Treasury Bonds: The Backbone of U.S. Government Financing

In this article, Camille KELLER (ESSEC Business School, Bachelor in Business Administration (BBA), 2020-2024) explains the purpose, significance, and global role of U.S. Treasury bonds.

Introduction

Treasury bonds (T-bonds) are long-term debt securities issued by the U.S. Department of the Treasury, fundamental to funding government operations and shaping economic policies. Backed by the “full faith and credit” of the U.S. government, they are regarded globally as benchmarks of stability and reliability.

These bonds play a dual role: domestically, they underpin the financial system and provide risk-free investment options, while globally, they influence capital flows and pricing in international markets. With their long maturities and predictable returns (if hold until maturity), Treasury bonds are a secure haven for investors in times of uncertainty.

This article explores the structure of Treasury bonds, their critical role in monetary policy, and their global significance in maintaining financial stability.

What Are Treasury Bonds and How Do They Work?

Treasury bonds are issued by the U.S. government to finance national projects and repay debt. They have maturities of 10 to 30 years and offer fixed semiannual interest payments, returning the principal amount at maturity.

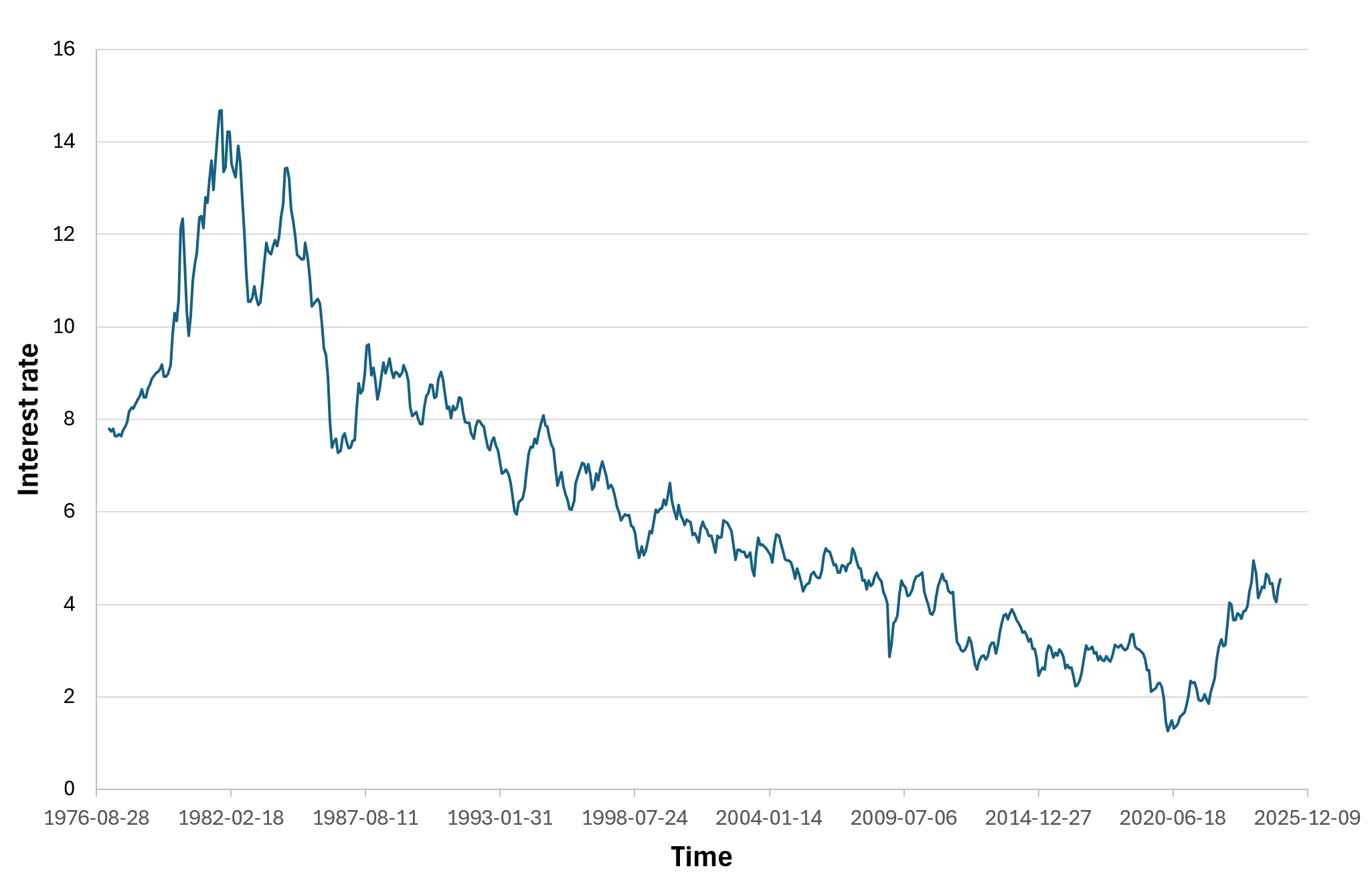

Figure 1 below gives the evolution of the interest rate of Treasury bonds (30 years of maturity) over the period March 1977 – December 2024 (data from Federal Reserve Bank of St. Louis). You can download the Excel file for the historical data used to build the figure.

Figure 1. Evolution of the US Treasury bonds interest rate.

Source: Federal Reserve Bank of St. Louis.

These bonds are sold through public auctions, where competitive bidders specify desired yields, and non-competitive bidders accept the auction’s determined rate. This transparent process ensures fair pricing and liquidity, making T-bonds accessible to a wide range of investors.

Treasury bonds are considered among the safest investments globally, given the U.S. government’s ability to generate revenue through taxation and currency issuance. This security makes them a key component of institutional portfolios, particularly for pension funds and central banks looking for low-risk, reliable returns.

In financial markets, T-bonds serve as a benchmark for long-term interest rates. Their yields influence borrowing costs for mortgages, corporate bonds, and loans, directly affecting economic activity. During financial uncertainty, their reputation as safe-haven assets attracts significant demand, reaffirming their stability and importance in global markets.

The Role of Treasury Bonds in Monetary Policy

Treasury bonds are integral to U.S. monetary policy, serving as tools for the Federal Reserve to manage money supply and interest rates. Through open market operations, the Federal Reserve buys or sells Treasury bonds to inject or withdraw liquidity from the financial system. These actions influence borrowing costs and economic activity.

When the Federal Reserve purchases T-bonds, it lowers interest rates, encouraging borrowing and investment. Conversely, selling bonds tightens liquidity and increases rates, curbing inflation and slowing economic growth.

T-bonds are also key indicators of inflation expectations. Fixed coupon payments lose value in inflationary periods, prompting investors to demand higher yields as compensation. Their role as a measure of market sentiment makes them critical in assessing economic conditions.

The yield curve—a graph of yields on Treasury securities of varying maturities—offers further insight. An inverted yield curve, where short-term yields exceed long-term yields, is often a precursor to economic recessions, signaling investor concerns about future growth.

Through these mechanisms, Treasury bonds enable the Federal Reserve to balance economic growth, inflation, and employment, making them indispensable to monetary policy.

Treasury Bonds as a Global Benchmark

Treasury bonds extend their influence far beyond U.S. borders, forming the bedrock of the global financial system. Their stability, liquidity, and dollar-denominated nature make them indispensable to central banks, institutional investors, and sovereign wealth funds worldwide.

Central banks, particularly those in countries like China and Japan, hold large reserves of T-bonds to stabilize exchange rates, manage currency reserves, and hedge against market volatility. Their status as a low-risk investment ensures enduring demand, reinforcing the U.S. dollar’s dominance in global finance.

T-bonds also serve as a benchmark for pricing other financial instruments. Their yields represent the risk-free rate used in valuation models for equities, corporate bonds, and derivatives, shaping investment decisions across markets.

In times of crisis, Treasury bonds attract capital as investors seek security, lowering yields and providing stability to global markets. However, this reliance also introduces vulnerabilities; events like U.S. debt ceiling debates or credit rating downgrades can disrupt global confidence in Treasury securities.

Despite these challenges, the unwavering demand for Treasury bonds highlights their critical role in ensuring liquidity and stability in the international financial system.

Why Should I Be Interested in This Post?

This post is a valuable resource for students and professionals interested in understanding the mechanics of Treasury bonds and their broader implications. It highlights the intersection of government finance, monetary policy, and global markets, offering insights into how these instruments shape economies worldwide.

Related Posts on the SimTrade Blog

▶ Georges WAUBERT Introduction to bonds

▶ Georges WAUBERT Bond Markets

▶ Georges WAUBERT Bond valuation

▶ Georges WAUBERT Bond risks

▶ Bijal GANDHI Credit Rating

▶ Jayati WALIA Credit risk

Useful Resources

U.S. Department of the Treasury

Federal Reserve Economic Data (FRED)

About the Author

The article was written in December 2024 by Camille KELLER (ESSEC Business School, Bachelor in Business Administration (BBA), 2020-2024).