In this article, Alberto BORGIA (ESSEC Business School, Global Bachelor in Business Administration (GBBA), Exchange student, Fall 2025) explains about ETPs on crypto.

Introduction

An Exchange-Traded Product (ETP) is a type of regulated financial instrument, which is traded on stock exchanges and allows exposure to the price movements of an underlying asset or a benchmark without requiring direct ownership of the asset.

Crypto ETPs are instruments that provide regulated access to all market participants. Since their inception, they have become the main access point for traditional investors seeking exposure to digital assets. Every year, the value of assets in this category continues to grow and in their latest report, 21Shares analysts agree that by 2026 these assets will be able to surpass $400 billion globally.

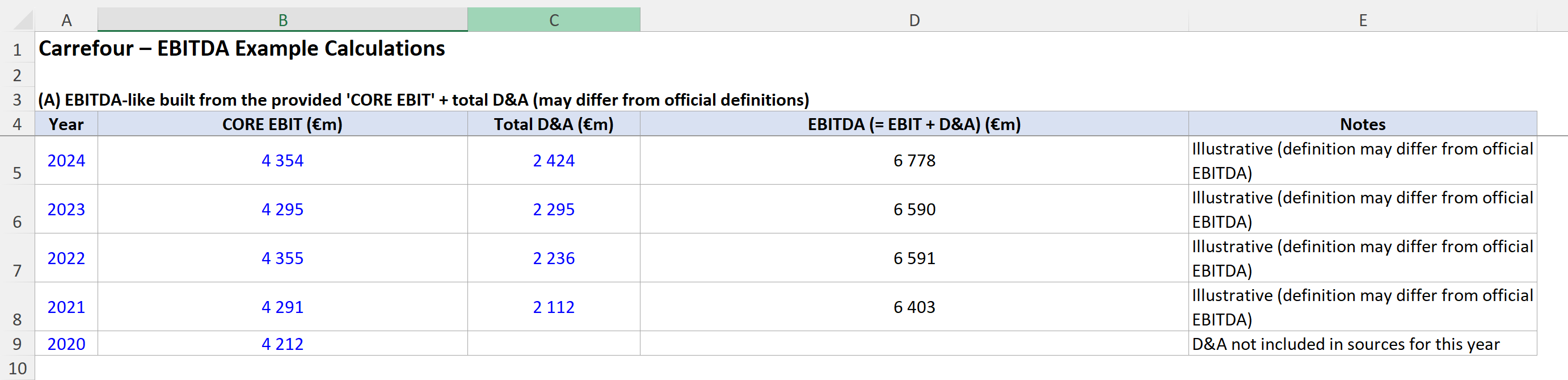

The picture shows how rapidly crypto ETPs have scaled from early 2024 to late 2025. Assets under management (blue area) rise in successive waves, moving from roughly the tens of billions to just under the $300B range by late October 2025, while cumulative net inflows (yellow line) trend steadily upward toward ~$100B, signaling that growth has been supported by persistent new capital in addition to market performance.

As regulated access expands through mainstream distribution channels and more jurisdictions formalize frameworks for crypto investment vehicles, ETPs increasingly become the default wrapper for exposure. As the market deepens, secondary-market liquidity typically improves and execution costs compress, reducing short-term dislocations around the product and reinforcing further allocations.

Crypto ETP Asset under Management (AUM)

Source: 21Shares.

This trend is driven not only by retail clients’ demand, but also by an increasing openness of traditional markets toward these types of products, meaning that established exchanges, broker-dealers, custodians and market-makers are increasingly willing to list, distribute and support crypto-linked ETPs within the same governance, disclosure and risk-management frameworks used for other exchange-traded instruments. In the US, more and more structural barriers are being removed thanks to new approval processes for crypto investment vehicles, as regulators and exchanges have been moving toward clearer, more standardized filing and review pathways and more predictable disclosure expectations.

By the end of 2025, more than 120 ETP applications were pending review in the USA, under assessment by the SEC and, where relevant, by the national securities exchanges seeking to list these products, positioning the market for significant inflows beyond Bitcoin and Ethereum in the new year.

We see this trend in other countries as well: the UK has removed the ban for retail investors, Luxembourg’s sovereign fund has invested as much as 1% of its portfolio in Bitcoin ETPs, while countries such as the Czech Republic and Pakistan have even started using such assets for national reserves. In Asia and Latin America, regulatory frameworks are also being formed, making crypto ETPs the global standard for regulated access.

This will lead to a virtuous cycle that will attract more and more capital: AUM growth enables a reduction in spreads, volatility decreases and liquidity increases, improving price efficiency and execution quality and reducing short-term dislocations, thereby supporting the growth of the asset class.

ETP o ETF

An Exchange-Traded Product is a broad category of regulated instruments that give investors transparent, tradable exposure to an underlying asset, index or a strategy. An Exchange-Traded Fund is a specific type of ETP that is legally structured as an investment fund, typically holding the underlying assets and calculating a net asset value. The key difference is therefore the legal form and the risk profile: ETFs are fund vehicles with segregated assets held for investors, whereas many non-ETF ETPs (such as ETNs) are debt instruments whose performance can also depend on the issuer’s creditworthiness. So, all ETFs are ETPs, but not all ETPs are ETFs.

Structure

There are two methods for replicating the underlying: physical and synthetic. Physical ETPs are created through the purchase and holding of the asset by the issuing entity, thus allowing a replication directly linked to the performance of the underlying. As for synthetic ETPs instead, they are created from a SWAP contract with a counterparty, for example a bank, in order to provide the return of that asset. To protect the liquidity of the daily return, the counterparty is required to post liquid collateral with the issuer and the amount of this collateral then fluctuates based on the value of the underlying asset and its volatility profile. Based on the data shown by Vanguard’s discussion of physical vs. synthetic ETF structures and with industry evidence showing that physical replication dominates European ETF AUM, we can say that in recent years investors have generally preferred physical ETPs, thanks to their transparency, the absence of counterparty risk and their relative simplicity rather than synthetic structures. In particular with regard to crypto, given the simplicity of holding the asset and their liquidity, almost all of these derivatives on cryptocurrencies are physical.

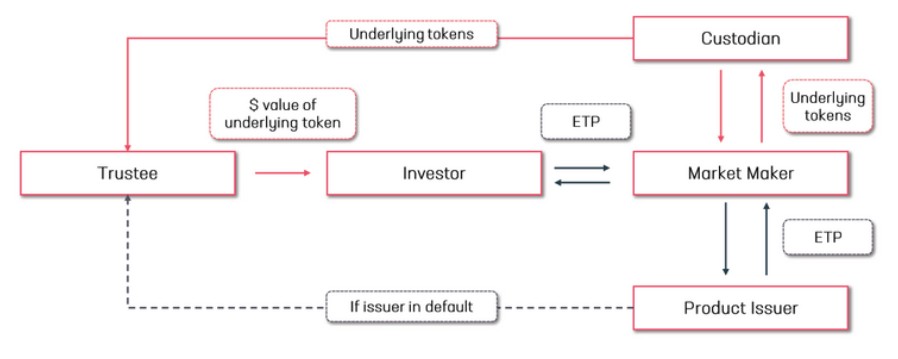

For this reasons, when you purchase this type of financial asset, you do not directly own the physical cryptocurrency (the underlying), but rather a debt security of the issuer, backed by the crypto and with a guarantee provided by the relationship with the trustee (This entity’s task is to represent the interests of investors, receiving all rights over the physical assets that collateralize the ETP. It therefore acts as a third and independent party that protects the ETP’s assets and ensures that it is managed in accordance with the terms and conditions established beforehand.)

Structure of Exchange Traded Product

Source: Sygnum Bank.

Single or diversified

Depending on the exposure the investor wants to obtain, various types of these assets can be purchased:

- Some may replicate a specific cryptocurrency by tracking the value of a single digital coin. Their task is therefore only to replicate the market of the underlying asset in a simple and efficient way.

- Other ETPs can replicate a basket or an index of cryptocurrencies; this is done to gain exposure simultaneously to different markets, diversifying risk.

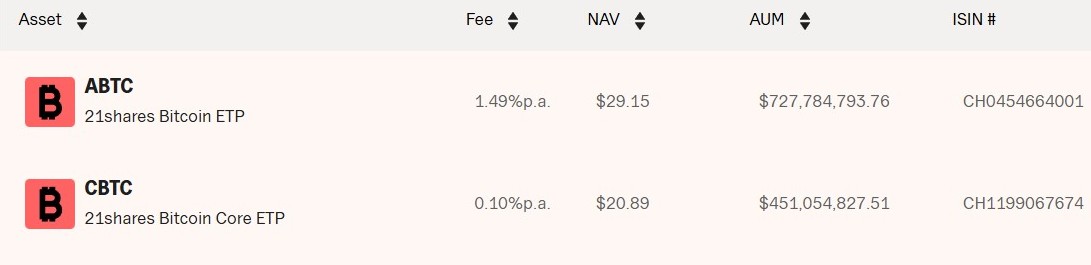

- We can find an example of this in the products offered by 21Shares. Part of it is represented by diversified products, such as the 21Shares Crypto Basket Equal Weight ETP, where several cryptocurrencies make up the product. The majority, however, both in terms of AUM and number of products, is single-asset, with only one underlying. Examples include the 21Shares Bitcoin ETP or the 21Shares Bitcoin Core ETP.

- When speaking specifically about these two products, there is a distinctive feature that makes 21Shares unique. The company was the first to bring these products to market and, for this reason, having a “monopoly” at the time, it was able to charge extremely high fees. With the arrival of new players, however, it was forced to reduce them and, thanks to its structure and competitive advantages, was able to offer extremely low fees, the lowest on the market, without delisting the previous products, as they remained profitable. In fact, the two products mentioned above have no differences of any kind, except for their costs.

BTC ETP

Source: 21Shares.

Advantages compared to traditional crypto

The reasons that may lead to the purchase of this type of financial instrument can be multiple. First of all, navigating the world of cryptocurrencies can seem difficult, but ETPs remove much of the complexity. Instead of relying on unregulated platforms or paying extremely high fees to traditional funds that invest only marginally in cryptocurrencies, investors have the opportunity to buy this asset directly as they would with other securities. ETPs will then sit alongside all other investments in the portfolio, thus enabling a simpler analysis of it and also comparison with other products. Moreover, even if these intermediaries do not offer true financial advice, they provide investor support that is far higher than that of classic crypto platforms.

Another element in their favor is the security and transparency on which they are based. In particular in Europe, these instruments are subject to stringent financial regulations and are required to comply with accounting, disclosure, and transparency rules. Then, since they are predominantly physically collateralized, their structure makes it possible to protect the client and the asset itself in the event of bankruptcy or insolvency of the issuer, limiting exposure to the underlying.

Why should I be interested in this post?

The crypto market is a complex world and constantly changing. This article can be read by anyone who intends even just to deepen their understanding or discover concepts that nowadays are becoming increasingly important and fundamental in financial markets and in everyday life, not only by those who want to pursue a career in the cryptocurrency sector.

Related posts on the SimTrade blog

▶ Snehasish CHINARA Top 10 Cryptocurrencies by Market Capitalization

▶ Hugo MEYER The regulation of cryptocurrencies: what are we talking about

Useful resources

Swem, N. and F. Carapella (28/03/2025) Crypto ETPs: An Examination of Liquidity and NAV Premium FEDS Notes.

Vanguard: Replication methodology / ETF knowledge

About the author

The article was written in December 2025 by Alberto BORGIA (ESSEC Business School, Global Bachelor in Business Administration (GBBA), Exchange student, Fall 2025).

▶ Read all articles by Alberto BORGIA.