Over the past decade, investing has become more accessible than ever. Anyone with a smartphone can now buy or sell shares, cryptocurrencies, or ETFs within seconds. While this democratization of finance has clear benefits, it has also led many to lose money by chasing “the next big stock.” Retail investors often believe they can find the next Tesla or Nvidia: the famous “needle in the haystack.” Yet, as history repeatedly shows, only a small fraction succeed.

That is precisely what John C. Bogle, the founder of Vanguard and the father of index investing, warned against. His advice was simple yet profound: stop trying to find the needle, just buy the entire haystack.

In this article, Hadrien Puche (ESSEC, Grande École, Master in Management – 2023/2027) comments on Bogle’s timeless quote, exploring how it captures one of the most important principles in modern investing: diversification.

About John C. Bogle

John Clifton Bogle (1929 – 2019) was an American investor and philanthropist best known as the founder of The Vanguard Group, one of the world’s largest asset management firms. In 1976, Bogle created the first index fund available to individual investors, the Vanguard 500 Index Fund, designed to replicate the performance of the S&P 500 index rather than beat it.

At the time, his idea was revolutionary. The prevailing belief was that skilled managers could consistently outperform the market through superior stock selection and market timing. Bogle argued the opposite: after accounting for management fees, transaction costs, and human error, most active managers fail to beat the market over the long term. His philosophy emphasized simplicity, discipline, and cost-efficiency, principles that now underpin the $12 trillion global index fund industry.

John C. Bogle

Analysis of the quote

Bogle’s quote encapsulates a powerful truth: successful investing does not require finding hidden gems, but rather owning the market as a whole. The “needle in the haystack” represents the elusive high-performing stock every investor dreams of. Yet statistically, most attempts to find it fail. By buying the entire “haystack” (that is, the full market) investors automatically own all the winners and minimize the risk of missing them.

Empirical research overwhelmingly supports this idea. Over time, a small number of stocks account for the majority of total market gains. A study by Hendrik Bessembinder (2018) found that, since 1926, just 4% of U.S. stocks generated the entire net wealth created by the stock market. Most others either underperformed or disappeared entirely. Thus, identifying the few long-term winners ex ante is nearly impossible. The rational solution is to own the entire market, a strategy that index funds make accessible and affordable.

Bogle’s insight also reflects humility: acknowledging that even professionals struggle to outperform broad market indexes. By accepting this, investors shift their focus from beating the market to participating in its long-term growth.

Economic / Financial concepts related to the quote

1 – Diversification

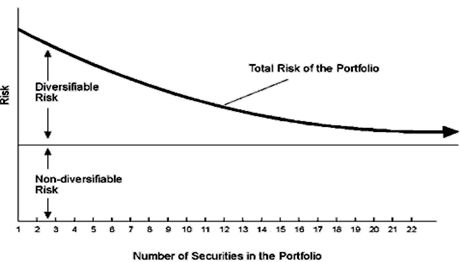

Diversification is the cornerstone of modern portfolio theory. It refers to spreading investments across different assets or sectors to reduce risk. By owning a broad range of companies, an investor limits the impact of any single firm’s poor performance.

Bogle’s philosophy embodies this principle. Buying the entire market, through an index fund tracking, for example, the S&P 500 or the CAC 40, ensures exposure to hundreds of firms across multiple sectors. The failure of one or two is offset by the success of others.

In practice, diversification improves a portfolio’s risk-adjusted return. It does not eliminate risk entirely but reduces idiosyncratic risk (the risk specific to individual companies). What remains is systematic risk, which affects the entire market and cannot be diversified away. This relationship is evident when observing how portfolio risk declines as the number of securities increases.

2 – Index funds

Index funds are collective investment vehicles that aim to replicate the performance of a specific market index, such as the S&P 500 (U.S.), the MSCI World (Global), or the CAC 40 (France). They hold the same securities as the index, in the same proportions, ensuring the fund’s return closely matches that of the benchmark. Because they are passively managed, index funds have very low management fees (often 10 to 20 times cheaper than traditional mutual funds). They also provide instant diversification: by buying one share of an S&P 500 ETF, you effectively invest in 500 companies.

This simplicity explains their rapid growth. According to Morningstar, index funds and ETFs now represent more than 50% of all U.S. equity fund assets. Their accessibility and transparency have fundamentally reshaped global investing.

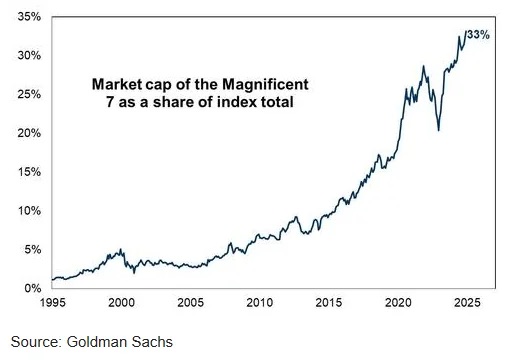

However, one subtle limitation is that most major indexes are market-cap weighted, meaning the largest companies exert the greatest influence. As of 2025, the “Magnificent 7” (Tesla, Nvidia, Apple, Microsoft, Alphabet, Meta, and Amazon) represent nearly 35% of the index’s total value. The chart below illustrates their growing share of total market capitalization over time, highlighting how even “diversified” investors are increasingly concentrated in a handful of mega-cap technology firms.

3 – The efficient frontier and portfolio optimization

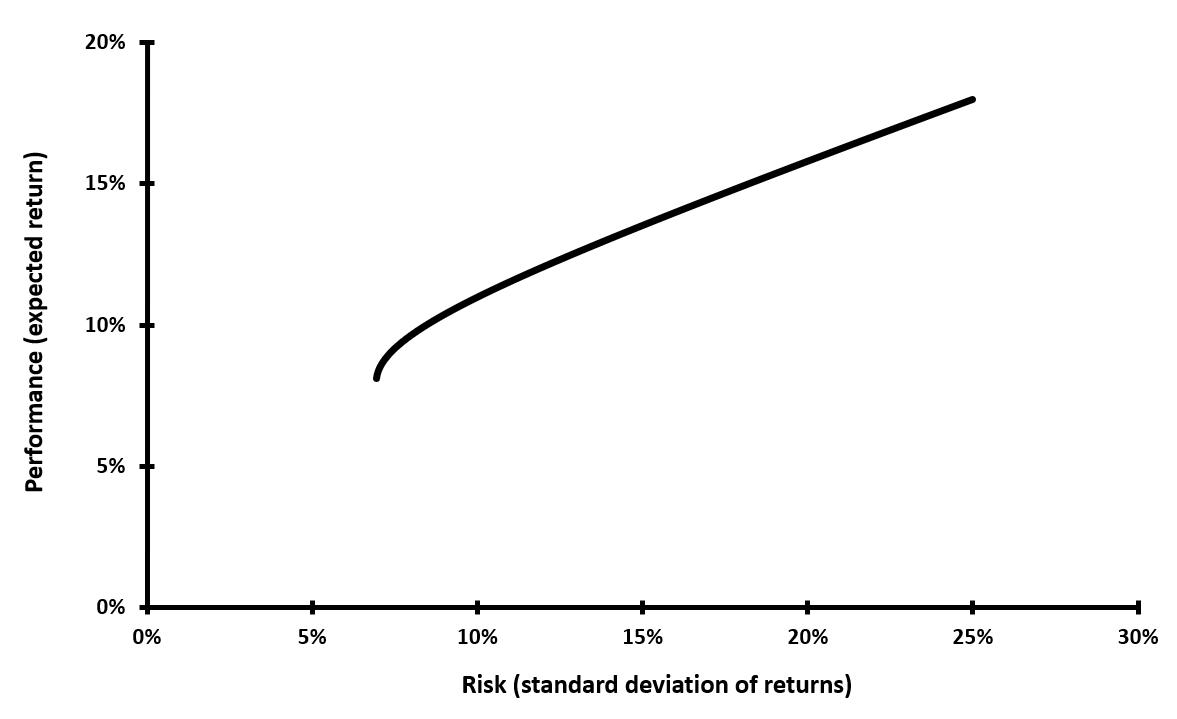

Introduced by Harry Markowitz in 1952, the efficient frontier illustrates the optimal trade-off between risk and (expected) return for a diversified portfolio. Each point on the curve represents the best possible expected return for a given level of risk.

Index investing often lies near this efficient frontier. Because broad indexes like the S&P 500 already aggregate thousands of investors’ information and preferences, they effectively represent a “market portfolio” close to the optimal mix. Passive investors benefit from this efficiency without needing to forecast which assets will outperform.

Understanding the efficient frontier also reveals why chasing high returns through concentrated bets is dangerous. While such strategies may yield spectacular results occasionally, they almost always involve disproportionate risk.

My opinion about this quote

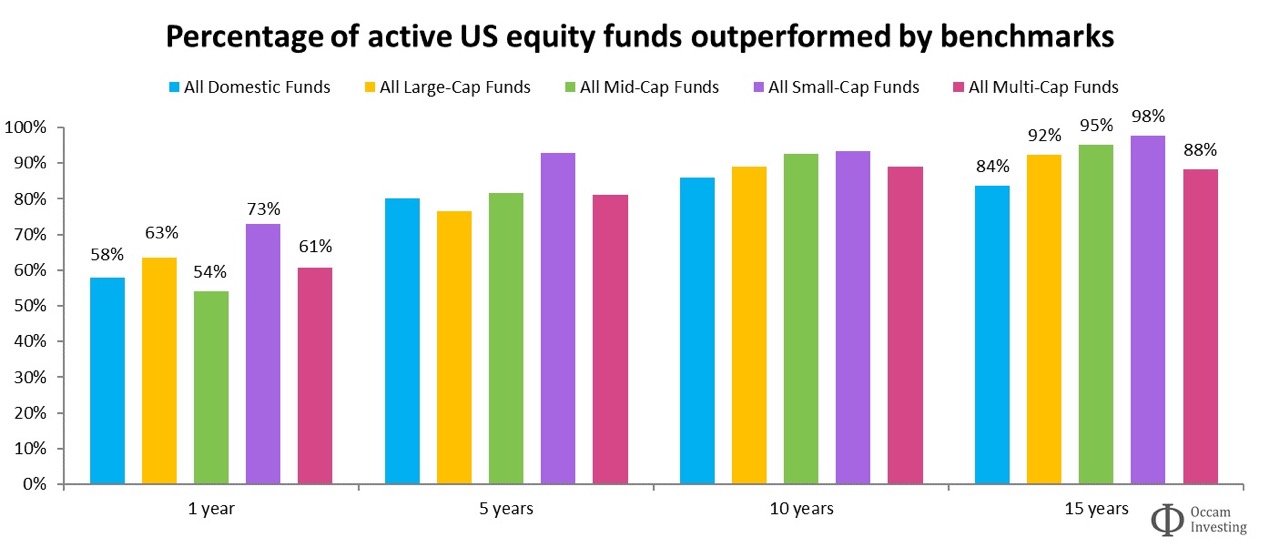

I believe this quote perfectly captures the essence of modern investing: simplicity often outperforms sophistication. Many individuals (and professionals) spend enormous time and money trying to beat the market, often with limited success. The SPIVA (S&P Indices Versus Active) report consistently shows that the majority of actively managed funds underperform their benchmark indexes over the long term. As of 2024, for instance, more than 85% of U.S. equity funds lagged the S&P 500 over a 10-year period.

The chart below illustrates this trend across different investment horizons, showing that the longer the time frame, the harder it becomes for active managers to outperform their benchmarks.

The reasons are clear: high management fees, excessive trading, and the psychological pressure to deliver short-term results. Fund managers often prioritize annual bonuses over long-term compounding, leading to decisions driven by incentives rather than rational analysis.

At the same time, Bogle’s approach is not entirely without nuance. Index funds may appear perfectly diversified, but as noted earlier, their concentration risk has increased with the rise of mega-cap tech firms. Buying “the market” today means owning a portfolio dominated by a handful of giants. That, too, is an investment choice, one that has worked well recently but may not always hold true.

Therefore, the essence of Bogle’s wisdom is not that index investing is flawless, but that it is rational. It reflects humility, an understanding that long-term success comes not from prediction, but from participation, discipline, and patience.

Why should you be interested in this post?

For students and young professionals, this quote offers two critical lessons.

First, from a personal investing perspective, it highlights the power of simplicity. Investing through low-cost index funds allows anyone, regardless of expertise, to participate in long-term market growth without the stress of constant stock-picking. It is a proven strategy for building wealth steadily over time.

Second, from a professional standpoint, understanding how and why index funds dominate modern markets is essential. Whether you aim to work in asset management, corporate finance, or risk consulting, you must grasp how passive investing shapes market dynamics, liquidity, and valuation.

Ultimately, Bogle’s message goes beyond finance. It teaches intellectual humility: the recognition that long-term discipline often triumphs over short-term brilliance.

Related posts on the SimTrade blog

Useful resources

Bessembinder, H. (2018). Do Stocks Outperform Treasury Bills? Journal of Financial Economics.

Markowitz, H. (1952). Portfolio Selection. Journal of Finance.

Bogle, J. C. (2017). The Little Book of Common Sense Investing.

About the Author

The article was written in October 2025 by Hadrien Puche (ESSEC, Grande École, Master in Management – 2023/2027).