In this article, Daniel MEAGHER (Trinity College Dublin, BESS Final Year, 2021-2025) explains the Irish Real Estate Market with its trends, challenges, and opportunities.

Ireland’s real estate market is at a critical crossroads. With housing shortages, soaring demand, and institutional investment set to surpass €3 billion in 2025, the sector has never been more pivotal. As the country balances rapid urbanisation, sustainability goals, and affordability challenges, its property market continues to shape Ireland’s economic future.

About the Irish Real Estate Market

Ireland’s real estate market remains at the core of its economic growth, driven by a growing population exceeding 5 million, strong foreign direct investment (FDI), and attractive tenant profiles. However, persistent challenges, including housing shortages, price inflation, and planning inefficiencies, continue to hinder progress.

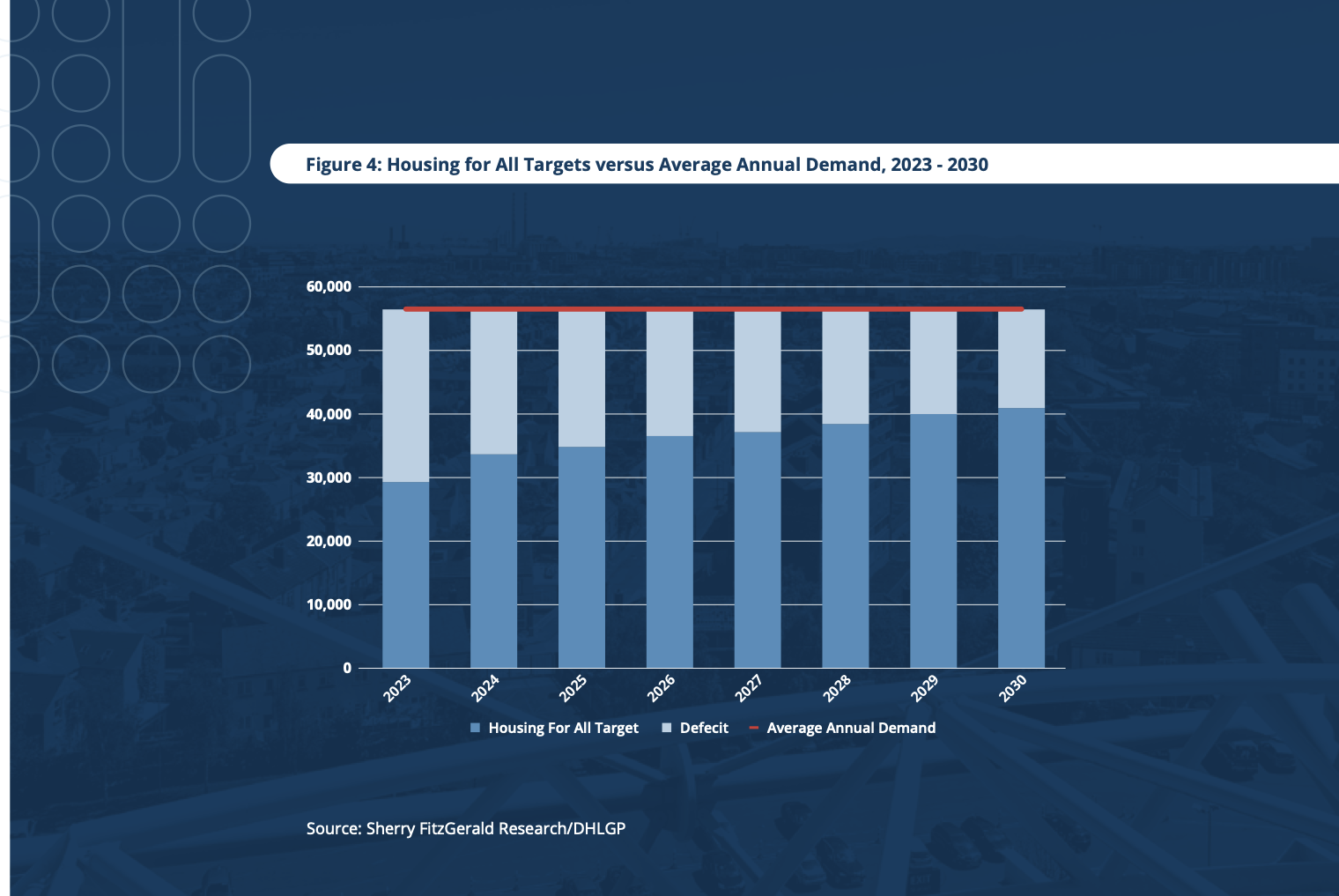

Housing for All Targets vs. Demand

Housing for All Targets vs. Demand.

Source: Sherry FitzGerald Research/DHLGP.

A significant factor behind Ireland’s sustained real estate demand is its status as a leading hub for multinational corporations in the European Union. Following Brexit, companies relocating their European headquarters to Dublin have further strained the office market. Tech giants such as Google, Meta, and Amazon occupy prime spaces in Dublin’s docklands, contributing to rising rental yields in the office sector.

Investment Landscape

Despite global macroeconomic uncertainties, Ireland’s real estate sector remains a highly attractive destination for institutional investors. In 2024, CBRE reported a 30% increase in investment transactions year-on-year, totalling €2.4 billion. While this figure remains 40% below the 10-year market average, the trajectory is positive, with investment activity expected to surpass €3 billion in 2025.

Key Highlights

- Multifamily Residential: 4.75%

- Prime Offices: 5.00%

- Industrial/Logistics: 5.00%

- Student Accommodation: 5.00%

Source: Savills Ireland Investment Market Report

Deep Dive into Key Asset Classes

Multifamily Residential: Institutional investors continue to focus on forward sales agreements in the multifamily sector, particularly in Dublin. These agreements enable developers to secure funding before construction begins, reducing their financial risk. With sustained demand from young professionals and families seeking long-term rentals, this sector provides stable, contracted yields.

Industrial and Logistics: The industrial and logistics sector has emerged as a standout performer, driven by the growth of e-commerce and the need for modern warehousing. In 2024, rents for prime logistics properties increased by 7%, reflecting both limited supply and strong demand from retailers expanding their distribution networks.

Notable Transactions in 2024

- Eagle Street Partners’ Acquisition of The Square Shopping Centre in Tallaght for €130 million.

- Davy’s Acquisition of the ‘Hexagon Portfolio’ for €74 million.

- The Sale of Blanchardstown Shopping Centre for €575 million.

The Square Shopping Centre, Tallaght.

Source: The Irish Times.

Blanchardstown Shopping Centre.

Source: The Irish Times.

Funding and Lending Dynamics

The exit of KBC Bank and Ulster Bank has reshaped the funding landscape, with non-bank lenders such as Activate Capital and Castlehaven Finance stepping in to provide financing. While these lenders have contributed to addressing some funding needs, the overall resources remain insufficient to meet the scale of demand required to alleviate Ireland’s housing shortage.

Although the ECB reduced its key interest rate to 3.5% in late 2024, mortgage rates in Ireland have remained elevated at 3.95%, posing challenges for developers and buyers alike. Rising borrowing costs have further constrained access to affordable financing for housing projects, exacerbating supply challenges.

To bridge this gap, attracting foreign international capital is essential, particularly for large-scale residential developments. Clearer policies, coupled with targeted incentives such as green financing or support for affordable housing, could encourage sustained foreign investment. Establishing a transparent, investor-friendly framework will be critical to unlocking the capital needed to drive housing supply and address the ongoing crisis.

Sustainability and Innovation

Green Certifications and Standards

Developments in Ireland are aligning with EU environmental targets, particularly those outlined in the European Green Deal and Ireland’s Climate Action Plan 2023. Certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and NZEB (Nearly Zero Energy Building) standards have become benchmarks for new and existing properties. These certifications not only improve the sustainability of properties but also enhance their marketability to tenants and investors who are increasingly seeking environmentally responsible spaces.

Technological Advancements in Real Estate

- Smart Building Technology: Modern real estate developments are incorporating smart technologies to optimise energy use and improve efficiency. Smart sensors, for example, monitor energy consumption and adjust heating, cooling, and lighting systems based on real-time needs, reducing operational costs and environmental impact.

- Renewable Energy Integration: Solar panels, wind turbines, and geothermal systems are becoming common features in larger developments. These systems not only reduce carbon emissions but also appeal to tenants and buyers looking for lower energy costs and greener living environments.

- Retrofitting Older Buildings: Retrofitting has become a significant focus for investors and developers. Many older properties, particularly in Dublin, are being upgraded with better insulation, energy-efficient windows, and renewable energy systems to reduce their carbon footprint and extend their life span.

Long-Term Resilience and Value

Sustainability initiatives not only reduce environmental impact but also future-proof investments against tightening regulations and rising energy costs. Green-certified buildings tend to attract premium tenants, enjoy lower vacancy rates, and command higher rental yields, making them a strategic choice for investors.

Why Should I Be Interested in This Post?

This article provides essential insights for students and professionals seeking to understand Ireland’s dynamic real estate market, offering perspectives on key trends, challenges, and future opportunities.

Related Posts on the SimTrade Blog

▶ Arthur EVERARD My experience as a Strategic Consultant at SGS

▶ Clément KEFALAS My experience of Account Manager in the office real estate market in Paris

▶ Ghali EL KOUHENE Asset valuation in the Real Estate sector

Resources

CBRE Ireland Real Estate Market Outlook 2025

Sherry FitzGerald Irish Residential Market Review Autumn 2024

EY Ireland Real Estate Funding and Investment Trends

About the Author

This article was written in January 2025 by Daniel MEAGHER (Trinity College Dublin, BESS Final Year, 2021-2025).