Good-til-Cancelled (GTC) order and Immediate-or-Cancel (IOC) order

In this article, Lokendra RATHORE (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2022-2023) explains the Good-til-Cancelled (GTC) order and the Immediate-or-Cancel (IOC) used to trade in financial markets.

In addition to the types of orders that we discussed in Period1 of the SimTrade certificate (market orders, limit orders, best limit orders, stop loss orders and stop limit orders), I would like to elaborate on the following two other types or order that I have used in the past and found useful: Good-til-Cancelled (GTC) Order and Immediate-or-Cancel (IOC) Order.

What is Good-til-Cancelled (GTC) Order?

A Good-till-Cancelled (GTC) order is an order that remains in effect until it is either executed or cancelled by the investor. This type of order allows the investor to place a standing order that remains active until the investor cancels it or it is filled. For example, if an investor wants to purchase a stock when it reaches a certain price, they can place a GTC order, and the order will remain active until either the price is reached or the investor cancels it.

Significance

Flexibility: GTC orders provide investors with a high level of flexibility, as they remain active for an indefinite period of time. This allows investors to take advantage of market opportunities without having to send order every day.

Long-term Investment Strategy: GTC orders are particularly useful for investors who have a long-term investment strategy and are looking to accumulate shares over a period of time. The investor can place a GTC order at a specific price, and the order will remain active until the desired price is reached.

What is Immediate-or-Cancel (IOC) Order?

An Immediate-or-Cancel (IOC) order is a type of order that must be executed immediately, and any portion of the order that cannot be filled is cancelled. This type of order is used when an investor wants to ensure that an order is executed as quickly as possible, even if only part of the order can be filled. For example, if an investor wants to purchase a large number of shares of a stock, they may place an IOC order. If only a portion of the shares can be purchased immediately, the remainder of the order will be cancelled.

Significance

Time-sensitive: IOC orders are suitable for investors who need to execute a trade quickly, such as when they need to close a position or take advantage of a sudden market opportunity.

Partial Fills: The IOC order allows for partial fills, meaning that if only a portion of the order can be executed immediately, the remainder of the order is cancelled. This can be useful when an investor wants to limit their exposure to a particular stock.

What is the difference between Good-til-Cancelled (GTC) Order and Day order

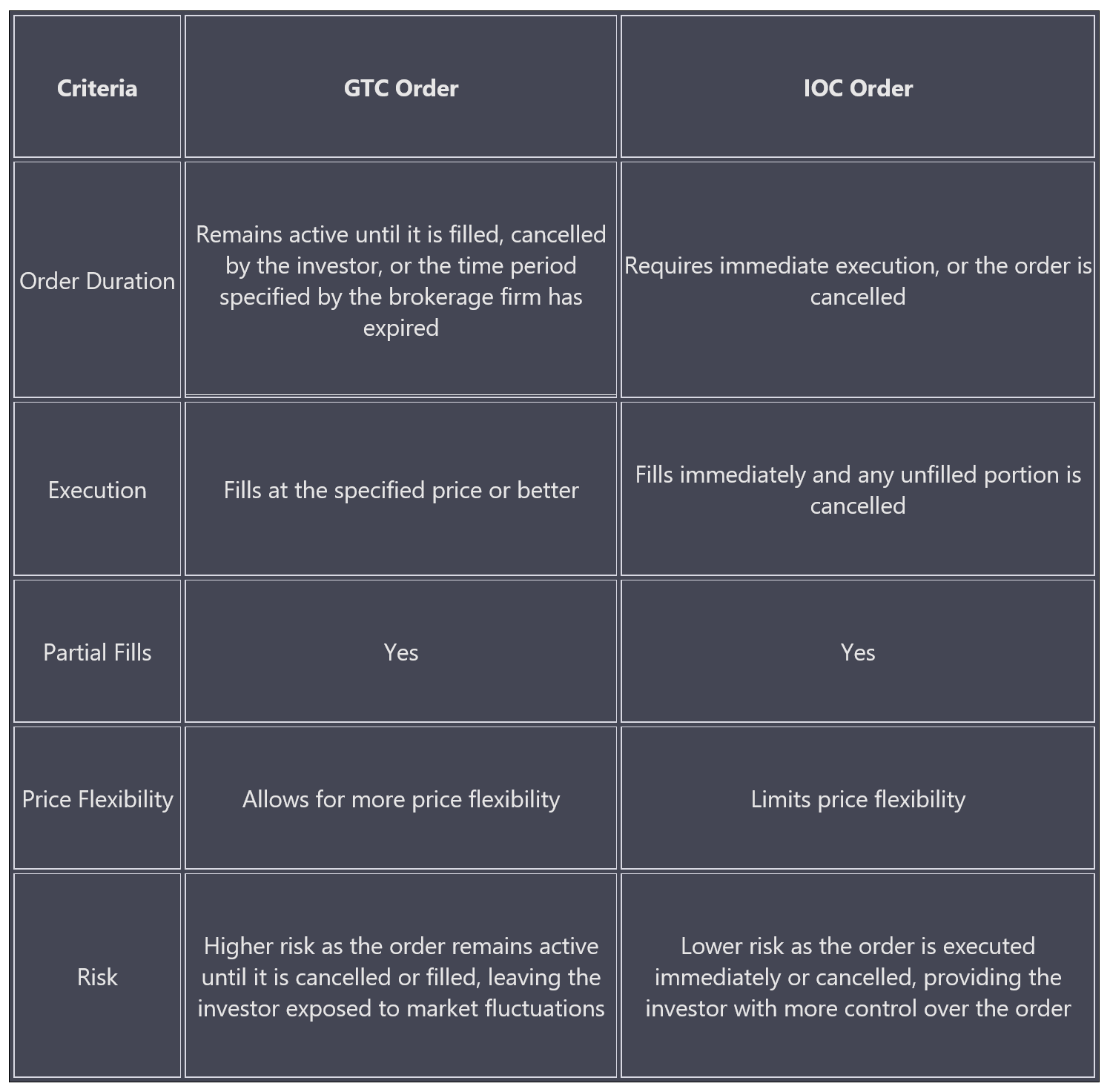

Table 1. Comparison of GTC and IOC orders.

Source: production by the author.

In conclusion, both GTC and IOC orders are useful tools for investors who want to manage their trades and execute their investment strategies effectively. The choice of which type of order to use will depend on the specific needs and investment objectives of the investor.

Related posts on the SimTrade blog

▶ Clara PINTO High-frequency trading and limit orders

▶ Federico DE ROSSI Understanding the Order Book: How It Impacts Trading

Useful resources

SimTrade course Trade orders

U.S. Securities and Exchange Commission (SEC) investor.gov

Investor.gov (SEC) Good-til-cancelled order

Investor.gov (SEC) Understanding Order Types

About the author

The article was written in April 2023 by Lokendra RATHORE (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2022-2023).