My professional experience as an intern at Caisse des Dépôts

In this article, Louise PIZON (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2020-2022) presents her internship experience at Bank of Territories from La Caisse des Dépôts in the Social and Solidarity Economy.

About the company

Caisse des Dépôts et Consignations (CDC), sometimes referred as Caisse des Dépôts, is a French public financial institution created in 1816. Under the direct control of a supervisory commission reporting to Parliament, it carries out general interest activities on behalf of the State and local authorities as well as competitive activities. It employs both civil servants and private-sector personnel under collective agreements.

Launched in 2018, Bank of Territories is a department of CDC. It supports local players in the service of regional development. It offers tailored advisory and financing solutions in loans and investments to meet the needs of local authorities, social housing organizations, local public companies and the legal professions. Bank of Territories also forges strategic partnerships with companies and financial players to carry out projects with a strong territorial impact. It is aimed at all territories, from rural areas to metropolitan areas, with the ambition of fighting against social inequalities and territorial fractures.

It mobilizes 20 billion by year to finance projects for local authorities and social housing actors. It has 35 local offices to ensure greater proximity to its clients. In September 2020, the Bank of Territories and BPI France launched a €40 billion “climate plan” over five years to support French companies in their ecological transition. Priority is given to building renovations and the development of renewable energies, with more than €14 billion budget for each. The rest of the budget should be devoted to innovation (5.6 billion euros), mobility (3.5 billion euros) and industry (1.5 billion euros).

To give an example, in 2013, the Caisse des Dépôts with the help of the State launched the waste recycling and insertion project in Haute Marne. The SCIC (Société Coopérative d’Intérêt Collectif) is called DIB 52 and consists of transforming common industrial waste (CIW), via the creation of platforms allowing the sorting and transformation of CIW into solid recovered fuel (SRF). This project has made it possible to respond to environmental issues thanks to an innovative industrial solution and, in addition, to create jobs.

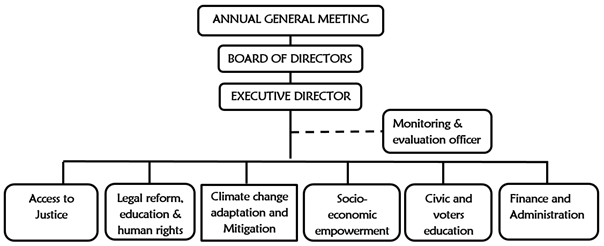

Logo of La Banque des Territoires

Source: CDC

What is SSE?

The concept of Social and Solidarity Economy (SSE) designates a set of organizations in the form of cooperatives, mutual insurance, associations or foundations, whose internal functioning and activities are based on a principle of solidarity and social utility.

These enterprises adopt democratic and participatory management methods. The profits made are reinvested. Their financial resources are generally partly public.

Thus, SSE enterprises are concerned with their social or ecological impact. They aim at putting the human being and solidarity at the heart of the economy and respond to the major challenges of society (ageing well, transition to a local, sustainable food system, the circular economy).

My role and personal missions

I was intern in the Social and Solidarity Economy department of Bank of Territories.

I selected innovative start-ups respecting the environment or social utility company and I created their identity card to classify them. Indeed, to be eligible for different type of funding we need to segment them by type of activities. Then some of them will be chose to be financed and we help them for the process of development as an incubator.

The Social and Solidarity Economy department offered them a two-stage support solution for the creation stage and then the development stage. Our mission was to offer them a support as early as possible to be successful during the maturation of the project.

During the creation stage

We help for several tasks :

- Create spaces for experimentation in each territory: specific advisors “young people” in an employment support contract, “hosting”/sponsoring of the bearers within a SSE enterprise of the sector (financed).

- Help for the rebound in case of failure: assessments of the skills acquired during the creation.

- Ensure a flexible and reactive support, adapted to the functioning of these initiatives, based on a mutual relationship between the mentor(s) and the entrepreneur(s)

- Offer both technical support (legal, financial, administrative) and support on the substance of the projects’ approach (values, collective management, knowledge of the SSE …).

- Immersions in other SSE companies, training on SSE and its values.

- To insert the young people as soon as possible in a network as broad and varied as possible (collectives of support to projects). Mutualize the tools and devices of the SSE and the classic economy by the creation of common platforms.

During the development stage

We help them to set up supports for the perpetuation: lines of financing intended for the social innovation of young people (indicators and criteria adapted to the realities of the projects), improve the links between funders to simplify access to funding, make available specific territorial “funds of assistance” for funds for SSE activities of people under 35 years of age.

Raising awareness among local support network’ agents about the characteristics of young SSE projects. Provision of “drawing rights” on all the dimensions that cover support for young people over several years. Offer permanent and informal exchange spaces between holders to simplify the mode of creation of a SCIC. To make a place for young entrepreneurs in the SSE support systems.

Commitment of the Bank of Territories to the development of the SSE and social innovation

The State Secretariat for the SSE and Bank of Territories signed on November 3rd, 2020, an agreement to take an action on the strengthening of the support of SSE companies, the development of their financing and the support to social innovation.

With this objective in mind, Bank of Territories is mobilizing €300 million for the social and solidarity economy (SSE) between 2020 and 2022, as part of a pact to boost the SSE and social innovation.

This pact is based on two main goals:

- Strengthening the support of SSE companies: Several actions must be carried out to improve the meeting between SSE companies and private financiers, particularly in the booming field of impact investment.

- Financing SSE companies and social innovation

Thus, in addition to its support actions, Bank of Territories is committed to the State to deploy its investment actions over the next three years by:

- Massively increasing the use of impact contracts*: These contracts make it possible to finance social innovation based on results and impact measurement. Within this framework, the State will launch calls for expressions of interest to identify projects in which the Bank of Territories will be able to invest in pre-financing.

- Reinforcing its direct investments in the sectors of solidarity and medico-social services, food transition, local economic development, education and professional training, and digital inclusion.

- Facilitate access to financing.

In addition, indirect investments (impact funds and sharing funds) will allow the Bank of Territories to multiply its support actions to SSE actors, in a complementary way to its direct investments.

General concepts

Impact contract

The impact contract is a partnership between the public and private sectors designed to encourage the emergence of innovative social and environmental projects. These contracts allow for the scaling up of solutions that have been identified in the field and are effective. The private and/or public investor pre-finances the project and takes the risk of failure in exchange for a pre-determined remuneration in case of success. The State only reimburses according to the results obtained and objectively observed by an independent evaluator.

How it works ?

The impact contract renews the financing of innovative projects carried out by actors in the social and solidarity economy. Under this system, social and environmental projects are financed by private and/or public investors, who are reimbursed by the State if the projects achieve the objectives previously set.

Impact contracts are not intended to replace traditional financing of social or environmental activities. They provide a complementary method of financing to facilitate the development of new activities or an innovative program for existing activities.

In concrete terms, the public authorities will launch calls for projects to meet social or environmental needs that are not, or are poorly, covered by the State: the selected structures will then be financed by a third-party investor. Depending on the results observed, based on indicators determined by the stakeholders, the State will remunerate the project leader, who will then be able to reimburse the investor.

Circular economy

The circular economy refers to an economic model whose objective is to produce goods and services in a sustainable manner, by limiting the consumption and waste of resources (raw materials, water, energy) as well as the production of waste. It is about breaking with the linear economy model (extract, manufacture, consume, throw away) for a “circular” economic model.

Intended to generate potential for the creation of activities and jobs, and to respond to the challenges of resource scarcity, circular economy approaches are based on the dynamics of multi-actor cooperation on a territorial scale.

Transition to a local, sustainable food system

The transition to food system refers to the process by which a society profoundly modifies its way of producing and consuming food. The term is used in the context of energy transition, the ecological transition or the demographic transition.

In the 2010s, the term transition to food system is increasingly used in the public debate to designate the expectations or efforts undertaken by the different actors in the chain (producers, processors, distributors, consumers, public authorities) to better respect the environment, improve the nutritional status of food, develop organic and fresh products, and produce under conditions that are more respectful of animal welfare and with greater equity between the actors in the chain.

Useful resources

Banque des territoires

Ellen MacArthur Foundation L’économie circulaire : du consommateur à l’utilisateur Video (in French).

About the author

The article was written in August 2022 by Louise PIZON (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2020-2022).