How to invest in Gold

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) provides an overview of types of gold investments, strategies and considerations that follows.

Introduction

There is a saying from ancient times: “There is no better way to increase and preserve your buying power than through ownership of gold and silver”. It could defer from country to country, but gold remains a preferred investment in contemporary financial markets. In this article, we delve a little deeper into types of gold investments such as physical gold investments, gold certificates, mutual funds, alternative gold investments, and investment strategies and considerations.

Physical Gold Investments

This refers to purchasing physical gold through bars, coins, and jewelry.

Bullion (Bars and Coins)

Bullion refers to purchasing physical gold in the form of bars or coins. The value is directly linked to the gold price, but it comes with storage and insurance costs. Popular among collectors and investors, gold coins like the American Eagle and Canadian Maple Leaf are often considered for their liquidity and ease of trade.

Gold Bullion: coins and bars

Source: US Gold Bureau

Advantages and disadvantages: It is a tangible asset that has no counterparty risk and possesses universally recognized value, but it has high storage costs, insurance and liquidity issues. Larger gold bars are generally more liquid than coins, as they are easier to sell and can be divided into smaller units if needed. Whereas, some coins, especially those with limited mintage (how many were made in the first place), may be less liquid and harder to sell. Current Gold Price as of October 17, 2024, is approximately $1,950 per ounce (USD).

Jewelry

Jewelry refers to purchasing physical gold in the form of ornaments. Most of the countries like China, India, Egypt, etc. have high cultural significance and resale value for these ornaments. Several ancient ornaments are passed on to their heirs in kingdoms that hold high value.

Gold Jewelry

Source: US Gold Bureau

Advantages and disadvantages:Jewelry is valued on its purity, craftsmanship, and market trends, but it has high wastage, and making charges. In countries like India, the wastage and making charges of gold depending on the complexity of the jewelry design could almost cost an extra one-third of the actual gold value in the ornament.

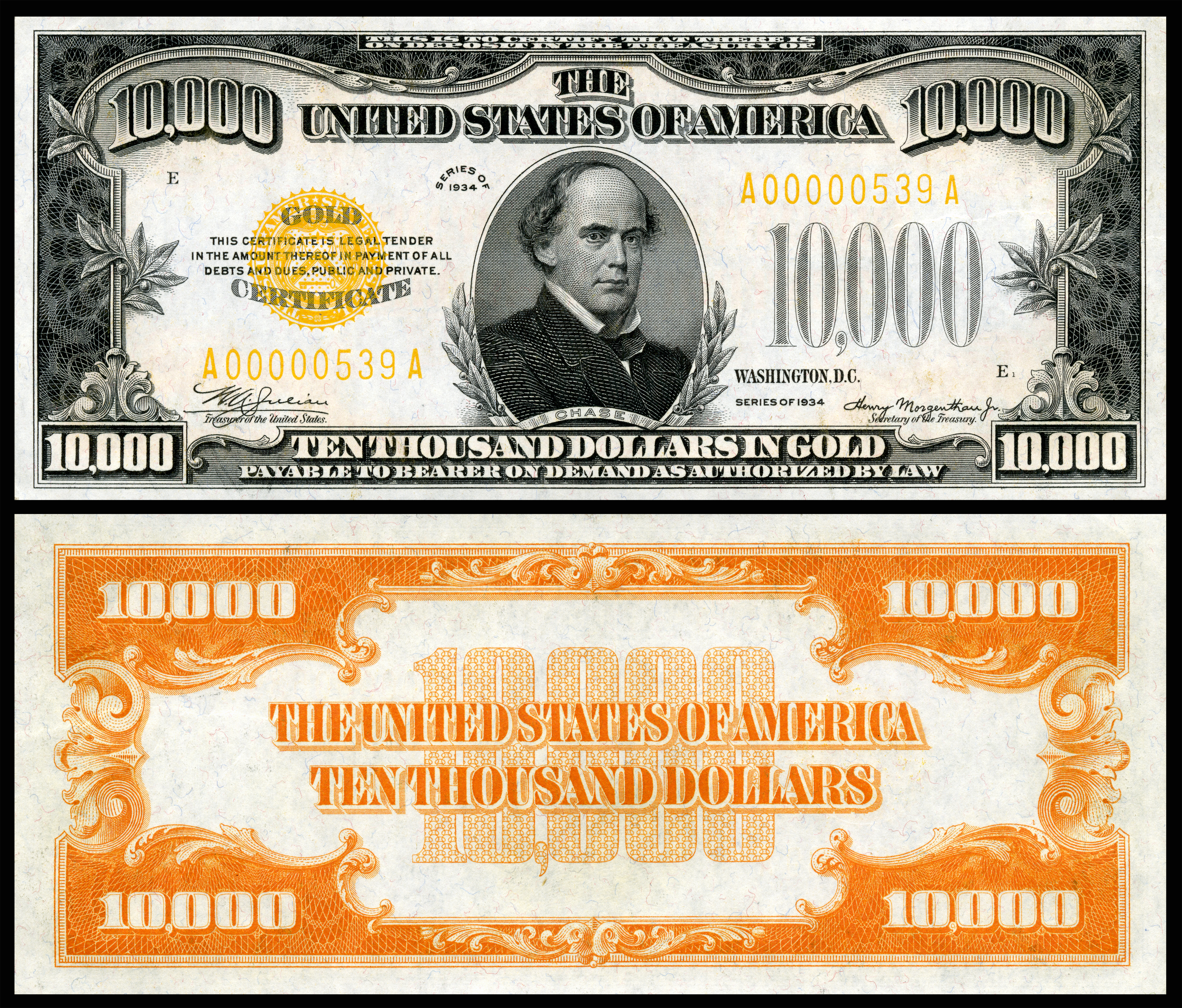

Gold Certificates

Starting in the 17th century, gold certificates were issued by goldsmiths in London and Amsterdam. These gold certificates then acted as proof of gold ownership. In time, the certificates were passed from hand to hand just like cash payments, without the hassle of having to move the gold bullion itself. In early 19th-century, US Treasury began to issue gold certificates which circulated as money until 1933, when the US government banned private gold ownership inside the United States. Today, gold certificates continue to be issued by several German and Swiss banks, as well as by gold pool programs in Australia and the US. These certificates represent ownership of a certain quantity of gold bullion or coins.

Gold Certificates

Source: Wikipedia

Advantages and disadvantages: Though it avoids physical storage issues and provides easy transferability, there was high counterparty risk and a lack of physical possession.

Paper Gold Investments

Gold Exchange Traded Funds (ETFs)

These funds allow investors to gain exposure to the gold price without owning the physical asset. ETFs like SPDR Gold Shares (GLD) track the gold price closely and are popular among institutional and retail investors.

Advantages and disadvantages: The main advantages of ETF’s are their ease of trading, Liquidity, and lower transaction costs. And the disadvantages are its high management fees and potential tracking errors. Added reference at the end of the article.

Several case studies examining the performance of SPDR Gold Shares (GLD) during economic downturns typically analyze how this gold-backed ETF tends to perform when broader stock markets experience significant declines, highlighting its potential as a “safe haven” asset where investors often flock to preserve wealth during times of uncertainty; this study would likely show that GLD prices often rise or remain relatively stable during economic downturns, demonstrating gold’s historical role as a hedge against market volatility.

Gold Mining Stocks

Gold stocks are shares of companies involved in the gold industry, either a mining corporation, gold Mutual Funds, or Exchange Traded Funds. It means that you own a certain part of the company, and you are entitled to any profit or loss that comes out of your investment in the gold stocks. The ETF’s here are called gold mining ETF’s and an example is VanEck Vectors Gold Miners ETF (GDX).

Advantages and disadvantages: Gold mining stocks can provide significant leverage to gold price movements. A small increase in gold prices can translate into a larger gain for the mining company’s stock.

Gold Mutual Funds

A “gold mutual fund” is a pooled investment that buys a variety of gold mining stocks, allowing you to indirectly gain exposure to the gold mining industry with less individual company risk; essentially, a gold mutual fund is a basket of gold mining stocks managed by a professional fund manager.

Advantages and disadvantages: Though it benefits from professional management and diversification, it has higher fees compared to ETFs, and less direct exposure to gold prices.

Alternative Gold Investments

- Gold Futures and Options: Derivative contracts based on future gold prices. It has high volatility and, the potential for significant losses.

- Gold IRAs: Individual Retirement Accounts that include physical gold. It has high tax advantages, and portfolio diversification but also has high custodial fees and storage requirements.

- Digital Gold: Investing in gold through digital platforms that represent ownership of physical gold. It has high risks in platform reliability and cybersecurity concerns.

General Terminology in Gold Investments

Diversification: How gold can balance a diversified investment portfolio.

Hedging Against Inflation: Gold’s role in protecting against currency devaluation and inflation.

Market Timing: Strategies for buying low and selling high, technical and fundamental analysis.

Risk Management: Setting investment goals, understanding volatility, and managing exposure.

Conclusion

Gold remains the top choice for many investors for portfolio diversification or protection against economic instability. This precious metal has held its value over centuries. While market prices fluctuate, many still choose to buy gold to secure their financial future.

Why should I be interested in this post?

Gold has been a key financial asset for centuries, acting as a store of value, a hedge against inflation, and a safe-haven asset during economic crises. Understanding its investment options helps students grasp fundamental market dynamics and investor behavior, especially during periods of economic uncertainty.

Related posts on the SimTrade blog

▶ Nithisha CHALLA History of Gold

▶ Nithisha CHALLA Gold resources in the world

Useful resources

Academic research

Bogle, John C. (2007). The Little Book of Common Sense Investing. John Wiley & Sons.

Erb, C.B., and C.R. Harvey (2013) The Golden Dilemma. Financial Analysts Journal 69 (4): 10–42.

Erb, C.B., and C.R. Harvey (2024) Is there still a Golden Dilemma. Working paper.

Business

World Gold Council Gold spot prices

Bloomberg Investing in Gold: Is Gold Still a Good Inflation Hedge in a Recession?

Focus economics Gold: The Most Precious of Metals

Gold Avenue What is a gold ETF?

Seeking Alpha GLD: Why Gold Should Be Your First Portfolio Pick In A Recession

Other

Wikipedia Gold

About the author

The article was written in October 2024 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024).