In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) delves into Retained Earnings, providing a comprehensive analysis on type of retained earnings, explaining its theoretical foundations, discussing the other financial metrics compared to it, its valuation and limitations.

Introduction

Retained Earnings (RE) represent the portion of a company’s net income that is reinvested in the business rather than distributed to shareholders as dividends. This financial metric is a crucial indicator of a firm’s long-term growth potential, profitability, and financial stability. For students pursuing finance, understanding retained earnings is essential for evaluating corporate financial health, capital structure decisions, and strategic reinvestment policies.

Unlike dividends, which provide immediate shareholder returns, retained earnings are used for reinvestments such as research and development (R&D), acquisitions, debt reduction, and business expansion. The strategic management of retained earnings plays a vital role in a company’s value creation, influencing stock price appreciation and long-term shareholder wealth.

Definition and Formula

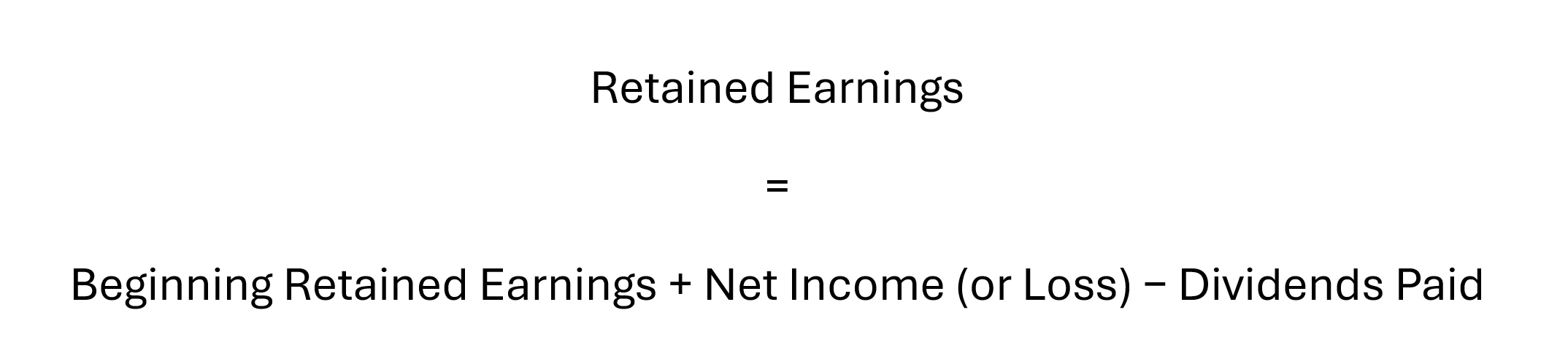

Retained earnings are calculated as follows:

A positive retained earnings balance indicates profitability and reinvestment potential, whereas negative retained earnings (also known as an accumulated deficit) suggest financial distress or excessive dividend payouts.

Theoretical Foundations of Retained Earnings

Retained earnings have been widely analyzed in financial theory, particularly in relation to dividends, investor behavior, and market efficiency.

Dividend Irrelevance Theory (Miller & Modigliani, 1961)

According to Miller and Modigliani’s capital structure theory, in a perfect market, dividend policy and retained earnings allocation do not affect firm value. However, in reality, taxes, transaction costs, and capital constraints make retained earnings a critical internal financing source.

Pecking Order Theory

According to Oxford Research Encyclopedias, this theory suggests that firms prefer internal financing (retained earnings) over external financing (debt or equity issuance) due to lower costs and reduced information asymmetry. Companies with strong retained earnings can fund expansion without diluting ownership or increasing leverage.

Growth Theory (Gordon Growth Model)

The Gordon Growth Model highlights the trade-off between paying dividends and reinvesting earnings. Higher retained earnings lead to greater reinvestment, potentially boosting future earnings and stock price appreciation.

Importance of Retained Earnings in Finance

Retained Earnings is vital in Finance to learn about a company’s growth, expansion, capital investments, and debt reductions.

- Capital Investment and Expansion – Retained earnings finance business growth, acquisitions, and infrastructure improvements.

- Debt Reduction – Companies use retained earnings to pay down debt, reducing interest costs and financial risk.

- Shareholder Wealth Creation – Reinvested earnings contribute to higher stock valuations, benefiting long-term investors.

- Liquidity and Financial Stability – Firms with substantial retained earnings have greater financial flexibility in economic downturns.

- Dividend Policy Decisions – Retained earnings influence dividend payout ratios and corporate distribution policies.

Retained Earnings vs. Other Financial Metrics

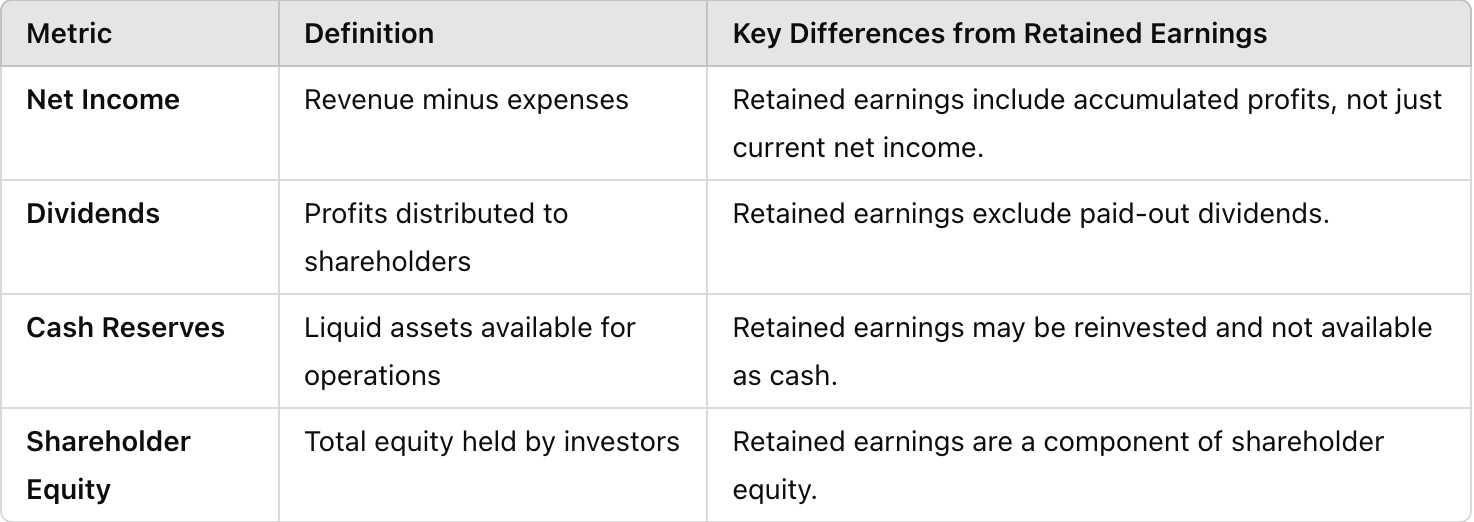

There are many return metrics apart from Retained earnings, such as dividends, Net income, cash reserves, and shareholder equity as follows below:

Retained Earnings vs Other metrics

While these metrics provide valuable insights into a company’s financial health, retained earnings remain unique in their ability to capture the total accumulated profits and give an idea for reinvestments.

When it comes to net income, retained earnings include accumulated profits and not just the current income; it excludes payout dividends, and can be reinvested but not obtained as cash. Retained earnings are a component of shareholder equity.

Factors Influencing Retained Earnings

Several factors influence retained earnings:

- Profitability – Higher net income leads to higher retained earnings.

- Dividend Policy – Companies paying higher dividends retain less for reinvestment.

- Capital Expenditure Needs – Firms requiring heavy reinvestment often retain more earnings.

- Industry Trends – High-growth sectors (e.g., tech) tend to reinvest more, while mature industries may prioritize dividend payouts.

- Economic Conditions – In downturns, firms may retain more earnings to maintain liquidity.

Retained Earnings in Corporate Valuation

Retained earnings play a vital role in corporate valuation models:

Discounted Cash Flow (DCF) Analysis

Retained earnings affect future cash flow projections and reinvestment rates.

Earnings Per Share (EPS) Growth

Higher retained earnings contribute to EPS expansion, driving stock value.

Case Studies in Retained Earnings Utilization

- Apple Inc. (AAPL) – Apple has historically retained earnings for R&D and acquisitions, fueling innovation and stock price appreciation.

- Amazon (AMZN) – Amazon reinvests nearly all its earnings into business expansion, prioritizing long-term growth over dividends.

- General Motors (GM) – During financial crises, GM retained earnings to strengthen its balance sheet, ensuring long-term survival.

Challenges and Limitations of Retained Earnings

- Underutilization Risks – Excessive retained earnings without reinvestment plans may lead to inefficient capital allocation.

- Shareholder Expectations – Investors seeking dividends may view high retained earnings as a lack of returns.

- Inflation and Depreciation – Inflation can erode the real value of retained earnings over time.

Conclusion

Retained earnings serve as a powerful financial tool, influencing corporate growth, shareholder returns, and financial stability. Understanding their impact on valuation, reinvestment strategies, and dividend policies is essential for finance professionals aiming to make data-driven investment and corporate finance decisions. By mastering retained earnings analysis, finance students can enhance their analytical skills and prepare for careers in investment banking, corporate finance, and asset management.

Why should I be interested in this post?

For finance students, understanding retained earnings is crucial as it directly impacts financial modeling and company valuation. Mastery of financial statement analysis, including retained earnings, is essential for roles in asset management, equity research, and financial consulting.

Related posts on the SimTrade blog

▶ Shruti CHAND Shareholder’s Equity

▶ Bijal GANDHI Income Statement

▶ Raphaël ROERO DE CORTANZE Dividend policy

Useful resources

Academic resources

Myers, S. C., & Majluf, N. S. (1984) Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221.

Other resources

Bajaj Finserve What is the meaning of retained earnings?

About the author

The article was written in May 2025 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024).