In this article, Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) talks about hyperinflation in Argentina.

Introduction

Starting from the year 2018, Argentina has been battling one of the unsurpassed economic setbacks in its history. The economy is facing hyperinflation, widespread poverty, and debts that are simply too vast to comprehend. Although Argentinian citizens have experienced chronic struggles with inflation, the crisis of 2018 onwards lingers with intensity. In this article, we’ll look at how and why hyperinflation occurred in Argentina.

Argentina’s Inflation Timeline

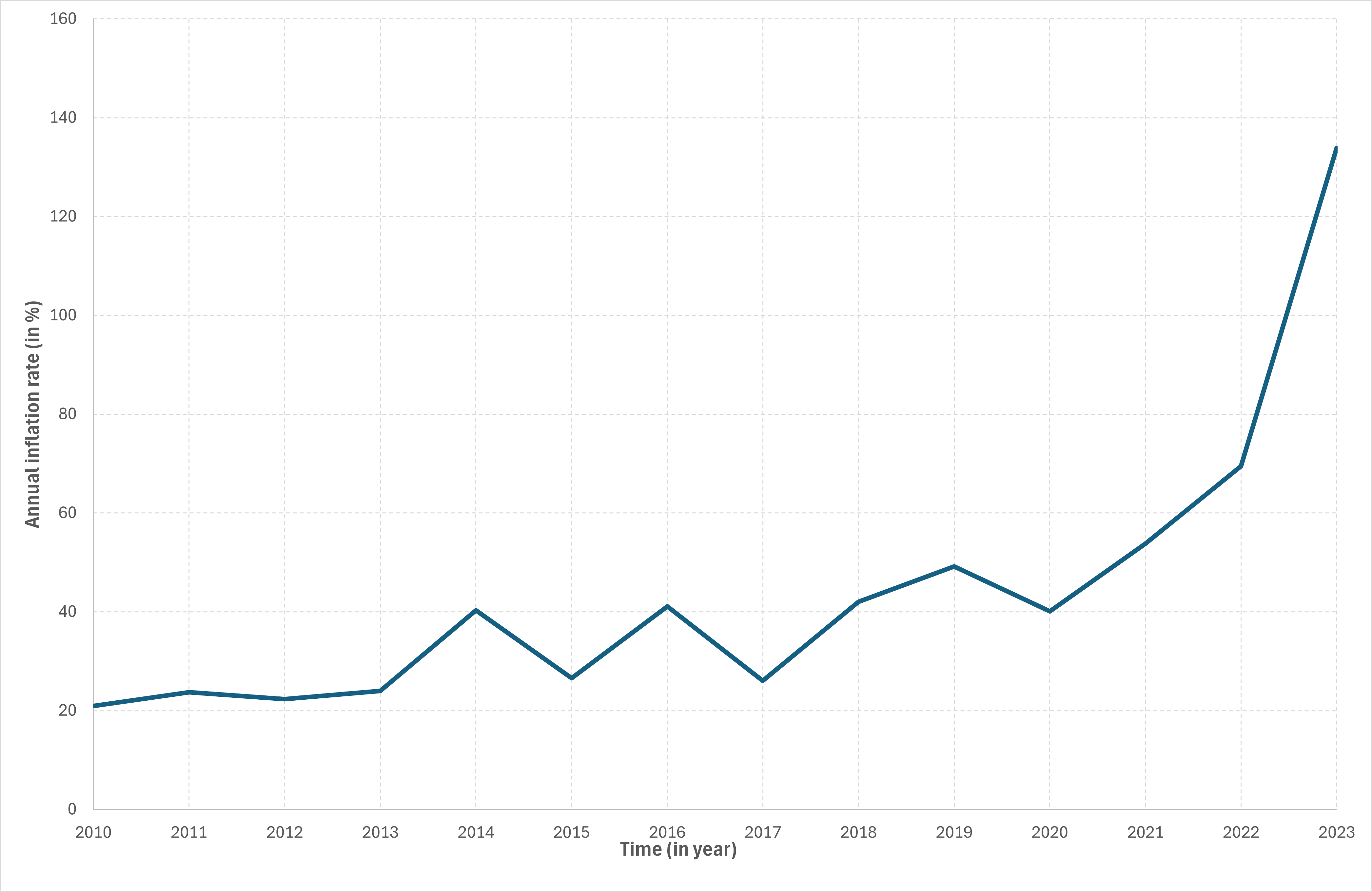

To understand the scale of the problem, it’s important to first look at how inflation in Argentina has evolved over the years.

2018: Argentina entered a period of acute economic stress, with inflation reaching 47.6% by the end of the year, up from 24.8% in 2017, according to the National Institute of Statistics and Census (INDEC). This sharp increase in inflation was a direct consequence of a currency crisis, triggered by a combination of poor economic policies, external debt, and an overreliance on foreign borrowing.

2019: Inflation accelerated further, hitting 53.8%. This made Argentina one of the highest-inflation economies in the world, surpassed only by Venezuela and Zimbabwe. The International Monetary Fund (IMF) played a significant role during this period by extending a record $57 billion bailout to stabilize the economy.

2020: Despite the global slowdown due to the COVID-19 pandemic, inflation in Argentina remained high, clocking in at 36.1%, as per INDEC data. The global pandemic worsened the country’s recession, leading to a 9.9% contraction in GDP, further exacerbating the economic crisis.

2021: Inflation surged again to 50.9%, reflecting ongoing macroeconomic imbalances and the effects of expansionary monetary policy that the government had implemented to stimulate a recovery post-pandemic.

2022: Argentina’s inflation skyrocketed to 94.8%, as the country struggled with soaring food prices, energy costs, and wage pressures. By comparison, the global inflation average was just 8.8%, according to the World Bank. Argentina’s inflation was driven by a devaluation of the peso, energy subsidies, and political uncertainty.

2023: By mid-2023, Argentina was firmly in the grips of hyperinflation, with an annual inflation rate of 114.5%. This has put millions of Argentinians in financial distress, as the purchasing power of the peso continues to erode at an alarming rate.

The figure below gives the evolution of the annual inflation rate in Argentina for the period 2010-2023 (data source: World Bank).

Figure 1. Inflation Rate In Argentina.

Source: World bank

Drivers of Hyperinflation

The causes which have led to hyperinflation in Argentina, can be pieced together from a variety of sources. It includes factors including unwise fiscal policies and global economic conditions as contributing elements of the country’s ever intractable monetary disorder.

Currency Depreciation

The Argentine peso has been sharply devalued since 2018. The exchange rate stood at around $20ARS:$1USD at the beginning of 2018, but by 2023, the black-market rate stood at more than $900 ARS:$1USD. This decline in the value of the currency in turn has led to inflation, as the cost of imports has significantly increased and hence raised cost in different industries.

Debt Crisis

Argentina’s debt-to-GDP ratio surged to 89.4% by 2020, up from 53.6% in 2017, according to the IMF. The country’s repeated reliance on foreign loans and failure to pay them back has led to a loss of investor confidence. Argentina defaulted on its debt in 2020, further complicating efforts to stabilize its economy.

Fiscal Deficits

Chronic fiscal deficits are a core reason for the hyperinflation that Argentina experiences. Between 2018 and 2023, Argentina ran persistent fiscal deficits that averaged 5.2% of GDP, according to the data from Trading Economics. Such deficits were financed through the printing press of the government, which served to worsens inflationary factors.

Political Instability

The political scene in Argentina has been chaotic that virtually every incumbent believes in different policies to resolve the economic crisis. Policies which Mauricio Macri (2015-2019) aimed at deficit reduction through austerity was not implemented due to opposition. In this regard, former president Alberto Fernández (2019-present) swayed the economy towards more expansionary policies which increased the level of inflation. Political fragmentation and lack of consensus around economic strategy has been the main contributor to lack of progress in national reforms.

External Shocks

Argentina is heavily reliant on commodities especially soybeans. The world market price of soybeans dramatically dropped in the year 2018, which adversely affected the revenue from exports and increased the balance of payment deficit. Additionally, the increase in global interest rate after 2021 made it too expensive for Argentina to borrow thus worsening its already bad debts.

Impact on Society

The consequences of hyperinflation are most acutely felt by the Argentine people. A few of the most significant impacts include:

Poverty

The World Bank estimates that Argentina has a poverty rate of over 40.1% in the year 2023. Inflation has impaired the purchasing capabilities of middle and lower scorers, pushing several millions into the poverty bracket. This is particularly worrying in a country where poverty dropped to 25.7% in 2017.

Real Wages

Real wages in Argentina have taken a drastic downward turn. The average wage in Argentine Workers’ Central Union (CTA) was about 20% lower in 2022 compared to 2017 figures. This is due to the faster rate of inflation meant that any growth in wages was eclipsed, cutting working peoples earnings and making basic needs more expensive.

Food Prices

Food inflation is one of the worst in the world at over 120% in the year 2023 according to INDEC. The prices of most basic staples such as bread, meat and vegetables have spiralled out of control leading to widespread food insecurity.

Social Unrest

The economic misadministration and the spiralling consumer prices have, for a long-time now, suffocated the economy and triggered a number of protests throughout the country. In July 2022, large scale protests emerged in Buenos Aires with protestors clamouring for wage increases and government action over inflation. A continued cycle of instability gave rise to fears of further violence.

Policy Responses

The government of Argentina has attempted many policies aimed at reducing inflation including price controls however the results have mostly been progressively ineffective.

Price Controls

The menace of runaway inflation had prompted the governments which succeeded the Macri’s administration to attempt implementing caps on the prices of basic needs. To the contrary, however, there was an increase in the demand for those goods which could not be satisfied in the market due to the proliferation of the black market which increased the prices of goods significantly.

Currency Exchange Controls

In an effort to contain the depreciation of the peso, rigid exchange control was administered over external currency within Argentine borders. These measures, while effective only in the short term, have never resolved the chronic deficits and dependence on external borrowing. It is known that since 2023, the unofficial rate of the peso serving black market transactions drifted a long way from the official one and in fact magnified other economic distortions.

IMF Bailouts

The last time the International Monetary Fund (IMF) came to Argentina’s aid was in 2018, when the Fund approved a record $57 billion package. The purpose of this package was to boost Argentina’s liquidity and promote fiscal discipline. Unfortunately, the loans’ provisions such as public expense cuts, have caused public outrage and it has been hard to enforce them politically. In 2022, the IMF and Argentina renegotiated the loan terms, extending repayment deadlines but without significant relief from the debt burden.

Interest rate

Attempts to reduce the inflation by increasing the interest rates were made by the Central Bank of Argentina. As of 2022, the central bank’s rate has been raised to 75%, which is considered one of the world’s highest, but this significantly controlled inflation, but rather increased borrowing and thereby inhibited growth.

Conclusion

Argentina’s hyperinflation since 2018 has been driven by a complex web of factors, including currency depreciation, external debt, fiscal deficits, and political instability. The human and social costs have been severe, with rising poverty, declining real wages, and widespread food insecurity.

To stabilize the economy, Argentina must focus on structural reforms, including improving fiscal responsibility, renegotiating its debt burden, and fostering political stability. However, the road ahead is fraught with challenges. Without a concerted effort to address the root causes of the crisis, Argentina risks continuing down the path of economic collapse, with hyperinflation threatening to erode the social fabric of the nation.

Related Posts On The SimTrade Blog

▶ Anant JAIN Understanding Hyperinflation

▶ Anant JAIN The Ongoing Hyperinflation In Turkey And Its Ripple Effects On European Union

Useful Resources

International Monetary Fund (IMF) Argentina

World Bank Economic data for Argentina (inflation rate)

El País (12/01/2024) Argentina’s annual inflation soars to 211.4%, the highest in the world

International Banker (16/05/2023) Why Inflation in Argentina Is Above 100 Percent

About The Author

The article was written in February 2025 by Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).

▶ Read all articles by Anant JAIN.