Understanding Sustainable Finance through ESG Indexes

In this article, Pablo COHEN (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2024–2025) explores how sustainable finance is reshaping investment strategies through ESG indexes.

Introduction and Context

For decades, success was measured through financial indicators. Profits defined companies, and GDP per capita ranked nations. But as Robert F. Kennedy pointed out, GDP “measures air pollution and cigarette advertising… and ambulances to clear our highways of carnage.” It reflects economic activity, not societal well-being”.

Our actions shape the climate, ecosystems, and social outcomes — and those same forces now pose real risks to economies. France may have a far higher GDP per capita than El Salvador, but which emits more carbon per citizen? Which has a credible plan for net-zero by 2050? These questions are more relevant to long-term sustainability.

To enable meaningful comparisons, global bodies like the UN and EU have created frameworks and standards for sustainability reporting. Tools such as the EU Taxonomy, SFDR, and CSRD bring structure and consistency to ESG disclosures, helping investors assess corporate impact and redirect capital toward sustainable outcomes. If we don’t change what we measure, we won’t change what we prioritize — or what we build.

How ESG Indexes Work

We have an impact on the world, and the world has an impact on us. That’s the essence of double materiality — a foundational concept in sustainable finance. Sustainability risks, whether physical (like climate disasters) or transitional (like policy shifts), can directly affect financial performance through credit risk, operational disruption, legal exposure, and reputational damage.

Just as external events shape a company’s bottom line, financial decisions influence the environment and society. This two-way relationship is increasingly recognized by regulators and investors alike. Navigating it requires tools that make ESG performance measurable, comparable, and investable. This is where ESG indexes come into play.

ESG indexes allow investors to evaluate companies based on their sustainability profile. Depending on their design, they may exclude controversial sectors, highlight ESG leaders, track themes like clean energy, or align with climate targets such as the 1.5°C scenario. Examples include the MSCI ESG Leaders and Climate Paris Aligned Indexes, the S&P 500 ESG Index, FTSE4Good, and the Dow Jones Sustainability Index. These indexes are used not only as benchmarks, but as a basis for constructing portfolios that reflect long-term sustainability goals.

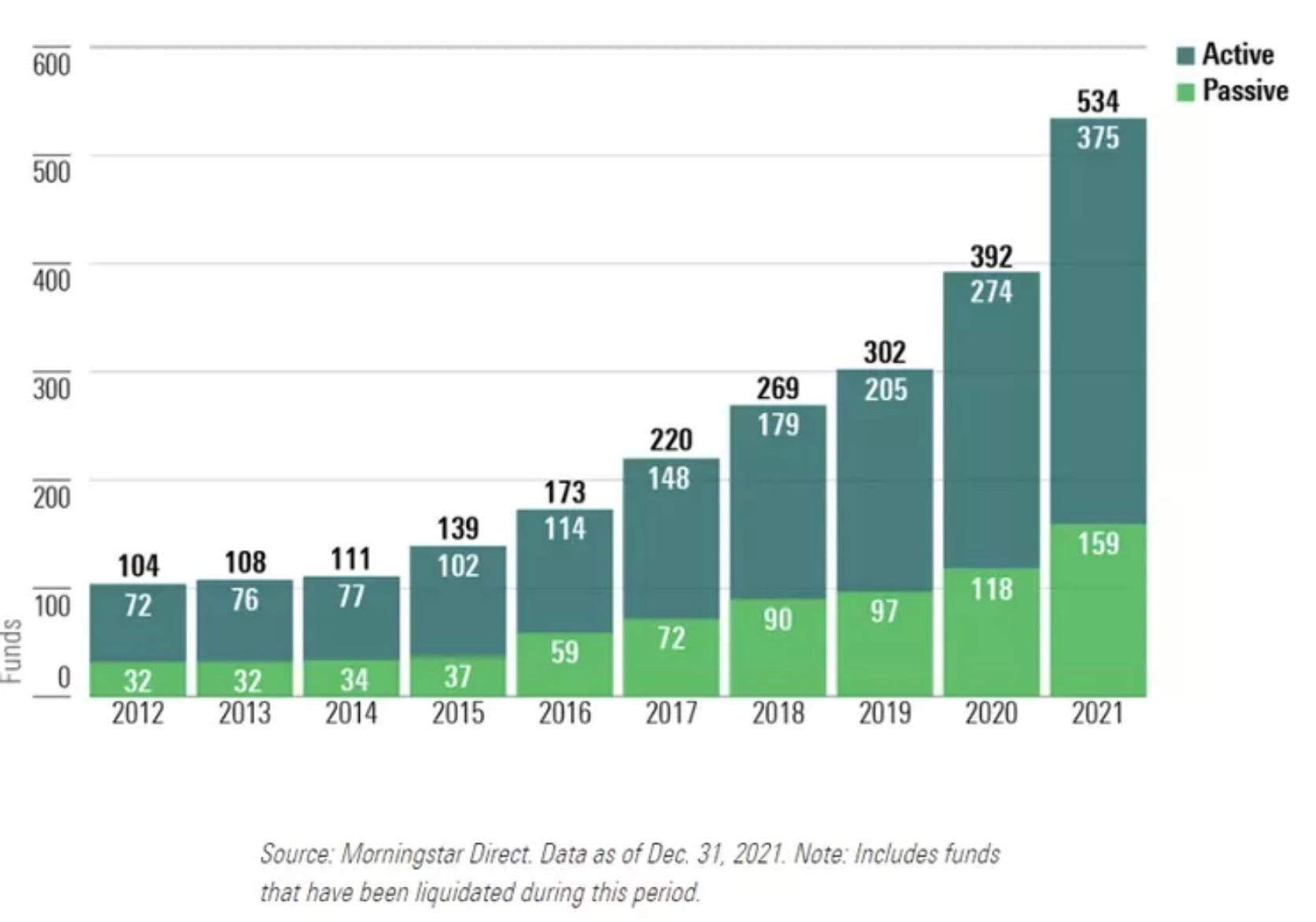

The growth of ESG indexes and sustainable funds has mirrored the rising demand for more responsible investment strategies. The following chart shows how both active and passive sustainable funds have surged over the past decade:

ESG Fund Growth Chart.

Source: Morningstar Direct.

ESG in Practice and Market Performance

Index construction starts with exclusions — companies involved in fossil fuels, weapons, or major ESG controversies are filtered out. Then comes ESG scoring, based on data from corporate disclosures, regulatory filings, and third-party assessments. Companies are evaluated across environmental impact, social responsibility, and governance quality. This might include emissions intensity, labor practices, or board independence. Based on these scores, indexes select and weight constituents and are rebalanced periodically to reflect updated data.

The MSCI Climate Paris Aligned Index is designed to align with a 1.5°C scenario. It reduces both physical and transition risks by excluding fossil-fuel-intensive companies and emphasizing those with low emissions and strong climate governance. Compared to its parent index, the MSCI ACWI, it includes fewer companies but achieves a 50% reduction in portfolio carbon intensity. It’s a forward-looking tool that anticipates tightening regulations and evolving investor expectations.

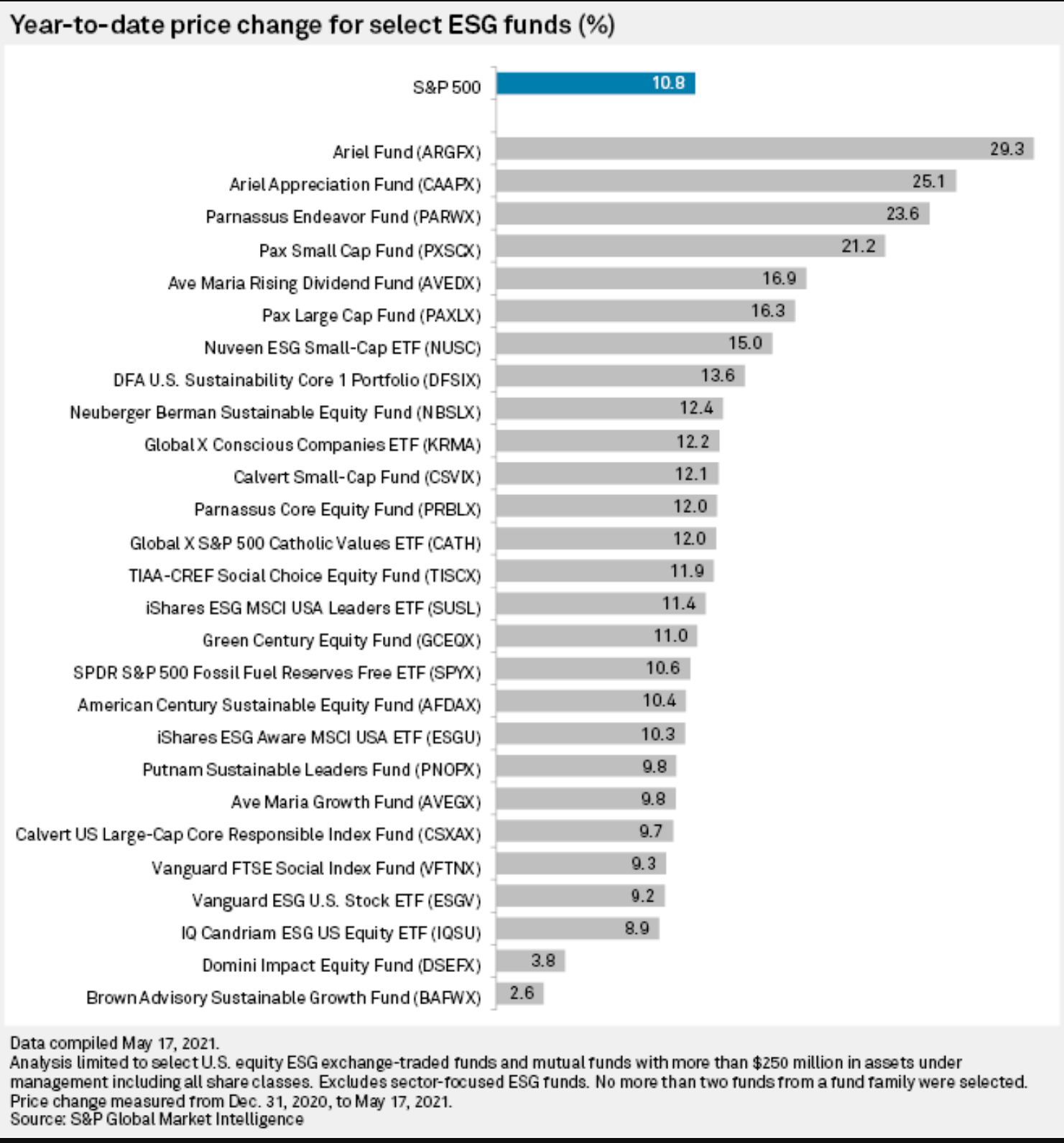

Some ESG funds have even outperformed traditional benchmarks like the S&P 500. The chart below shows that several ESG funds delivered significantly higher year-to-date returns in early 2021:

ESG Fund performance compared to the S&P 500 index.

Source: S&P Global Market Intelligence.

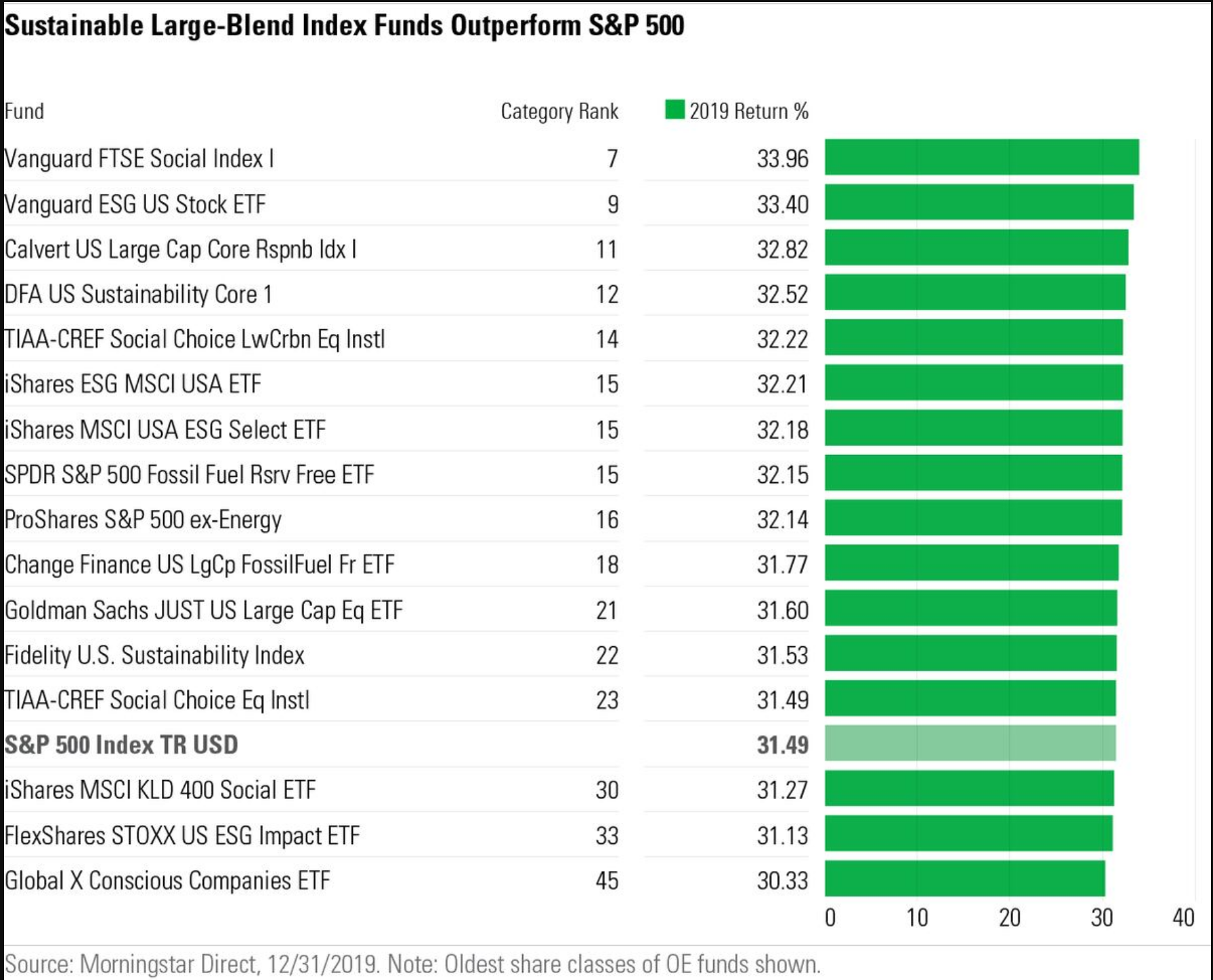

This outperformance isn’t just recent. In 2019, sustainable large-blend index funds consistently beat the S&P 500 — with many delivering returns above 32%, as the following chart demonstrates:

Sustainable Funds Performance (year 2019).

Source: Morningstar Direct.

The rise of ESG is also visible in fund flows. More sustainable funds are being launched each year, and investor inflows have reached record levels — confirming that ESG isn’t just a trend, it’s a lasting shift in investment priorities.

Why should I be interested in this post?

As an ESSEC student preparing for a career in finance, understanding sustainable finance is no longer optional. ESG principles are reshaping how capital is allocated, how companies report, and how investment strategies are built. Whether you’re pursuing a role in banking, asset management, consulting, or entrepreneurship, knowledge of ESG frameworks and sustainable indexes will be essential for making informed, future-ready decisions in a rapidly changing financial landscape.

Related posts on the SimTrade blog

▶ Anant JAIN The Future Of CleanTech: Innovations Driving A Sustainable World And Their Financial Implications

▶ Anant JAIN Milton Friedman VS Archie B. Carroll On CSR

▶ Anant JAIN The Paris Agreement

▶ Anant JAIN The World 10 Most Sustainable Companies in 2021

▶ Anant JAIN Green Investments

▶ Anant JAIN United Nations Global Compact

Useful resources

Morgan Stanley (2023) Sustainable Funds Outperformed Peers in 2023

IEEFA ESG Investing: Steady Growth Amidst Adversity

Morgan Stanley (2024) Sustainable Funds Modestly Outperform in First Half of 2024

IEEFA ESG Funds Continue to Outperform

S&P Global Most ESG Funds Outperformed S&P 500 in Early 2021

Morningstar U.S. ESG Funds Outperformed Conventional Funds in 2019

The Economist American Sustainable Funds Outperform the Market

About the author

This article was written in April 2025 by Pablo COHEN (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2024–2025).