Market Consensus Based on Financial Analysts’ Forecasts

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) explains what is the market consensus based on financial analysts’ forecasts.

Introduction

Market consensus represents the average derived from the individual predictions made by financial analysts who closely monitor and analyze corporate and market conditions. In the context of financial analysts’ forecasts, the consensus refers to the collective expectation or average prediction of a group of analysts regarding the future performance of a firm measured by sales and profits, of a financial asset such as a stock, commodity, or currency. Few examples of market consensus based on financial analysts forecast would be: Forecasts for economic indicators such as GDP growth, inflation rates, or unemployment levels. It is derived from the aggregated predictions of various analysts, providing a consensus viewpoint on the expected direction or magnitude of economic changes. Forecasts of the future exchange rates between currencies such as the euro/dollar rate. If multiple analysts predict the exchange rates for the Euro to U.S. Dollar, the market consensus would be an average or median of these forecasts, indicating the collective expectation for the currency pair. Forecasts of price targets for stocks based on the projections of future performance. If a market stock is covered by multiple analysts, the market consensus price target would be the average of those figures, giving investors a benchmark for assessing the stock’s anticipated value. Forecasts of the company’s earnings per share (EPS). The market consensus, in this case, would be the average or median of these individual EPS predictions, representing the collective expectation of analysts regarding Company’s earnings. Forecasts of commodity prices such as oil, gold, or agricultural products. The market consensus for a commodity’s future price is determined by averaging or considering the median of these individual forecasts, reflecting the consensus view on the commodity’s likely trajectory.

Key participants

Financial analysts

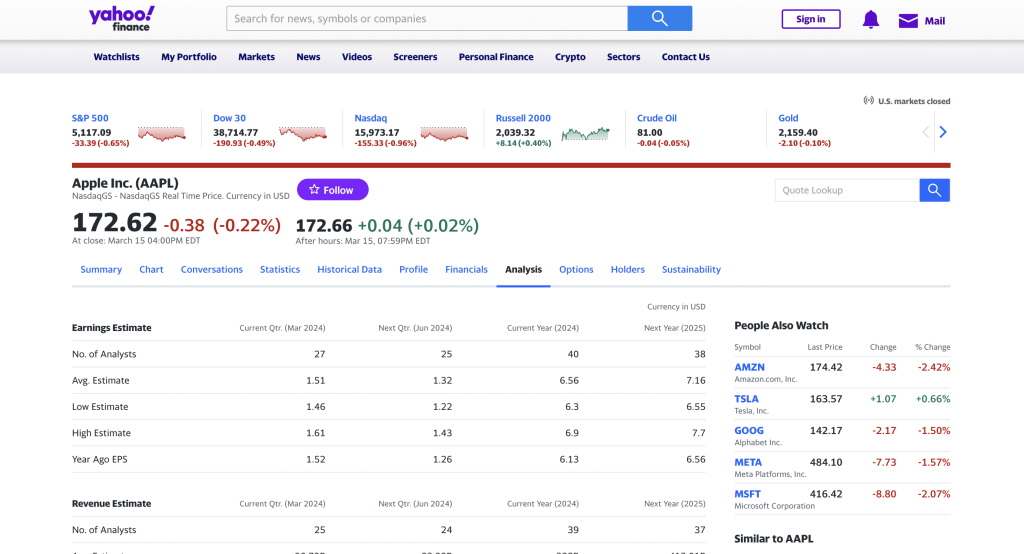

Talk about financial analysts: who are they?where do they work? To determine the market consensus for Apple Inc. (AAPL), one would typically aggregate and analyze the forecasts and estimates provided by sell-side financial analysts who cover the company. These analysts regularly publish their projections for key financial metrics such as revenue, earnings per share (EPS), and other performance indicators.

Market consensus firms

Market consensus firms specialize in producing market consensus based on financial analysts’ forecasts and opinions. These firms aggregate and analyze data from multiple analysts to provide a consensus view on various financial metrics such as earnings estimates, revenue projections, and target prices for individual stocks and broader market indices. Some prominent firms that offer market consensus based on financial analysts’ input include: FactSet: FactSet aggregates and standardizes data from various sources, including sell-side analysts, to provide consensus estimates for earnings, revenue, and other financial metrics. Their platform offers detailed consensus estimates for individual companies, sectors, and industries. Refinitiv (formerly Thomson Reuters): Refinitiv offers consensus estimates and forecasts compiled from sell-side analysts’ research reports. Their platform provides consensus data on earnings, revenue, and other key financial metrics for equities, fixed income, and commodities. IBES by Refinitiv: IBES (Institutional Brokers’ Estimate System) is a leading database of consensus estimates and analyst recommendations. It offers comprehensive coverage of earnings estimates, revenue projections, and other financial metrics for thousands of companies globally.

Data providers

Companies that provide financial data and analytics services play a crucial role. They compile and disseminate information about analysts’ forecasts, making it accessible to various participants in the financial ecosystem. Bloomberg is a prominent example here, its terminal, a widely used platform in the financial industry, aggregates and delivers a vast array of financial data, including analysts’ predictions and consensus estimates. It also exemplifies how data providers contribute to the transparency and accessibility of financial analysts’ forecasts.

Investors

Investors rely on the forecasts and predictions made by financial analysts to make informed investment decisions. The market consensus provides investors with a collective viewpoint, helping them assess potential risks and returns. Their role is pivotal in the financial markets, and they interact with market consensus in several ways like decision making, portfolio construction, risk assessment, performance evaluation, communication with shareholders, etc.

Traders

Traders are individuals or entities that actively buy and sell financial instruments, such as stocks, bonds, currencies, or commodities, with the aim of making short-term profits. Traders can be categorized into various types, including day traders, swing traders, and algorithmic traders, each with a different time horizon and approach to the market. There are various types of traders, each with different strategies, time horizons, and goals. Few examples of them would be day trader, swing trader, Algo trader, position trader, scalper, options trader, forex trader and commodity trader.

Process for building a market consensus

Building a market consensus involves aggregating the predictions and expectations of various financial analysts, experts, and stakeholders regarding the future performance of a financial instrument, economic indicator, or asset.

There are certain steps we typically follow in this process:

- Data collection of forecasts: Financial analysts, often employed by brokerage firms, investment banks, or independent research firms, conduct in-depth analyses of specific assets, companies, or economic indicators. They generate individual forecasts based on factors such as earnings projections, economic data, and market trends.

- Analyst Ratings and Recommendations: Analysts may assign ratings (e.g., buy, hold, sell) and provide recommendations for investors. These ratings and recommendations reflect their views on the expected performance of a particular asset. These assessments contribute to the overall market consensus.

- Normalization: Before computing the consensus, the data may undergo normalization to ensure consistency across different analysts’ estimates. This step involves adjusting for any variations in reporting standards, accounting methods, or other factors that could affect the comparability of estimates.

- Weighting: Some consensus providers may apply weighting to analysts’ estimates based on factors such as historical accuracy, reputation, or coverage universe. Weighting ensures that more accurate or influential analysts have a greater impact on the consensus.

- Calculation: The market consensus is calculated by averaging the aggregated forecasts and estimates from all contributing analysts. This average represents the consensus view of analysts regarding the expected performance of the company or market index for the specified period.

- Dissemination: The computed consensus estimates are then disseminated to clients through various channels, such as financial data platforms, research reports, and market data terminals. Clients use this information to assess market expectations, benchmark against their own forecasts, and make investment decisions.

- Tracking and Updates: Market consensus providers continuously track and update the consensus estimates as new information becomes available. This includes incorporating revisions to analysts’ forecasts, earnings announcements, and other relevant developments that may impact the consensus view.

It’s important to note that while market consensus based on financial analysts’ estimates provides valuable insights into market expectations, it is not a guarantee of future performance. Investors should consider various factors, conduct their own analysis, and exercise judgment when making investment decisions. Additionally, consensus estimates are subject to revisions over time as new information emerges and analysts update their forecasts. The market consensus is key to understand how financial markets work, how stock market prices react to the announcements of profits by firms or economic indicators.

Quality of the market consensus

Behavioral Influences

Beyond numbers and charts, market consensus is deeply influenced by human behavior. Emotions, biases, and psychological factors play a significant role in shaping consensus views. Behavioral finance studies, backed by statistical evidence, highlight how psychological biases such as herding, overreaction, and anchoring contribute to the formation and evolution of consensus views.

Talk about Dot bubble of the 2000s

The late 1990s saw the widespread adoption of the internet for both commercial and personal use. In 2000, the stock market experienced a significant downturn. Dot-com stocks, in particular, faced sharp declines, wiping out substantial market capitalization. The Dot-Com Bubble refers to the rapid rise, speculative frenzy, and subsequent collapse of stock prices of many internet-based companies in the late 1990s and early 2000s.

Example: market consensus for Apple

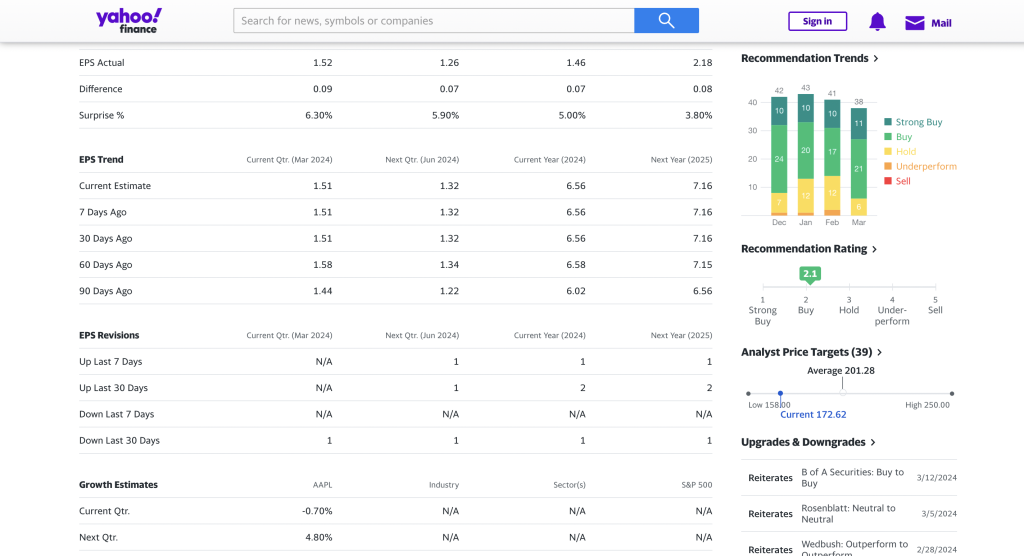

The prevailing market sentiment toward Apple Inc. (AAPL) is generally optimistic, according to analyst assessments. As reported by Stock Analysis, the consensus among 32 analysts places the average price target for Apple’s stock at $203.25. The range spans from a low estimate of $120 to a high estimate of $250. Based on this average target, a potential increase of approximately 11.48% is anticipated from the current stock price of $182.32. Notably, analysts collectively advocate a “Buy” rating for Apple.

Yahoo Finance offers in-depth projections for Apple’s financial performance, encompassing estimates for earnings and revenue across upcoming quarters and years. For the ongoing quarter concluding in March 2024, analysts predict an average earnings per share (EPS) of $1.51, accompanied by revenue estimates averaging $91.02 billion. These forecasts align with a broader outlook suggesting a growth trajectory for Apple, with both EPS and revenue anticipated to expand in the subsequent years. For those seeking more comprehensive analyses and real-time updates on Apple’s stock performance, as well as expert opinions from analysts, a direct visit to Yahoo Finance and Stock Analysis is recommended.

Why should I be interested in this post?

In essence, this article provides a perspective on market consensus based on financial analysts. For a student who would like to work in finance (either in the corporate world or the financial sector), it is important to know about the market consensus as it relates to both the corporate world and financial markets.

Related posts on the SimTrade blog

▶ Aamey MEHTA Market efficiency: the case study of Yes bank in India

▶ Louis DETALLE The importance of data in finance

▶ Louis DETALLE Bloomberg

Useful resources

Market consensus What is market consensus?

Faster Capital Navigating Markets: The Power of Market Analysis and Consensus Estimates