In this article, Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) talks about the M&A trends in the FMCG sector.

Introduction

The Fast-Moving Consumer Goods (FMCG) sector plays an essential part in the global economy due to its high volume of goods and consistent consumer demand. It includes goods from everyday essentials such as food and beverages to personal care products, and this sector thrives on efficiency, scale, and market penetration. In recent years, this sector recorded a spike in mergers and acquisitions (M&A) activities to help companies in the process to be come more globalized companies, increase market penetration, expanding the portfolio of the companies and help becoming more digitalized. This article studies the trends, tactics and effects of M&A in the FMCG sector and supported by data and case studies where applicable.

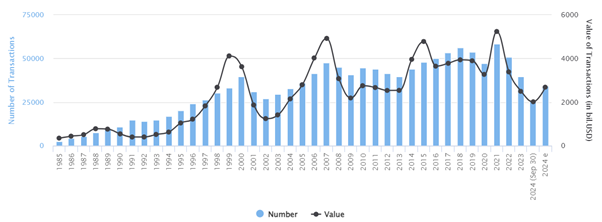

Figure 1. M&A Transactions & Value Worldwide Across All Sectors.

Source: IMAA

Key Drivers Of M&A In The FMCG Sector

Globalization And Market Expansion

Of the many reasons that drive M&A activity in the FMCG industry, globalization is the most important one. Firms in this industry have ambitions – they want to widen their geographical reach, access new markets and customers, and capitalize on the growth of these establishments in the emerging markets. With the saturation of mature markets such as North America and Western Europe, FMCG companies have been targeting new and emerging economies regions such as Asia, Africa and Latin America where the growth rates are relatively higher.

Global FMCG M&A Activity: According to PwC 2022 reports, the total value of M&A transactions in the consumer goods industry, including FMCG mergers, stood at about $300 billion in the year 2022. Emerging markets accounted for about 25% of this figure, shedding light on the focus of global FMCG strategies.

Case Study – Unilever’s Acquisition of Carver Korea: Unilever acquired Carver Korea for $2.7 billion in 2017. Carver Korea is focused on skincare, a market especially in South Korea that was estimated to grow at a CAGR of 9.2% between 2017 and 2025. Through this acquisition, Unilever enhanced its foothold in the Asian beauty market, where millennial consumers are becoming the target demographic for a leading beauty economy.

Portfolio Diversification

Diversification is a major driver for FMCG companies pursuing M&A. As consumer preferences shift and emerging trends, such as the big trend of health and wellness, companies are extending their products to cater to the changing dynamics. This trend combined has become crucial as FMCG giants are increasing their expansion efforts towards less mature categories, shifting from traditional product categories with slower growth prospects.

Nestlé’s Health and Wellness Strategy: Nestlé has recently been acquiring numerous companies operating within the health and wellness industry. The acquisition of Atrium Innovations for $2.3 billion in 2017 underscored their resolve to broaden their nutritional health services. Specializing in vitamins, minerals, and supplements, Atrium Innovations is positioned in a market projected to reach $349.4 billion dollars in 2026. Nestlé’s diversified strategy fits the emerging trend where consumers are in the market for products which guarantee health, wellness and elongation of lifespan.

Coca-Cola and Costa Coffee: Coca Cola purchased Costa Coffee for $5.1 billion in 2018 as a part of their strategy to enhance diversification by moving beyond non-alcoholic beverages. Investment in Costa Coffee also reflected Coca-Cola’s recognition that coffee is incrementally becoming a category with strong revenue potential especially with the CAGR of 4.3% projected for the coffee market globally.

Innovation And Product Development

Acquisition of small companies that are agile and quick in product development has been the focus of growth for many FMCG companies. As consumers become more selective of what they eat and drink, there is a shift in strategy for many companies that are looking to expand their portfolio through acquisition, targeting high growth areas such as plant-based foods, functional drinks and natural cosmetics.

PepsiCo’s Acquisition of KeVita: PepsiCo’s purchase of the US based company keVita, leading manufacturer of probiotics beverages, for $200 million as a part of the strategy of expanding and capturing a greater share in the functional beverage market. The market worldwide for probiotics is estimated to grow at a compound annual growth rate of 7.2% for the period of 2021 up to 2026. This acquisition reflects the broader trend of FMCG companies acquiring brands in high-growth, health-focused categories.

Sustainability And ESG Pressures

To consumers and businesses alike, sustainability has become a cause that is key to them, and in effect has led to a shift in the landscape of FMCGs. There are high levels of demand and need for sustainable business models among companies that have made M&As focused on acquiring brands that are environmentally friendly.

Unilever and Seventh Generation: Unilever’s acquisition of Seventh Generation, a US based company selling environmentally friendly cleaning products is a response to the change in consumer preferences in regard to their buying behavior. From 2021 to 2028, the market for eco-friendly household items is anticipated to grow at a CAGR of 6.5%. This acquisition made it possible for Unilever to pivot its portfolio to sustainable eco-friendly options which was in line with Unilever’s wider environmental, social and governance strategies goals.

M&A Trends In The FMCG Sector

Rise Of The Health And Wellness Segment

In the FMCG industry, it is relevant to talk about companies’ acquisitions in the health and wellness category as this sector has witnessed one of the fastest growth rates within the FMCG market. As per the market trends, consumers are now more oriented and prone towards healthy lifestyle products, hence the rise in acquisition in this space. According to recent developments, the majority of the FMCG companies are effectively acquiring minor brands from places that specialize in selling plant-based food, vitamins, dietary supplements, and functional beverages.

Global Health and Wellness Industry: As per the Global Wellness Institute, the estimated value of the global health and wellness market is expected to cross $6.9 Trillion by 2025. PepsiCo’s acquisition of KeVita illustrates how FMCGs are buying into companies with health benefits, as KeVita is an innovator in the probiotics market. The move is consistent with PepsiCo’s goal of expanding beyond sodas into healthier options.

Digital And E-Commerce Capabilities

The expansion of e-commerce which has been further fueled by the COVID-19 pandemic, has revolutionized the strategies of FMCG marketing. The recent mergers and acquisitions have gravitated towards the acquisition of companies with ability to perform and distribute goods directly to customers (DTC). Such trends are likely to prevail with e-commerce becoming a very important target to the selling of FMCG products.

Growth of FMCG E-Commerce: According to Kantar, in 2022, the e-commerce market of the Fast Moving Consumer Goods globally increased by 16%. To participate in this growth, FMCG players are expanding through mergers and acquisitions. Unilever’s acquisition of Onnit, a predominantly e-commerce wellness company, is an example of this transition.

Private Label Consolidation

The rise of private label brands has been evident given the demand from customers for quality products but at cheaper prices. This has in turn created a scenario where large FMCG companies have moved to buy private label manufacturing companies.

Private Label Market Share: As per NielsenIQ, private labels in Europe represent about 40% of the market. This trend spurred extensive consolidation in the industry as traditional FMCGs tried to protect market share by expanding their private label businesses against retailers’ brands.

Focus On Regional Players

Acquisition of regional players remains a popular corporate strategy for global multinationals in the FMCG industry. These acquisitions enable the companies to tap into local knowledge, existing distribution channels and local consumer tastes and preferences.

Regional FMCG M&A: Approximately 35% of the FMCG acquisition deals arranged in 2022 were targeted at acquiring regional players. This indicates the shift towards localized customizing of goods and services, especially in developing countries which tend to be very different in terms of their consumer base from western markets.

Implications Of M&A In The FMCG Sector

Increased Competition

The consolidation of FMCG companies through M&A has led to increased competition in the marketplace. This is because larger and more established players are able to leverage economies of scale, enhance their marketing capabilities, and invest in new product development, putting significant pressure on smaller players.

Global FMCG Market Size: According to Allied Market Research, the global FMCG market is on track to reach $15.4 trillion by the year 2025 and is expected to grow at a 4.9% CAGR. It is anticipated that this growth will be led by larger FGMC players hence leaving little room for smaller independent firms unless they figure out a way to innovate or are bought off.

Consumer Choice And Innovation

While M&A can lead to greater innovation as companies acquire new capabilities, it can also result in fewer choices for consumers if large companies consolidate and dominate key segments. Balancing innovation with consumer choice remains a challenge for FMCG giants.

Innovation through Acquisition: The research conducted by Deloitte’s M&A has shown that 75% of FMCG’s CEOs, view merger and acquisitions of smaller agile companies as rational and a desirable form of development. It is important to emphasize the position of M&A in the FMCG sector as a facilitator of innovation but as a means of ensuring diversity in the market.

Supply Chain Efficiencies

One of the main financial benefits of M&A is the realization of supply chain efficiencies. By consolidating supply chains and leveraging economies of scale, companies can reduce costs and improve profitability. However, this often involves the closure of redundant facilities and potential job losses.

Cost Synergies in FMCG M&A: Bain & Company estimates that FMCG companies typically achieve cost synergies of 5-10% following acquisitions, primarily through supply chain optimization and the elimination of overlapping processes. While these efficiencies benefit shareholders, they can also lead to short-term disruptions in the workforce.

Regulatory And Antitrust Scrutiny

As M&A activity in the FMCG sector increases, companies must also contend with regulatory scrutiny. Antitrust regulators, particularly in the U.S. and Europe, have become increasingly concerned with the impact of consolidation on competition.

Regulatory Actions: The takeover of Pioneer Foods by PepsiCo was ineffective in 2018 because the European Commission disallowed the merger on account of what it perceived as reduced competition in the food and drink market. More regulatory evaluation can be expected especially in situation where big FMCG companies want to acquire key competitors in the industry.

Conclusion

Rapid changes continue to occur in the FMCG industry and these changes are being driven by M&As. Through these strategic alliances, companies optimize growth in new markets, grow their business through other more versatile brands, or target expansion/diversification. However, as the sector consolidates, companies must carefully navigate regulatory challenges, maintain consumer choice, and balance innovation with market competition. The next decade is likely to see continued M&A activity as FMCG companies respond to evolving consumer preferences, digital disruptions, and sustainability pressures.

Related Posts On The SimTrade Blog

▶ Anant JAIN Top 12 FMCG Companies Worldwide

▶ Lilian BALLOIS M&A Strategies: Benefits and Challenges

▶ Suyue MA Analysis of synergy-based theories for M&A

▶ Basma ISSADIK My experience as an M&A Analyst Intern at Oaklins Atlas Capital

Useful Resources

PwC Consumer Markets Insights 2022

Statista FMCG Market Data

Grand View Research FMCG and Health & Wellness Market Reports

Deloitte Consumer Products M&A Outlook

Global Wellness Institute Global Wellness Economy Report

Kantar FMCG E-Commerce Growth Report

Bain & Company Synergies in M&A

European Commission Merger Control Decisions

About The Author

The article was written in February 2025 by Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).