In this article, Adam MERALLI BALLOU (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2026) introduces the Secondary Market in Private Equity.

Introduction

Over the past decade, the private equity secondary market has undergone a profound transformation. Originally conceived as a marginal liquidity outlet for constrained investors, it has progressively become a central component of private markets architecture, as it increasingly shapes how capital circulates within the private equity ecosystem rather than merely how it exits it. The secondary market now acts as a mechanism through which investors actively manage portfolio duration, smooth cash-flow profiles, and adjust exposure across vintages and strategies, while allowing General Partners to optimize asset holding periods in response to market conditions. This evolution reflects a broader shift away from a rigid, linear fund lifecycle toward a more dynamic and continuous model of capital allocation.

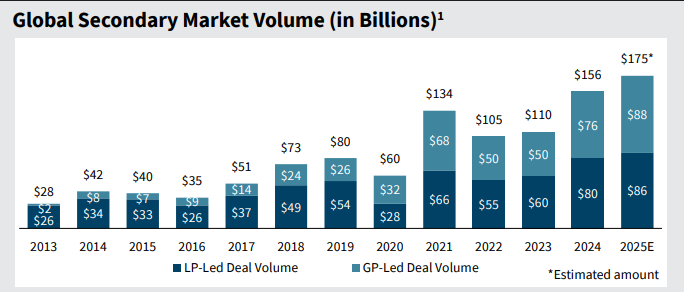

This transformation has accelerated in the recent cycle, as exit activity slowed materially and fund durations extended beyond initial expectations, amplifying the need for alternative liquidity and capital recycling solutions. According to the Preqin Secondaries in 2025 report and the William Blair Private Capital Advisory Secondary Market Report (2025), year 2025 is expected to mark a historical milestone, with global secondary transaction volumes reaching approximately $175bn, the highest level ever recorded. This surge reflects not only cyclical pressures on liquidity, but also a deeper structural shift in how private equity portfolios are managed, financed, and recycled across market cycles.

Global Secondary Market Volume

Source: Willliam Blair.

This figure illustrates the rapid expansion of the global private equity secondary market. According to the William Blair Private Capital Advisory Secondary Market Report (2025), transaction volumes grew from $28bn in 2013 to $156bn in 2024, with $175bn projected for 2025. The increasing share of GP-led transactions highlights the growing role of secondary markets in addressing liquidity needs and exit constraints.

LP-led vs GP-led secondaries: complementary functions within the ecosystem

The secondary market is fundamentally organized around two distinct transaction types: LP-led and GP-led, each fulfilling a different economic function within the private equity ecosystem. LP-led transactions represent the original backbone of the market. In these deals, Limited Partners sell existing fund interests to obtain liquidity, rebalance their portfolios, or reduce exposure following overallocation to private equity. Data from the 2025 Preqin report shows that LP-led transactions tend to dominate in number, particularly during periods of market stress, as institutional investors respond to denominator effects, regulatory constraints, or liability-matching requirements. However, while LP-led transactions account for a high share of deal count, their relative weight in value terms has become more balanced. In 2024, LP-led secondaries represented roughly $80bn, or close to half of total market volume. GP-led by contrast, are initiated by the General Partner rather than by investors. In a GP-led secondary, the GP transfers one or several assets from an existing fund into a new vehicle. In 2024, GP-led transactions represented approximately $76bn in value, accounting for a share comparable to LP-led transactions despite being fewer in number, which reflects their significantly larger average deal sizes.

The explosion of continuation funds and the normalization of GP-led structures

Within the GP-led universe, the rapid rise of continuation funds stands out as the most consequential development of the past few years. Once viewed as exceptional restructuring tools for underperforming or illiquid assets, continuation funds have become mainstream instruments used to extend the ownership of high-quality portfolio companies. The Preqin report identifies 401 continuation funds launched between 2006 and 2025, with a striking acceleration after 2020. Of these, 340 funds are already closed, representing an aggregate capital base of approximately $182.7bn. In value terms, continuation funds now account for around 45–50% of total secondary market volume and nearly 80% of GP-led transactions. This expansion has been driven by a combination of prolonged exit timelines, improved governance standards, systematic use of third-party valuations, and stronger alignment mechanisms such as GP carry rollovers. The data confirms that continuation funds are no longer marginal or opportunistic structures, but rather standardized tools for managing asset life cycles and sustaining value creation beyond the constraints of traditional closed-end fund structures.

Capital concentration, pricing normalization, and the strategic role of secondaries

Beyond transaction structures, the scale of capital committed to the secondary market underscores its growing strategic importance. The William Blair report highlights that secondary-focused investors held more than $200bn of dry powder in 2024, equivalent to approximately 43% of total secondary AUM (Asset under Management), a proportion materially higher than that observed in private equity primaries. This accumulation of capital has enabled the execution of increasingly large and complex transactions and has supported a notable improvement in pricing conditions. In 2024, 91% of single-asset continuation fund transactions were priced at or above 90% of NAV (Net Asset Value, i.e. the estimated fair value of a fund’s underlying), while multi-asset continuation funds also saw a significant normalization in discounts. At the same time, performance data from Preqin indicates that secondaries continue to offer a differentiated risk-return profile, characterized by lower dispersion of outcomes and faster cash-flow generation relative to primary funds. In an environment marked by distribution scarcity and heightened uncertainty, these characteristics help explain why the secondary market has moved from a peripheral liquidity solution to a structural stabilizer of the private equity ecosystem .Why should I be interested in this post?

As the private equity secondary market reached record transaction volumes of around $156bn in 2024 and could grow to nearly $300bn by 2030, understanding its mechanics has become essential for anyone interested in private markets. This post provides a data-driven explanation of LP-led and GP-led transactions and highlights why continuation funds now account for a large share of secondary activity. These structures are central to liquidity management, portfolio rebalancing, and capital recycling in a constrained exit environment. The different industry reports used in this analysis can be found in the “Useful information” section below.

Related posts on the SimTrade blog

▶ All posts about Private Equity

▶ Emmanuel CYROT Deep Dive into evergreen funds

▶ Lilian BALLOIS Discovering Private Equity: Behind the Scenes of Fund Strategies

▶ Adam MERALLI BALLOU My internship experience in Investor Relation at Eurazeo

Useful resources

William Blair (March 2025) William Blair Private Capital Advisory: 2025 Secondary Market Report

Preqin (June 2025) Secondaries in 2025

About the author

The article was written in December 2025 by < https://www.linkedin.com/in/adam-meralli-ballou/" target="_blank">Adam Meralli Ballou (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2026).

▶ Read all articles by Adam MERALLI BALLOU.