Sharing my experience during the SimTrade course

In this article, Lara HADDAD (ESSEC Business School, Bachelor in Business Administration (BBA), 2020-2024) shares her experience experience with the SimTrade course at ESSEC and how it significantly enhanced her understanding of financial markets, particularly in relation to her internships and career aspirations in finance.

About the SimTrade course

SimTrade is a simulated trading platform that provides a realistic and engaging learning environment for students to explore the complexities of financial markets. It allows participants to develop and test trading strategies, manage portfolios, and analyze market data. The platform covers various asset classes, including equities, bonds, and derivatives, offering a comprehensive overview of financial instruments and trading mechanics. The module is well divided, and we get the chance to explore all the aspects of financial markets with a realistic simulator.

My SimTrade Experience

The SimTrade course provided a practical and hands-on approach to learning about financial markets. I actively participated in simulated trading sessions, managing a virtual portfolio and making investment decisions based on market analysis and research.

The platform’s real-time data and interactive features allowed me to experience the dynamics of market fluctuations and the impact of various economic factors on asset prices. This immersive experience significantly deepened my understanding of financial concepts and strengthened my analytical skills.

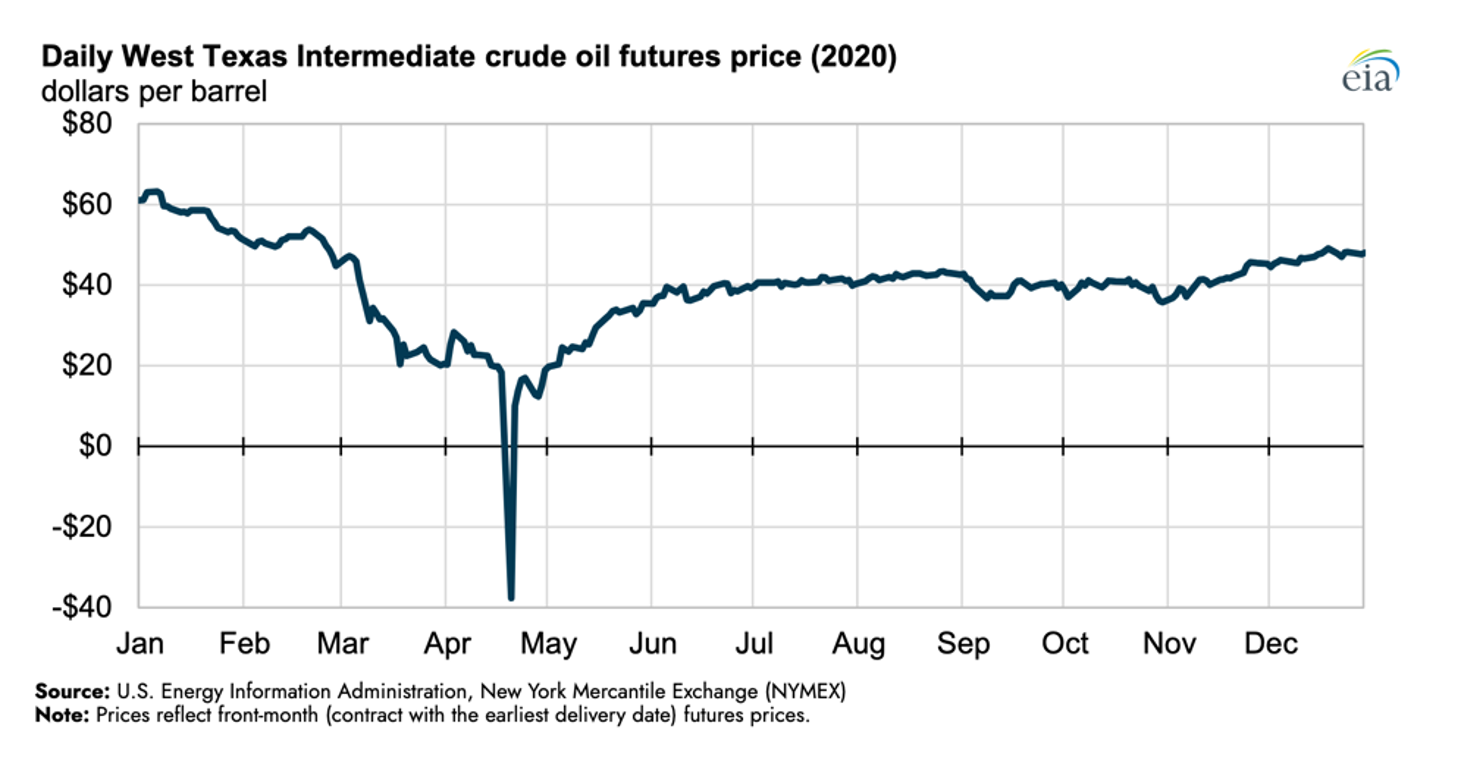

I also learned a lot about the impact of real-world events on the price and the health of the market. For instance, in a requested case study, I was able to understand and analyze one of the most dramatic real-time impacts which was seen in the oil markets. In April 2020, West Texas Intermediate (WTI) crude oil futures turned negative for the first time in history. This is because the covid 19 pandemic resulted in the collapse of oil demand as global economic activity stalled.

Crude oil price change

Source: the website.

In addition to that, the course allowed me to apply theoretical concepts in a practical setting, deepening my understanding of how economic factors, corporate performance, and investor psychology interact to shape asset prices. This immersive learning experience sparked my curiosity and solidified my interest in pursuing a career in finance, as I realized the power of financial decision-making not just in simulations, but in real-world applications as well.

I now defined the next steps in my career. I am now applying for a master in Finance to enforce my knowledge in the finance world and different aspects of the industry.

Connecting SimTrade to Real-World Finance

The knowledge and skills I gained through SimTrade proved invaluable during my internships. At L’Oréal, I utilized the principles of financial modeling and market analysis learned in SimTrade to analyze market trends and contribute to financial simulations. At Do well do good, the concepts of portfolio diversification and risk management helped me assess the financial feasibility of different startup projects. At SmartStream Technologies, the understanding of trading mechanics and market dynamics gained through SimTrade enhanced my ability to develop and implement sales and marketing strategies for their fintech products.

Three Key Financial Concepts from SimTrade

Portfolio Diversification

SimTrade emphasized the importance of diversifying investments across different asset classes to mitigate risk and optimize returns. This concept proved crucial in my real-world financial analyses.

Technical Analysis

The platform introduced me to various technical indicators and charting techniques used to analyze market trends and predict price movements. This knowledge enhanced my ability to interpret market data and make informed investment decisions.

Fundamental Analysis

SimTrade highlighted the importance of evaluating a company’s financial performance and intrinsic value through fundamental analysis. This skill proved essential in assessing the financial health of companies during my internships.

This SimTrade experience significantly strengthened my financial acumen and provided a solid foundation for my career aspirations in finance. The practical skills and knowledge gained through the platform have been instrumental in my internships and will continue to be valuable assets as I progress in my career.

Useful Resources

About the author

The article was written in December 2024 by Lara HADDAD (ESSEC Business School, Bachelor in Business Administration (BBA), 2020-2024).