantitative Easing (QE) involves central banks purchasing financial assets (like government bonds) from the market to increase money supply and stimulate economic activity.

Qualitative Easing (QE) focuses on the types of assets purchased, often including riskier assets (like corporate bonds or equities) rather than just government bonds. The idea is to influence not just the quantity of money but also the quality of the central bank’s balance sheet.

Yield Curve Control (YCC)

YCC involves targeting specific interest rates along the yield curve, typically focusing on short-term and long-term government bond yields. The central bank commits to buying or selling bonds in the market as necessary to keep these yields at or below the target levels.

QQE With Yield Curve Control

In the year 2013, the Bank of Japan incorporated the adoption of QQE With Yield Curve Control as a bold measure to address deflation issues and spur the economy in what was the introduction of its new strategy. It further aimed to influence borrowing and investments through lower interest rates across the entire yield curve by enhancing liquidity in the economy through large upwards shifts in the purchases of government issued bonds and other financial instruments.

The BoJ (on 21st September, 2016) expanded its efforts to implement monetary easing by adding the ability to control the entire yield curve by making appropriate adjustments to the interest rate of Japan’s 10-year government bonds. As a result, this policy resulted in the expansion of high liquidity in the country as Japan’s economy was already forecasted to face deflationary pressures. The policy was aimed at eventually pushing Japan’s economy to higher longer-term interest rates which in turn, would allow for greater economic stability in Japan.

The End Of Negative Interest Rates

Implemented in 2016, the BOJ’s negative interest rate policy was an unconventional measure aimed at stimulating economic activity by imposing a negative rate of -0.1% on excess reserves held by commercial banks. This policy was intended to encourage banks to lend more and invest, thereby boosting consumption and economic growth. However, after 8 years, the BOJ has decided to raise the short-term interest rate to a range of 0% to 0.1%. This shift towards normalization reflects the central bank’s recognition of improving economic conditions and the need to mitigate potential negative effects of prolonged negative rates, such as financial imbalances and reduced bank profitability.

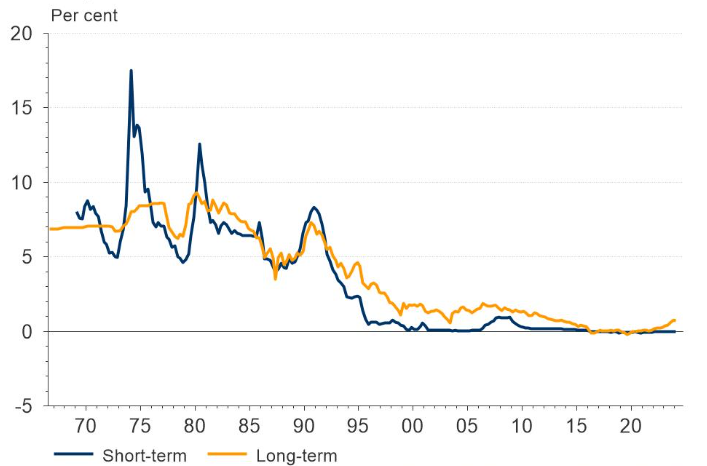

Figure 1: Interest Rates In Japan (X Axis = Years & Y Axis = Interest Rates).

Source: LSEG DataStream | Fathom Consulting

Discontinuation Of QQE With Yield Curve Control

While opting to end the negative interest policy, the BoJ has also opted for the gradual phasing out of its QQE with YCC program. This program, a central part of the BoJ’s approach to achieving its inflation target of 2% in the medium term, was of a gradual practice of large scale buying of assets and managing the yield curve in order to contain long term interest rates. The decision to discontinue this program indicates the BoJ’s belief that the economy is self-sustainable and does not require extraordinary measures to support growth and stable inflation.

Implications For The Japanese Economy

BoJ policy adjustment is likely to yield several changes with regards to different facets of the Japanese economy:

Interest Rates And Borrowing Costs

The removal of negative interest rates suggests that the cost of borrowing for a firm and a consumer is expected to rise. Although this may withdraw consumption and investment at the beginning, it is anticipated that this change in interest rates will encourage a better interaction with money by mitigating chances of asset bubble.

Financial Markets

A gradual return to normal levels of monetary policy may cause turbulence in financial markets as the participants are able to slowly adapt to the changes. However, on the flip side, it does point towards a return of business conditions that are expected to be more stable and predictable which in the long run may boost the confidence of investors.

Banking Sector

The removal of negative rates can in one way enhance the profitability of banking institutions. These financial intermediaries have always been working at unpalatable margins during the prevailing negative rate policy and with the new norm they should be able to make a decent lend and participate more meaningfully at the level of the economy.

Inflation And Economic Growth

The BoJ is confident that inflation will remain on average close to its target rate of 2%. Some of these inflation expectations could allow for better and resistant economic growth as businesses and the general populace refer to the new inflationary tendencies to make more informed decisions.

Global Implications Of The Policy Change Of Bank of Japan

The policies that the Bank of Japan has changed from are vastly relevant not only to Japan but also to the global economic network in general.

Global Financial Markets

As one of the world’s largest economies, changes in Japan’s monetary policy are capable of affecting world financial markets. Countries can supplement their capital structure from Japan after the era of negative interest rates and pooling of assets into the country will take place upon normalization of policy.

Exchange Rates

The shift in policies may have a direct effect on the Japanese yen’s rate. The enhanced interest rates may lead to a more robust yen which would in turn have an effect on Japan’s balance of trade and the cost of their exports. This, in a sense, may modify international trade relations and the economic status of nations that trade with Japan.

Central Bank Policies

Japan’s turn towards normalization, might compel other central banks to reconsider their own money policies especially in view of recovery of economies and the behavior of inflation during the time of recovery. In this respect, one may expect a more widespread pattern of policy tightening of monetary conditions across the globe economy.

Investment Strategies

Investors across the world may be forced to realign their strategies as a result of the new measures put in place by Japan’s key decision makers. Any shifts in interest rates and or conditions within the financial markets in Japan may impact investment strategies in terms of portfolio management and even risk management.

Conclusion

The Bank of Japan’s 2024 policy change is indicative of the beginning of the end for its unconventional monetary policies and is the start of a new chapter in the economic history of Japan. The BOJ, through the removal of negative interest rates and by discontinuing QQE with YCC, is demonstrating its faith in the performance and strength of the economy and is willing to implement more orthodox solutions. It is perceived that this action will have serious ramifications not only for Japanese economy and its financial markets but also for the prevailing global economic environment, paving the way for a more balanced and healthy future economy.

Related Posts On The SimTrade Blog

▶ Bijal GANDHI Interest rates

▶ Youssef LOURAOUI Interest rate term structure and yield curve calibration

Useful Resources

Bank of Japan – Monetary Policy Releases 2024

The Diplomat – What’s Next for Japan’s Economy After Monetary Policy Shift?

Twitter Bank of Japan

About The Author

The article was written in May 2025 by Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).

▶ Read all articles by Anant JAIN.