In this article, Mathis DIALLO (ESSEC Business School, Grande Ecole Program – Master in Management, 2023-2026) explains what the environmental repercussions of the production and supply of cocoa are.

Introduction

The carbon footprint is an which measures the anthropogenic greenhouse gas emissions, i.e. a measure of the emissions that can be attributed to that human activity. Unfortunately, chocolate produces a lot of green gas emissions. Growing and harvesting cocoa, making chocolate, transportation, packaging: each stage of production produces greenhouse gases.

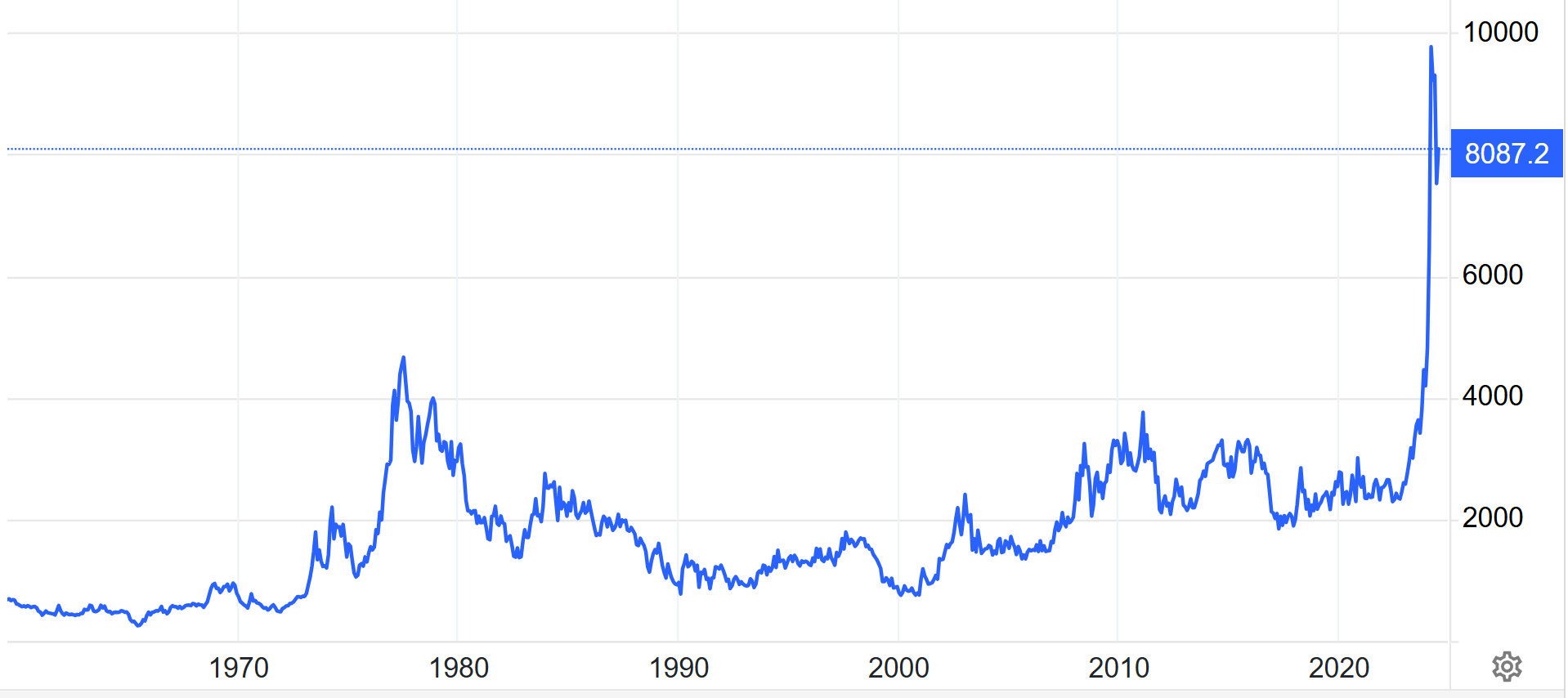

Figure 1 gives the process flowchart for cocoa production designed by Sucden (a French trading company specializing in soft commodities and mainly in sugar).

Process flowchart for cocoa production

Source: Sucden.

Global cocoa production therefore has a significant environmental impact. However, chocolate can also influence the climate and deforestation. Indeed, the manufacture of this product has a negative impact on the environment. Certain prints also have an impact on cocoa plantations.

Cocoa’s carbon footprint

It seems fair to say that chocolate’s carbon footprint is far from acceptable. A kilo of chocolate has a carbon footprint of around 13.7kg of CO² (data from the Agribalyse database). The two factors that will influence the increase or decrease of this figure are either the type of chocolate, or its impact on deforestation. It means that some types of chocolates may need more transformation than others, which implies that there will be more chances to require some other products which have some influence in the green gas emissions.

Cocoa production is responsible for 70% of chocolate’s CO² emissions. All subsequent stages are included in the remaining 30%: processing from cocoa to packaging, addition of other foods and transport to the point of sale.

Most cocoa is grown using conventional agricultural methods such as pesticides, machinery and fertilizers. These processes are energy-intensive and directly produce greenhouse gases, with the result that agriculture currently accounts for around 20% of global emissions.

In the case of cocoa beans, there are also processing steps. The cocoa beans are first ground into cocoa powder, then the other ingredients are added:

- Cocoa per kilo consumes more greenhouse gases than cow’s milk for milk chocolate or white chocolate, mainly due to the methane associated with livestock farming.

- Sugar, palm oil (also responsible for deforestation), preservatives, etc. all contribute to the carbon footprint of chocolate.

The carbon footprint of chocolate is further increased by transport, as cocoa is grown only in countries located around the equator.

The current environmental problems of deforestation caused by cocoa

We have cleared areas of primary forest in Côte d’Ivoire to grow more cocoa. This country, which used to export the most cocoa in the world, has destroyed 90% of its forests in 60 years!

The primary cause of deforestation in West Africa is cocoa farming, which accounts for 70% of the world’s cocoa production.

Since 1960, Côte d’Ivoire has lost 90% of its afforestation. If the trend does not change, the entire Ivorian forest will disappear by 2034, according to some ecologists.

So, given all these problems linked to the production and delivery of cocoa to our market, it’s understandable that some people are reacting. For many specialists, chocolate is the symbol of our globalized system, which he does not hesitate to criticize: “The international cocoa-chocolate market today is the portrait of a capitalism at the end of its rope, locked in its own contradictions: the enormous amount of money invested and mobilized to maintain the levels of production and consumption necessary for the survival of the model completely paralyzes action and innovation”, he explains, painting a rather bitter picture of today’s market.

A glimmer of hope for the future

Even if the market seems to be ticking a lot of the wrong boxes, some people are still trying to change things.

In December 2022, a new European regulation was introduced to prevent the import of products derived from deforestation (the European Union (EU) deforestation-free regulation (EUDR)). . This applies to products such as coffee, cocoa, rubber and palm oil.

By requiring the companies concerned to guarantee that the products they export involve zero or negligible risk of deforestation, these regulations will certainly help the cocoa sector to become more responsible in the future, to the benefit of both producers and our planet.

Why should I be interested in this post?

Thus, we can see how much the process of production of cocoa a significant impact in our environment may have, be it with deforestation, but also with the process of supply chain itself.

Related posts

▶ Mathis DIALLO The cocoa production

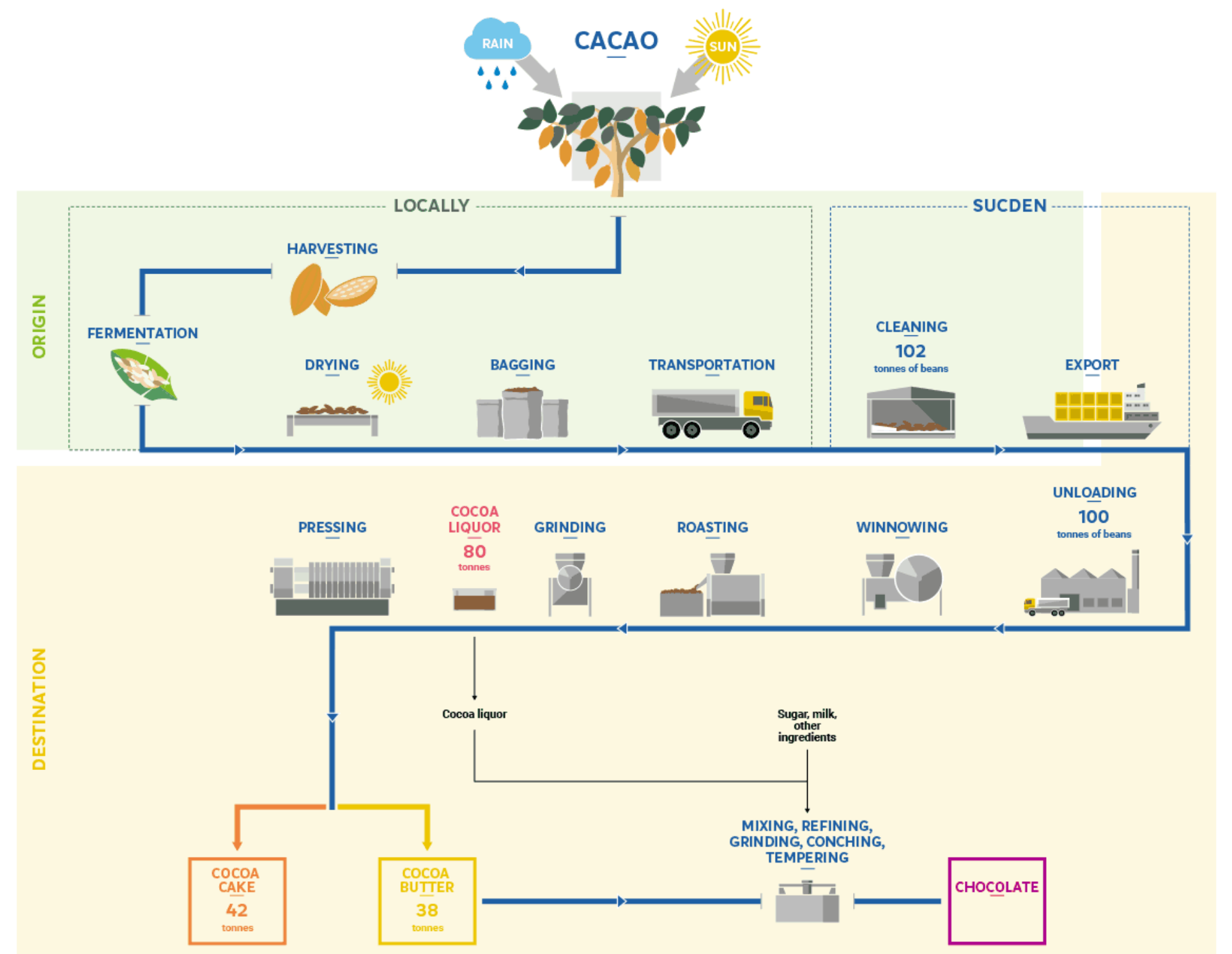

▶ Mathis DIALLO The price of cocoa

▶ Mathis DIALLO Different types of chocolate

▶ Mathis DIALLO The Armarajo hedge fund’s corner in the cocoa market in 2010

Useful resources

Anna Gardner (07/05/2022) The Cocoa Industry: Its Environmental Impacts ClimaTalk

Sucden Products and activities – Cocoa

About the author

The article was written in July 2024 by Mathis DIALLO (ESSEC Business School, Grande Ecole Program – Master in Management, 2023-2026).